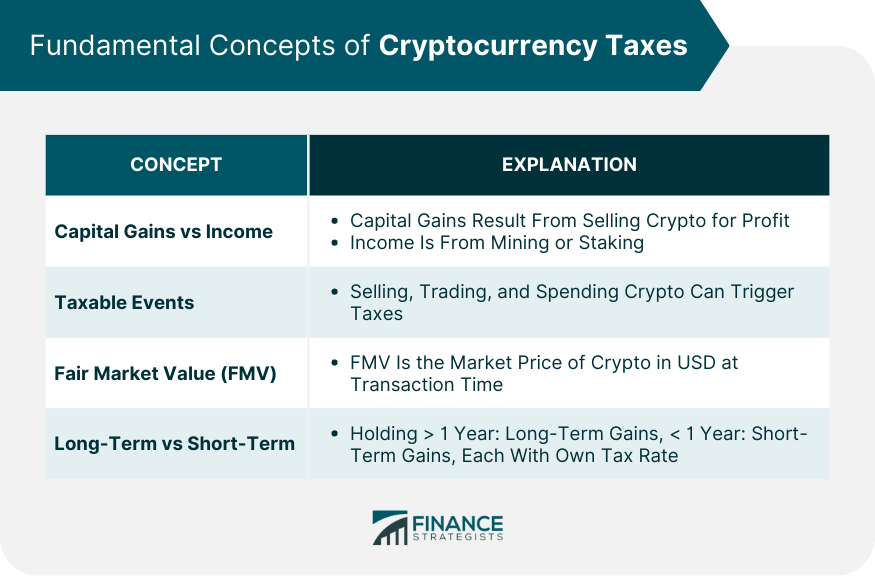

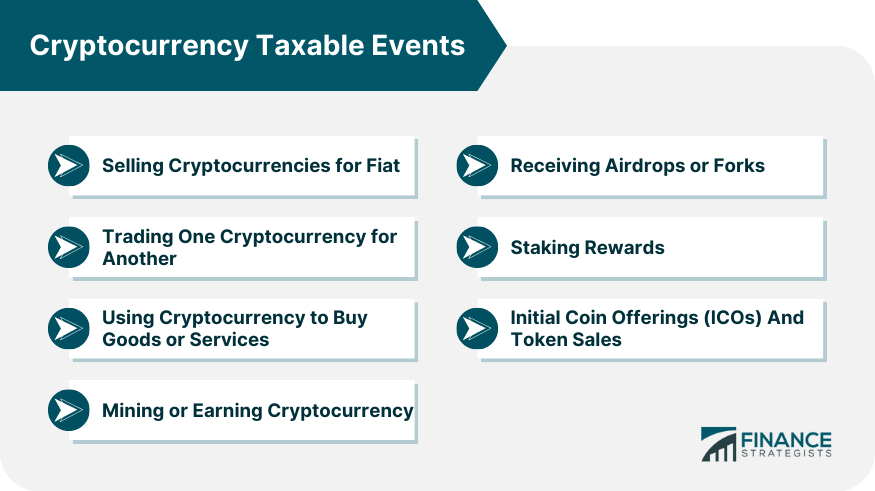

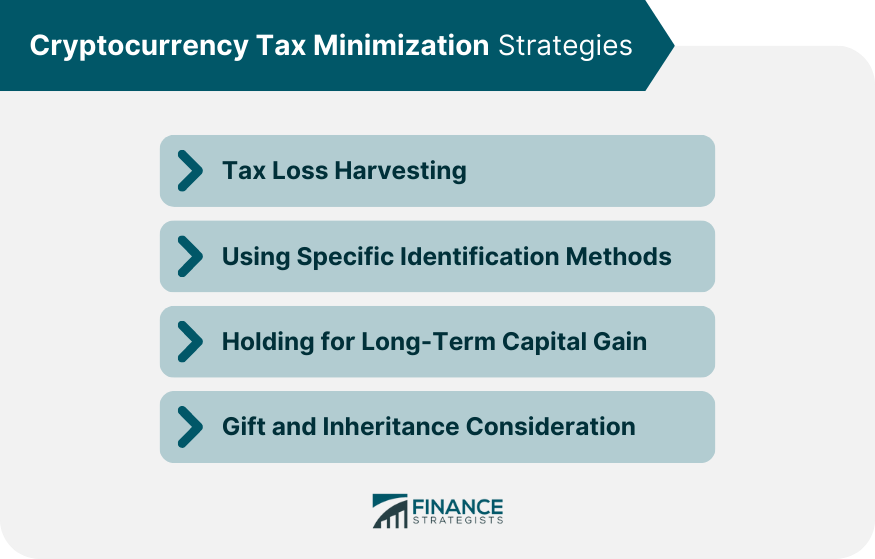

Cryptocurrency taxes refers to the taxation of transactions involving digital or virtual currencies like Bitcoin, Ethereum, and countless others. As cryptocurrencies have surged in popularity, regulatory authorities worldwide have established guidelines for their taxation. Typically, cryptocurrencies are treated as property rather than currency. In the U.S., for instance, the IRS classifies them as such, subjecting them to capital gains tax. This means that if an individual buys Bitcoin at $10,000 and sells it at $15,000, they would be liable for taxes on the $5,000 profit. The specific tax rate depends on how long the cryptocurrency was held; assets held for over a year may benefit from lower long-term capital gains rates. It's crucial for investors to keep detailed records of their transactions to calculate and report their tax obligations accurately, considering the potential for significant financial penalties for non-compliance. In the realm of cryptocurrency, one can either incur capital gains or receive income. Capital gains arise when an individual sells their crypto for more than they acquired it for, while income pertains to cryptocurrencies earned from mining or staking. Not all crypto transactions trigger taxes. However, some events like selling, trading, or spending cryptocurrencies can be considered taxable. FMV refers to the market price at which an asset would change hands between a willing buyer and a willing seller. In the context of cryptocurrency, it means the U.S. dollar value of one cryptocurrency at the time of the transaction. The duration for which one holds a cryptocurrency determines the nature of the capital gains. If held for more than a year, it's considered long-term, while anything less constitutes short-term gains, each with its own tax rate. When you sell cryptocurrencies like Bitcoin for fiat money, such as USD or EUR, you may incur capital gains or losses, which need to be reported. Swapping one cryptocurrency for another is considered a taxable event. Each trade necessitates the calculation of capital gains or losses. Purchasing items with cryptocurrency is seen as a sale of that cryptocurrency and, therefore, might be subject to capital gains tax. Mining cryptocurrencies or earning them as payment subjects the receiver to income tax on the asset's value. Airdrops and forks, methods by which users receive new tokens, are usually considered taxable income. Rewards from staking crypto are treated as income and should be reported as such for taxation purposes. Participation in ICOs or token sales can have tax implications, especially when selling these tokens later at a profit or loss. Maintaining detailed records of all cryptocurrency transactions is vital for accurate tax reporting. These records help ascertain the purchase