Sukuk, often referred to as Islamic bonds, are financial instruments that comply with Islamic principles and are used for raising capital in the Islamic finance industry. Unlike conventional bonds that represent debt obligations, sukuk represents ownership in underlying assets, projects, or business activities. The issuance of sukuk involves the securitization of these assets or cash flows, providing investors with a share of the profits generated from the underlying activities. Sukuk adhere to the principles of Shariah law, which prohibit the charging or paying of interest (riba) and promote ethical investment practices. They have gained popularity globally as a means of attracting Islamic investors and diversifying sources of funding. In Islamic finance, the charging or receiving of interest is strictly forbidden. This prohibition stems from the belief that money should not generate more money by itself, which is the underlying principle of interest. Instead, profits should arise from a shared business risk or an investment in a tangible asset or service. This principle shapes the structure of Sukuk, where returns arise from profits or rental income. Sukuk is always linked to an underlying asset or business. This feature distinguishes them from conventional bonds, which are simply based on the issuer's creditworthiness. By being asset-based or asset-backed, Sukuk offers a more secure investment as investors have a claim on a tangible asset. Sukuk embodies the Islamic principle of risk-sharing, where both profit and loss are shared between the issuer and investors. This principle contrasts with conventional bonds, where the issuer bears the risk of default. Sukuk also complies with the Islamic principles of ethical investment and prohibition of uncertain transactions. Sukuk cannot finance businesses deemed 'haram' or forbidden by Islamic law, such as gambling or alcohol. They also avoid 'gharar' or uncertainty, requiring the terms of the investment to be clear and definite. Ijara Sukuk is akin to leasing contracts. The Sukuk issuer leases an asset to the investor, who receives regular rental payments. At the end of the Sukuk term, the issuer buys back the asset at a predetermined price. Mudaraba Sukuk represents an investment partnership, where the issuer (or entrepreneur) uses the investors' capital to invest in a business or project. Profits are shared according to a predetermined ratio, while the investors bear losses unless the issuer is negligent. Musharaka Sukuk represents a joint venture or partnership. All parties contribute capital and share in the profits and losses of the venture. This type of Sukuk is often used for large-scale infrastructure projects. Murabaha Sukuk involves a cost-plus financing agreement. The issuer uses the Sukuk proceeds to buy an asset, which is then sold to the investor at a markup. The investor makes fixed payments over time. Salam Sukuk is based on a forward sale contract. The issuer receives payment from the investors upfront and delivers the underlying asset at a future date. These Sukuk are often used in agriculture, where farmers need capital to grow crops. Istisna Sukuk represents a contract for manufacturing or construction. The issuer (manufacturer or builder) agrees to deliver a project or asset at a future date. These Sukuk are suitable for infrastructure or real estate development. Hybrid Sukuk combines different types of contracts to meet specific financing needs. They are used when a single contract type does not suffice. Sukuk issuance involves multiple parties, including the issuer (who needs to raise capital), the investors (who provide the capital), the trustee (who manages the Sukuk assets), and the Shariah board (which ensures Shariah compliance). Legal and financial advisors are also typically involved. The process of issuing Sukuk involves several steps. First, the issuer and advisors structure the Sukuk according to Shariah principles. Next, the Sukuk is approved by the Shariah board and relevant regulatory bodies. Then, the Sukuk is marketed to potential investors, often through a roadshow. Finally, the Sukuk is issued, and the proceeds are transferred to the issuer. The Sukuk issuance process involves several key documents, including the prospectus (which details the investment terms), the subscription agreement (which investors sign to purchase Sukuk), and the trust deed (which outlines the trustee's responsibilities). The structure of the Sukuk may require additional agreements, such as lease agreements for Ijara Sukuk or sale agreements for Murabaha Sukuk. Like all investments, Sukuk carries risks. These include credit risk (if the issuer cannot meet