Cryptocurrencies, at their core, are digital or virtual forms of currency that leverage cryptographic techniques for security. Unlike traditional currencies issued by governments and central banks, cryptocurrencies operate on technology known as the blockchain, a decentralized system. Every single transaction made using these digital currencies is recorded on this blockchain, ensuring its authenticity and preventing double-spending. The genesis of cryptocurrency is rooted in the 2008 financial crisis. The mysterious entity named Satoshi Nakamoto introduced Bitcoin, the pioneer, proclaiming a currency free from central bank control. Since then, the allure of cryptocurrencies has burgeoned, with thousands of variants popping up. Their rapid rise can be attributed to their revolutionary features, potential profitability, and the promise of a financial system where transactions are more secure, private, and decentralized. Cryptocurrencies stand out due to their decentralized nature. This means they are not controlled by any government or financial institution. Instead, they operate on a peer-to-peer network. Such a structure eradicates the need for intermediaries, streamlining processes and potentially reducing costs. Furthermore, decentralization also diminishes the risks associated with central authority control, such as currency devaluation or political interference. The backbone of cryptocurrency is the groundbreaking blockchain technology. Each transaction gets recorded in a block and added to a chain in a linear, chronological order. This transparency ensures all transactions are open for verification by users. However, paradoxically, while the transaction history is transparent, the identities of the people involved in the transactions are encrypted, offering a level of privacy and security that's tough to breach. A significant appeal of cryptocurrencies lies in the pocket-friendly transaction fees. Traditional banking systems and online transfers typically involve fees and exchange costs. In contrast, the decentralized nature of cryptocurrency transactions often results in reduced fees. This becomes particularly palpable during international transfers, which can become not only faster but considerably cheaper when using cryptocurrencies. Over two billion people worldwide lack access to traditional banking systems, primarily due to geographical and financial barriers. Cryptocurrencies offer an accessible gateway for this unbanked populace. Without the need for brick-and-mortar banks or even a formal ID, anyone with an internet connection can create a cryptocurrency wallet. This accessibility can prove revolutionary, offering financial empowerment and inclusion to those historically excluded. The volatile nature of cryptocurrency prices can be seen as both a boon and a bane. While they can swing wildly, this very trait has led to massive gains for some investors. For instance, those who invested in Bitcoin's early days witnessed astronomical returns. Historical performance aside, many believe that cryptocurrencies, despite their volatility, present a future of financial diversification and potential upsides. Cryptocurrency markets are infamous for their volatile nature. It's not uncommon for the value of a cryptocurrency to swing by double-digit percentages within a single day. Such unpredictability can be off-putting for many, especially those looking for stability in their investments. This extreme volatility can lead to significant monetary setbacks for investors who don't time the market accurately or succumb to panic selling. The crypto realm is still akin to the Wild West in terms of regulation. The absence of a consistent global regulatory framework breeds uncertainty. Different countries have taken varied stances, with some welcoming cryptocurrencies while others have outright banned them. This patchy regulatory landscape can be daunting for potential investors. Furthermore, while cryptocurrencies themselves are secure, the broader ecosystem is susceptible to cyberattacks, with several high-profile hacks and breaches reported over the years. One cannot discuss cryptocurrencies without addressing the elephant in the room: their environmental impact. Mining, especially that of Bitcoin, is energy-intensive. Often, this energy comes from non-renewable sources, leading to significant carbon emissions. Such sustainability concerns have led many to question the long-term viability of energy-intensive cryptocurrencies, especially in an increasingly eco-conscious world. Despite their growing popularity, cryptocurrencies are still not universally accepted. Many businesses, both online and offline, do not accept cryptocurrency as a payment method. This restricted acceptance limits its immediate usability for everyday transactions. Moreover, the onus often lies on merchants and service providers to integrate crypto payment gateways, and not all are willing to take that leap. Cryptocurrencies, by nature, come with a steep learning curve. Their intricacies, combined with the jargon-heavy information available, can be intimidating for