Treasury STRIPS (Separate Trading of Registered Interest and Principal Securities) are U.S. government-guaranteed debt securities that are sold at a significant discount to face value and offer no interest payments because they mature at par. Essentially, STRIPS are Treasury notes or bonds that have had their principal and interest components stripped apart and sold separately as zero-coupon bonds. These financial instruments were introduced by the U.S. Treasury in 1985 to meet the demand for zero-coupon securities, which allow investors to benefit from the reliability of U.S. government-backed securities without the inconvenience of semi-annual coupon payments. While conventional Treasury bonds pay semi-annual interest and return the principal upon maturity, Treasury STRIPS do not make regular coupon payments. The investor purchases the STRIPS at a discount and then receives the full face value at maturity. For instance, an investor may purchase a STRIP for $600 with a face value of $1,000 that matures in ten years. At the end of the ten years, the investor receives the $1,000, realizing a profit of $400. Unlike conventional bonds, STRIPS allow investors to make a one-time investment with a guaranteed return at a future date. The process of "stripping" or "zeroing" a bond is done by approved financial institutions, typically large investment banks or brokerage firms. This involves separating the bond's interest payments (represented by the bond's coupon) from its principal repayment. Once stripped, each interest payment and the principal repayment become separate securities, each with its unique Committee on Uniform Securities Identification Procedures (CUSIP) number. These new securities can then be sold separately to investors. Financial institutions, including commercial and investment banks, play a crucial role in creating STRIPS. These institutions buy Treasury securities, separate or strip them into individual principal and interest payments, and then sell those components to investors as individual securities. The U.S. Department of the Treasury does not issue STRIPS directly to investors; it is the authorized financial institutions that strip the bonds and then repackage them for resale. A Principal STRIP represents the face value payment of the original bond due at maturity. It does not make any interest payments. Principal STRIPS are typically more expensive than interest STRIPS because they have a higher face value. Interest STRIPS represent the semi-annual interest payments of the original bond. Each of these payments can be stripped and sold as an individual zero-coupon bond. These are generally sold for a lower price than principal STRIPS due to their smaller face value. Participants in the STRIPS market are typically institutional investors, such as pension funds, insurance companies, and mutual funds. However, individual investors can also participate in this market. STRIPS are an attractive investment for those looking for a safe and predictable return, especially for entities with future liabilities that they want to match exactly with income from investments. STRIPS are traded over the counter through brokers or dealers. They are typically bought and sold in large quantities, which can make them less accessible to individual investors. Nonetheless, smaller quantities of STRIPS can sometimes be purchased through brokerage firms. The price of STRIPS is influenced by several factors, including the overall interest rate environment, the demand for zero-coupon securities, and the time to maturity of the STRIP. Because STRIPS do not make regular interest payments, their prices can be more volatile than those of regular bonds. There is an inverse relationship between interest rates and the price of STRIPS. When interest rates rise, the price of existing STRIPS falls, and vice versa. This is because as interest rates increase, new bonds come to market offering higher yields, making existing bonds with lower yields less attractive. STRIPS are essentially zero-coupon bonds, meaning they are bought at a discount to face value and pay