Long-Term Bonds are debt securities issued by governments or corporations with a maturity period typically exceeding 10 years. These bonds serve as a critical financing tool for issuers and a potential income-generating investment for bondholders. When you purchase a long-term bond, you're essentially lending money to the issuer for an extended period, and in return, you receive periodic interest payments and the principal amount at maturity. Understanding Long-Term Bonds is crucial for investors seeking to diversify their portfolios and manage risk, as these instruments offer potentially higher returns due to longer maturity periods but also carry increased risk, particularly in fluctuating interest rate environments. By comprehending the dynamics of Long-Term Bonds, readers can make more informed investment decisions and better anticipate how market conditions, such as inflation and changes in monetary policy, may impact their investments. Issued by a national government, these bonds are often deemed low-risk investments because they are backed by the full faith and credit of the issuing country. Municipalities issue these bonds to finance public projects. They often provide tax-free interest income, making them attractive to investors in high tax brackets. Corporations issue these bonds to fund business needs. Corporate Bonds typically offer higher yields than government or municipal bonds, but they also carry higher risks. Long-Term Bonds come with longer maturities, usually ten years or more. The longer maturity leads to higher sensitivity to interest rate changes. Long-Term Bonds usually offer higher interest rates than short-term bonds. This higher yield compensates investors for the additional risk associated with holding the bond for a longer period. The creditworthiness of the bond issuer impacts the bond's risk level and yield. Bonds from issuers with lower credit ratings offer higher yields to compensate for the increased risk of default. Long-Term Bonds tend to be less liquid than short-term bonds due to their longer maturity. However, government Long-Term Bonds are generally highly liquid due to their strong demand in the market. Long-term bonds play a crucial role in the financial market by providing governments and corporations with a reliable source of long-term financing. These bonds enable issuers to fund capital-intensive projects, such as infrastructure development or expansion initiatives. They also offer investors an opportunity to earn a steady stream of interest income over an extended period. Adding Long-Term Bonds to an investment portfolio can provide several benefits, including diversification, a steady income stream, and potential for higher returns. The periodic interest payments from Long-Term Bonds can provide a steady income stream, making them a suitable investment for those seeking regular income. The inclusion of Long-Term Bonds can help balance the volatility of other investments in a portfolio, such as equities, providing a cushion during periods of market turbulence. In a falling interest rate environment, Long-Term Bonds can offer capital appreciation potential as bond prices increase when rates decrease. Investors can directly purchase bonds from the issuers. For instance, government bonds can be bought directly from the U.S. Treasury Department. Long-Term Bonds can also be bought and sold on the secondary market. Their price will depend on several factors, including the prevailing interest rates and the bond's time to maturity. These investment vehicles allow individuals to gain exposure to a diversified portfolio of Long-Term Bonds. They offer the benefits of diversification and professional management. Higher Yields: Long-term bonds usually offer higher yields than short- or medium-term bonds. This higher yield compensates investors for the increased risk associated with holding the bond for a longer period. Predictable Income: Because most long-term bonds have fixed interest rates, they provide a steady and predictable income stream. This makes them particularly attractive to investors seeking regular income, such as retirees. Capital Appreciation Potential: In a falling interest rate environment, bond prices typically rise, providing the potential for capital appreciation. Portfolio Diversification: Long-term bonds can serve as a diversification tool in an investment portfolio. They tend to have a low correlation with equities, and their returns can offset losses from other riskier investments during periods of market volatility. Interest Rate Risk: Long-term bonds are more susceptible to interest rate risk than their shorter-term counterparts. If interest rates rise, the price of existing bonds falls, which could lead to capital losses if the bond is sold before its maturity. Default Risk: There is a risk that the bond issuer may default or fail to make scheduled interest or principal payments. This risk tends to be higher for corporate bonds than for government or municipal bonds due to the inherent stability of governmental entities. Reinvestment Risk: This risk pertains to the uncertainty around the interest rate at which future cash flows (the periodic coupon payments) can be reinvested. If interest rates decline, investors might have to reinvest their coupon earnings at a lower rate. Liquidity Risk: Long-term bonds tend to be less liquid than short-term bonds. If an investor needs to sell a bond before maturity, it may be challenging to find a buyer, particularly in a market disruption or for bonds of issuers with lower credit ratings. While short-term bonds offer lower yields and lower risk, Long-Term Bonds typically offer higher yields to compensate for their increased risk and longer commitment of capital. Medium-term bonds provide a middle ground between short and Long-Term Bonds. They offer a balance between the yield potential of Long-Term Bonds and the lower risk of short-term bonds. Unlike fixed-rate Long-Term Bonds, floating rate bonds have variable interest rates that adjust with market changes. While this feature can protect against rising interest rates, it also introduces uncertainty regarding future income from the bond. Several macroeconomic factors can influence the performance of Long-Term Bonds, including monetary policy, economic growth, and inflation expectations. Long-term bond yields are sensitive to changes in monetary policy. If the central bank raises interest rates, the yield on newly issued Long-Term Bonds will also increase. During periods of strong economic growth, corporations are more likely to issue long-term debt, increasing the supply of corporate Long-Term Bonds. Moreover, strong growth can lead to rising interest rates, which can impact long-term bond prices. Inflation erodes the purchasing power of a bond's fixed interest payments. Therefore, if investors expect inflation to rise, they may demand higher yields on Long-Term Bonds, driving down their prices. Long-Term Bonds, with their unique characteristics and roles, offer notable opportunities and risks for both issuers and investors. They can provide critical funding for issuers and present attractive yield potentials for investors. Long-Term Bonds also serve as effective instruments for portfolio diversification, offsetting the volatility of riskier assets. However, they come with their own set of risks, including interest rate risk, default risk, and reinvestment risk. Understanding these facets, alongside the impact of macroeconomic factors, enables investors to make informed decisions. As the financial landscape continues to evolve, the role of Long-Term Bonds is likely to remain significant, influenced by technological advancements, regulatory changes, and market conditions.Long-Term Bonds Overview

