Sovereign bonds is debt instruments issued by a country's government, typically denominated in the country's own currency or a foreign currency. Investors who purchase these bonds essentially lend money to the issuing government, which promises to pay periodic interest payments and repay the principal amount upon the bond's maturity. Sovereign bonds play a crucial role in the global financial market by providing governments with a source of funding and investors with a relatively safe and stable investment option. These bonds also help maintain the liquidity of financial markets and can serve as benchmarks for other debt securities, such as corporate bonds. Fixed-rate sovereign bonds are the most common type of sovereign bonds. These bonds pay a fixed interest rate, also known as the coupon rate, over the bond's life. The interest payments are typically made semi-annually or annually, providing investors with a stable and predictable income stream. Fixed-rate bonds are affected by interest rate fluctuations, which can cause their market value to rise or fall. Inflation-linked sovereign bonds, also known as inflation-indexed bonds or real return bonds, are designed to protect investors from the adverse effects of inflation. The principal amount and interest payments of these bonds are adjusted according to an inflation index, such as the Consumer Price Index (CPI). As a result, the income generated by inflation-linked bonds maintains its purchasing power over time, providing investors with a hedge against inflation. Examples of inflation-linked sovereign bonds include the U.S. Treasury Inflation-Protected Securities (TIPS) and the U.K. Index-Linked Gilts. Zero-coupon sovereign bonds do not pay periodic interest payments like traditional fixed-rate or inflation-linked bonds. Instead, these bonds are issued at a discount to their face value, and investors receive the full face value upon maturity. The difference between the purchase price and the face value represents the interest earned by the investor. Zero-coupon bonds are particularly attractive to investors who prefer a long-term investment without the need for regular income. While most sovereign bonds are denominated in the issuing country's currency, some governments issue bonds in foreign currencies. This type of sovereign bond can help a government raise funds from international investors and diversify its sources of financing. However, foreign currency-denominated bonds expose both the issuer and the investor to currency risk, which arises from fluctuations in exchange rates. Examples of foreign currency-denominated sovereign bonds include Eurobonds, Samurai bonds, and Yankee bonds. Floating-rate sovereign bonds have variable interest rates that adjust periodically based on a reference rate, such as the London Interbank Offered Rate (LIBOR) or a central bank's policy rate. The interest payments on floating-rate bonds rise or fall with changes in the reference rate, providing investors with some protection against interest rate risk. However, the income generated by these bonds may be less predictable than fixed-rate bonds. Governments issue sovereign bonds for various reasons, including: Financing Government Spending: Governments often rely on sovereign bonds to finance public spending on social services, defense, and other programs. Infrastructure Projects: Sovereign bonds can provide funding for large-scale infrastructure projects, such as highways, airports, and energy facilities. Debt Refinancing: Governments may issue new bonds to repay existing debt, which can help them manage their debt levels and extend the repayment period. The issuance process for sovereign bonds typically involves the following steps: Investing in sovereign bonds offers several benefits, including: Safety and Stability: Sovereign bonds are generally considered low-risk investments because they are backed by the full faith and credit of the issuing government. Diversification: Including sovereign bonds in an investment portfolio can help diversify risk and enhance overall returns. Income Generation: Sovereign bonds typically pay periodic interest payments, providing a steady stream of income for investors. Investing in sovereign bonds also involves certain risks, such as interest rate risk, credit risk, currency risk, and political risk. The major sovereign bond markets include the United States, European Union, Japan, and China. These markets are characterized by large trading volumes and high liquidity, making them attractive to investors seeking safety and stability. Sovereign bonds are traded in secondary markets after their initial issuance. These markets allow investors to buy and sell bonds before they reach maturity, providing flexibility and liquidity. Over-The-Counter (OTC) Trading: Most sovereign bonds are traded OTC, meaning transactions occur directly between buyers and sellers, often facilitated by brokers or dealers. Electronic Trading Platforms: Some sovereign bonds are traded on electronic trading platforms, which provide increased transparency and efficiency. Market Liquidity: The liquidity of a sovereign bond market refers to the ease with which investors can buy and sell bonds. High liquidity is generally associated with lower transaction costs and more stable prices. Market indicators provide insight into the performance and health of the sovereign bond market. Some common indicators include: Yield Curves: A yield curve plots the interest rates of bonds with different maturities, providing a snapshot of the market's expectations for future interest rates and economic growth. Bond Spreads: Bond spreads measure the difference in yields between two bonds, often comparing a sovereign bond to a benchmark bond. Wider spreads indicate a higher perceived risk for the bond in question.| Credit Default Swaps: Credit default swaps (CDS) are financial instruments that provide insurance against the risk of default on a bond. Higher CDS prices signal a higher perceived risk of default. Credit rating agencies evaluate the creditworthiness of governments and their sovereign bonds. The three major credit rating agencies are Standard & Poor's (S&P), Moody's, and Fitch Ratings. Credit rating agencies consider various factors when assessing sovereign bond ratings, including economic factors, political factors, fiscal factors, and external factors. Credit ratings has a significant impact on sovereign bonds, influencing interest rates, investor demand, and market perception. Interest Rates: Higher credit ratings typically result in lower borrowing costs for governments, as investors perceive lower risks associated with these bonds. Investor Demand: Bonds with higher credit ratings tend to attract more demand from investors, leading to higher prices and lower yields. Market Perception: Credit ratings can shape market perception and influence the overall sentiment toward a country's economy and financial stability. A sovereign debt crisis occurs when a country struggles to repay its debt obligations, often due to a combination of factors such as economic slowdown, fiscal mismanagement, and external shocks. Several sovereign debt crises have occurred throughout history, including the Latin American debt crisis (the 1980s), the Asian financial crisis (1997-1998), and the European debt crisis (2010-2012). International organizations, such as the International Monetary Fund (IMF) and the World Bank, often play a crucial role in addressing sovereign debt crises by providing financial assistance, policy advice, and technical support. Solutions to sovereign debt crises may involve debt restructuring, bailouts, and the implementation of economic reforms. Sovereign bonds play a critical role in the global financial market by providing governments with a means to finance their activities and offering investors a relatively safe and stable investment option. Understanding the intricacies of sovereign bonds, their issuance, and the factors that influence their performance is essential for investors and policymakers alike.Definition of Sovereign Bonds

