A Cryptocurrency Analysis Tool is a specialized software or platform designed to interpret and scrutinize cryptocurrency market data. As the crypto world grows in complexity, these tools become essential for traders and investors alike. They offer insights into price trends, market sentiment, and other pivotal factors, aiding in informed trading and investment decisions. With features ranging from real-time data updates to intricate predictive analytics, these tools allow users to navigate the often volatile crypto markets with increased confidence and precision. Whether gauging public sentiment through sentiment analysis tools or tracking historical price data with technical analysis features, these tools provide a comprehensive understanding of market dynamics. In essence, a Cryptocurrency Analysis Tool is the compass guiding enthusiasts through the intricate landscapes of the digital currency world. Making informed decisions is the crux of profitable crypto trading. Analysis tools process real-time data, helping traders make calculated moves based on current market conditions, historical data, and predictive analytics. Recognizing patterns is invaluable in the volatile world of cryptocurrencies. Tools equipped with robust algorithms can highlight bullish or bearish trends, assisting traders in identifying potential breakout or downturn moments. Every investment comes with risks. But in the crypto realm, the stakes can be significantly higher due to its inherent volatility. Analysis tools evaluate potential pitfalls and guide users in managing their portfolios optimally. With regulators worldwide turning a keen eye toward the crypto market, compliance is paramount. Certain analytical tools ensure that traders and investors adhere to regional regulations, ensuring smooth and legal operations. In a market where prices can skyrocket or plummet within minutes, real-time data isn't a luxury—it's a necessity. Reliable tools ensure up-to-the-second updates, allowing for swift action. A comprehensive analysis tool offers a plethora of indicators, from Moving Averages to Relative Strength Index (RSI), catering to diverse analytical needs. An intuitive, easy-to-navigate interface can make all the difference. The focus should always be on analysis, not on struggling to figure out the tool itself. Given the sensitive nature of financial data, top-tier encryption and robust security measures are non-negotiable for any reputable analysis tool. Seamlessness is key. Tools that can integrate directly with popular exchanges and wallets offer users a holistic experience, eliminating the need to juggle multiple platforms. Often the first choice for traders, these tools evaluate historical price data. They employ various indicators, such as Bollinger Bands and MACD, to predict future price movements based on past patterns. The crypto market, like any other, is influenced by public sentiment. By scouring social media, news sites, and forums, these tools gauge the mood of the market, helping predict potential price movements based on public sentiment. Transparency is one of blockchain's primary attributes. Blockchain explorers allow users to verify transactions, view wallet balances, and study token distribution, making the world of crypto a bit more understandable. With investments spread across various platforms and coins, keeping track can be daunting. Portfolio management tools simplify this, allowing for easy monitoring, reallocation, and optimization of crypto holdings. All tools rely on data, and if this data is flawed, the insights derived can be misleading. Ensuring data accuracy and the reliability of sources is a persistent challenge. For crypto neophytes, the barrage of charts, graphs, and metrics can be intimidating. There's a steep learning curve, and without proper guidance, one can easily be lost in a sea of information. With cyber-attacks becoming increasingly sophisticated, even the most secure platforms are under threat. It's paramount for users to be aware and choose tools with impeccable security records. The crypto space is in constant flux, with new projects, technologies, and trends emerging regularly. Tools must evolve at a similar pace, or they risk becoming obsolete. Before diving into the myriad of tools available, it's crucial to assess one's needs. A day trader's requirements will vastly differ from a long-term holder. With numerous options in the market, checking user reviews and expert opinions can provide clarity. Authentic feedback often reveals a tool's strengths and weaknesses. A tool's longevity is determined by its adaptability. As the crypto world evolves, so should the tools, integrating new features and adapting to market changes. Budget considerations are vital. While many free tools offer excellent features, sometimes a premium tool might offer the advanced functionalities a user needs. The best tools allow users to customize features according to their needs and can handle increased data loads as a user's portfolio grows. The complex world of cryptocurrency demands specialized tools for precise and informed decision-making. Analysis tools bridge this gap, empowering traders with real-time data, trend detections, risk assessments, and regulatory compliance. A dependable tool offers a wealth of indicators, a user-centric interface, stringent security, and seamless integrations. As choices abound, users encounter diverse tool types like technical, fundamental, sentiment analyzers, blockchain explorers, and portfolio managers. While these tools promise insights, there are challenges that arise, such as data accuracy, information overload, security threats, and staying updated in a rapidly changing crypto environment. Thus, choosing the right tool requires a clear understanding of one's goals, thorough credibility checks, adaptability assessments, and a balance between cost and need. Customizability and scalability further enhance a tool's utility. In essence, as cryptocurrency continues its ascent, analysis tools remain the compass, guiding enthusiasts through its intricate landscapes.What is Cryptocurrency Analysis Tool?

