The EMBI is J.P. Morgan's index for emerging market bonds, offering a comprehensive view of their fixed-income market and serving as a benchmark for sovereign and quasi-sovereign bonds. The index includes diverse bond types and currencies, reflecting the performance of emerging market fixed-income assets. EMBI offers insights into the health and performance of emerging market economies, which is vital for diversified portfolios. It helps investors assess credit risk, liquidity, and potential returns in these markets. J.P. Morgan leads in providing EMBI indices, while other institutions like Bloomberg Barclays and FTSE offer their versions with unique methodologies. EMBI plays a crucial role in analyzing investment opportunities and measuring portfolio performance in emerging markets, which contribute significantly to global finance and economic growth. EMBI includes bonds issued by countries classified as emerging markets by index providers. The classification criteria may vary but typically consider factors such as GDP per capita, market capitalization, and the extent of market openness. Examples of countries included in EMBI are Brazil, Russia, India, China, South Africa, Turkey, and Mexico. The index comprises various bond types, including sovereign, quasi-sovereign, and corporate bonds. National governments issue sovereign bonds, while quasi-sovereign bonds are issued by entities that are either wholly or partially owned by the government. Corporate bonds are issued by private companies operating in emerging markets. EMBI may include bonds denominated in both local and hard currencies, such as the US dollar or euro. To be included in EMBI, bonds must meet certain market capitalization and liquidity requirements. These criteria ensure that the index accurately reflects the investable universe of emerging market debt and minimizes the impact of illiquid securities on index performance. Market capitalization refers to the total value of outstanding bonds, while liquidity measures the ease with which bonds can be bought or sold without significantly affecting their prices. The J.P. Morgan EMBI Global is the most widely followed EMBI index, representing a broad universe of emerging market sovereign and quasi-sovereign bonds. It includes hard currency-denominated and local currency-denominated bonds, focusing on market capitalization and liquidity. The J.P. Morgan EMBI Global Diversified is a variant of the EMBI Global that aims to reduce concentration risk by imposing limits on the weights of individual countries and issuers. This approach results in a more balanced and diversified portfolio, making it attractive to investors who are concerned about excessive exposure to specific markets. The J.P. Morgan EMBI+ Index is a narrower version of the EMBI Global, focusing exclusively on hard currency-denominated sovereign and quasi-sovereign bonds from select emerging market countries. By limiting its scope to bonds with higher liquidity and credit quality, the EMBI+ Index offers a more conservative investment profile than the broader EMBI Global. In addition to the aforementioned indices, other EMBI variants cater to specific investment needs or risk profiles. Some examples include the J.P. Morgan Corporate Emerging Markets Bond Index (CEMBI), which focuses on corporate bonds, and the Bloomberg Barclays Emerging Markets Local Currency Government Bond Index, which concentrates on local currency-denominated sovereign bonds. Historically, EMBI indices have offered attractive returns compared to developed market bonds, driven by higher yields and the potential for currency appreciation. However, they have also exhibited higher volatility and risk, as emerging market bonds are more susceptible to economic, political, and market fluctuations. A range of factors, such as interest rate movements, inflation, sovereign credit ratings, and geopolitical events, can influence the performance of the EMBI. For instance, rising global interest rates can reduce demand for emerging market bonds, leading to lower prices and higher yields. Similarly, changes in credit ratings or political stability can affect investor sentiment and bond prices. EMBI typically exhibits a low to moderate correlation with other major asset classes, such as equities and developed market bonds. This characteristic makes EMBI a valuable addition to diversified investment portfolios, as it can enhance risk-adjusted returns and reduce overall portfolio volatility. Investing in EMBI provides several benefits for investors. Including EMBI in a portfolio allows for diversification by adding exposure to a different asset class and geographic region. Emerging market bonds have a low correlation with developed market bonds, which can help reduce portfolio risk. Diversification across various countries and issuers within the index can further enhance risk management. Emerging market bonds typically offer higher yields compared to bonds from developed economies. This is due to the higher risk associated with investing in emerging markets. The potential for higher returns can be appealing to investors seeking income generation or seeking to enhance their overall yield profile. Emerging market economies often experience higher economic growth rates compared to developed markets. Investing in EMBI allows investors to participate in the growth potential of these economies. This exposure to faster-growing economies can provide opportunities for capital appreciation and potentially higher investment returns. As emerging market economies develop and their creditworthiness improves, the prices of their bonds can increase, leading to capital appreciation for bondholders. This potential for price appreciation can further contribute to the overall return generated by investing in EMBI. Investing in EMBI carries certain risks that investors should be aware of: Currency risk arises from fluctuations in exchange rates between the investor's home currency and the currency in which the bonds are denominated. Changes in exchange rates can impact the value of foreign currency-denominated bonds and potentially erode returns when converted back into