Mission-related investments are investments made by organizations with the primary goal of generating both a financial return and a positive social or environmental impact. These investments align an organization's investment strategy with their mission and values, and can support initiatives that are consistent with their goals. Examples of mission-related investments include loans and microfinance, bonds, equity financing, and investments in real assets such as green infrastructure, affordable housing, and sustainable agriculture. Foundations and philanthropic organizations play a crucial role in MRIs, using their financial resources to support mission-aligned projects and companies. These organizations often leverage their investments to catalyze change and drive impact in their areas of focus. Nonprofit organizations, including NGOs and charitable organizations, are increasingly adopting MRIs as a way to generate additional funding for their programs and initiatives. By investing in projects that align with their mission, nonprofits can diversify their revenue streams and increase their financial sustainability. Social enterprises and mission-driven businesses can benefit from MRIs by attracting investments that help them scale their impact and achieve their mission. In turn, they contribute to the growth and success of the impact investing ecosystem. Impact investment funds and advisors play a pivotal role in connecting organizations with mission-related investment opportunities. These professionals provide guidance, expertise, and resources to help organizations develop and implement effective MRI strategies. Organizations can provide loans and microfinance to mission-aligned businesses and projects, supporting their growth and impact. These investments can range from small loans to individuals and communities to larger loans for infrastructure projects. Mission-related bonds are debt instruments issued by companies, governments, or organizations to finance projects with a social or environmental impact. By investing in these bonds, organizations can support initiatives that align with their mission while generating financial returns. Guarantees are financial instruments that provide credit enhancement for mission-aligned projects, helping to reduce risk and attract additional investors. By offering guarantees, organizations can support projects that might not have access to traditional financing. Private equity investments involve acquiring ownership stakes in private companies that have a social or environmental impact. Through these investments, organizations can support mission-aligned businesses while potentially realizing significant financial returns. Venture capital investments focus on early-stage companies with high growth potential and a clear mission-related impact. By investing in these startups, organizations can foster innovation and drive change in industries and sectors that align with their mission. Public equity investments consist of buying shares in publicly traded companies that have a strong social or environmental focus. These investments allow organizations to support mission-aligned businesses while benefiting from potential stock market gains. Investing in green infrastructure and renewable energy projects can help organizations support the transition to a low-carbon economy while generating financial returns. Examples include solar, wind, and hydroelectric power projects, as well as energy-efficient buildings and transportation systems. Organizations can invest in affordable housing and community development projects to support low-income communities and foster social inclusion. These investments may include the development or renovation of housing, community centers, schools, and healthcare facilities. Investments in sustainable agriculture and forestry can help organizations contribute to food security, biodiversity conservation, and climate change mitigation. Examples include organic farming, agroforestry, and responsible forestry management practices. Organizations must begin by defining their investment goals and risk tolerance to develop an effective MRI strategy. This process involves determining the desired balance between financial returns and social or environmental impact, as well as assessing the organization's capacity for risk. Once investment goals and risk tolerance have been established, organizations must identify potential investments that align with their mission. This may involve researching industries, sectors, and specific projects or companies that demonstrate a strong commitment to social and environmental responsibility. Organizations must conduct thorough due diligence and impact assessment to evaluate the financial viability and potential social or environmental impact of their investments. This process may include financial analysis, impact measurement, and engagement with stakeholders. To minimize risk and optimize returns, organizations should construct a diversified investment portfolio that includes a mix of different asset classes, industries, and geographies. This approach helps ensure that the overall performance of the portfolio remains resilient in various market conditions. Organizations must regularly monitor and evaluate their mission-related investments to ensure they continue to align with their mission and generate the desired impact. This process may involve tracking financial performance, assessing impact outcomes, and engaging with investees to address challenges and identify opportunities for growth. One of the main benefits of MRIs is their ability to align an organization's investment portfolio with its mission. By investing in companies and projects that share the same values and objectives, organizations can promote their mission and make a tangible impact on social and environmental issues. MRIs offer organizations the opportunity to create lasting, positive change by addressing social and environmental problems. By investing in projects that tackle these issues, organizations can contribute to sustainable development and improve the quality of life for communities around the world. Mission-related investments focus on long-term value creation, leading to sustainable growth. By investing in companies and projects that prioritize social and environmental impact, organizations can ensure that their financial returns are generated in a responsible and sustainable manner. MRIs can enhance an organization's reputation and strengthen relationships with stakeholders, including donors, employees, customers, and community members. By demonstrating a commitment to social and environmental responsibility, organizations can build trust and credibility among their stakeholders. One of the main challenges in mission-related investing is finding the right balance between financial returns and social or environmental impact. Organizations must carefully weigh their investment decisions to ensure they can achieve their mission objectives without compromising financial sustainability. There is currently no universally accepted standard for measuring and reporting the impact of mission-related investments. This lack of standardization can make it difficult for organizations to compare investment opportunities and assess their overall impact. The availability of mission-aligned investment opportunities can be limited, particularly for smaller or niche organizations. This may make it challenging for organizations to find suitable investments that align with their mission and meet their risk and return requirements. Organizations must navigate a complex web of regulatory and legal considerations when engaging in mission-related investing. This may include compliance with fiduciary duties, tax implications, and adherence to investment restrictions. Mission-related investments have the potential to drive positive change and create lasting impact in the social and environmental spheres. As the field continues to evolve, organizations must navigate the challenges and risks associated with MRIs while capitalizing on emerging trends and opportunities. By embracing mission-related investing, organizations can advance their mission objectives, contribute to sustainable growth, and foster a more equitable and just world.What Are Mission-Related Investments?

