Fundamental analysis in cryptocurrencies refers to the comprehensive evaluation of a digital asset based on intrinsic and external factors. Unlike its counterpart, technical analysis, which primarily focuses on price and volume trends, fundamental analysis delves deeper into the core of a cryptocurrency. This includes an examination of the underlying technology (like the robustness of the blockchain), the team behind the project, real-world applications, partnerships, the regulatory environment, and the overall sentiment in the crypto market. Investors leverage fundamental analysis to gauge the true value of a cryptocurrency and make informed decisions about long-term investments. By understanding a coin's intrinsic value, one can discern if it is undervalued or overvalued in the market, making it a crucial tool for sustainable investment strategies. Whitepapers serve as the blueprint for any cryptocurrency project. They detail the objectives, technology, token distribution, and overall vision of the project. A thorough evaluation of a whitepaper can offer insights into the project's viability and long-term potential. The technological backbone of a cryptocurrency can be its greatest strength or its most vulnerable weakness. Reviewing the codebase and understanding its functionality, scalability, and security features can provide a depth of insight into the project's robustness and innovation. Understanding the team behind a cryptocurrency is crucial. Their track record, expertise, and vision can either propel the project to success or doom it to obscurity. Advisors, too, play a pivotal role, offering guidance based on industry knowledge and experience. The position of a cryptocurrency within the larger market ecosystem can determine its potential for growth and adoption. Assessing its competitors, understanding market saturation, and the unique selling propositions can illuminate the project's standing and potential trajectory. The macro health of the crypto market is influenced by factors like global adoption rates, regulatory news, and significant technological developments. Analyzing overarching market trends can help in gauging the potential direction of individual cryptocurrencies. Regulations and political decisions have a profound impact on the crypto market. Countries embracing or rejecting crypto can affect market sentiment, adoption rates, and even the fundamental functioning of certain cryptocurrencies. Metrics like transaction volume, hash rate, and active addresses can provide valuable information about the cryptocurrency’s current usage and potential scalability issues or benefits. Understanding how and where a cryptocurrency is being adopted, be it for retail, finance, supply chain, or any other use case, can provide insights into its real-world utility and potential for growth. Tokenomics is the economics of a token within its ecosystem. It includes its distribution, scarcity, utility, and how it’s used for governance or incentives within the system. Proper tokenomics can encourage active participation and ensure the sustainability of a project. A project's roadmap outlines its future trajectory. Assessing its milestones, past achievements, and future plans can give a clear picture of its ambitions and the likelihood of achieving them. A robust community can be a cryptocurrency’s greatest asset. Analyzing engagement on platforms like Reddit, Twitter, or dedicated forums can gauge the sentiment, trust, and involvement of its user base. Security is paramount in the crypto world. Understanding a project’s security measures, its consensus mechanism, and potential vulnerabilities can guide informed investment decisions. Past security breaches, and more importantly, the response to those breaches, can illuminate a project's resilience and commitment to its user base. It is notorious for its volatility. Price swings based on speculation can often overshadow fundamental values, leading to potential misjudgments. The fast-evolving nature of blockchain technology means that today's innovation can become obsolete tomorrow. Hard forks, or splits in the blockchain, can also create unforeseen challenges and opportunities. Not all whitepapers are created equal. Some can be intentionally misleading or overly optimistic. A discerning eye and cross-referencing with external sources is essential. While fundamental analysis delves into the intrinsic value of a cryptocurrency, technical analysis focuses on price movements and historical market behavior. Both have their strengths and limitations, and understanding these can help investors apply them judiciously. While fundamental analysis offers a deep dive into the inherent value of a project, technical analysis provides insights into market sentiment and potential price movements. By combining these approaches, investors can gain a more holistic view of the market. Understanding the intrinsic value of a cryptocurrency is paramount for informed investment decisions. The fundamental analysis serves as a comprehensive tool, delving deep into the heart of a cryptocurrency, from its technological backbone and the vision of its founding team to its position in the broader market ecosystem. Key to this approach is the analysis of whitepapers, which unveil the project's ambitions and feasibility. Yet, while the fundamental approach offers deep insights, it isn't without challenges namely, the market's inherent volatility, technological shifts, and the potential for misleading project documentation. However, when complemented with technical analysis, which emphasizes price trends, investors stand a better chance at holistic market understanding. In essence, for sustainable and strategic investments in the cryptocurrency domain, a balanced application of both fundamental and technical analysis is indispensable.What Is Fundamental Analysis in Cryptocurrencies?

