The term to maturity is a crucial concept in the finance world, primarily associated with bond investments. It refers to the time remaining for a bond or any other fixed-income security to reach its repayment date. Essentially, it's the lifespan of the bond, beginning from the issue date and ending on the maturity date - the date when the issuer must pay the bondholder the principal amount in full. It's easy to conflate term to maturity with similar concepts like bond duration or bond tenor, but they are not the same. Duration is a measure of a bond's sensitivity to interest rate changes, taking into account both the present value of future interest and principal payments. Bond tenor, on the other hand, simply refers to the total lifespan of the bond from issue to maturity. Thus, term to maturity is the remaining lifespan of the bond, while tenor is the total lifespan. The term to maturity provides insight into the time horizon of their investment. It's a key determinant of the bond's yield or interest rate, and it significantly influences the risk-return profile. For instance, longer-term bonds typically offer higher yields to compensate for the increased risk of interest rate changes and defaults. The term to maturity is a strategic tool for managing their debt obligations and cash flows. Shorter maturity terms can minimize interest cost, but they may lead to a higher risk of refinancing if the issuer doesn't manage their liabilities efficiently. Interest rates are a primary factor affecting term to maturity. The prevailing interest rates in the economy determine the yield on a bond. Higher interest rates often result in higher yields for new bonds. For existing bonds, an increase in interest rates can decrease the bond’s price, extending its term to maturity as it will take longer for the bond to reach its par value. Conversely, lower interest rates tend to shorten the term to maturity. Inflation affects the term to maturity indirectly. High inflation erodes the purchasing power of money over time. Therefore, long-term bonds, which expose investors to inflation risk for an extended period, often require a higher yield to compensate for potential inflation. This can result in longer terms to maturity as issuers are hesitant to repay the high-interest debt. In periods of economic stability and growth, issuers are more likely to issue long-term bonds, confident they can meet their future obligations. However, in times of economic uncertainty or recession, issuers might prefer short-term bonds, thus decreasing the term to maturity. The issuer's creditworthiness plays a significant role in the term to maturity. Highly creditworthy issuers—those with strong credit ratings—are often more comfortable issuing long-term bonds, as investors are confident in their ability to meet long-term obligations. Less creditworthy issuers may have to rely on short-term bonds, as investors may be unwilling to accept the higher risk of longer terms to maturity. Regulatory factors may also affect the term to maturity. For instance, banking regulations might limit the types of bonds that banks can invest in, potentially influencing the demand for certain maturities. If investors prefer long-term bonds due to their typically higher yields, issuers may accommodate these preferences by issuing bonds with longer terms to maturity. Conversely, if investors prefer short-term bonds due to lower risk, issuers may opt for shorter maturities. Short-term maturity refers to bonds or other fixed-income securities with a term to maturity of less than three years. These are considered less risky due to their shorter exposure to interest rate changes and default risk. Medium-term maturity typically refers to bonds with a term to maturity ranging from three to ten years. These carry a moderate level of risk, balanced between the low-risk profile of short-term bonds and the high-risk profile of long-term bonds. Long-term maturity refers to bonds with a term to maturity of more than ten years. These bonds offer higher yields to compensate for their increased exposure to interest rate changes and default risk. As mentioned, bonds are the most common type of investment associated with term to maturity. The term informs investors about the time until the bond's principal is returned, significantly influencing its yield and price. Certificates of Deposit (CDs) are time deposit accounts offered by banks with a fixed term to maturity. When the term ends, the investor can withdraw their initial deposit along with the accrued interest. Early withdrawal usually results in a penalty. Mortgages also have a term to maturity, representing the lifespan of the loan. It's the period over which the borrower must repay the loan principal and interest. Common mortgage terms include 15, 20, and 30 years. It involves investing in multiple bonds with different maturity dates. This reduces interest rate and reinvestment risk by spreading out the maturity dates, ensuring not all investments are affected by interest rate changes at the same time. In this method, an investor invests in short-term and long-term bonds, but not in medium-term bonds. This creates a "barbell" effect, mitigating both interest rate risk and reinvestment risk. It involves investing in bonds that all mature at the same time. This can be beneficial if the investor anticipates a specific future cash need or expects future interest rates to be favorable. Interest rate risk is the risk that changing interest rates will negatively affect a bond's price. It's more pronounced for bonds with a longer term to maturity because of their longer exposure to potential interest rate changes. Default risk is the chance that the bond issuer will fail to meet their debt obligations. Like interest rate risk, default risk tends to increase with the term to maturity since longer periods offer more opportunities for the issuer's financial condition to deteriorate. Reinvestment Risk refers to the risk that the bondholder won't be able to reinvest the bond's cash flows at a comparable rate if interest rates decrease. Shorter-term bonds tend to have a higher reinvestment risk because their principal is returned sooner, necessitating reinvestment. The Term to maturity represents the remaining lifespan of a bond or fixed income security from its issue date to its maturity date. For investors, it helps determine the time horizon of their investment and influences the bond's yield and risk-return profile. Issuers, on the other hand, utilize the term to maturity strategically to manage debt obligations and cash flows. Factors such as interest rates, inflation, market conditions, the creditworthiness of the issuer, regulations, and investor preferences all contribute to the term to maturity and its implications. Understanding the term to maturity is essential for bond pricing. It also impacts the yield, price, and repayment schedules of CDs and mortgages. Investors can employ various investment strategies, such as laddering, barbell, and bullet strategies, based on the term to maturity to manage its risks. Recognizing the risks associated with term to maturity, such as interest rate risk, default risk, and reinvestment risk, is vital for investors and issuers alike in making informed financial.What Is the Term to Maturity?