its obligations), market risk (if the value of the Sukuk or underlying asset changes), and liquidity risk (if the Sukuk cannot be sold quickly). However, Sukuk's asset-backed or asset-based nature often makes them less risky than conventional bonds. The returns on Sukuk are often competitive with those of conventional bonds. They typically come from profits or rental income from the underlying asset or business. However, returns can vary depending on the type and structure of the Sukuk, the performance of the underlying asset, and market conditions. While Sukuk and conventional bonds have similar risk-return profiles, there are key differences. Sukuk returns are usually asset-linked and variable, while bond returns are fixed and represent interest. Sukuk also tends to have lower risk due to their asset-backed or asset-based nature, but they may carry higher liquidity risk as the market is smaller and less developed. Shariah boards play a critical role in Sukuk by ensuring Shariah compliance. They review and approve the Sukuk structure and documentation, and they may also oversee the use of Sukuk proceeds. The Shariah board is typically composed of scholars knowledgeable in Islamic law and finance. Regulatory concerns in Sukuk can include issues related to the disclosure of information, the protection of investors, and the transparency of the issuance process. Regulatory bodies aim to ensure that Sukuk markets operate fairly and efficiently. They may also need to address cross-border issues, as Sukuk are often issued in one country and sold to investors in others. As Sukuk has gained global acceptance, they must comply with international financial regulations. This compliance can include anti-money laundering rules, securities regulations, and accounting standards. Compliance can pose challenges, as these regulations were often designed with conventional finance in mind, but it can also enhance the attractiveness of Sukuk to global investors. The global Sukuk market has grown significantly over the past two decades, driven by demand for ethical and Shariah-compliant investments. Sukuk issuances have come from diverse sources, including governments, corporations, and international organizations. The market has also seen innovation with the issuance of green and social Sukuk. While the Sukuk market originated in Muslim-majority countries, it has spread worldwide. The Gulf Cooperation Council (GCC) countries and Malaysia are leading issuers, but Sukuk has also been issued in Europe, Africa, and Asia. The UK became the first Western country to issue a sovereign Sukuk in 2014. Major players in the Sukuk market include sovereign issuers like Malaysia, Saudi Arabia, and the United Arab Emirates, as well as corporate issuers like Dubai Islamic Bank and Axiata Group. International organizations like the Islamic Development Bank also issue Sukuk. On the investor side, Islamic financial institutions, pension funds, and sovereign wealth funds are major Sukuk holders. Economic factors can significantly impact the Sukuk market. For example, oil prices can affect Sukuk issuances from oil-exporting countries. Interest rates can influence the attractiveness of Sukuk relative to conventional bonds. Moreover, economic growth can drive demand for capital and, thus, for Sukuk. Despite its growth, the Sukuk market faces several challenges. These include a lack of standardization, which can create uncertainty for investors, and regulatory hurdles, which can complicate cross-border issuances. The market also needs to improve its liquidity and broaden its investor base. The Sukuk market also presents exciting opportunities. The demand for ethical investments could drive the growth of green and social Sukuk. The development of FinTech could improve market access and efficiency. Moreover, as more countries adopt regulatory frameworks for Sukuk, the market could further expand globally. Sukuk, or Islamic bonds, presents a unique opportunity for ethical, asset-backed investment in line with Islamic principles. They offer an alternative to conventional bonds, with returns derived from shared profits or rental income instead of interest. Various types, from Ijara to Hybrid Sukuk, cater to different contractual needs. The Sukuk market, while facing challenges such as standardization and regulatory issues, also holds immense growth potential, particularly with the advent of FinTech and increasing demand for ethical investments. The role of Sukuk in the global economy is set to grow. If you're considering investing in Sukuk, it's crucial to seek professional services to navigate this complex yet rewarding investment landscape.Definition of Sukuk

