Ethical investing, also known as socially responsible investing (SRI) or sustainable investing, is an investment strategy that considers environmental, social, and governance (ESG) factors in addition to financial performance. It is based on the belief that investment decisions should align with personal values and contribute to sustainable development. This approach recognizes that companies have a broader impact on society beyond their financial performance and considers factors such as their environmental impact, labor practices, human rights, and corporate governance. Ethical investing aims to align investments with personal values, promote corporate social responsibility, and contribute to sustainable development. Investors are increasingly looking for ways to incorporate their values into their investment decisions, and ethical investing provides a framework for doing so. Socially responsible investing is an investment approach that considers the impact of a company's operations on society and the environment. The screening criteria for SRI can be either positive or negative. Positive screening involves investing in companies that have a positive impact on society or the environment, such as those that produce renewable energy or provide access to healthcare. Negative screening involves avoiding companies that have a negative impact on society or the environment, such as those involved in the production of weapons or tobacco. Positive screening involves identifying and investing in companies that demonstrate responsible and sustainable practices. For example, a positive screen could be applied to companies that have policies to reduce their carbon footprint or promote gender equality. Negative screening, on the other hand, involves avoiding companies that engage in practices that go against an investor's values, such as those that contribute to climate change, use sweatshops, or violate human rights. SRI offers investors the opportunity to invest in companies that align with their values and avoid those that do not. Environmental, Social, and Governance investing is a type of ethical investing that considers a company's ESG factors when making investment decisions. ESG factors include environmental impact, social responsibility, and corporate governance practices. The goal of ESG investing is to identify companies that operate in a sustainable and responsible manner. ESG investing considers a range of factors when evaluating companies, including their environmental impact, social responsibility, and corporate governance practices. Environmental factors could include a company's carbon footprint, water usage, and waste management practices. Social factors could include a company's impact on local communities, labor practices, and human rights policies. Governance factors could include the independence of a company's board of directors, executive compensation practices, and transparency in financial reporting. Research has shown that ESG investments can deliver financial returns that are on par with or better than traditional investments. One study found that companies with high ESG ratings outperformed those with low ESG ratings in terms of stock price performance and profitability. Additionally, companies that prioritize ESG factors are better positioned to mitigate risks associated with climate change, social issues, and corporate governance. Ethical investing promotes corporate social responsibility by rewarding companies that prioritize ESG factors. Companies that implement sustainable and responsible practices are more likely to attract ethical investors and avoid negative publicity associated with unethical behavior. This, in turn, can incentivize other companies to prioritize ESG factors in their operations, creating a positive impact on society and the environment. Ethical investing can contribute to sustainable development by channeling investment capital into companies that prioritize sustainable and responsible practices. This can help promote the development of clean technologies, renewable energy, and socially responsible businesses. Ethical investing can also help reduce the negative impact of companies on the environment, such as those involved in fossil fuel extraction, deforestation, or water pollution. Ethical investing allows investors to align their investments with their personal values. Investors who prioritize social and environmental responsibility can use ethical investing to support companies that share their values. This can provide a sense of satisfaction and purpose beyond just financial gain, as investments can also be a way to support positive change in society. Contrary to the popular belief that ethical investing requires sacrificing financial returns, research has shown that ethical investing can generate positive financial returns. Companies that prioritize ESG factors are often better positioned to mitigate risks associated with environmental, social, and governance issues. This can result in better long-term financial performance for the company, which translates to better returns for the investor. One of the challenges of ethical investing is the lack of standardization in screening criteria and reporting practices. There is no widely accepted definition of what constitutes ethical investing or how to measure the impact of ESG factors. This can lead to confusion and inconsistency in investment decisions, as different investors may have different views on what constitutes ethical behavior. Another challenge of ethical investing is the limited investment options available to investors. Many companies do not prioritize ESG factors, which can limit the pool of potential investments for ethical investors. This can result in a trade-off between ethical values and financial returns, as ethical investors may need to sacrifice some financial gains to invest in companies that align with their values. Ethical investing requires balancing ethical and financial considerations. Ethical investors must carefully evaluate investment opportunities to ensure that they align with their values while also providing the potential for positive financial returns. This can be a complex process that requires careful analysis of ESG factors, financial performance, and other investment considerations. Ethical investing has emerged as a popular investment strategy that seeks to align investments with personal values and promote corporate social responsibility. SRI and ESG investing are two types of ethical investing that consider environmental, social, and governance factors when making investment decisions. Ethical investing offers a range of benefits, including promoting corporate social responsibility, contributing to sustainable development, aligning investments with personal values, and the potential for positive financial returns. However, ethical investing also comes with challenges, such as the lack of standardization in screening criteria and reporting practices, limited investment options, and the need to balance ethical and financial considerations. Despite these challenges, ethical investing offers investors the opportunity to make a positive impact on society and the environment while also achieving financial goals. Investors should carefully evaluate investment opportunities to ensure that they align with their values and provide the potential for positive financial returns.What Is Ethical Investing?