the layperson. Understanding wallets, private keys, public addresses, and the nuances of various cryptocurrencies can be daunting. Moreover, managing and safeguarding one's crypto assets requires diligence, with the risk of irreversible loss looming large for those who aren't careful. DeFi, or Decentralized Finance, represents a seismic shift in the way we approach finance. It encompasses a range of financial applications built on blockchain technologies. By eliminating intermediaries, DeFi platforms aim to create a more open and accessible financial system. The DeFi realm is burgeoning, with platforms offering services ranging from borrowing and lending to insurance and yield farming. Enter the world of NFTs, where every digital asset, be it art, music, or collectibles, is uniquely identifiable. This uniqueness brings undeniable value. Artists and creators are now minting their creations as NFTs, ensuring provenance and earning their rightful dues in the process. The surge of this digital artistry is not just a fad but a testament to the evolving intersection of art, technology, and economics. Cross-border transactions have historically been cumbersome, time-consuming, and expensive. Cryptocurrencies offer a refreshing alternative. By leveraging their global nature and decentralization, cryptocurrencies simplify international monetary transfers. Not only can funds be transferred faster, but the transaction costs are also often lower than traditional banking routes. As the crypto ecosystem evolves, more merchants, both online and physical, are accepting cryptocurrencies. From cafes to online retailers, the list of businesses integrating crypto payments is growing. Such integration not only provides consumers with more payment options but also taps into a burgeoning market of crypto enthusiasts eager to spend their holdings. Cryptocurrencies are reshaping philanthropy. Charitable organizations worldwide are now accepting crypto donations, unlocking a new avenue of funding. Beyond charity, the crypto space has also revolutionized capital raising. Initial Coin Offerings (ICOs) have emerged as a novel way for projects to raise funds, democratizing access to investment opportunities and reshaping the venture capital paradigm. • Risk Tolerance: Cryptocurrency markets are known for their high volatility. Prices can swing dramatically over short periods, leading to significant gains or losses. Assess your risk tolerance and determine how much of your investment portfolio you're willing to allocate to these potentially volatile assets. • Investment Goals: Consider why you want to invest in cryptocurrencies. Are you looking for long-term growth, diversification, or short-term gains? Different cryptocurrencies serve various purposes, from being a store of value like Bitcoin to enabling smart contracts like Ethereum. Align your investment choices with your goals. • Research: Before investing, educate yourself about the different cryptocurrencies, their use cases, and the technology behind them. Avoid FOMO (fear of missing out) and make informed decisions based on solid research. • Security: Cryptocurrency ownership involves securing your private keys. Without proper security measures, you risk losing access to your funds. Explore reputable wallets and exchanges with strong security practices to safeguard your investments. • Regulation and Legal Considerations: Cryptocurrency regulations vary widely from country to country. Ensure you understand the legal status of cryptocurrencies in your jurisdiction, including tax implications. • Long-Term Viability: While some cryptocurrencies have gained mainstream acceptance, others might fizzle out over time. Look for projects with strong development teams, real-world use cases, and a clear roadmap. • Technological Proficiency: Using cryptocurrencies requires some level of technological understanding. If you're not comfortable with digital tools and processes, there could be a learning curve. Cryptocurrencies present a revolutionary approach to finance, offering a blend of advantages and challenges. The decentralized nature of cryptocurrencies ensures freedom from central authorities, increased transparency, security, and reduced transaction fees. They provide unprecedented financial inclusion, creating avenues for the unbanked and offering lucrative investment potentials. Yet, the crypto world is not without its pitfalls. The pronounced volatility of these digital currencies poses risks for investors. Regulatory inconsistencies, coupled with security concerns, deter many potential users. Additionally, the environmental footprint of some cryptocurrencies, primarily due to energy-intensive mining, raises sustainability concerns. While cryptocurrencies are still not universally accepted, their integration into sectors like retail and philanthropy, as well as innovations like DeFi and NFTs, demonstrates their transformative potential. Balancing the benefits and drawbacks is crucial for individuals and institutions considering diving into the intricate world of cryptocurrency.Overview of Cryptocurrency