Types of Long-Term Bonds

Government Bonds

Municipal Bonds

Corporate Bonds

Characteristics of Long-Term Bonds

Duration and Maturity

Interest Rates and Yields

Credit Quality and Risk

Market Liquidity

Role of Long-Term Bonds in the Financial Market

Role of Long-Term Bonds in Portfolio Diversification

Income Generation

Balancing Portfolio Volatility

Potential for Capital Appreciation

How to Invest in Long-Term Bonds

Direct Purchase From Issuers

Secondary Market Purchase

Long-Term Bond Mutual Funds and ETFs

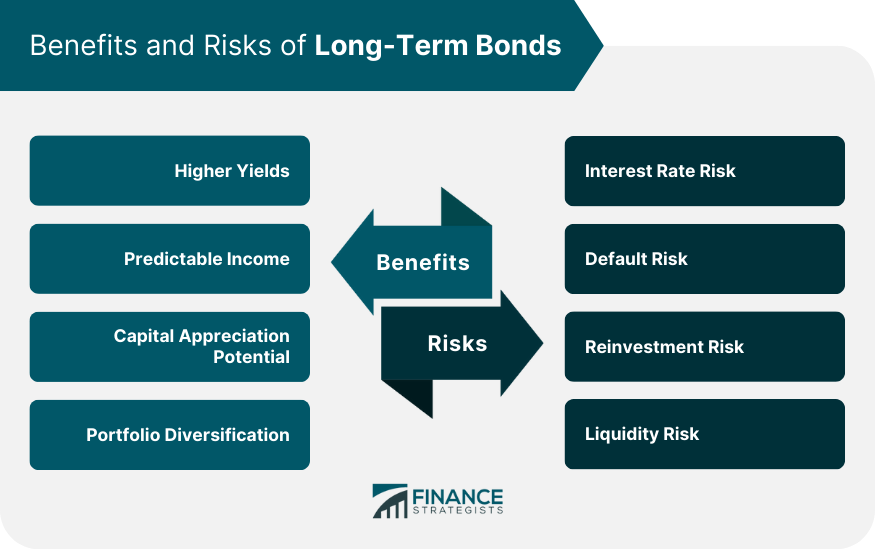

Benefits and Risks of Long-Term Bonds

Benefits

Long-term bonds, in particular, may offer more pronounced price increases due to their longer maturities and higher sensitivity to interest rate changes.Risks

Comparing Long-Term Bonds to Other Bonds

Long-Term Bonds vs Short-Term Bonds

Long-Term Bonds vs Medium-Term Bonds

Long-Term Bonds vs Floating Rate Bonds

Impact of Economic Factors on Long-Term Bonds

Monetary Policy and Long-Term Interest Rates

Economic Growth

Inflation Expectations

Conclusion

Long-Term Bonds FAQs

Long-Term Bonds are debt securities issued by governments or corporations with a maturity period typically exceeding 10 years. They provide a source of financing for the issuer and an income-generating opportunity for investors.

Some common types include government bonds, municipal bonds, and corporate bonds. Long-Term Bonds can be issued by various entities, and the type of issuer significantly influences the risk and return profile of the bond.

Advantages include higher potential yields and income stability. However, Long-Term Bonds also come with risks, including interest rate risk, default risk, and reinvestment risk. These risks can lead to fluctuating bond prices and potential losses.

Economic factors like monetary policy, economic growth, and inflation can significantly impact the performance of Long-Term Bonds. For instance, rising interest rates or inflation can lead to falling bond prices.

Long-Term Bonds can provide a stable income stream and potential for capital appreciation, helping to balance out riskier assets in a portfolio. They can serve as a buffer during periods of stock market volatility, thus contributing to overall portfolio diversification.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.