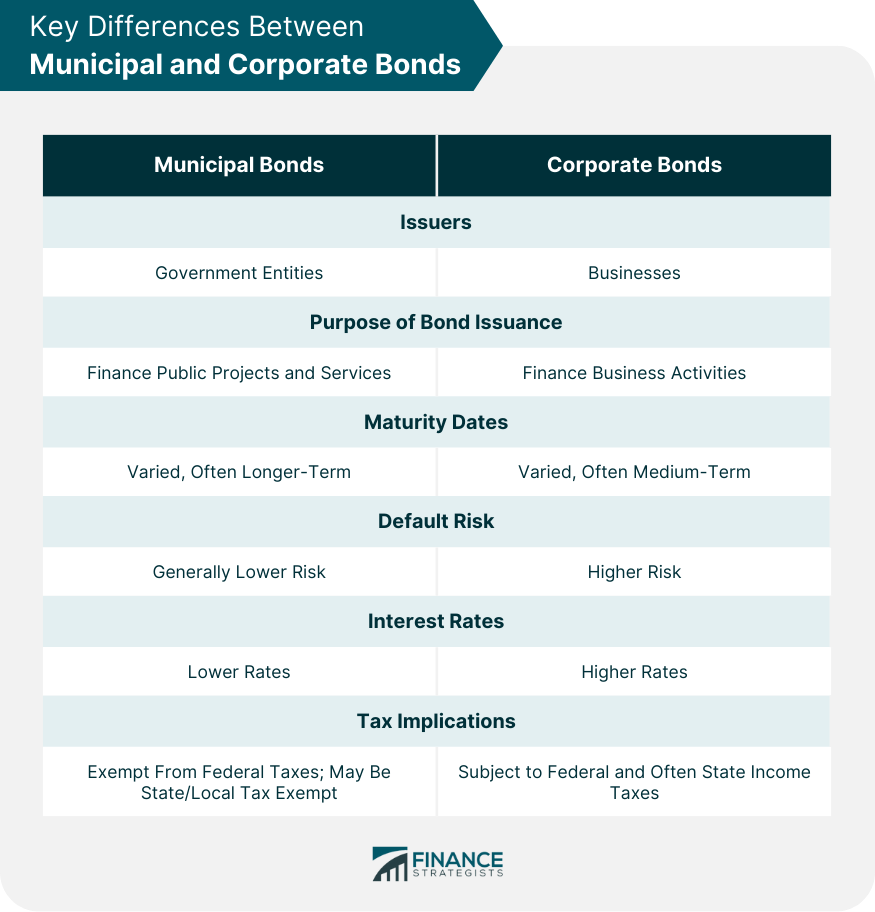

Bonds are fixed income instruments that represent a loan made by an investor to a borrower, typically a corporate or government entity. Borrowers issue bonds to raise money and investors buy them, essentially lending money to the issuer in exchange for interest. The issuer is obligated to pay the principal back at the "maturity date" and provide periodic interest payments to the bondholder. Municipal bonds, or "munis," are debt securities issued by states, cities, counties, and other governmental entities to fund day-to-day obligations and finance capital projects such as building schools, highways, or sewer systems. These bonds are advantageous for investors due to their tax-exempt status at the federal and often state and local level. On the other hand, corporate bonds are debt securities issued by businesses. Companies issue corporate bonds to raise funds for various purposes, like operations, acquisitions, or expansions. Unlike municipal bonds, the interest earned from corporate bonds is subject to federal and, in some cases, state and local tax. Municipal bonds are issued by government entities, whereas corporate bonds are issued by businesses. The issuing entity is significant because it impacts the risk and tax treatment of the bond. Municipal bonds are issued to finance public projects and services that benefit the community at large, such as schools, hospitals, and public infrastructure. Corporate bonds, meanwhile, are issued to finance a wide range of business activities. These could include funding expansion plans, investing in new projects, or refinancing existing debt. Both municipal and corporate bonds can have a variety of maturity dates, generally categorized as short-term (under two years), medium-term (two to ten years), and long-term (over ten years). However, there can be trends within each type of bond. Municipal bonds, for example, often have longer maturities, which align with the long-term nature of the public projects they fund. Corporate bonds, on the other hand, can span all ranges but may often fall into the medium-term category, aligning with the business cycles of corporations. Municipal bonds are generally considered safer than corporate bonds. This is because they are backed by governmental entities, which have the power to raise taxes or adjust budgets to meet their obligations. In contrast, corporations may face financial difficulties or even bankruptcy, leading to a higher risk of default. However, it's important to note that "safe" doesn't mean "risk-free," and municipal bonds can and do default on rare occasions. Corporate bonds typically offer higher interest rates than municipal bonds due to the higher risk associated with corporate lending. However, the after-tax yield may be higher for municipal bonds depending on the investor's tax bracket. The interest earned on municipal bonds is typically exempt from federal taxes, and if the bond is issued within the investor's state of residence, it may also be exempt from state and local taxes. In contrast, interest earned on corporate bonds is subject to federal and, often, state income taxes. During periods of economic growth, corporations are likely to thrive, decreasing the default risk associated with corporate bonds. However, stronger economies often coincide with rising interest rates, which can negatively affect bond prices. Conversely, in times of economic downturns, corporate defaults may rise, but interest rates often decrease, which can increase bond prices. Municipal bonds, being more linked to governmental policy and less susceptible to market fluctuations, may offer some degree of protection in volatile economic times, though they are not entirely immune to broad economic trends. A corporation with strong earnings and low debt is likely to have a higher credit rating, meaning its bonds are considered a safer investment. Likewise, a city or state with a stable tax base and responsible fiscal management is likely to issue more secure municipal bonds. Any changes in tax laws can significantly impact the attractiveness and value of municipal and corporate bonds. For instance, if the federal government were to change the tax-exempt status of municipal bonds, this could severely dampen their appeal to investors. Similarly, alterations to the tax treatment of corporate bond income could affect their desirability. Investors need to stay informed about potential tax law changes and consider how these might impact their bond investments. Just like any market, the bond market