price, sale price, and any fees incurred. Various tools and software solutions, like CoinTracker and CryptoTrader.Tax, have emerged to help users track their cryptocurrency transactions and calculate gains or losses. In the U.S., for instance, the IRS requires taxpayers to report cryptocurrency transactions on Form 8949 and Schedule D. It's essential to be aware of evolving tax regulations in one's country and ensure that all cryptocurrency transactions are reported in compliance with these rules. Tax Loss Harvesting: By selling cryptocurrencies that have decreased in value, investors can offset capital gains elsewhere, thus potentially reducing their overall tax liability. Using Specific Identification Methods: Methods like First-In, First-Out (FIFO), or Last-In, First-Out (LIFO) can help individuals optimize their tax liabilities when selling or trading crypto. Holding for Long-Term Capital Gain: Holding crypto investments for over a year might qualify them for lower tax rates in many jurisdictions. Gift and Inheritance Consideration: Gifting cryptocurrencies or inheriting them can have unique tax implications. It's crucial to understand these nuances to avoid unforeseen tax consequences. U.S.: Cryptocurrencies are treated as property, with capital gains tax applied to any profits. EU countries: Treatment varies, but many nations view cryptocurrencies as private money, with tax applied to capital gains. Australia: Cryptocurrency is considered property and subject to capital gains tax. Canada: Cryptocurrency transactions can be treated as income or capital gains, depending on the circumstances. Some investors face double taxation, where they're taxed in multiple countries for the same income. Treaties can mitigate these concerns. Different countries have different regulatory frameworks for cryptocurrencies. It's crucial for global investors to understand these nuances. Cryptocurrency taxes are becoming increasingly relevant as digital currencies like Bitcoin and Ethereum gain prominence in the financial landscape. Worldwide, regulatory authorities classify these assets often as property, making transactions subject to capital gains tax. The U.S. leads this classification, emphasizing the importance of understanding one's obligations when trading, selling, or even spending cryptocurrencies. Key factors like the duration of holding these assets determine whether they attract short or long-term capital gains. Tools have emerged to aid in meticulous record-keeping, ensuring accurate tax reporting. As regulations differ across nations, it's paramount for global investors to remain informed about specific jurisdictional nuances. Moreover, employing strategies like tax loss harvesting can optimize tax liabilities. In a rapidly evolving digital economy, understanding and navigating cryptocurrency tax landscapes is essential for informed investment and compliance.Overview of Cryptocurrency Taxes

