Endowments and foundations management refers to the practice of managing assets and managing investments for non-profit organizations such as charitable foundations, educational institutions, and healthcare organizations. Endowments and foundations are typically created with the purpose of providing long-term financial stability and support for a specific cause or mission. These organizations rely on their investment portfolios to generate income and grow over time, in order to support their programs and initiatives. Effective management involves a range of activities, including setting investment policies and strategies, selecting investment managers, monitoring and reporting on investment performance, and making decisions about how to allocate resources to different programs and initiatives. Educational endowments and foundations support schools, universities, and other learning institutions. They provide scholarships, fund research, and contribute to the overall financial stability of these institutions. Healthcare endowments and foundations support hospitals, research institutions, and medical organizations. They finance research, provide resources for improved patient care, and help maintain and upgrade facilities. These endowments and foundations support museums, theaters, and other arts and cultural organizations. They help fund exhibits, performances, and educational programs, as well as preserve and maintain valuable collections. Religious endowments and foundations support places of worship, religious education, and charitable activities affiliated with various faith traditions. Community foundations are grantmaking organizations that pool donations from individuals, families, and businesses to support local nonprofit organizations and initiatives. These endowments and foundations focus on preserving natural resources, promoting environmental awareness, and supporting conservation initiatives. Diversification is essential in endowment and foundation management. By investing in a mix of asset classes, managers can balance risk and return and achieve more consistent performance over time. Effective risk management involves assessing potential threats to the endowment or foundation's assets and taking measures to mitigate those risks. Monitoring investment performance helps managers determine if the investment strategy aligns with the organization's objectives and allows for adjustments as needed. A well-structured board of directors is crucial for effective governance. Board members should possess relevant skills, experience, and a clear understanding of their roles and responsibilities. Committees, such as investment, audit, and governance committees, can help the board better manage specific aspects of the endowment or foundation's operations. Clear policies and guidelines, such as investment policy statements, conflict of interest policies, and spending policies, provide a framework for decision-making and accountability. A comprehensive strategy guides fundraising efforts and helps ensure that funds are effectively allocated to support the organization's mission. Maintaining strong relationships with donors is essential for sustained support. Donor engagement and stewardship activities, such as recognition programs and regular communication, can help nurture these relationships. Planned giving programs encourage donors to make long-term commitments, which can significantly contribute to endowment growth. Endowments and foundations must adhere to various IRS regulations, including tax-exempt status requirements and annual reporting. UPMIFA provides guidelines for endowment and foundation managers regarding investment practices, spending policies, and donor intent. Endowments and foundations may be subject to additional state-level regulations and oversight, depending on their location and activities. Endowments and foundations managers have a fiduciary duty to act in the best interests of the organization and its beneficiaries. This includes exercising care, skill, and diligence in decision-making and adhering to ethical standards. Endowments and foundations must navigate economic and market fluctuations, which can affect investment returns and create challenges for financial planning and budgeting. Environmental, social, and governance (ESG) factors and impact investing are becoming increasingly important in endowment and foundation management, as stakeholders demand more responsible investment practices. Technology is transforming endowment management, with new tools and platforms improving efficiency, data analysis, and communication. Donors' expectations and preferences are constantly evolving, and endowments and foundations must adapt their strategies to engage and retain supporters effectively. Endowment and foundation managers should ensure that their investment strategies align with the organization's mission, values, and long-term goals. Investment policies should be regularly reviewed and updated to reflect changes in the organization's objectives, risk tolerance, and market conditions. Establishing a well-structured board and committee system helps ensure effective oversight and decision-making within the organization. Endowments and foundations should prioritize transparency and accountability, regularly reporting on their activities and financial performance to stakeholders. Continued education and professional development are essential for endowment and foundation managers to stay informed about industry trends, regulatory changes, and best practices. Endowments and foundations management plays a pivotal role in empowering institutions and causes around the world to achieve their goals and fulfill their missions. A thorough understanding of the key elements of management, the ability to navigate regulatory requirements, and staying informed about industry trends are crucial for endowment and foundation managers to ensure the long-term success and impact of their organizations. Effective management encompasses investment strategies, governance structures, fundraising, and donor relations, all of which contribute to the overall stability and growth of endowments and foundations. Adopting best practices in endowments and foundations management is essential to maximize the potential of these organizations and to ensure their continued ability to make a positive difference in the lives of countless individuals and communities. By focusing on continuous improvement, adapting to new challenges and opportunities, and maintaining a strong commitment to transparency and accountability, endowments and foundations can strengthen their impact and contribute to a better future for all those who rely on their support.What Is Endowments and Foundations Management?

