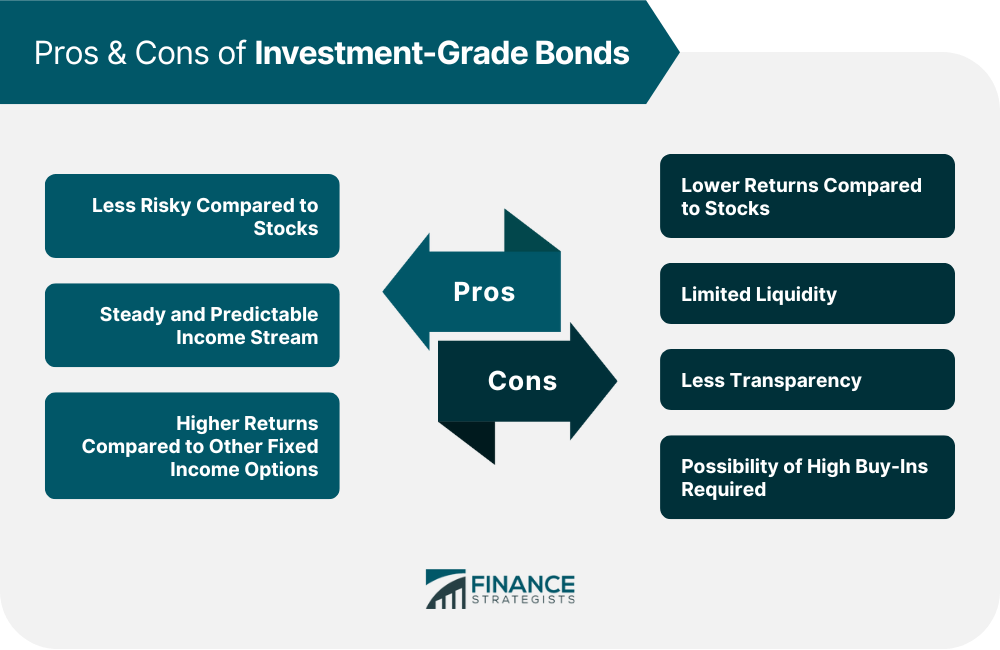

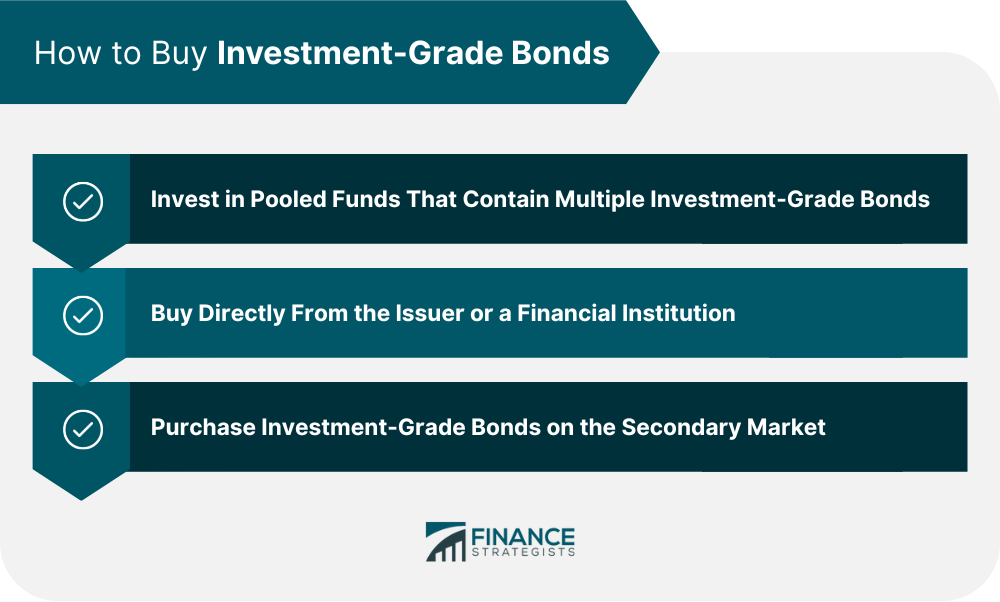

Investment-grade bonds are a type of fixed-income security that is rated highly by credit rating agencies. These bonds offer investors the potential for lower risk than other forms of investing. However, because they have less risk, they also tend to have lower returns. To be classified as investment-grade, credit rating agencies like Standard & Poor's, Moody's, and Fitch all set the minimum bond rank at either BBB- or Baa3. The exact ranking can vary depending on the agency. These ratings help investors assess their options better and seek income sources with a proven portfolio of stable performance compared to speculative bonds offered by lesser-known providers. Investment-grade bonds offer many advantages for investors. The following are some of them: Investment-grade bonds provide many advantages over stock investments. They are less risky, and their value is more reliable and consistent. If a company goes out of business, returning bondholders’ investment is a top priority. Thus, investment-grade bonds best suit investors seeking to protect their principal investment. Investment-grade bonds offer investors the potential to generate income through interest payments. This type of bond can feature higher yields than other fixed-income investments. They also provide a steady and predictable income stream, making them ideal for retirees or those living on a fixed income. While certain stocks may also offer dividend payments, these payments are not guaranteed the way bond interest payments are. Investment-grade bonds offer investors a higher return on their fixed-income portfolios than other alternatives. On their own, yields on investment-grade bonds are less attractive, owing to the prevailing low-interest rate environment in recent years. However, the average yield of these types of bonds over the long term is around 2%, compared to municipal bonds, which offer an average yield of approximately 1.3%. When comparing these two options, investment-grade bond instruments become a more attractive investment option. Investment-grade bonds have historically been low-risk, but they also come with several downsides that may warrant caution. Investing in investment-grade bonds may seem like an excellent way to conserve capital while earning interest, yet the return on investment is generally significantly lower than stocks. This makes them unattractive for those trying to save towards retirement or another longer-term goal. Investment-grade bonds are generally less liquid investments. If individuals invest directly in bonds, they can usually only access their funds upon maturity, which can be several years later. Even if they choose to sell on the secondary market, they might lose due to the lower liquidity of investment-grade bonds. Therefore investors need to recognize this limitation when making their decision. One major disadvantage of investment-grade bonds is their lack of transparency. Since most corporate bonds are traded over-the-counter (OTC), the market tends to lack liquidity and price transparency. This may result in investors paying higher prices for their bond purchases, making it a less desirable option when compared to buying into a bond fund. Because of this, most financial advisors generally advocate using bond funds instead of investing in individual bonds. Individual bonds can sometimes be tricky for beginning investors due to their potentially huge buy-in costs. Most bonds are only available in $1,000 increments, meaning those just starting out need to have a significant amount of capital set aside even to consider investing. This can be intimidating for novice investors intimidated by the idea of committing such large sums of money all at once. Investing in bond funds can save time and money and provide added security. Expert-level knowledge is required to purchase individual investment-grade bonds and