Fundamental Concepts of Cryptocurrency Taxes

Capital Gains vs Income

Taxable Events

Fair Market Value (FMV)

Long-Term vs Short-Term Capital Gains

Cryptocurrency Taxable Events

Selling Cryptocurrencies for Fiat

Trading One Cryptocurrency for Another

Using Cryptocurrency to Buy Goods or Services

Mining or Earning Cryptocurrency

Receiving Airdrops or Forks

Staking Rewards

Initial Coin Offerings (ICOs) And Token Sales

Record Keeping and Reporting of Cryptocurrency Taxes

Importance of Consistent and Accurate Record-Keeping

Tools and Software for Tracking Transactions

Common Forms Used in Different Countries

Ensuring Compliance With Tax Regulations

Cryptocurrency Tax Minimization Strategies

Global Perspectives of Cryptocurrency Taxes

Comparison of Cryptocurrency Tax Treatments in Different Countries

Double-Taxation Concerns and Treaties

Regulation and Compliance in Various Jurisdictions

Bottom Line

Cryptocurrency Taxes FAQs

A taxable event in cryptocurrency occurs when one sells, trades, or spends crypto. Other events, such as mining, receiving airdrops or forks, participating in ICOs, and staking rewards, are also typically considered taxable.

The duration for which one holds a cryptocurrency determines its capital gains nature. If held for more than a year, it's considered long-term. Anything less is short-term. These durations come with distinct tax rates in many jurisdictions, often making long-term gains more tax-efficient.

Yes, numerous tools and software solutions, such as CoinTracker and CryptoTrader.Tax, has been developed to help users track cryptocurrency transactions, calculate gains or losses, and streamline tax reporting.

Cryptocurrency tax regulations vary significantly across countries. For instance, in the U.S., cryptocurrencies are treated as property with capital gains tax on profits. Meanwhile, many EU countries view them as private money, and Australia considers them property with implications for capital gains tax. It's essential to familiarize oneself with the specific regulations in one's jurisdiction.

Yes, strategies like tax loss harvesting, using specific identification methods (e.g., FIFO or LIFO), and holding cryptocurrencies for over a year to qualify for long-term capital gains rates can help reduce tax liabilities. It's recommended to consult with a tax professional to explore and implement these strategies effectively.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.