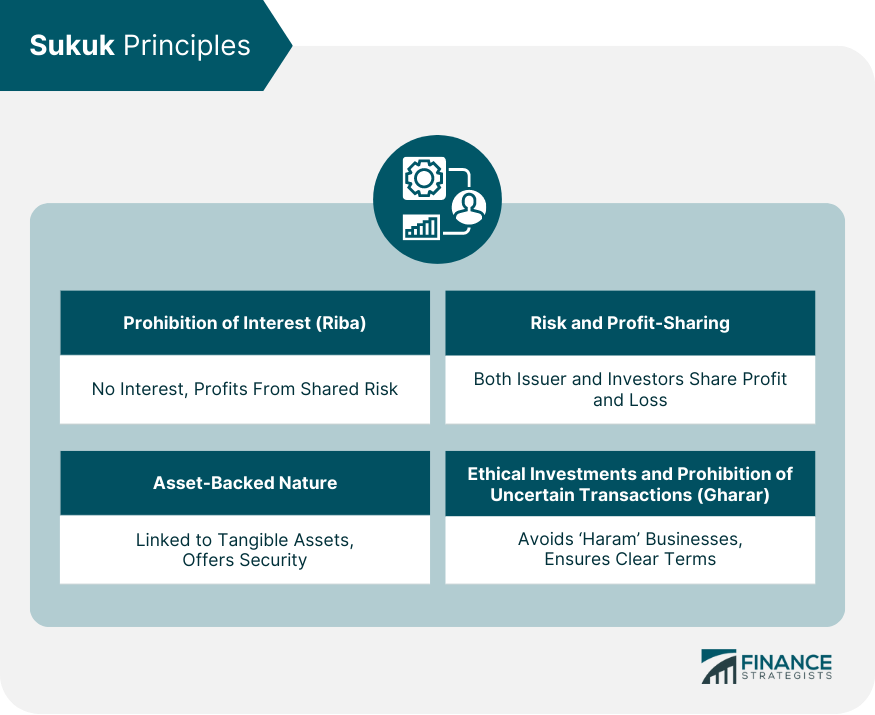

Understanding the Basic Principles of Sukuk

Prohibition of Interest (Riba)

Asset-Backed Nature

Risk and Profit-Sharing

Ethical Investments and Prohibition of Uncertain Transactions (Gharar)