navigate the sometimes treacherous bond market. Opting for pooled financial vehicles like mutual funds, index funds, and exchange-traded funds (ETFs) provides an easy way to simultaneously invest in multiple investment-grade bonds. This option also comes with built-in diversification without needing to choose each bond personally. Another method to secure investment-grade bonds is buying directly from the issuer or a financial institution. However, this can involve a much more complicated process and is not always successful. Thus, investors may purchase through a secondary market instead, an alternative with its own potential pitfalls, such as less favorable terms and non-transparent pricing. In any case, investors need to understand what they are getting into when investing in these kinds of securities. This will help them make an informed decision that can eventually maximize their returns. Investment-grade bonds are a form of debt security with fixed returns that can provide financial stability and income for investors. Although providing more safety than stock investments, investment-grade bonds still carry some risk. Previous knowledge and analysis of the bond issuer may be necessary when evaluating potential investments. The benefits of investing in investment-grade bonds include regular, periodic payments, less risk, and higher returns compared to other fixed-income options. However, there are also risks, such as lower returns than stocks, transparency issues, and liquidity risks. To invest in an investment-grade bond, an investor has three main options: investing in pooled funds that contain multiple investment-grade bonds, buying directly from the issuer or a financial institution, and purchasing these bonds on the secondary market. If you are interested in buying investment-grade bonds, it is essential to do your research before committing any money to such an instrument. You may also consult a financial professional specializing in wealth management services to help you select the best type of bond for you.What Are Investment-Grade Bonds?

Pros of Investment-Grade Bonds

Less Risky Compared to Stocks

Steady and Predictable Income Stream

Higher Returns Compared to Other Fixed Income Options

Cons of Investment-Grade Bonds

Lower Returns Compared to Stocks

Limited Liquidity

Less Transparency

Possibility of High Buy-Ins Required

How to Buy Investment-Grade Bonds

Final Thoughts

Investment-Grade Bonds FAQs

Yes, investment-grade bonds can be a good investment. They offer a higher return compared to other fixed-income instruments such as money market accounts and certificates of deposit (CDs). They also provide regular income streams through interest payments and are less risky than stocks, which may suit more conservative investors.

The main advantage is that they carry reduced risk due to their credit ratings assigned by agencies like Moody's and S&P Global. Investment-grade bonds can also generate higher returns than other fixed-income options while providing relatively safe income streams.

To invest in an investment-grade bond, an investor has three main options: investing in pooled funds that contain multiple investment-grade bonds, buying directly from the issuer or a financial institution, and purchasing these bonds on the secondary market.

The main disadvantage of investment-grade bonds is that they tend to be less liquid than stocks, meaning it can take longer to sell them if investors need the cash. Additionally, they tend to offer lower returns compared to stocks while possibly requiring a high buy-in.

Investment grade refers to bonds that have been assigned a rating of BBB- or higher by credit rating agencies like Moody's and S&P Global. These ratings indicate how likely investors will get repaid on their investments in case of default from the issuer. Investment-grade bonds carry a much lower risk than individual stocks.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.