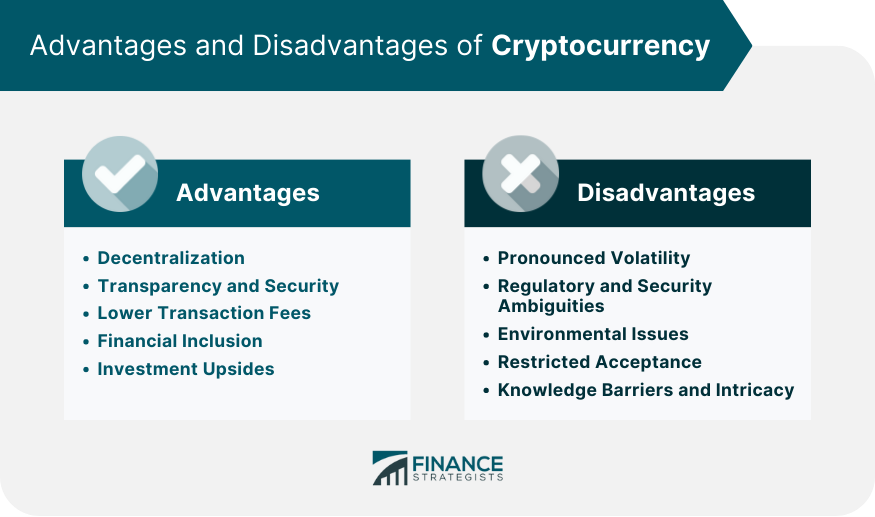

Advantages of Cryptocurrency

Decentralization

Transparency and Security

Lower Transaction Fees

Financial Inclusion

Investment Upsides

Disadvantages of Cryptocurrency

Pronounced Volatility

Regulatory and Security Ambiguities

Environmental Issues

Restricted Acceptance

Knowledge Barriers and Intricacy

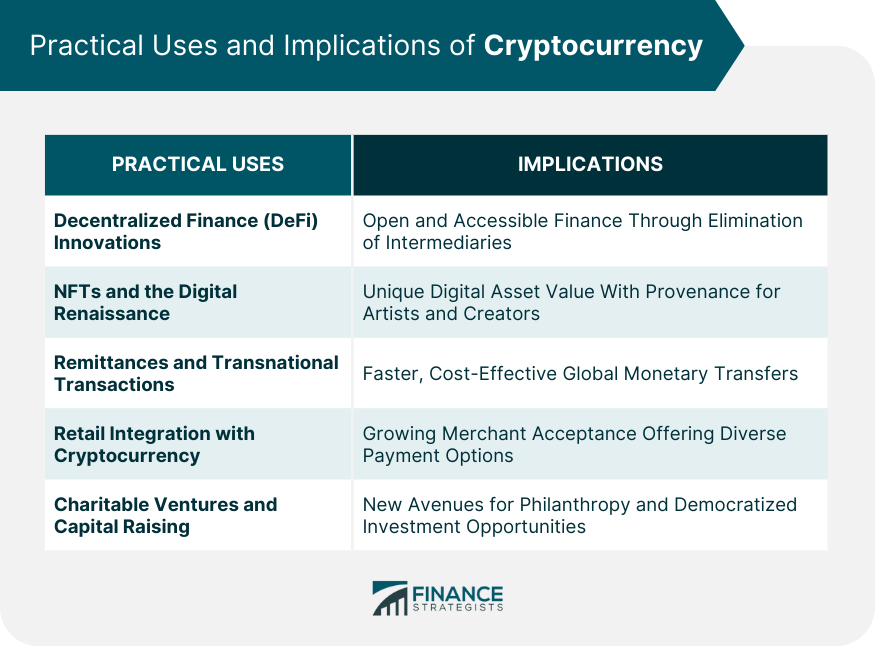

Practical Uses and Implications of Cryptocurrency

Decentralized Finance (DeFi) Innovations

NFTs (Non-Fungible Tokens) and the Digital Renaissance

Remittances and Transnational Transactions

Retail Integration With Cryptocurrency

Charitable Ventures and Capital Raising

Factors to Consider: Is Cryptocurrency Right for You?

Bottom Line

Advantages and Disadvantages of Cryptocurrencies FAQs

Cryptocurrency offers decentralization, lower transaction fees, transparency, financial inclusion, and significant investment opportunities.

Cryptocurrency markets can experience rapid and large price fluctuations, leading to unpredictable investment outcomes.

Cryptocurrency mining, especially Bitcoin, can be energy-intensive, raising concerns about carbon emissions and sustainability.

Cryptocurrency finds applications in Decentralized Finance (DeFi), remittances, retail, NFT artistry, and charitable ventures.

The technology behind cryptocurrency, combined with its jargon-heavy information, can be daunting for newcomers, leading to knowledge barriers.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.