Yield equivalence is a concept in financial analysis that facilitates the comparison of yields between different types of debt securities, even if they have varying payment frequencies or structures. It is typically used to convert the yield of one security into terms comparable to another. For instance, it can help translate a bond's semiannual yield into an annual yield, making it directly comparable with a bond that pays annually. By standardizing yield calculations, investors can more effectively evaluate and contrast diverse investment opportunities. Therefore, yield equivalence serves as an important tool in portfolio management, assisting investors in making informed decisions about different debt securities to optimize their returns. Understanding yield equivalence is crucial in financial analysis and investment decision-making as it aids investors in measuring the rate of return on various investment options. It enables investors to compare different types of securities and make more informed decisions. Given the diverse range of investment options available in the financial market, yield equivalence acts as a valuable tool for investors and financial analysts alike. In investment analysis, yield equivalence plays a key role in determining the investment value. It allows investors to compare the performance of various investment instruments, including bonds, equities, and fixed deposits. For instance, an investor can determine whether investing in a bond with an annual interest payment is better than a bond with semi-annual interest payments. The calculation of yield equivalence involves converting the yield of security into an equivalent yield of reference security. This involves several factors, including the interest rates, the maturity period, and the risk involved. There are several formulas and methods to calculate yield equivalence, which will be discussed in detail later. Current yield refers to the annual income generated by an investment as a percentage of its current market price. It is calculated by dividing the annual income by the current market price. Yield to maturity (YTM) is the total return expected on a bond if it is held until it matures. YTM is a complex calculation but is often considered the most meaningful figure for assessing a bond. Yield to call (YTC) is the yield of a bond or note if you were to hold the security until the call date rather than the date it matures. This calculation takes into account the value of the bond if it is called prior to maturity. Yield to worst (YTW) refers to the worst possible yield scenario on a bond without the issuer defaulting. The YTW is calculated by making worst-case scenario assumptions on the issue by calculating the return that would be received if the issuer uses provisions, including prepayments, callback, or conversion. Yield equivalence is essential when investing in corporate bonds. The yields of these bonds are usually compared with those of risk-free treasury securities to understand their additional risk premium. In the case of municipal bonds, yield equivalence helps in comparing their tax-free yields with the taxable yields of other bonds. The tax-free nature of municipal bonds often makes their nominal yields lower than corporate bonds, but once adjusted for tax, they may offer a higher effective yield. Treasury securities are generally considered risk-free. However, yield equivalence helps in comparing them with other risky securities to evaluate the risk premium. It also helps in comparing treasury securities with different maturities. Yield equivalence is also applied to other fixed-income securities, like certificates of deposits and money market instruments. It aids in comparing their yields and understanding the return for the risk undertaken. Interest rates significantly impact yield equivalence. A rise in interest rates usually results in a decrease in the yield equivalence, while a drop in interest rates results in an increase. Inflation impacts the real return from investments. Higher inflation can erode the value of returns, reducing the yield equivalence. The credit risk of a bond issuer also affects the yield equivalence. Higher credit risk is usually compensated with higher yields. Duration, or the sensitivity of a bond's price to interest rate changes, impacts the yield equivalence. Longer-duration bonds are more susceptible to interest rate changes, affecting their yield equivalence. Tax implications significantly impact yield equivalence, especially when comparing taxable and tax-free bonds. The after-tax yield may be higher for tax-free bonds even if their nominal yield is lower. Yield equivalence plays a crucial role in comparing taxable and tax-exempt securities. The nominal yield of