Purpose of Cryptocurrency Analysis Tools

Assistance in Trading and Investment Decisions

Detection of Market Trends and Patterns

Risk Assessment and Management

Ensuring Regulatory Compliance

Key Features of a Reliable Cryptocurrency Analysis Tool

Real-Time Data and Updates

Diverse Range of Indicators and Analytical Metrics

User-Friendly Interface

Security Features

Integration With Exchanges and Wallets

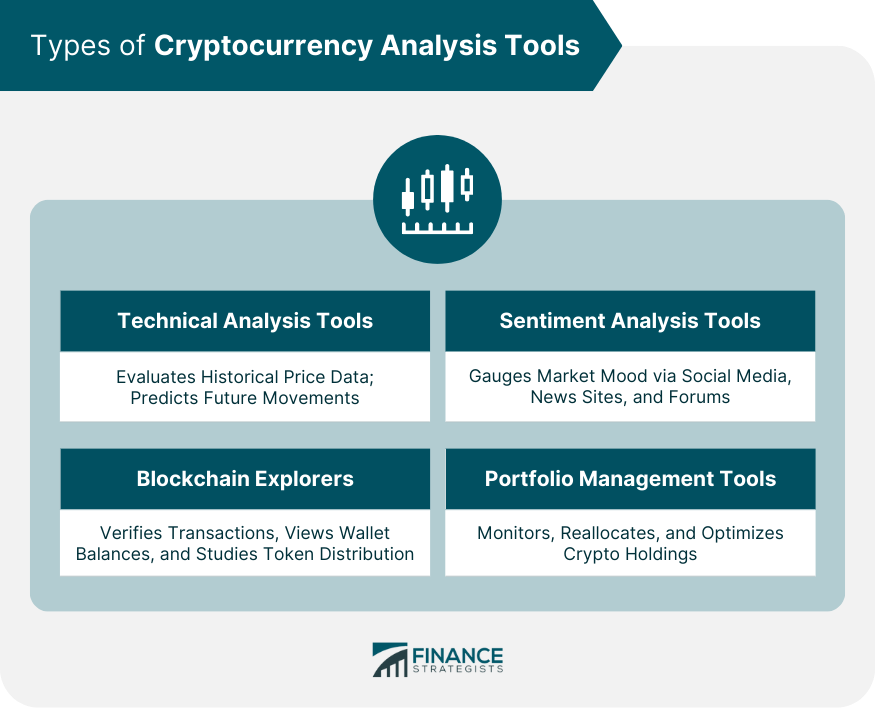

Types of Cryptocurrency Analysis Tools

Technical Analysis Tools

Sentiment Analysis Tools

Blockchain Explorers

Portfolio Management Tools

Challenges in Using Cryptocurrency Analysis Tools

Accuracy and Reliability of Data

Overwhelming Information for Newcomers

Potential Security Vulnerabilities

Ever-Evolving Landscape of the Crypto Market

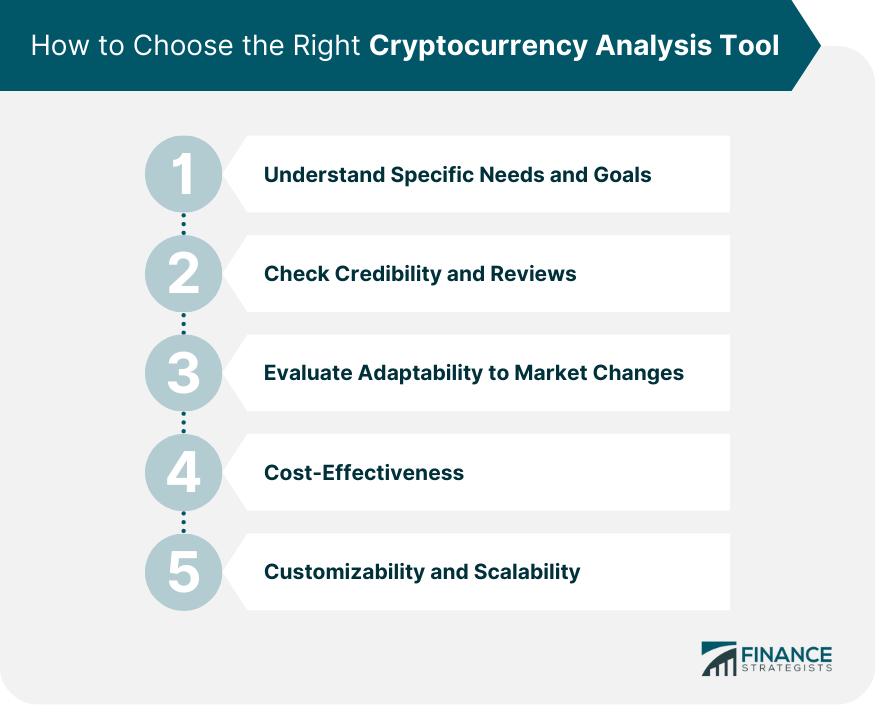

How to Choose the Right Cryptocurrency Analysis Tool

Understand the Specific Needs and Goals

Check the Credibility and Reviews of the Tool

Evaluate the Tool’s Adaptability to Market Changes

Cost-Effectiveness

Customizability and Scalability

Conclusion

Cryptocurrency Analysis Tool FAQs

A Cryptocurrency Analysis Tool is a software or platform used to interpret and analyze cryptocurrency market data. It offers insights into price trends, market sentiment, and other essential factors to aid in trading and investment decisions.

A Cryptocurrency Analysis Tool provides traders with real-time data, trend predictions, and comprehensive insights into the crypto market. It helps traders make informed decisions, manage risks, detect market patterns, and ensure regulatory compliance.

Start by understanding your specific goals, whether you're a day trader or a long-term investor. Check the credibility and reviews of the tool, evaluate its adaptability to market changes, consider its cost-effectiveness, and ensure it offers the customizability and scalability you need.

Not necessarily. While many tools prioritize security, it's essential to check the security measures in place, such as encryption and two-factor authentication, before selecting a tool.

AI and machine learning will enhance the predictive analytics capabilities of Cryptocurrency Analysis Tools. These technologies can process vast amounts of data to forecast market movements with higher accuracy, ensuring traders are better informed about potential market shifts.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.