the investor's home currency. Credit risk is the risk that the issuer of the bond may default on its interest or principal payments. Emerging market economies may have a higher risk of default compared to developed economies. Factors such as political instability, weak economic conditions, or fiscal challenges can increase credit risk in emerging markets. Geopolitical risk encompasses political instability, policy changes, and other events that can impact bond prices. Emerging markets may be more susceptible to geopolitical risks, including social unrest, government intervention, regulatory changes, or trade disputes. These events can lead to increased volatility and uncertainty in the bond market. Liquidity risk refers to the risk of not being able to sell or buy bonds quickly or at a favorable price. Emerging market bonds may have lower liquidity compared to bonds from developed markets, making it more challenging to execute trades, especially during times of market stress. Limited liquidity can result in wider bid-ask spreads and potentially impact the ability to enter or exit positions. Sovereign risk refers to the risk associated with investing in bonds issued by governments. Factors such as political instability, changes in government policies, or economic downturns can impact the creditworthiness of sovereign issuers in emerging markets, increasing the risk of default. Investors can gain exposure to EMBI through various investment vehicles, including: ETFs are marketable securities that track an index, such as EMBI, and can be bought or sold on a stock exchange. They offer a cost-effective and liquid way to invest in emerging market bonds. Mutual funds pool money from multiple investors to invest in a diversified portfolio of bonds, including those from emerging markets. Some funds may specifically focus on EMBI or adopt a more general emerging market bond strategy. Investors can also directly purchase individual bonds issued by emerging market countries or corporations. This approach allows for greater customization but may require more research and expertise to manage risk effectively. Changes in interest rates and inflation can significantly impact the performance of EMBI. Higher interest rates can lead to reduced bond demand, causing bond prices to fall and yields to rise. Conversely, lower interest rates can increase bond demand, leading to higher prices and lower yields. Inflation can also influence bond prices, eroding the purchasing power of fixed-income investments. Central banks in emerging market countries may adjust interest rates to combat inflation, further affecting bond performance. Sovereign credit ratings are an essential factor in determining a country's creditworthiness and its ability to meet its debt obligations. Rating agencies such as Standard & Poor's, Moody's, and Fitch assign credit ratings based on various economic, financial, and political factors. Changes in a country's credit rating can significantly impact the value of its bonds and, consequently, the performance of EMBI. Political stability and governance play a crucial role in the performance of EMBI, as they can directly influence a country's economic health and creditworthiness. Political events, such as elections, coups, or policy changes, can create uncertainty in the market and affect investor sentiment, leading to fluctuations in bond prices. Strong governance and sound fiscal policies can also enhance a country's credit rating, making its bonds more attractive to investors. Global economic trends, such as shifts in economic growth, trade relations, and commodity prices can influence EMBI performance. For example, strong global economic growth can boost demand for emerging market exports, leading to higher GDP growth and increased bond demand. On the other hand, a global economic slowdown or trade disputes can negatively impact emerging market economies, affecting bond performance. Environmental, Social, and Governance (ESG) factors are increasingly important considerations for investors in emerging market bonds. These factors can impact a country's creditworthiness and long-term economic prospects, influencing bond performance. Examples of ESG factors include climate change, social inequality, and corporate governance. Many investors are incorporating ESG factors into their emerging market bond investment strategies, recognizing that ESG risks can affect bond returns and credit risk. This integration can take various forms, such as screening bonds based on ESG criteria, engaging with issuers on ESG issues, or incorporating ESG factors into credit analysis. To cater to the growing demand for ESG integration, index providers and asset managers are offering ESG-focused EMBI indices and funds. These products may apply ESG screens, weightings, or other methodologies to create a bond portfolio with a higher ESG profile than traditional EMBI indices. Examples include the J.P. Morgan ESG EMBI Index and the BlackRock iShares ESG USD Emerging Markets Bond ETF. The Emerging Markets Bond Index (EMBI) plays a crucial role in assessing investment opportunities and measuring portfolio performance in emerging markets. EMBI offers insights into emerging market economies with diverse bonds and currencies. J.P. Morgan's EMBI Global is widely followed, while other variants like EMBI Global Diversified and EMBI+ cater to different risk profiles. EMBI has historically provided attractive returns, although it carries higher volatility and risk due to economic, political, and market fluctuations. Investing in EMBI offers benefits such as diversification, attractive yields, exposure to faster-growing economies, and potential capital appreciation. However, investors should be aware of risks such as currency risk, credit risk, geopolitical risk, liquidity risk, and sovereign risk. Various investment vehicles, including ETFs, mutual funds, and individual bonds, provide avenues for EMBI exposure. Economic and political factors, including interest rates, inflation, sovereign credit ratings, and political stability, significantly impact EMBI performance. What Is the Emerging Markets Bond Index (EMBI)?

