A municipal bond, sometimes called a muni bond, is a type of debt security issued by a state, city, or local government entity. These bonds are used to finance various public projects and services, such as building schools, highways, and hospitals. The maintenance and improvement of infrastructure, such as water and sewage systems, are also funded by municipal bonds. Municipal bonds are issued to raise capital for these projects and services. The investors lend money to the issuing entity in exchange for interest payments and the return of the principal amount at maturity. Municipal bonds are considered relatively safe investments, as they are backed by the issuing entity's ability to collect taxes and revenues. There are two main categories of municipal bonds: General obligation bonds are issued to finance various public projects but are not backed by revenues from a specific source. These bonds are backed by the issuing entity's general taxing power, which means that the issuer can exercise its taxing authority to repay the bond. Two types of tax guarantees support general obligation bonds, namely, limited and unlimited tax guarantees. In limited tax guarantees, taxes are imposed within the boundaries of existing laws to guarantee the repayment of the debt. With unlimited tax guarantees, taxes are imposed in a way that guarantees the repayment of the debt without a restriction on the tax rate or the amount collected. State and local governments, as well as school districts, often issue general obligation bonds. Revenue bonds are issued to finance projects that generate specific revenues, such as bridge tolls or water and sewage services charges. These bonds are backed by the revenues generated by the project or service and not by the issuer's general taxing power. There are two categories of revenue bonds: tax revenue municipal bonds and enterprise municipal bonds. A portion of ongoing taxes, such as income from a utility tax, resort or hotel tax, excise tax, or sales tax comprise tax revenue municipal bonds. Enterprise municipal bonds are secured by income generated by the costs of using a particular service or facility instead of relying on taxes. These types of bonds are typically issued by entities that charge for services, such as utilities, airports, hospitals, and even sewer authorities. The money collected from users is used to guarantee debt repayment. To compare the two, consider a city with the objective of financing the construction of a convention district. The city may issue municipal bonds. They then set aside some funds collected through hotel use tax to secure a tax revenue bond. Conversely, a city can also fund projects such as maintaining highways with enterprise revenue bonds supported by tolls. Municipal bond investors can enjoy a number of benefits, such as: Interest earned from municipal bonds is generally absolved from federal income taxes and, sometimes, state and local income taxes. This can make municipal bonds an attractive option for investors in higher tax brackets. Investors can save money by being strategic about where they purchase tax-free municipal bonds. For instance, individuals in higher tax brackets may buy tax-exempt municipal bonds in their taxable brokerage accounts. They may place other fixed-income investments that are less tax-advantaged in retirement accounts, such as traditional IRAs and 401(k)s, that are intended to postpone taxes. Municipal bonds can provide a stable, fixed-income stream that is not highly correlated with other asset classes, such as stocks and real estate. This can help reduce overall portfolio risk and improve overall returns. Municipal bonds come with various maturities, credit ratings, and sectors, providing investors with a wide range of options. This allows investors to diversify not only by asset class but also by credit quality and sector. For example, an investor can choose to invest in municipal bonds for infrastructure projects or educational institutions. Diversification across various sectors and credit quality can reduce the portfolio's overall risk and increase the chances of positive returns. Municipal bonds are typically issued by state and local governments, which are considered stable entities. Thus, investing in municipal bonds is considered relatively safe because the full faith and credit of the issuing entity supports them. Municipal bonds also have a lower default rate than other types of bonds because the issuer can use its taxing authority to repay the bond if needed. This can provide investors with added peace of mind and make the bond more attractive to potential buyers. In addition, state and local governments have a vested interest in repaying their debts as they rely on the support of their citizens and businesses. This is a significant factor in reducing the risk of default compared to other types of bonds, such as those issued by corporations. Municipal bonds, like any investment, come with certain risks. Below are common risks associated with investing in municipal bonds: Call risk refers to the possibility that the bond issuer will redeem or "call" the bond before its maturity date. This can happen when interest rates fall and the issuer wishes to refinance the debt at a lower rate. If this happens, investors will have to reinvest the proceeds at lower interest rates, resulting in a reduction in income. The possibility that the bond issuer is unable to make interest or principal payments as scheduled is called credit risk. Also known as default risk, this can happen if the issuer's financial condition deteriorates or the project or service financed by the bond is unsuccessful. Municipal bonds have a lower default rate than other types