Types of Ethical Investing

Socially Responsible Investing (SRI)

Environmental, Social, and Governance (ESG) Investing

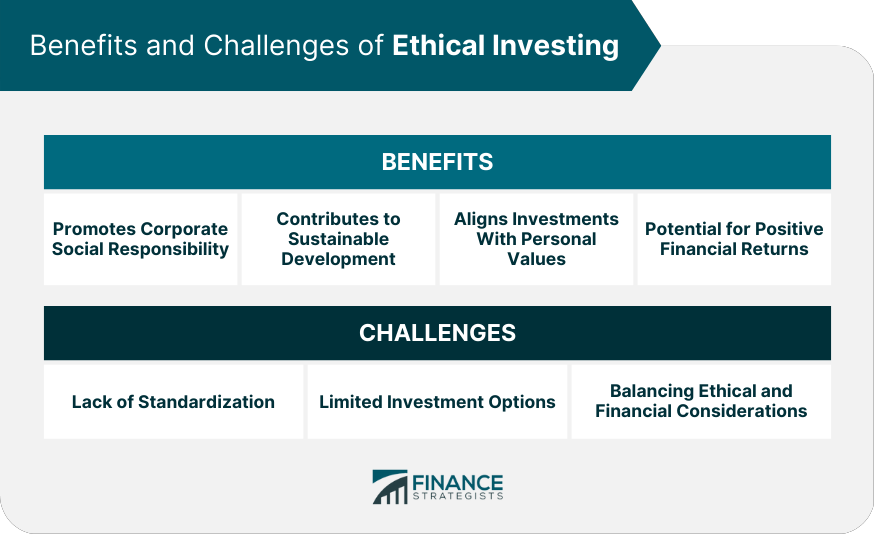

Benefits of Ethical Investing

Promotes Corporate Social Responsibility

Contributes to Sustainable Development

Aligns Investments With Personal Values

Potential for Positive Financial Returns

Challenges of Ethical Investing

Lack of Standardization

Limited Investment Options

Balancing Ethical and Financial Considerations

Final Thoughts

Ethical Investing FAQs

Ethical investing, also known as socially responsible investing (SRI) or sustainable investing, is an investment strategy that considers environmental, social, and governance (ESG) factors in addition to financial performance.

Ethical investing promotes corporate social responsibility, contributes to sustainable development, aligns investments with personal values, and offers the potential for positive financial returns.

The two main types of ethical investing are Socially Responsible Investing (SRI) and Environmental, Social, and Governance (ESG) Investing.

The challenges of ethical investing include the lack of standardization in screening criteria and reporting practices, limited investment options, and the need to balance ethical and financial considerations.

Yes, research has shown that ethical investing can generate positive financial returns. Companies that prioritize ESG factors are often better positioned to mitigate risks associated with environmental, social, and governance issues, resulting in better long-term financial performance for the company and better returns for the investor.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.