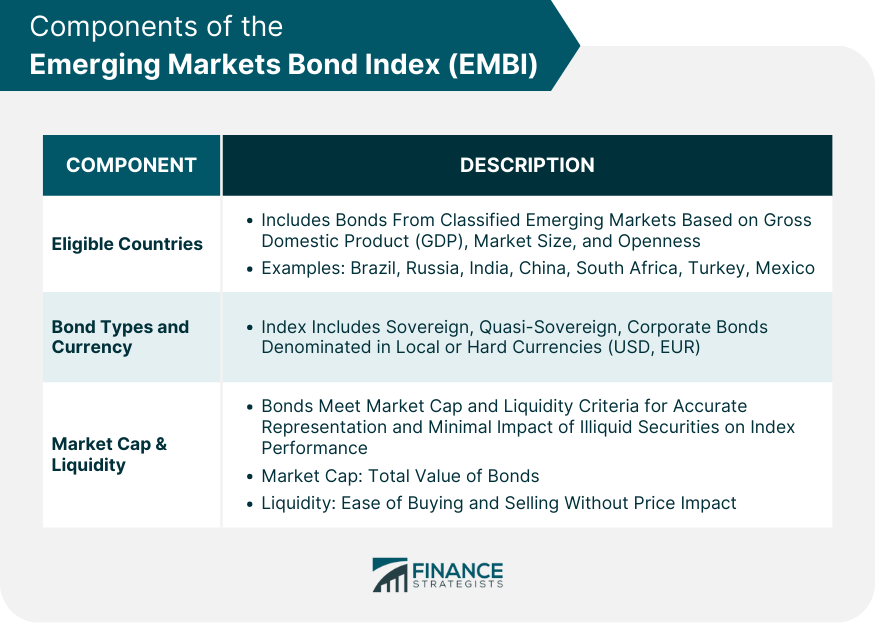

Components of the Emerging Markets Bond Index (EMBI)

Eligible Countries

Bond Types and Currency

Market Capitalization and Liquidity Requirements

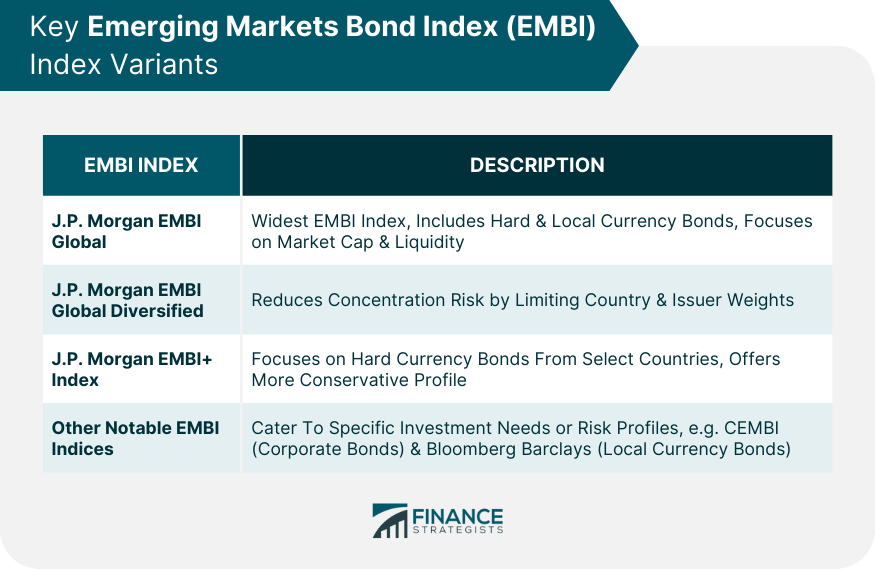

Key EMBI Index Variants

J.P. Morgan EMBI Global

J.P. Morgan EMBI Global Diversified

J.P. Morgan EMBI+ Index

Other Notable EMBI Indices

Performance of Emerging Markets Bond Index (EMBI)

Historical Trends

Factors Affecting EMBI Performance

Correlation With Other Asset Classes

Investing in Emerging Markets Bond Index (EMBI)

