Gold-backed cryptocurrencies are a unique breed in the world of digital assets. Instead of being pegged to fiat currencies or left unbacked, these digital coins are tied to the value of gold. For every unit of such a cryptocurrency in circulation, there's a corresponding amount of physical gold stored in a secure location, often a verified vault. The allure of these coins lies in their ability to combine the technological benefits of blockchain — decentralization, security, and transparency — with the inherent value and historical reliability of gold. Investors can enjoy the price stability gold offers while leveraging the ease and speed of cryptocurrency transactions. This fusion seeks to reduce the extreme volatility seen in the crypto space while offering a tangible asset that has been a store of value for millennia. Tokens are minted based on gold reserves. This means that for every token created, a corresponding amount of gold is held in reserve. This process ensures transparency and trustworthiness, as investors can be confident in the token's value. Regular audits and verifications further cement this trust, ensuring the actual gold amount corresponds to the tokens in circulation. The real advantage of gold-backed crypto is the option to convert it back to physical gold. Whether you're a believer in the digital future or a traditionalist at heart, the ability to switch between digital tokens and tangible gold offers flexibility. However, while redeeming sounds straightforward, factors like storage fees, transaction fees, and minimum redemption amounts can come into play. The growing demand for stable investments has given birth to several gold-backed digital currencies. Among the pioneers, DigixDAO democratizes access to gold, offering tokens backed by gold bars in a 1:1 ratio. Another significant player, GoldCoin offers enhanced security features, ensuring that token holders' investments are safeguarded. Representing one fine troy ounce of gold, PAX Gold allows users to own and trade actual gold in tokenized form. Gold, throughout history, has been a trusted store of value. By backing digital tokens with gold, these cryptocurrencies aim to offer the same level of trust. The marriage between gold and crypto ensures that even if the digital market fluctuates, a tangible, universally accepted asset anchors the token's value. One of the major criticisms of cryptocurrencies like Bitcoin has been their price volatility. Gold-backed tokens tackle this head-on. By pegging the token's value to gold, price fluctuations are significantly reduced, making them a more attractive investment for risk-averse individuals. A common concern with traditional cryptocurrencies is the lack of tangible backing. Gold-backed cryptocurrencies dispel this concern. Knowing that behind every token, there's a real asset gives investors a sense of security. The physical storage of gold reserves present challenges. While digital assets can be stored using encryption, gold requires secure vaults. There's an inherent risk, be it theft or natural disasters, which can jeopardize the reserves. The regulatory landscape for gold-backed cryptocurrencies is still evolving. Different countries have varied stances, with some welcoming the concept and others being more wary. These varying regulations can pose challenges, especially in cross-border transactions or global trade scenarios. Despite their tangible backing, skepticism surrounds these tokens. Concerns about the genuineness of the gold backing, potential market manipulations, and the authenticity of audits can impact their widespread acceptance. Gold-backed crypto offers unparalleled digital access. Unlike physical gold which requires secure storage and is challenging to move, digital tokens can be traded globally, providing liquidity and ease of access. While gold has always been a liquid asset, tokenizing it enhances its transferability. Digital tokens can be moved across borders, sold, or purchased at the click of a button. Moreover, the storage challenges of physical gold are negated, reducing associated costs and risks. Both traditional gold and its digital counterpart are seen as long-term investments. However, gold-backed cryptocurrencies offer the added benefits of digital assets, making them suitable for diverse investment profiles. As blockchain technology evolves, it will undoubtedly impact gold-backed cryptocurrencies. Future iterations promise enhanced security, faster transaction times, and even more transparency, all of which will further boost the appeal of these tokens. The fusion of traditional and modern financial mechanisms positions gold-backed cryptocurrencies for potential mainstream adoption. Their ability to offer stability in turbulent times might make them a staple in diverse investment portfolios. With increasing awareness and the continuous evolution of blockchain technology, the market for gold-backed cryptocurrencies is poised for growth. A wider array of tokens, each with its unique features, is likely to emerge, catering to varied investor needs. Gold-backed cryptocurrencies marry the time-tested reliability of gold with cutting-edge blockchain technology. By tying each digital token to tangible gold stored securely in vaults, these assets provide both trust and tangible value, sidestepping the extreme volatility often seen with conventional cryptocurrencies. Key mechanics, such as token creation and redemption, ensure transparency and offer a seamless bridge between the digital and physical worlds. While they come with inherent advantages like stability, reduced volatility, and tangible backing, potential investors must be wary of challenges like secure storage and regulatory hurdles. As the intersection of age-old wealth and contemporary tech, gold-backed cryptocurrencies represent a potential path toward mainstream adoption in the financial world, bringing together traditionalists and tech enthusiasts under a unified investment banner. As with any investment, due diligence and understanding are essential.What Is Gold-Backed Cryptocurrency?