out the full face value at maturity. This gives the investor a predictable income stream, as the payout is known at the time of purchase. As a type of U.S. Treasury security, STRIPS are backed by the full faith and credit of the U.S. government. This makes them one of the safest investments around, with virtually no credit or default risk. This level of security can make STRIPS a good choice for conservative investors or as part of the lower-risk portion of a diversified portfolio. Regular bonds pay semi-annual coupon payments, which the holder must then reinvest. This leads to reinvestment risk—the possibility that interest rates will have fallen by the time you receive your coupon payment, leaving you to reinvest at lower rates. STRIPS pay no coupons; you receive your payout in one lump sum at maturity, thus eliminating reinvestment risk. STRIPS can serve as a valuable diversification tool. Because their prices are affected by different factors than stocks and other types of bonds, they can help spread and mitigate risk in a diversified investment portfolio. Because each STRIP has a defined maturity date and a guaranteed return, investors can plan their purchases to ensure that the returns coincide with when they will need the cash—for instance, to pay for a child's college tuition or to fund retirement expenses. Treasury STRIPS, like all bonds, are subject to interest rate risk. This risk arises because when interest rates rise, bond prices fall, and vice versa. STRIPS are particularly sensitive to changes in interest rates because they do not provide semi-annual interest payments that can help offset price changes. Even though STRIPS do not pay out any interest until maturity, the IRS considers their imputed or "phantom" interest as taxable. The investor must pay taxes on this income each year, even though they do not receive the income until the bond matures. For investors in high tax brackets, this can be a significant disadvantage unless the STRIPS are held in a tax-deferred account. Because they are zero-coupon bonds, STRIPS are more volatile than traditional bonds that pay regular interest. This is because all of their return is subject to a single, one-time payment upon maturity. Since STRIPS offer a fixed return, they are subject to inflation risk. If inflation rises, the purchasing power of the fixed return decreases. This can be particularly problematic for long-term STRIPS. STRIPS are generally more accessible to institutional investors than individuals. While individual investors can buy them, they are often traded in high denominations that may be out of reach for some investors. This can limit liquidity for retail investors. Treasury STRIPS are U.S. government-guaranteed debt securities that offer a unique investment opportunity for investors. By separating the principal and interest components of Treasury notes or bonds and selling them as zero-coupon bonds, STRIPS allow investors to benefit from the reliability of U.S. government-backed securities without the inconvenience of regular coupon payments. The predictable income, low risk, elimination of reinvestment risk, and portfolio diversification potential make STRIPS an attractive option for conservative investors or as part of a diversified portfolio. Additionally, the ability to match liabilities and plan for future cash needs adds to their appeal. However, there are limitations to consider. Interest rate risk and price volatility can affect the value of STRIPS, particularly as they do not provide regular interest payments to offset price changes. The taxation of imputed interest and the potential impact of inflation on the fixed return pose additional risks to investors. Furthermore, the accessibility and liquidity of STRIPS may be limited for individual investors due to high denominations typically traded in the market. It is important for investors considering Treasury STRIPS to consult with a qualified financial advisor who can provide personalized guidance based on their individual financial situation, investment goals, and risk tolerance.What Are Treasury STRIPS?