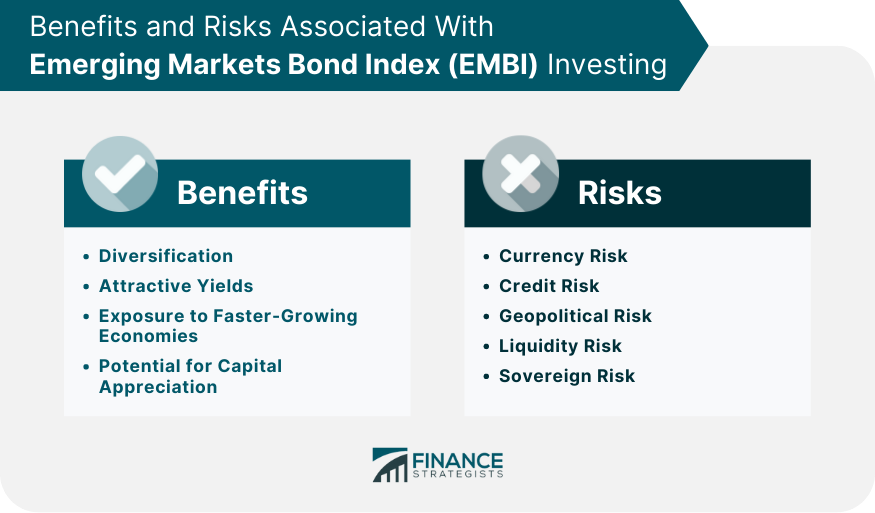

Benefits of Investing in EMBI

Diversification

Attractive Yields

Exposure to Faster-Growing Economies

Potential for Capital Appreciation

Risks Associated With EMBI Investing

Currency Risk

Credit Risk

Geopolitical Risk

Liquidity Risk

Sovereign Risk

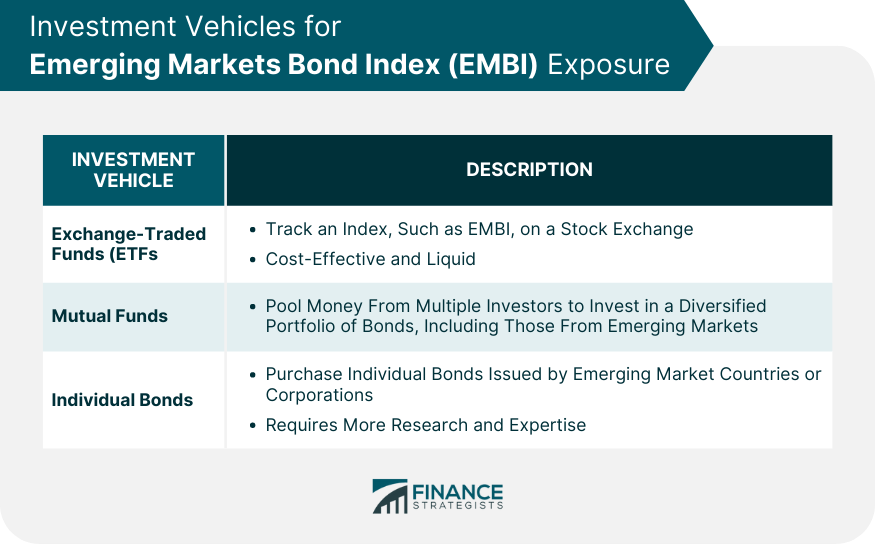

Investment Vehicles for EMBI Exposure

Exchange-Traded Funds (ETFs)

Mutual Funds

Individual Bonds

Impact of Economic and Political Factors on Emerging Markets Bond Index (EMBI)

Interest Rates and Inflation

Sovereign Credit Ratings

Political Stability and Governance

Global Economic Trends

Environmental, Social and Governance (ESG) Considerations in EMBI

Conclusion

Emerging Markets Bond Index (EMBI) FAQs

The Emerging Markets Bond Index (EMBI) is a benchmark index that tracks the performance of fixed-income securities issued by sovereign entities and corporations in emerging market economies.

Investing in the EMBI provides diversification benefits, the potential for higher returns than developed markets, exposure to emerging market economies, and liquidity in a growing asset class.

The risks of investing in the EMBI include currency, interest rate, credit, political, and liquidity risks. Global economic events can also affect the value of investments in the EMBI.

Investment vehicles for EMBI exposure include Exchange-traded funds (ETFs), mutual funds, and individual bonds.

Environmental, social, and governance (ESG) factors are increasingly important in EMBI investing. ESG integration is becoming more prevalent, and ESG-focused EMBI indices and funds are also available.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.