tax-exempt securities might be lower, but their after-tax yield could be higher, offering better returns to investors in higher tax brackets. The tax bracket of the investor is a crucial factor in calculating yield equivalence. Investors in higher tax brackets stand to gain more from investing in tax-free securities as their after-tax returns would be higher compared to taxable securities. To figure out the equivalent yield between tax-free and taxable bonds, first divide the bond's tax-free yield by 1 minus your tax rate. Imagine you're considering investing in a 5% tax-free municipal bond, but you're curious about the interest rate a taxable corporate bond would need to offer to generate the same return. If your tax rate is 30%, you would subtract this from one, giving you .70. Then, you would divide the tax-free yield of 5 by .70, which results in approximately 7.14. This indicates that you would need a return of 7.14% on your taxable investment to match the 5% return on your tax-free investment. However, if you're in the 40% tax bracket, you would require an 8.33% return on your corporate bond to match the 5% return on your municipal bond. Alternatively, if you're aware of your taxable rate of return, you can compute the equivalent rate on a tax-free investment. This is done by multiplying the taxable rate by 1 minus your tax rate. For example, if your taxable return is 8% and your tax rate is 28%, you would need a 5.76% return on a tax-free security to match the after-tax return on a taxable security. In bond investing, yield equivalence plays a crucial role. It helps investors compare the yields of bonds with different maturities, issuers, and tax implications. Yield equivalence significantly impacts portfolio construction. It helps in identifying the securities that offer the best returns for a given risk level, aiding in constructing an efficient portfolio. In risk management, yield equivalence is used to understand the risk-return trade-off. It helps in understanding the additional yield offered by risky securities over risk-free ones, aiding in risk assessment and management. Yield equivalence simplifies the complex process of comparing different securities. By converting the yields of different types of securities into a common standard, it allows investors to make apples-to-apples comparisons, thereby making the investment decision-making process less complicated. Yield equivalence also helps investors understand the risk-return trade-off associated with different securities. By offering a direct comparison between yields, investors can better gauge whether a higher potential return justifies taking on additional risk. One significant limitation of yield equivalence is its inherent assumption that all securities carry the same level of risk. This assumption is not always true, as different securities may come with various risk levels due to factors such as the issuer's creditworthiness or the overall economic environment. Another pitfall of yield equivalence is its disregard for liquidity and marketability factors. Securities may differ significantly in their ease of buying and selling or their marketability in the secondary market. Ignoring these factors can potentially lead to investment decisions that do not fully consider the investor's liquidity needs. Yield equivalence, while useful, can also be complex to calculate, particularly for novice investors. The computation process involves various elements, including the bond's coupon rate, maturity, and price. This complexity can deter some investors from utilizing yield equivalence, thereby limiting its overall usefulness. Yield equivalence is a critical financial concept, pivotal to accurate and beneficial investment decision-making. It standardizes yield calculations across varying debt securities, regardless of their distinct payment structures or frequencies, thereby enabling direct comparisons. This facilitates portfolio management and guides investors toward optimum returns. Different types of yields, such as current yield, yield to maturity, yield to call, and yield to worst, provide comprehensive insights into potential returns. Factors like interest rates, inflation, credit risk, duration, and tax considerations play a significant role in determining yield equivalence. Understanding yield equivalence is particularly crucial when comparing taxable and tax-exempt securities, as it reveals the potential benefits of tax-free investments. However, it's important to be cognizant of its limitations, including overlooking risk variations and liquidity factors and the complexity of calculations. Yield equivalence, despite these challenges, remains an indispensable tool in finance and investment analysis.What Is Yield Equivalence?