Mechanics of Gold-Backed Cryptocurrency

Token Creation

Token Redemption

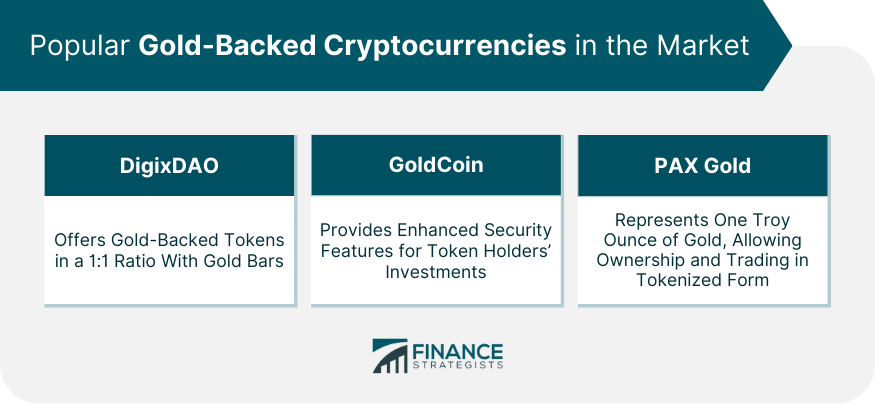

Popular Gold-Backed Cryptocurrencies in the Market

DigixDAO

GoldCoin

PAX Gold

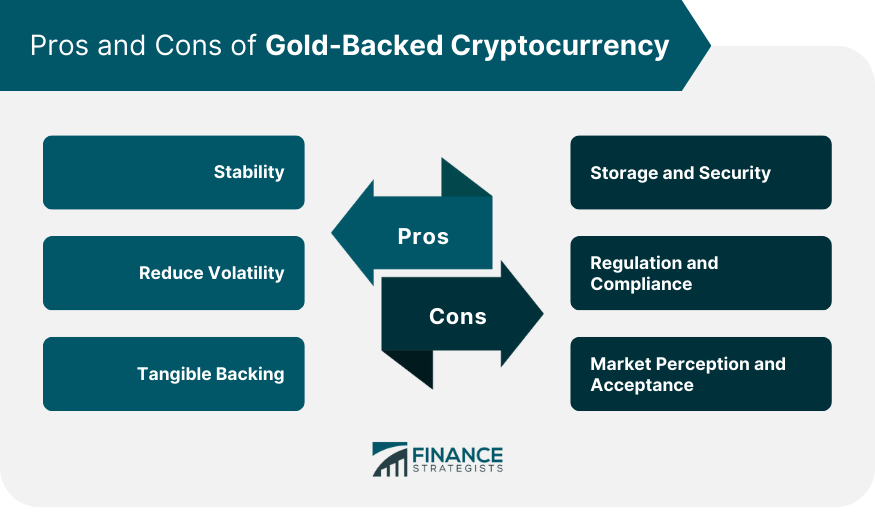

Pros of Gold-Backed Cryptocurrency

Stability

Reduce Volatility

Tangible Backing

Cons and Challenges of Gold-Backed Cryptocurrency

Storage and Security

Regulation and Compliance

Market Perception and Acceptance

Gold-Backed Cryptocurrency vs Traditional Gold Investments

Digital Access and Global Trade

Comparison of Liquidity, Transferability, and Storage

Investment Profiles

Future of Gold-Backed Cryptocurrency

Technological Advancements

Potential Mainstream Adoption

Predictions for Market Growth

Conclusion

Gold-Backed Cryptocurrency FAQs

A Gold-Backed Cryptocurrency is a type of digital token where each unit is pegged to a specific amount of gold, typically stored in secure vaults. Unlike traditional cryptocurrencies that derive value from market demand and supply, these tokens have a tangible asset (gold) underpinning their value.

Most reputable Gold-Backed Cryptocurrencies undergo regular audits and verifications to prove the amount of gold in reserve. You can typically find these audit reports on the cryptocurrency's official website or platform.

Yes, one of the advantages of Gold-Backed Cryptocurrency is the ability to redeem tokens for their equivalent in physical gold. However, there may be stipulations like minimum redemption amounts or associated fees.

While the digital tokens themselves use secure blockchain technology, concerns might arise regarding the physical storage of gold reserves. It's crucial to choose tokens backed by gold stored in highly secure and insured vaults.

Gold-Backed Cryptocurrencies tend to be less volatile than traditional cryptocurrencies because they're pegged to the relatively stable value of gold. This tangible backing offers a buffer against extreme market fluctuations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.