Cryptocurrency futures are financial contracts that obligate the buyer to purchase and the seller to sell a specific amount of a cryptocurrency at a predetermined price on a specified future date. Much like futures contracts in traditional financial markets, these instruments allow traders to speculate on the future price of a cryptocurrency without actually having to own or take delivery of the asset itself. They serve as a tool for hedging, price discovery, and risk management, allowing participants to lock in prices today for future transactions. The mechanics of cryptocurrency futures are similar to those of other futures contracts. Two parties agree upon a price for a set amount of cryptocurrency to be transacted on a specific future date. By doing so, they can provide themselves with price certainty and mitigate potential price risks. Depending on the nature of the contract, cryptocurrency futures might be settled either in cash, where the difference between the contract price and the market price is paid out or by the physical delivery of the cryptocurrency. Cryptocurrency futures trading operates on principles akin to futures trading in traditional markets but revolves around cryptocurrencies as the underlying asset. Here's a breakdown of how it works: The foundation of cryptocurrency futures trading is the contract, a binding commitment between two entities – typically a buyer and a seller. They lock in a price today, deciding upon which they'll transact the cryptocurrency on a specific future date, shielded from market price fluctuations at the contract's maturity. The consistency provided by such agreements can aid in long-term planning and stability. Futures trading is often synonymous with leverage, giving traders the capability to command positions much larger than their initial capital outlay. This powerful feature provides traders with the opportunity to maximize their potential returns, even with limited funds. However, while leverage can amplify profits, it can also magnify losses, making it crucial for traders to exercise caution and understand the risks involved To account for cryptocurrency's inherent volatility, traders are mandated to keep a margin – a portion of their position's value. This acts as a safety net, ensuring adequate funds to cover potential adverse movements. If unfavorable market swings erode a trader's balance below the stipulated maintenance margin, they are alerted via a "margin call," prompting them to infuse additional funds or liquidate their position, safeguarding both the trader and the platform. There are primarily two settlement modalities for cryptocurrency futures: cash-settled and physically-settled. In the former, differences are settled in fiat or another cryptocurrency, negating the need to transfer the underlying crypto asset. Conversely, physically-settled contracts culminate in the actual transfer of the cryptocurrency once the contract expires, catering to those who wish to receive or deliver the real asset. Serving as the nexus for cryptocurrency futures trading are dedicated platforms. They empower traders with an array of tools, analytics, and real-time data, underpinning informed decision-making. Moreover, these platforms shoulder the responsibility of ensuring a fair, transparent, and efficient trading environment, often acting as intermediaries in trade settlements. Futures help people guess where prices might go in the future. This gives everyone a sense of what most people think will happen with prices later on. Also, futures let businesses and regular folks protect themselves from unexpected price changes, bringing some calm in markets that can jump up or down quickly. The rules for cryptocurrency futures vary widely, with some places having strict controls and others being more relaxed. Some trading platforms might exist in a gray area where rules aren't clear, while others actively follow set guidelines, building trust and keeping their users safe. As the crypto world changes quickly, staying up-to-date with these rules is essential for both platforms and those trading on them. Trading cryptocurrency futures can be rewarding, but having the right strategies in place is crucial for success. In basic terms, "going long" means buying a futures contract because you believe the cryptocurrency's price will rise. Conversely, "going short" is selling a futures contract, expecting the price to fall. By understanding market trends and analyzing price patterns, you can decide whether to take a long or short position. Staying updated on major developments can offer hints about potential price movements. Subscribing to news outlets or joining crypto communities can be beneficial. Being informed helps in making timely and educated decisions, ensuring you're not caught off guard. Setting a stop-loss is like having a safety net. It allows you to predetermine a price at which your futures contract will automatically be sold. This strategy can prevent substantial losses during rapid market downturns. It's always wise to have safeguards in place, especially in a market as volatile as cryptocurrencies. For newcomers, the world of cryptocurrency futures can be overwhelming. It's advisable to begin with a modest investment, allowing you to learn without excessive risk. As you gain experience and confidence, you can gradually increase your investment. Every step in trading is a learning opportunity. It's an age-old saying not to put all your eggs in one basket, and it holds in futures trading. By diversifying your investments across various cryptocurrency futures, you spread the risk. If one asset underperforms, another might compensate. Diversification offers a cushion against unforeseen market adversities. Hedging is a tactic used to counteract potential losses in the spot market. If you own a particular cryptocurrency and are concerned about its price dropping, selling a futures contract can act as a protective measure. If the cryptocurrency's price does decline, gains from the futures contract can offset the losses. It's like having insurance for your investments. Trading cryptocurrency futures might sound exciting, but there are some things to keep in mind before diving in. Volatility: Cryptocurrency prices can change really fast, going up or down quickly. This can mean big profits but also big losses, so it's essential to be prepared for these swings. Regulations: Different places have different rules about cryptocurrency trading. It's good to know the rules of your country or region to avoid any surprises or legal troubles. Costs and Fees: Trading isn't free. There might be fees for buying, selling, or just holding onto a futures contract. Always check the costs involved so you're not caught off guard. Platform Security: Not all trading platforms are created equal. Make sure to pick one that's known to be safe and trustworthy. The last thing anyone wants is to lose money because of a hack. Liquidity: This is about how easily you can turn your futures contract into cash. If there aren't many buyers or sellers, it might be hard to sell your contract when you want to. Risk Management: Never invest money you can't afford to lose. It's a good idea to set limits for yourself on how much you're willing to risk and stick to them. Cryptocurrency futures represent a powerful financial instrument that allows traders to speculate on the future price of cryptocurrencies without needing to own the actual assets. These futures contracts serve multiple purposes: as tools for hedging against price fluctuations, for price discovery, and as risk management strategies. The mechanics of cryptocurrency futures mirror those of traditional futures contracts, involving contract agreements, leverage, margin and maintenance, settlement modalities, and trading platforms. Traders should carefully consider their strategies, whether going long or short, staying informed, using stop-losses, starting small, and diversifying their investments to mitigate risks. However, potential traders must remain mindful of certain considerations. Cryptocurrency markets are known for their volatility, demanding cautious decision-making. Thorough research, awareness of regulations, cost assessment, platform security, liquidity evaluation, and effective risk management are crucial steps to succeed in cryptocurrency futures trading.What Are Cryptocurrency Futures?