Yield Equivalence in Financial Analysis and Investment Decision-Making

Conceptual Framework of Yield Equivalence

Role in Investment Analysis

Calculating Yield Equivalence

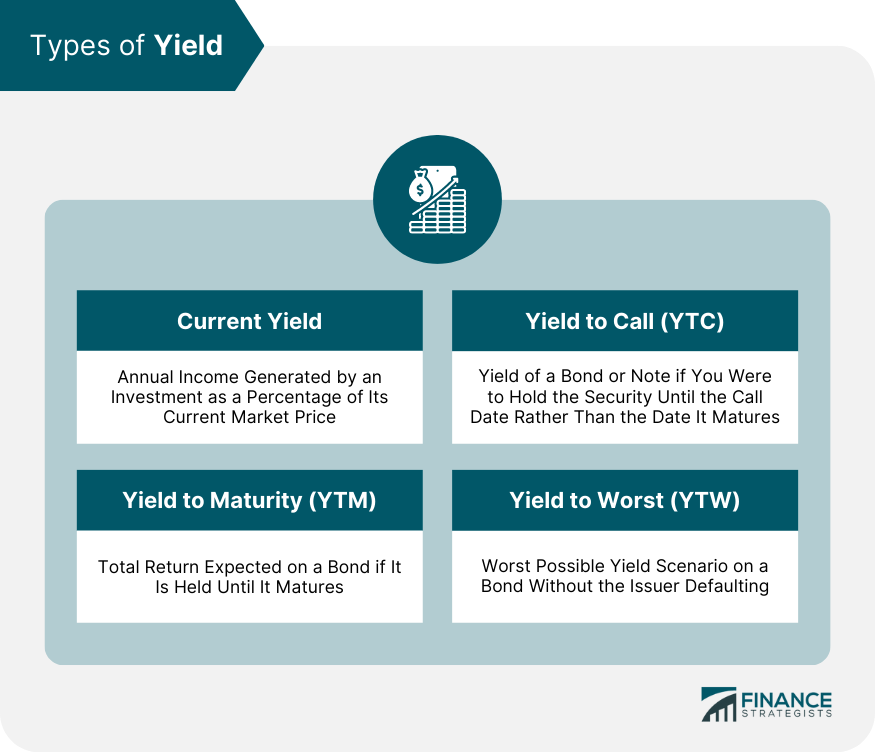

Types of Yield

Current Yield

Yield to Maturity

Yield to Call

Yield to Worst

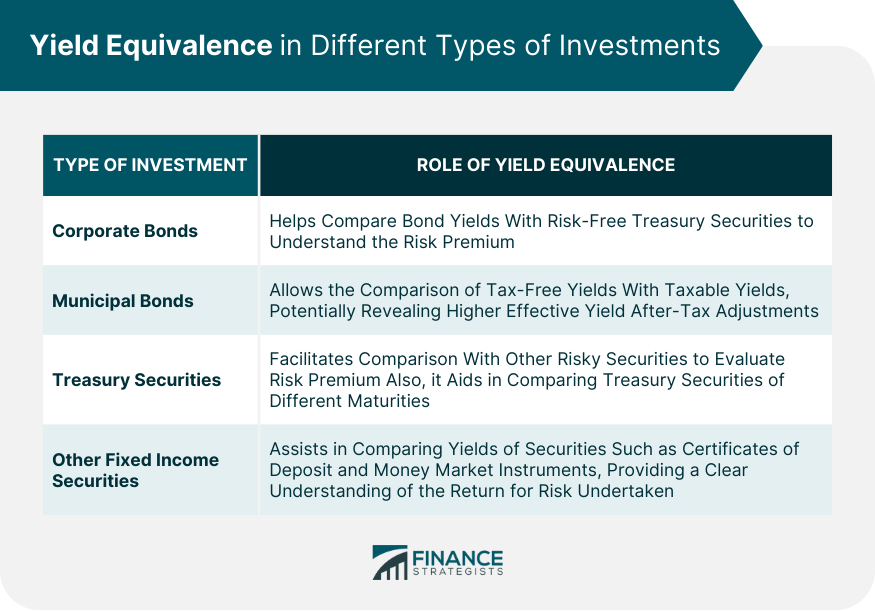

Yield Equivalence in Different Types of Investments

Corporate Bonds

Municipal Bonds

Treasury Securities

Other Fixed Income Securities

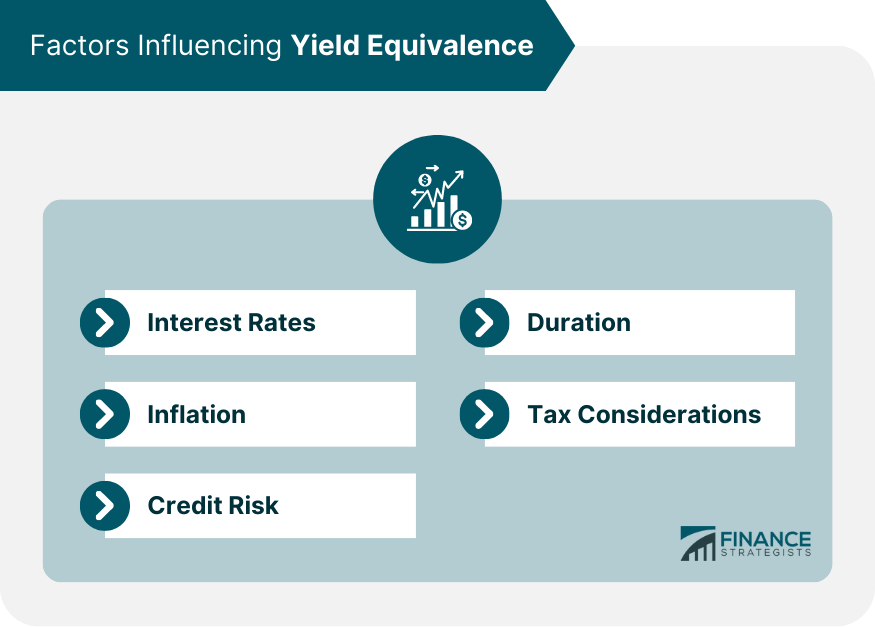

Factors Influencing Yield Equivalence

Interest Rates

Inflation

Credit Risk

Duration

Tax Considerations

Yield Equivalence in Taxable vs Tax-Exempt Securities

Comparing Taxable and Tax-Exempt Yields

Tax Bracket in Yield Equivalence Calculation

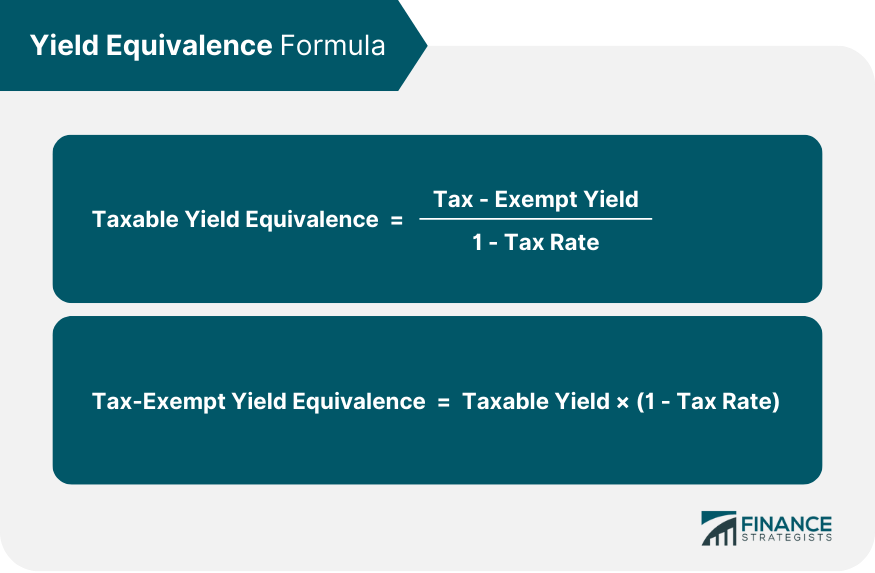

Yield Equivalence Formula and Calculation

Application of Yield Equivalence in Real World Investing

Bond Investing

Portfolio Construction

Risk Management

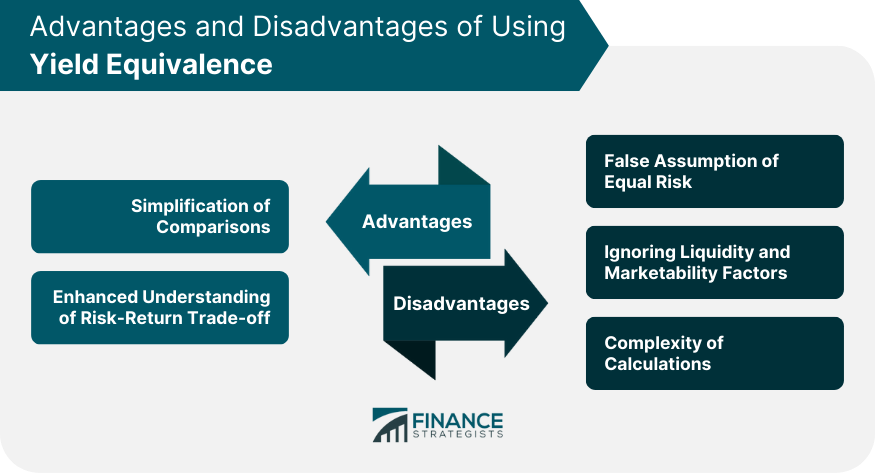

Advantages of Using Yield Equivalence

Simplification of Comparisons

Enhanced Understanding of Risk-Return Trade-off

Disadvantages of Using Yield Equivalence

False Assumption of Equal Risk

Ignoring Liquidity and Marketability Factors

Complexity of Calculations

Final Thoughts

Yield Equivalence FAQs

Yield equivalence is a concept in finance that allows investors to compare the returns, or yields, of different financial securities on a standard basis. This concept plays a crucial role in investment decision-making as it provides a more precise understanding of potential returns.

Yield equivalence is important in financial analysis and investment decision-making because it enables investors to measure and compare the rate of return on various investment options. Standardizing the returns to a common basis, it provides investors with a clearer perspective on which investment options offer the highest yield.

Several factors can influence yield equivalence, including interest rates, inflation, credit risk, duration, and tax considerations. Changes in these factors can lead to variations in yield equivalence, affecting the comparison and selection of investment options.

Yield equivalence is crucial when comparing taxable and tax-exempt securities. It allows investors to understand the after-tax yield of these securities. The tax bracket of an investor plays a significant role in these calculations. Investors in higher tax brackets can often realize higher after-tax yields from tax-exempt securities despite their lower nominal yields.

Despite its advantages, yield equivalence does have some limitations. It assumes all securities have the same risk level, and it can often overlook factors such as liquidity and marketability. Additionally, calculating yield equivalence can be complex, particularly for beginners, and might require a solid understanding of various financial concepts and methods.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.