How Treasury STRIPS Work

Stripping a Bond

Role of Financial Institutions

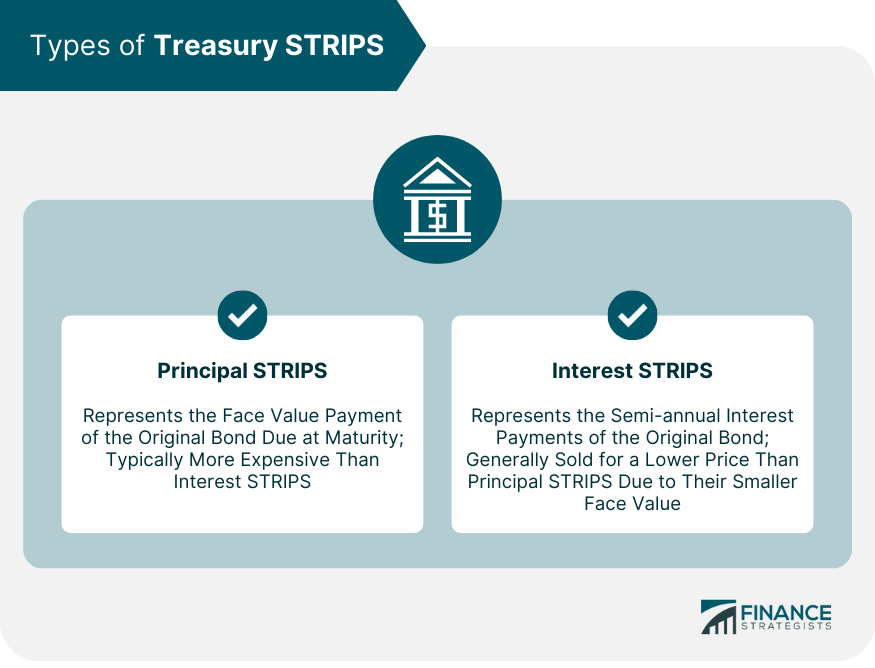

Types of Treasury STRIPS

Principal STRIPS

Interest STRIPS

Treasury STRIPS Market

Participants

Trade

Valuation of Treasury STRIPS

Factors Affecting the Price

Relationship Between Interest Rates and Prices

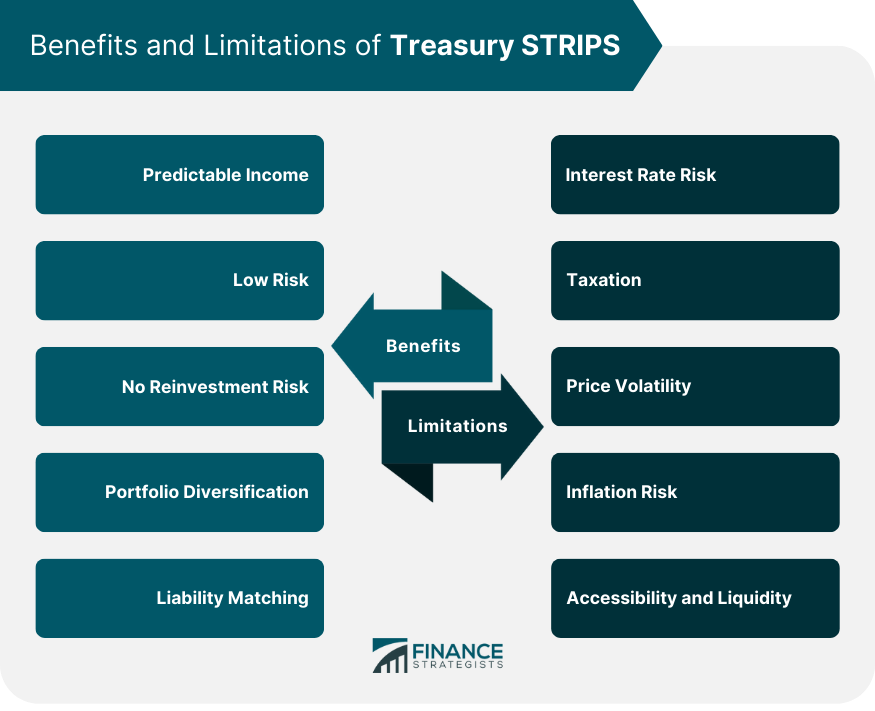

Benefits of Investing in Treasury STRIPS

Predictable Income

Low Risk

No Reinvestment Risk

Portfolio Diversification

Liability Matching

Limitations of Treasury STRIPS

Interest Rate Risk

Taxation

Price Volatility

Inflation Risk

Accessibility and Liquidity

Final Thoughts

Treasury STRIPS FAQs

The main difference between Treasury STRIPS and regular Treasury bonds is that STRIPS do not make regular coupon payments. Instead, they are sold at a discount to face value and mature at par, providing a one-time payment of the full face value at maturity. Regular Treasury bonds, on the other hand, pay semi-annual interest payments along with the return of principal upon maturity.

Treasury STRIPS are typically available to both institutional investors and individual investors. Institutional investors such as pension funds, insurance companies, and mutual funds often participate in the STRIPS market. While STRIPS are often traded in large quantities, smaller quantities can sometimes be purchased through brokerage firms, making them accessible to individual investors as well.

Treasury STRIPS are subject to taxation on their imputed or "phantom" interest. Even though STRIPS do not make interest payments until maturity, the investor is required to pay taxes on the imputed interest each year. However, investors may find tax advantages by holding STRIPS in tax-deferred accounts, which can help mitigate the tax burden.

Yes, Treasury STRIPS are sensitive to changes in interest rates. An inverse relationship exists between interest rates and the price of STRIPS. When interest rates rise, the price of existing STRIPS tends to fall, and vice versa. This is because higher interest rates make newly issued bonds more attractive, reducing demand for existing bonds with lower yields.

Yes, Treasury STRIPS can be used for liability matching. Because each STRIP has a defined maturity date and a guaranteed return, investors can plan their purchases to align with their future cash needs. This feature makes STRIPS suitable for matching income from investments with specific liabilities, such as funding retirement expenses or paying for a child's college tuition.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.