of bonds but are not immune to default. Changes in interest rates will affect the value of the bond. When interest rates go up, the value of existing bonds falls, and vice versa. Investors who try to resell their low-rate municipal bonds could suffer losses due to the diminished market value of their bonds. The purchasing power of the bond's interest and principal payments will be eroded by inflation. As prices rise, the value of fixed-income payments decreases. Municipal bonds with longer maturities are generally more susceptible to inflation risk. Investors wishing to access the funds tied up in a municipal bond might resell it in the secondary market. However, it might not be possible for the bond to be sold at a fair price during periods of market stress. This is known as liquidity risk and is particularly relevant for bonds that are not widely traded or for bonds that less well-known issuers issue, which leads to price volatility and difficulty in exiting a position. Investing in municipal bonds is a wise decision for many individuals, and here are several ways to get started: Individual bonds can be purchased directly from the issuer or through a broker. When buying individual bonds, investors should research the issuer's creditworthiness and the bond's terms, such as maturity date and coupon rate. It is also essential to pay attention to the call provisions, which can affect the bond's liquidity and the bond's yield to maturity. A municipal bond ladder is a strategy where investors buy a series of bonds with different maturity dates. When a bond on the ladder matures, the principal from that previous bond is reinvested into a new bond. Laddering can be done by buying individual bonds or through a bond fund that implements this strategy. This strategy provides investors with a steady income from the interest payments of unmatured bonds while also spreading out the risk of interest rate changes and defaults. Municipal bond funds, also known as muni funds, are a way to invest in a diversified portfolio of municipal bonds without having to research and buy individual bonds. Muni funds can offer professional management, instant diversification, and liquidity. Since these types of funds spread investments across bonds from different municipalities with varying credit ratings, projects, and types, investors can easily reduce default risk. They can also rely on the fund manager to monitor and provide expertise and convenience. Municipal bonds and Treasury bonds are both debt securities issued by government entities, but there are some key differences between the two. Municipal bonds, also known as munis, are issued by state and local governments. These are used to finance a wide range of public projects such as schools, roads, and water treatment facilities. The main benefit of investing in munis is that the interest income is generally tax-free at the federal level and may also be tax-free at the state and local levels. This can make munis an attractive investment for individuals in high tax brackets. On the other hand, Treasury bonds are issued by the federal government and used to finance the government's spending. The interest income from Treasury bonds is subject to federal income tax. It is, however, exempt from state and local income taxes. Treasury bonds are believed to be one of the safest investments available, as the full faith and credit of the government supports them. Municipal bonds offer relatively low risk, while Treasury bonds are considered risk-free. Both are good strategies to add stability and income to a portfolio. However, there are certain situations when investing in one type of bond over the other may be more appropriate. For example, if an investor is in a high tax bracket and is looking for tax-free income, munis may be a better choice. On the other hand, if an investor is looking for a very safe investment with a high degree of liquidity, Treasury bonds may be the better choice. When comparing munis and Treasury bonds, it is not just about the yields but also about the issuer's credit ratings, the bond's duration, and the overall economic and market conditions. Do not hesitate to consult and work with a professional who specializes in wealth management services to help you select the best option. Municipal bonds are debt securities issued by local government entities such as cities, counties, and states. They are used to finance various public projects such as infrastructure, schools, and hospitals. There are two types of Muni bonds. First, general obligation bonds involve issuers using their taxing authority to repay the bond. The second type, revenue bonds, are repaid using the revenue generated by the project or entity rather than by the government's taxing authority. Investors can invest in individual municipal bonds or purchase multiple bonds and implement a laddering strategy. They can also buy shares in a bond fund, which provides diversification and professional management. Municipal bonds can offer a considerable tax advantage regardless of the investment strategy applied. The interest earned is usually free from federal income tax and, sometimes, state and local taxes. However, municipal bonds also come with credit, interest rate, and liquidity risks. The value of municipal bonds may be affected by changes in interest rates and the issuer's financial condition. For this reason, they are often compared with Treasury bonds, which are fully guaranteed and considered risk-free. The risk of investing in municipal bonds varies depending on the issuer's creditworthiness and the terms of the bond. Investors should conduct thorough research before investing in this type of bond.What Is a Municipal Bond?