Several factors can influence the issuance of sovereign bonds, such as market conditions, interest rates, credit ratings, and government fiscal policy.Purpose and Role of Sovereign Bonds in the Financial Market

Types of Sovereign Bonds

Fixed-Rate Sovereign Bonds

Inflation-Linked Sovereign Bonds

Zero-Coupon Sovereign Bonds

Foreign Currency-Denominated Sovereign Bonds

Floating-Rate Sovereign Bonds

Reasons for Issuing Sovereign Bonds

Issuing Process for Sovereign Bonds

1. Planning: The government determines the amount, currency, maturity, and other terms of the bond issuance.

2. Underwriting: Investment banks or other financial institutions help the government structure the bond issuance and market it to potential investors.

3. Auction or Sale: The government sells the bonds through an auction or a direct sale to investors.

4. Settlement: The government receives the proceeds from the bond sale, and the investors receive the bonds in their portfolios.

Benefits of Investing in Sovereign Bonds

Risks of Investing in Sovereign Bonds

Sovereign Bond Market

Sovereign Bond Ratings

Sovereign Debt Crises

The Bottom Line

Sovereign Bonds FAQs

Sovereign bonds are debt securities issued by a national government to raise funds for various purposes, such as financing government spending, infrastructure projects, and debt refinancing. Governments issue sovereign bonds to meet their financial needs and maintain stability in the financial market.

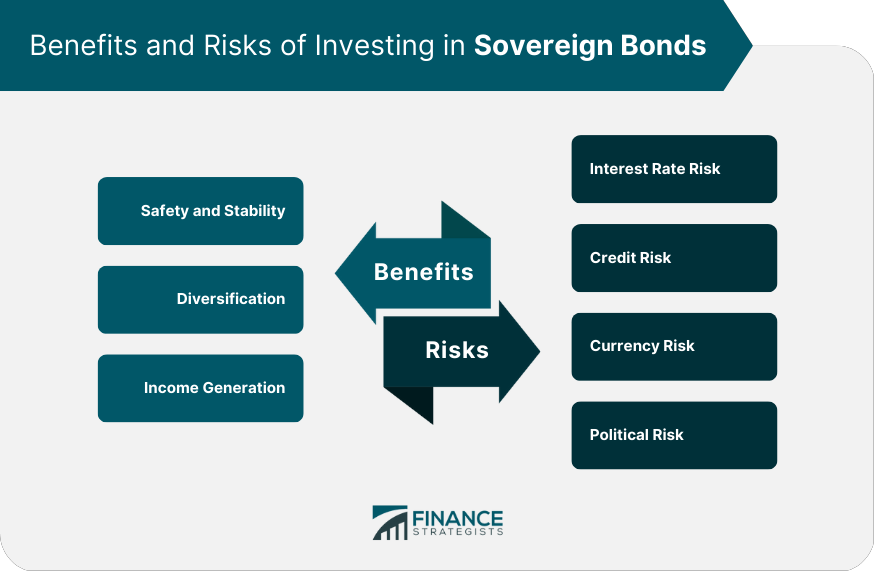

Investing in sovereign bonds offers several benefits, including safety and stability due to their backing by the issuing government, diversification for an investment portfolio, and income generation through periodic interest payments.

Investing in sovereign bonds involves risks such as interest rate risk, credit risk, currency risk, and political risk. These risks can affect the value of the bonds and the income generated by them, so investors should carefully assess these factors before investing.

Credit ratings have a significant impact on sovereign bonds, as they influence interest rates, investor demand, and market perception. Higher credit ratings typically result in lower borrowing costs for governments and increased demand from investors, while lower ratings may signal higher perceived risks and potentially higher borrowing costs.

International organizations, such as the International Monetary Fund (IMF) and the World Bank, often play a crucial role in addressing sovereign debt crises by providing financial assistance, policy advice, and technical support. Solutions to sovereign debt crises may involve debt restructuring, bailouts, and the implementation of economic reforms.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.