How Cryptocurrency Futures Trading Work

Contract Agreement

Leverage

Margin and Maintenance

Settlement

Trading Platforms

Price Discovery and Hedging

Regulation and Compliance

Strategies for Trading Cryptocurrency Futures

Go Long or Short

Stay Updated

Use Stop-Losses

Start Small

Diversify

Hedging

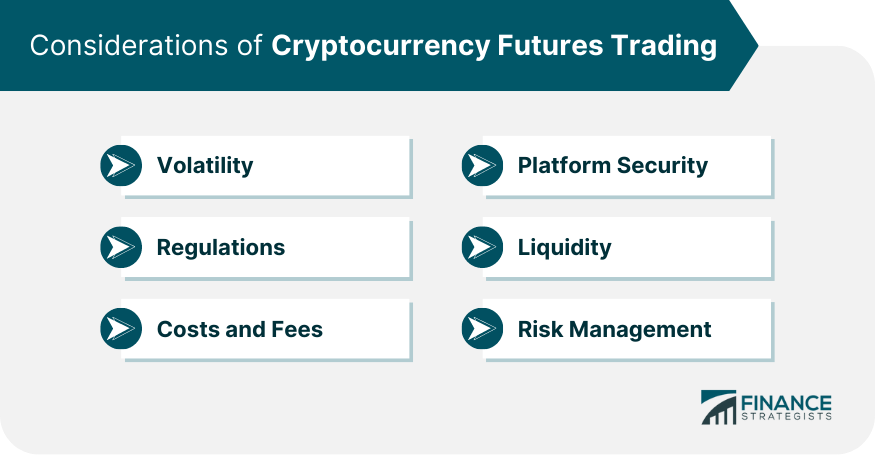

Considerations of Cryptocurrency Futures Trading

Conclusion

Futures Trading in Cryptocurrency FAQs

Futures trading in cryptocurrency involves buying or selling contracts that obligate participants to transact a specific amount of a cryptocurrency at a predetermined price on a future date.

Cryptocurrency futures trading allows traders to speculate on price movements without owning the actual asset. Buyers and sellers agree on a price today for a future date, providing stability against market fluctuations.

Cryptocurrency futures trading offers opportunities for speculation, risk management, and price discovery. Traders can profit from both upward and downward price movements, hedge against losses, and gain insights into market trends.

Common strategies include going long and going short. Other strategies involve staying informed, using stop-losses, starting small, diversifying investments, and hedging to protect against losses.

Consider the volatility of cryptocurrency markets, conduct thorough research, understand regulations, assess costs and fees, prioritize platform security, evaluate liquidity, and implement effective risk management.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.