Types of Municipal Bonds

General Obligation Bonds

Revenue Bonds

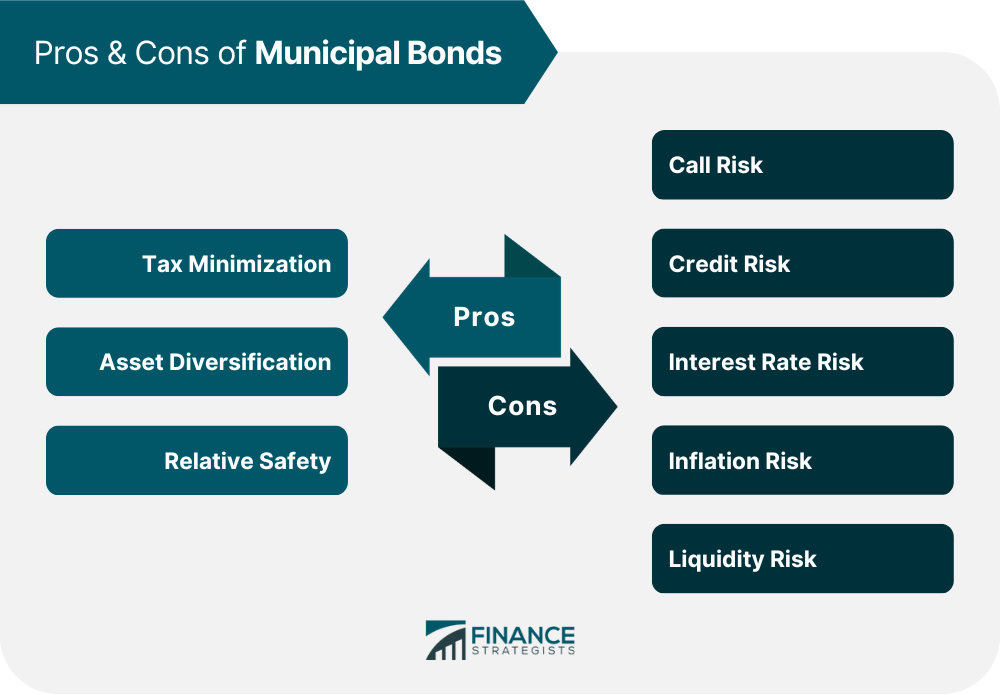

Benefits of Investing in Municipal Bonds

Tax Minimization

Asset Diversification

Relative Safety

Risks of Investing in Municipal Bonds

Call Risk

Credit Risk

Interest Rate Risk

Inflation Risk

Liquidity Risk

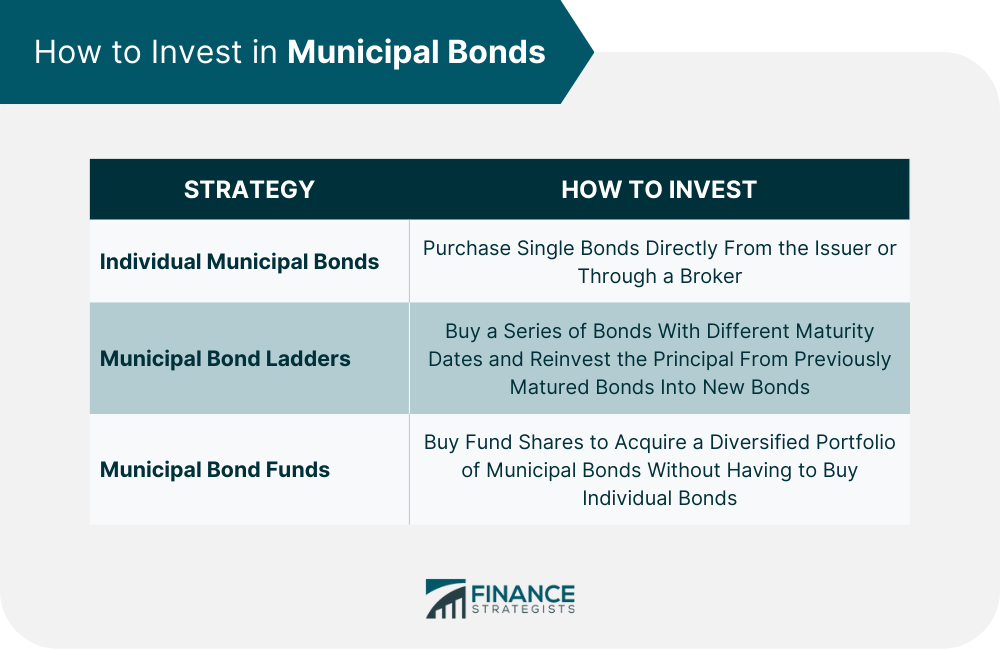

How to Invest in Municipal Bonds

Individual Municipal Bonds

Municipal Bond Ladders

Municipal Bond Funds

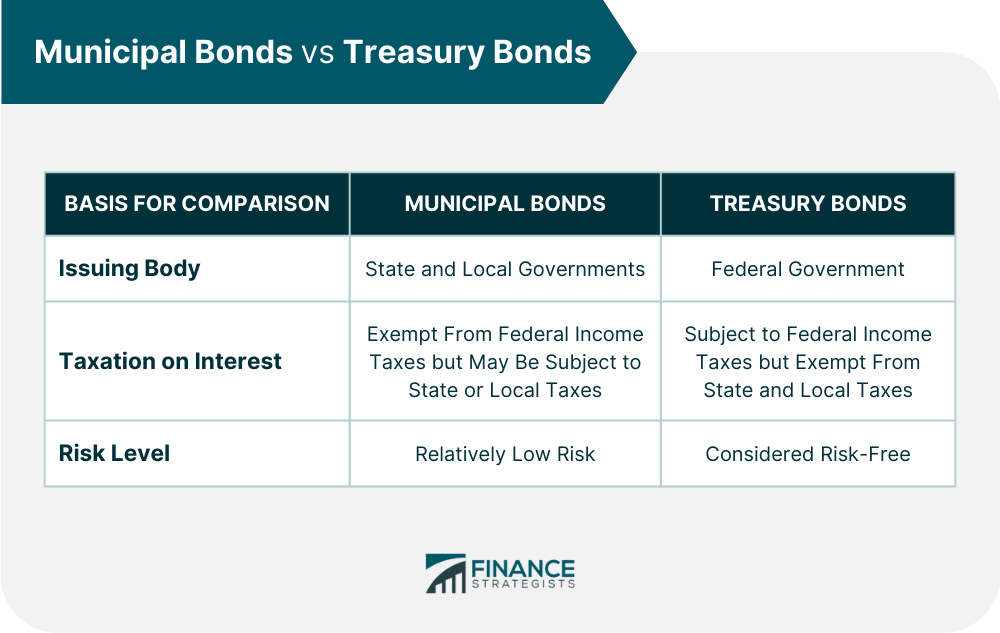

Municipal Bonds vs Treasury Bonds

Final Thoughts

Municipal Bond FAQs

Investors buy municipal bonds because they offer tax-free income, diversification benefits, and relatively low default risk compared to other types of bonds.

Municipal bonds are issued by state and local governments and are generally tax-free at the federal level, and in many cases, at the state and local levels as well.

Municipal bonds may have a minimum investment of $5,000.

Municipal bonds can offer several benefits to investors. First, interest earned is generally free from federal income taxes and, sometimes, state and local income taxes. Municipal bonds are also considered relatively safe because the issuing entity backs them and offers a guarantee. Lastly, municipal bonds allow an investor to diversify their investment portfolio.

Municipal bonds may be a good investment for some investors as they offer a relatively stable and fixed income stream, are tax-advantaged, and can help diversify a portfolio. However, it is important to consider the risks involved, such as credit risk, interest rate risk, and inflation risk.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.