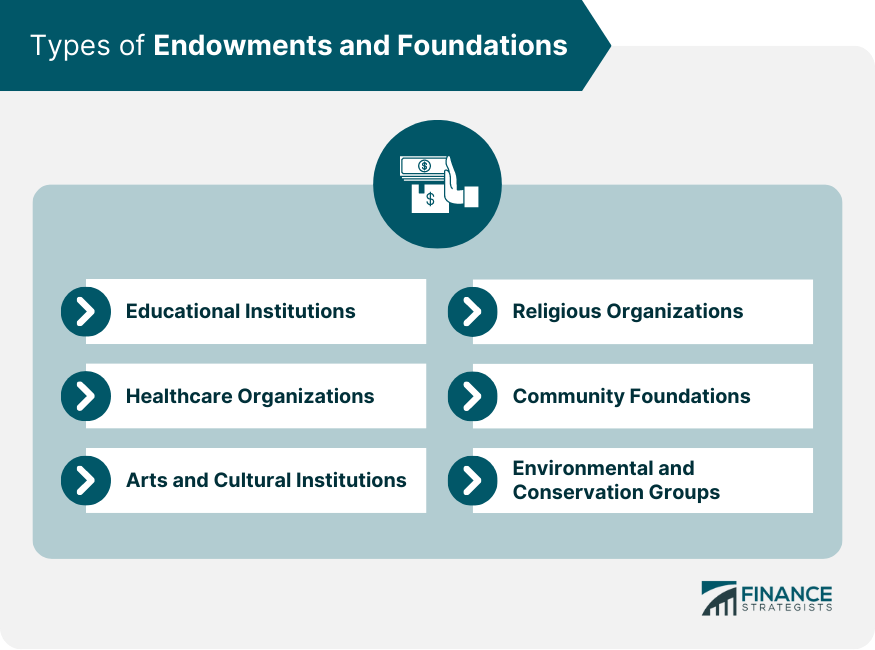

Types of Endowments and Foundations

Educational Institutions

Healthcare Organizations

Arts and Cultural Institutions

Religious Organizations

Community Foundations

Environmental and Conservation Groups

Key Elements of Endowments and Foundations Management

Investment Strategy and Asset Allocation

Diversification

Risk Management

Performance Measurement

Governance and Oversight

Board Composition and Responsibilities

Committee Structures

Policies and Guidelines

Fundraising and Donor Relations

Grantmaking and Fundraising Strategy

Donor Engagement and Stewardship

Planned Giving and Endowment Growth

Regulatory and Compliance Considerations

IRS Regulations and Reporting Requirements

Uniform Prudent Management of Institutional Funds Act (UPMIFA)

State-Level Regulations and Oversight

Fiduciary Duties and Ethical Considerations

Industry Trends and Challenges in Endowments and Foundations Management

Impact of Economic and Market Fluctuations

ESG and Impact Investing

Technological Advancements in Endowment Management

Evolving Donor Expectations and Preferences

Best Practices for Endowments and Foundations Management

Aligning Investment Strategy With Mission and Goals

Regularly Reviewing and Updating Investment Policies

Implementing Effective Governance Structures

Emphasizing Transparency and Accountability

Engaging in Continuous Education and Professional Development

Conclusion

Endowments and Foundations Management FAQs

Endowments and foundations are non-profit organizations that operate on donations and investment income. Endowments are typically established to provide financial support to educational institutions, while foundations support charitable causes.

Endowments and foundations are managed by a team of professionals, including investment managers, financial advisors, and trustees. They typically follow an investment policy statement that outlines their goals, risk tolerance, and investment strategy.

Investment managers are responsible for managing the portfolio of assets held by endowments and foundations. They work closely with the board of trustees to develop an investment strategy that meets the organization's financial objectives and risk tolerance.

Endowments and foundations typically invest their assets in a diversified portfolio of stocks, bonds, and alternative investments such as real estate, private equity, and hedge funds. The asset allocation and investment strategy may vary based on the organization's financial goals, risk tolerance, and time horizon.

One of the main challenges in endowments and foundations management is balancing the need for current spending with the need to preserve capital for future generations. Another challenge is managing risk and volatility in the investment portfolio while generating sufficient returns to meet the organization's financial obligations. Additionally, endowments and foundations must navigate complex tax and regulatory requirements.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.