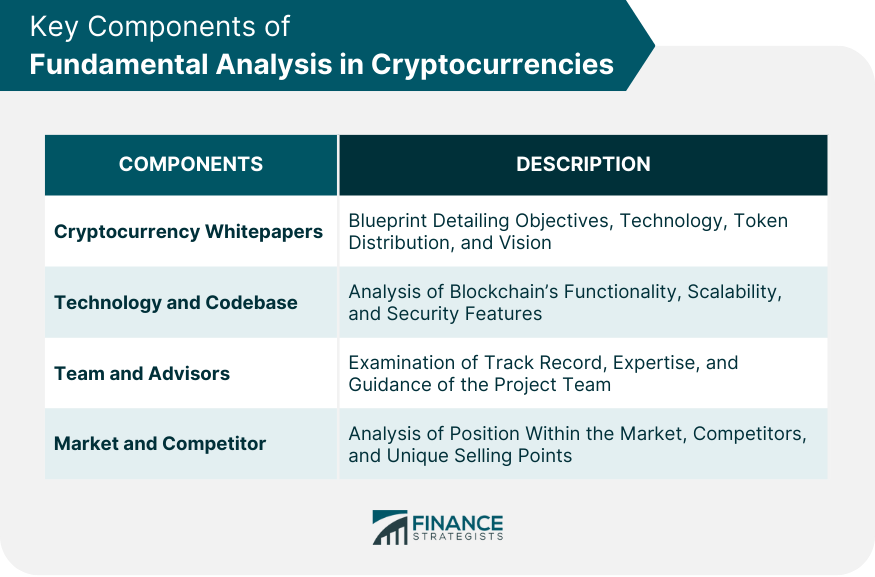

Key Components of Fundamental Analysis in Cryptocurrencies

Cryptocurrency Whitepapers

Technology and Codebase Analysis

Team and Advisors

Market and Competitor Analysis

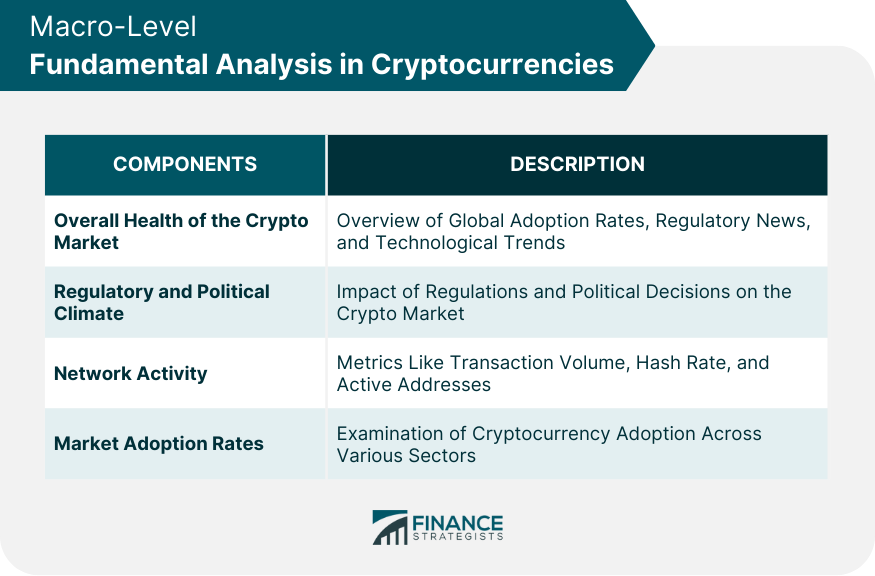

Macro-Level Fundamental Analysis in Cryptocurrencies

Overall Health of the Crypto Market

Regulatory and Political Climate

Network Activity

Market Adoption Rates

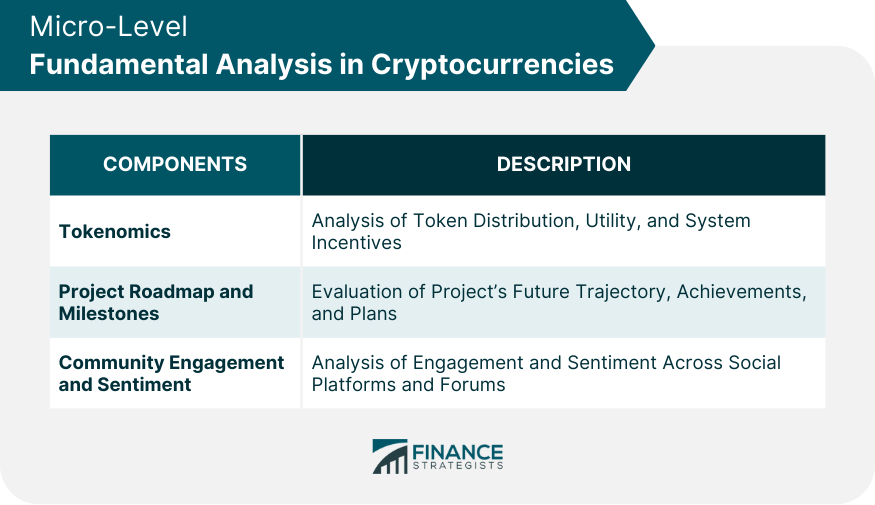

Micro-Level Fundamental Analysis in Cryptocurrencies

Tokenomics

Project Roadmap and Milestones

Community Engagement and Sentiment Analysis

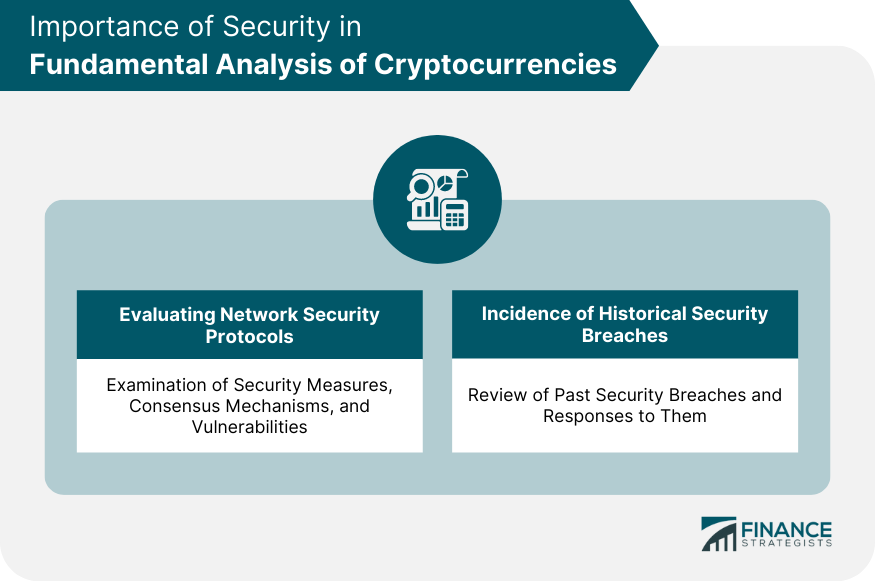

Importance of Security in Fundamental Analysis of Cryptocurrencies

Evaluating Network Security Protocols

Incidence of Historical Security Breaches and Responses

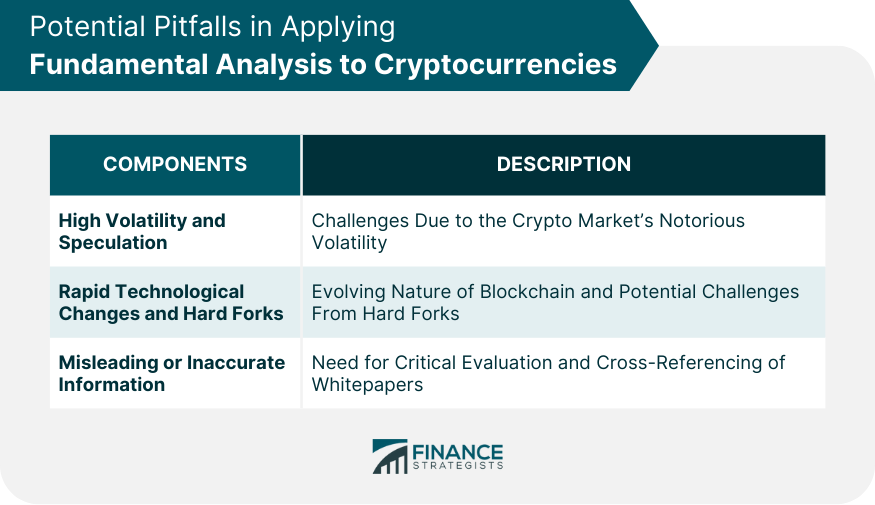

Potential Pitfalls in Applying Fundamental Analysis to Cryptocurrencies