is influenced by supply and demand dynamics. If a large number of investors want to buy bonds, prices will rise, and yields will fall. Alternately, if many investors are trying to sell bonds, prices will drop, and yields will rise. Demand for bonds can be influenced by many factors, including economic conditions, investor sentiment, and changes in interest rates. Tracking these trends can provide insights into potential shifts in bond pricing and returns. Given the tax advantages and lower risk, municipal bonds can be an excellent choice for conservative investors in higher tax brackets. They are particularly appealing to those seeking steady, predictable income, such as retirees. Additionally, those who value the social impact of their investments may find municipal bonds satisfying, as they contribute to societal development and public projects. On the other hand, corporate bonds can be a good fit for investors seeking higher potential returns and willing to accept a higher level of risk. They may be particularly appealing to individuals in lower tax brackets or those investing through tax-advantaged accounts, where the impact of taxes on bond interest would be minimized. An essential part of any investment strategy is diversification - the practice of spreading your investments across various types of assets to mitigate risk. Including a mix of municipal and corporate bonds in your portfolio can help achieve this. Municipal bonds can offer stability and tax advantages, whereas corporate bonds may provide higher yields. By balancing these assets, you can manage the risk-return trade-off based on your financial goals and risk tolerance. Moreover, within the bond segment of your portfolio, further diversification can be achieved by investing in bonds with different maturity dates, credit qualities, and sectors. This strategy can help smooth out returns over time and reduce the impact of any single bond or issuer defaulting. It's vital to review its rating provided by credit rating agencies such as Standard & Poor's, Moody's, and Fitch Ratings. These ratings assess the issuer's ability to meet the financial obligations of the bond - in essence, their likelihood of default. Higher-rated bonds (AAA or AA, for instance) are deemed more creditworthy and thus less likely to default, but they generally offer lower yields. Lower-rated bonds (BBB or lower), sometimes referred to as high-yield or junk bonds, carry a higher risk of default but offer higher potential returns. Investors should consider these ratings in the context of their risk tolerance and investment goals. For example, a retiree might prefer higher-rated bonds for their safety, while a younger investor might be willing to take on higher-risk bonds for potential growth. As discussed earlier, municipal bonds offer tax-exempt interest, making them attractive to investors in higher tax brackets. On the other hand, the interest from corporate bonds is taxable but might provide a higher yield, which can be beneficial for those in lower tax brackets or investing through tax-advantaged accounts. Carefully considering your tax situation can help you optimize your after-tax return and effectively manage your overall investment strategy. It's often beneficial to consult with a tax professional or financial advisor to understand fully the potential tax implications of your bond investments. Bonds offer investors the opportunity to lend money in exchange for interest payments. Municipal bonds, issued by government entities, are used to finance public projects and services and provide tax-exempt status at the federal and often state and local levels. On the other hand, corporate bonds are issued by businesses for various purposes and are subject to federal and sometimes state and local taxes. They generally offer higher interest rates to compensate for the higher risk associated with corporate lending. Several factors influence municipal and corporate bonds, including economic conditions, issuer credit quality, tax laws, and market demand. Diversification is crucial in bond investments, as it allows investors to balance stability, tax advantages, and higher yields by including a mix of municipal and corporate bonds with different characteristics. Additionally, considering bond ratings and tax implications can help optimize after-tax returns and effectively manage overall investment strategies. By understanding the key differences and implementing sound strategies, investors can make informed decisions to achieve their financial goals.Overview of Bonds