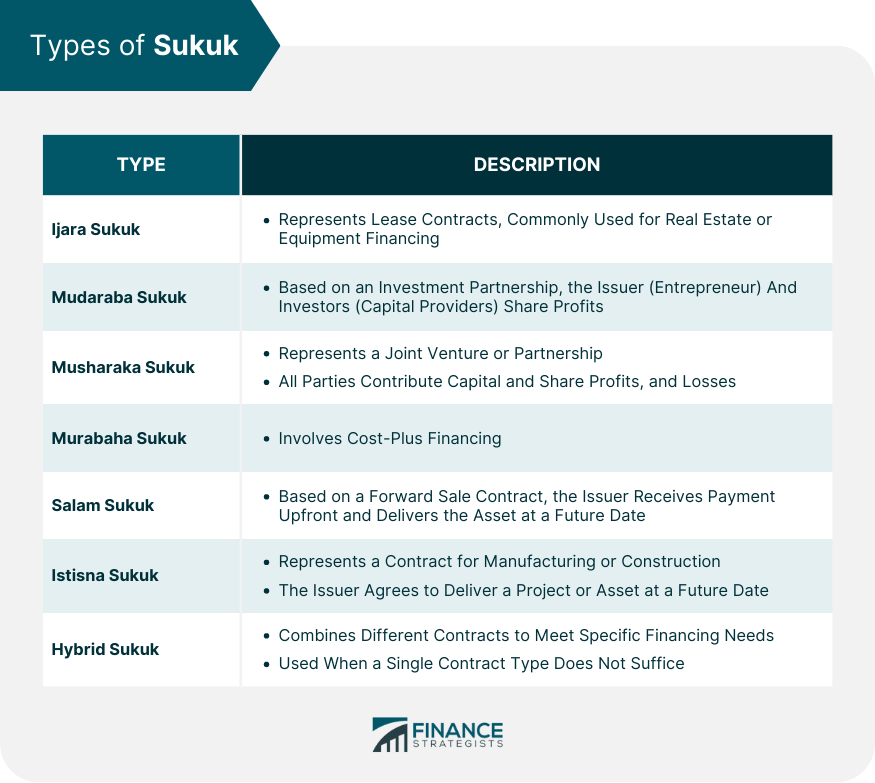

Types of Sukuk

Ijara Sukuk

Mudaraba Sukuk

Musharaka Sukuk

Murabaha Sukuk

Salam Sukuk

Istisna Sukuk

Hybrid Sukuk

Structure and Issuance Process of Sukuk

Role of Parties Involved in Sukuk Issuance

Steps in Sukuk Issuance

Key Documentation and Agreements in Sukuk

Risk and Returns of Sukuk

Understanding the Risk Profile of Sukuk

Analysis of Returns in Sukuk

Comparison of Risk and Returns With Conventional Bonds

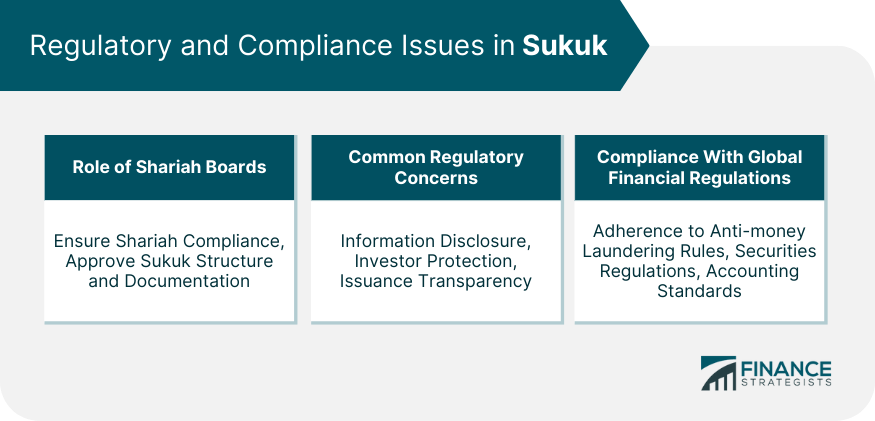

Regulatory and Compliance Issues in Sukuk

Role of Shariah Boards in Sukuk

Common Regulatory Concerns in Sukuk

Compliance With Global Financial Regulations

Sukuk Market Analysis

Global Sukuk Market Overview

Regional Trends in Sukuk Issuance

Major Players in the Sukuk Market

Impact of Economic Factors on the Sukuk Market

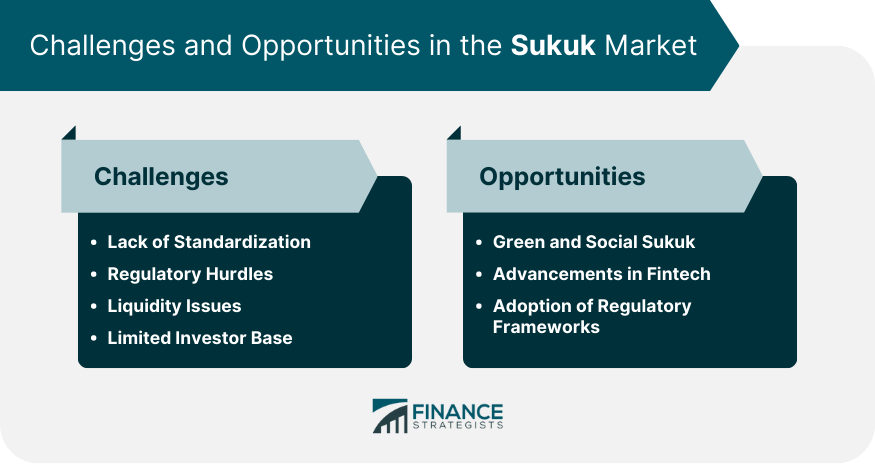

Challenges and Opportunities in the Sukuk Market

Key Challenges Faced by the Sukuk Market

Future Opportunities and Potential Growth Areas

Conclusion

Sukuk FAQs

Sukuk, often referred to as Islamic bonds, differ from conventional bonds as they represent shared ownership in a tangible asset or business rather than a simple debt obligation. They provide returns as a share of profits or rental income rather than as interest, aligning with Islamic law's prohibition of interest or 'riba'.

There are several types of Sukuk, including Ijara, Mudaraba, Musharaka, Murabaha, Salam, Istisna, and Hybrid Sukuk. Each type corresponds to a different type of contractual agreement, ranging from leasing contracts (Ijara) to investment partnerships (Mudaraba) and joint ventures (Musharaka), among others.

Like all investments, Sukuk carries risks such as credit risk, market risk, and liquidity risk. However, because Sukuk are asset-backed or asset-based, they often pose less risk than conventional bonds. It's important for investors to understand the specific risk profile of any Sukuk they consider investing in.

Regulatory bodies ensure that the issuance and trading of Sukuk comply with applicable laws and regulations. They aim to ensure market fairness and efficiency, protect investors, and promote transparency. In the case of Sukuk, an additional layer of oversight is provided by Shariah boards, which ensure compliance with Islamic law.

Technology, particularly financial technology or FinTech, has the potential to significantly influence the Sukuk market. It can streamline the issuance process, increase market transparency, and enhance liquidity. Additionally, it can broaden market access, enabling a greater number of investors to participate in the Sukuk market. Future innovations include digital Sukuk that leverage blockchain technology.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.