High Volatility and Speculation in the Crypto Market

Rapid Technological Changes and Hard Forks

Misleading or Inaccurate Information in Whitepapers

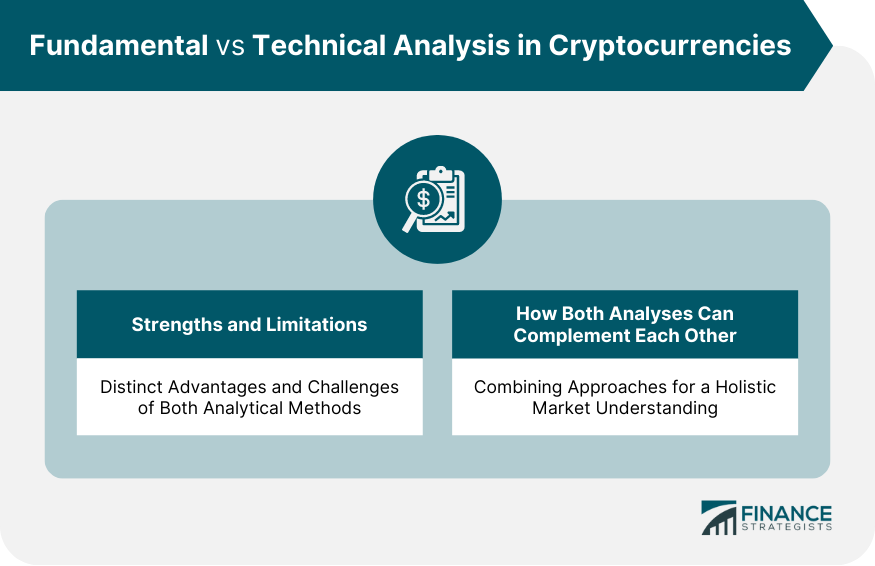

Fundamental vs Technical Analysis in Cryptocurrencies

Strengths and Limitations of Both Approaches

How Both Analyses Can Complement Each Other

Conclusion

Fundamental Analysis in Cryptocurrencies FAQs

Fundamental Analysis in Cryptocurrencies involves assessing the intrinsic value of a digital asset by analyzing various factors like the project's technology, team, market position, and economic indicators, to make informed investment decisions.

Unlike traditional markets that focus on economic indicators, company earnings, and sector growth, Fundamental Analysis in Cryptocurrencies evaluates aspects like the project's whitepaper, technological feasibility, tokenomics, and community engagement.

The whitepaper is a foundational document that outlines a cryptocurrency project's objectives, vision, technology, and token distribution. It provides insights into the project's viability and potential, making it essential for Fundamental Analysis of Cryptocurrencies.

Yes, the crypto market's high volatility, rapid technological changes, and the presence of misleading information in some whitepapers can pose challenges when applying Fundamental Analysis in Cryptocurrencies. It's essential to use a combination of research tools and stay updated.

While Fundamental Analysis in Cryptocurrencies evaluates the intrinsic value and potential of a digital asset, Technical Analysis focuses on historical price movements and market behavior. By combining these approaches, investors can gain a comprehensive understanding of a cryptocurrency's potential and market sentiment.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.