Key Differences Between Municipal and Corporate Bonds

Issuers

Purpose of the Bond Issuance

Maturity Dates

Default Risk

Interest Rates

Tax Implications

Factors Influencing Municipal and Corporate Bonds

Economic Conditions

Issuer's Credit Quality

Tax Laws

Market Demand

Ideal Investor Profile for Municipal and Corporate Bonds

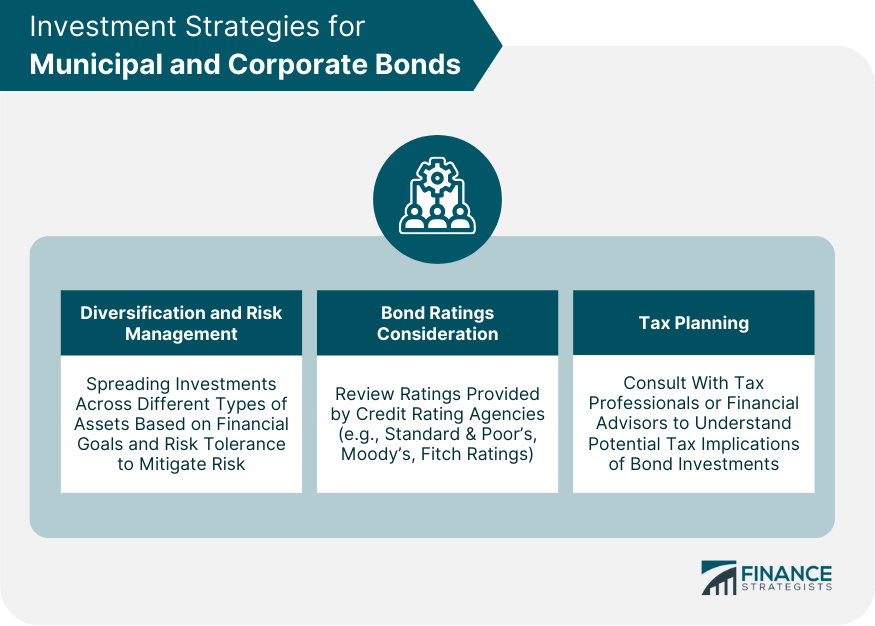

Tips for Investing in Municipal and Corporate Bonds

Diversification and Risk Management

Bond Ratings Consideration

Tax Planning

Final Thoughts

Municipal Bonds vs Corporate Bonds FAQs

Municipal bonds are issued by government entities to finance public projects, while corporate bonds are issued by businesses to raise funds for various purposes. This distinction affects the risk profile, tax treatment, and purpose of the bond issuance.

Generally, municipal bonds are considered safer than corporate bonds. Municipal bonds benefit from the backing of governmental entities, which have the power to raise taxes or adjust budgets to meet their obligations. Corporate bonds, on the other hand, are subject to the financial health and potential risks of the issuing business. However, it's important to note that no investment is entirely risk-free, and rare cases of municipal bond defaults can occur.

Municipal bonds offer tax advantages. The interest earned from municipal bonds is typically exempt from federal taxes. In addition, if the bond is issued within the investor's state of residence, it may also be exempt from state and local taxes. Conversely, the interest earned from corporate bonds is subject to federal taxes and, in some cases, state and local income taxes.

Yes, municipal bonds and corporate bonds generally have different interest rates. Corporate bonds typically offer higher interest rates than municipal bonds due to the higher risk associated with lending to corporations. However, when considering the after-tax yield, the tax-exempt status of municipal bonds may make them more attractive, depending on the investor's tax bracket.

Municipal bonds are often suitable for conservative investors, particularly those in higher tax brackets. They are appealing to individuals seeking steady, predictable income and those who value the social impact of their investments. Corporate bonds, on the other hand, may be more suitable for investors seeking higher potential returns and are willing to accept a higher level of risk. They may be particularly appealing to individuals in lower tax brackets or those investing through tax-advantaged accounts, where the impact of taxes on bond interest would be minimized.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.