Key Players in Mission-Related Investments

Foundations and Philanthropic Organizations

Nonprofit Organizations

Social Enterprises and Businesses

Impact Investment Funds and Advisors

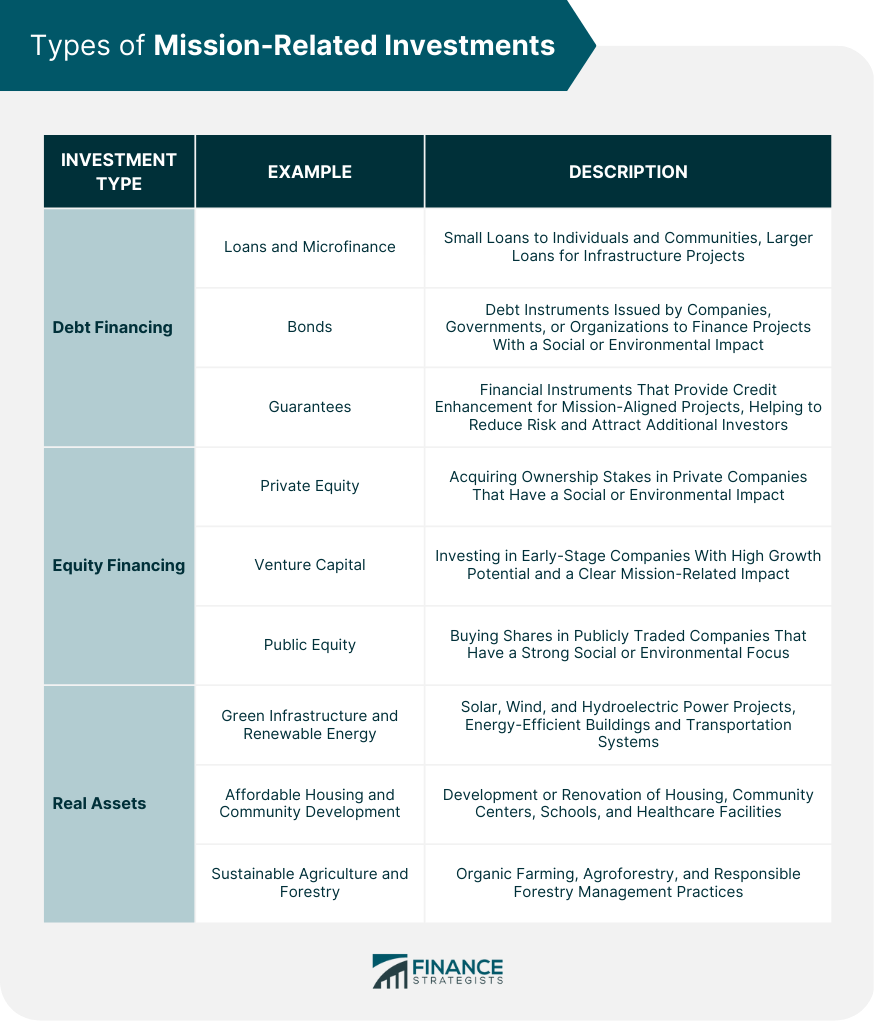

Types of Mission-Related Investments

Debt Financing

Loans and Microfinance

Bonds

Guarantees

Equity Financing

Private Equity

Venture Capital

Public Equity

Real Assets

Green Infrastructure and Renewable Energy

Affordable Housing and Community Development

Sustainable Agriculture and Forestry

Mission-Related Investment Process and Strategy

Defining Investment Goals and Risk Tolerance

Identifying Potential Investments Aligned With the Mission

Due Diligence and Impact Assessment

Portfolio Construction and Diversification

Ongoing Monitoring and Evaluation

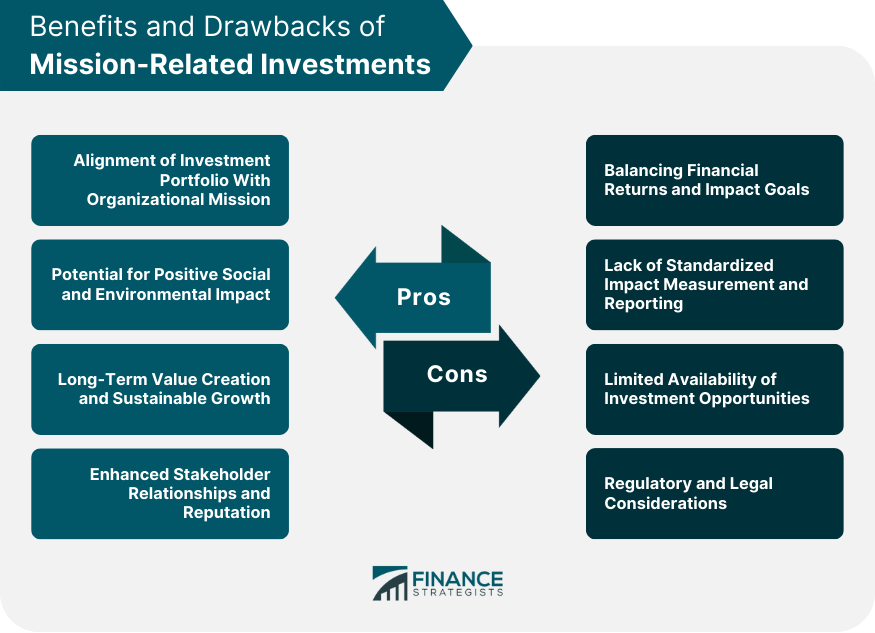

Advantages of Mission-Related Investments

Alignment of Investment Portfolio With Organizational Mission

Potential for Positive Social and Environmental Impact

Long-Term Value Creation and Sustainable Growth

Enhanced Stakeholder Relationships and Reputation

Challenges and Risks in Mission-Related Investments

Balancing Financial Returns and Impact Goals

Lack of Standardized Impact Measurement and Reporting

Limited Availability of Investment Opportunities

Regulatory and Legal Considerations

Conclusion

Mission-Related Investments (MRIs) FAQs

Mission-related investments (MRIs) are investments made by foundations and other organizations that are designed to generate both a financial return and a positive social or environmental impact. MRIs are a way for organizations to align their investment strategies with their mission and values, and to support initiatives that are consistent with their goals.

Traditional investments are typically made with the primary goal of generating a financial return. MRIs, on the other hand, are made with the primary goal of generating both a financial return and a positive social or environmental impact. While traditional investments may consider factors such as risk and liquidity, MRIs are evaluated based on their alignment with an organization's mission and values.

MRIs are most commonly made by foundations, endowments, and other philanthropic organizations that have a strong mission or social purpose. However, some individual investors and asset managers are also starting to explore MRIs as a way to align their investment strategies with their personal values.

Initiatives supported by MRIs can vary widely depending on the organization's mission and values. Some common areas of focus for MRIs include environmental sustainability, social justice, community development, and education. MRIs may support projects such as renewable energy development, affordable housing construction, or job training programs.

The financial returns on MRIs are measured using a combination of traditional financial metrics and impact metrics that measure the social or environmental impact of the investment. Traditional financial metrics such as return on investment (ROI) and internal rate of return (IRR) are used to evaluate the financial performance of the investment. Impact metrics such as carbon emissions reduced or jobs created are used to evaluate the social or environmental impact of the investment.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.