Importance of the Term to Maturity

For Investors

For Issuers

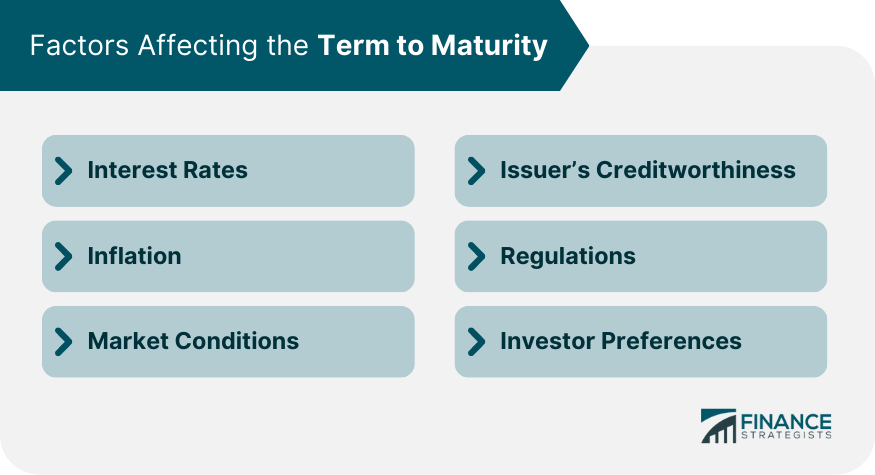

Factors Affecting the Term to Maturity

Interest Rates

Inflation

Market Conditions

Issuer’s Creditworthiness

Regulations

Investor Preferences

Types of Maturities

Short-Term Maturity

Medium-Term Maturity

Long-Term Maturity

Term to Maturity in Different Financial Instruments

Bonds

Certificates of Deposit (CDs)

Mortgages

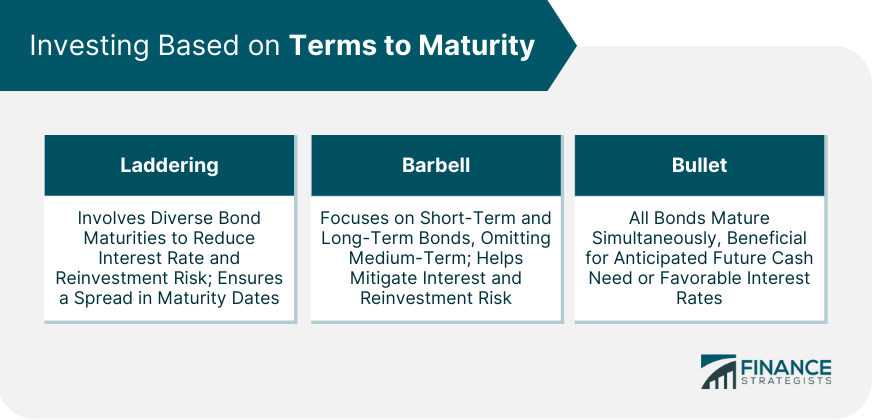

Investing Based on Terms to Maturity

Laddering Strategy

Barbell Strategy

Bullet Strategy

Risks Related to Terms to Maturity

Interest Rate Risk

Default Risk

Reinvestment Risk

Final Thoughts

Term to Maturity FAQs

The term to maturity in bond investments provides valuable information about the remaining lifespan of a bond, helping investors determine the time horizon of their investment. It also influences the bond's yield and risk-return profile, as longer-term bonds typically offer higher yields to compensate for increased risks.

While term to maturity refers to the remaining lifespan of a bond, bond duration measures a bond's sensitivity to interest rate changes, taking into account future interest and principal payments. Bond tenor, on the other hand, simply represents the total lifespan of the bond from issuance to maturity.

Several factors can impact the term to maturity of a bond. Interest rates play a significant role, as higher rates may result in longer terms to maturity, while lower rates tend to shorten the term. Inflation, market conditions, issuer's creditworthiness, regulations, and investor preferences can also influence the term to maturity.

The term to maturity plays a fundamental role in bond pricing. Generally, bonds with longer terms to maturity have higher yields to compensate for increased risk. As interest rates and term to maturity are inversely related, rising interest rates can lower bond prices, while falling rates can increase prices to maintain competitiveness.

Yes, the term to maturity is relevant to various financial instruments. Certificates of Deposit (CDs) have fixed terms to maturity, indicating the duration until the initial deposit can be withdrawn. Mortgages also have a term to maturity, representing the period over which the borrower must repay the loan principal and interest.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.