Socially responsible mutual funds (SRMFs) are investment vehicles that seek to generate financial returns while adhering to specific environmental, social, and governance (ESG) criteria. These funds aim to invest in companies that demonstrate ethical and sustainable practices, aligning with the values and principles of socially responsible investing (SRI). The concept of SRMFs traces its roots back to the 1960s and 1970s when investors began to consider social and environmental factors in their investment decisions. Over the years, the popularity of these funds has grown, and the range of available funds has expanded to cater to various social and environmental causes. As awareness about the impacts of climate change, social inequality, and corporate governance grows, the demand for SRMFs has surged. These funds allow investors to align their investments with their values and contribute to positive societal change. ESG criteria serve as the foundation for SRMFs, guiding the fund managers in selecting companies that demonstrate strong performance in these areas. Environmental factors include energy efficiency, waste management, and climate change mitigation. Social factors encompass labor practices, human rights, and community development. Governance factors cover corporate ethics, executive compensation, and board diversity. Ethical investing involves avoiding investments in companies or industries that are perceived as having a negative impact on society or the environment. Examples include tobacco, firearms, and fossil fuels. Impact investing aims to generate measurable, positive social or environmental outcomes alongside financial returns. These investments often target specific issues such as poverty alleviation, clean energy, or access to education. Sustainability-focused investing prioritizes long-term value creation by considering environmental and social impacts of business activities, promoting sustainable development and corporate responsibility. These funds invest primarily in companies with strong ESG performance, offering a diversified portfolio that aligns with ESG criteria. Socially conscious funds avoid investments in specific industries or companies that conflict with the fund's ethical guidelines or societal values. Green or clean technology funds focus on investing in companies that develop or provide environmentally friendly technologies, products, or services, such as renewable energy or pollution control. Faith-based funds align their investments with the values and principles of a specific religious tradition, often excluding industries that conflict with the faith's teachings. Community development funds invest in projects that promote economic growth, job creation, and affordable housing in underserved communities. SRMFs allow investors to support companies and industries aligning with their values, fostering a sense of purpose and satisfaction. Companies with strong ESG performance may exhibit lower risk and volatility, contributing to a more stable and resilient investment portfolio. Investing in SRMFs can drive positive change by channeling capital toward companies that are committed to social and environmental responsibility. SRMFs encourage companies to adopt more transparent and accountable business practices, leading to improved corporate governance and ethical standards. Research suggests that SRMFs can generate competitive financial returns, demonstrating that responsible investing does not necessarily mean sacrificing financial performance. Some companies may overstate their commitment to ESG principles, using greenwashing to attract investments. This can make it challenging for investors to identify genuinely responsible companies. The lack of standardized ESG evaluation methodologies can result in consistency across SRMFs, making it difficult for investors to compare funds and make informed decisions. SRMFs may have limited investment options due to their focus on specific industries or criteria, which can lead to reduced diversification and increased portfolio risk. SRMFs may charge higher management fees than traditional mutual funds, as evaluating and selecting investments based on ESG criteria can be more labor-intensive and costly. Before investing in an SRMF, investors should examine the fund's objectives, investment strategies, and ESG criteria to ensure alignment with their personal values and financial goals. Investors should analyze the ESG ratings and methodologies used by the fund to evaluate the underlying investments, ensuring a comprehensive and reliable assessment. It is crucial to consider the fund's historical performance, risk-adjusted returns, and volatility compared to benchmark indices and peer funds. Investors should compare the management fees, expense ratios, and other costs associated with the SRMFs under consideration to make cost-effective investment decisions. The SEC regulates mutual funds in the United States, including SRMFs, ensuring compliance with disclosure requirements and protecting investors' interests. Various global reporting initiatives, such as the Global Reporting Initiative (GRI) and the Task Force on Climate-related Financial Disclosures (TCFD), provide ESG reporting and disclosure guidelines, promoting transparency and consistency. Industry standards and certifications, such as the UN Principles for Responsible Investment (PRI) and the Sustainable Accounting Standards Board (SASB), help establish best practices and benchmarks for responsible investing. Socially responsible mutual funds offer investors an opportunity to align their investments with their values while generating financial returns. With various fund types and investment strategies, SRMFs cater to diverse investor preferences and objectives. Despite challenges such as greenwashing and inconsistent ESG methodologies, the growing interest in SRMFs demonstrates their potential to drive positive societal change and promote sustainable business practices. Investing in SRMFs enables investors to support companies that are committed to social and environmental responsibility, ultimately contributing to a more sustainable future. As responsible investing becomes increasingly mainstream, the impact of SRMFs on corporate behavior and sustainability is expected to grow. By making informed decisions and choosing SRMFs that align with their values, investors can play an essential role in driving responsible investing and fostering a sustainable future. The continued growth and evolution of SRMFs, coupled with advancements in ESG evaluation methodologies and technology, promise to impact the global investment landscape and contribute to realizing a more just and sustainable world. Consider consulting with a wealth management professional to make informed investment decisions that align with your values and financial goals. They can provide personalized guidance on selecting socially responsible mutual funds and creating a diversified investment portfolioWhat Are Socially Responsible Mutual Funds (SRMFs)?

Key Principles of Socially Responsible Investing (SRI)

Environmental, Social, and Governance (ESG) Criteria

Ethical Investing

Impact Investing

Sustainability-Focused Investing

Types of Socially Responsible Mutual Funds

ESG-Focused Funds

Socially Conscious Funds

Green or Clean Technology Funds

Faith-Based Funds

Community Development Funds

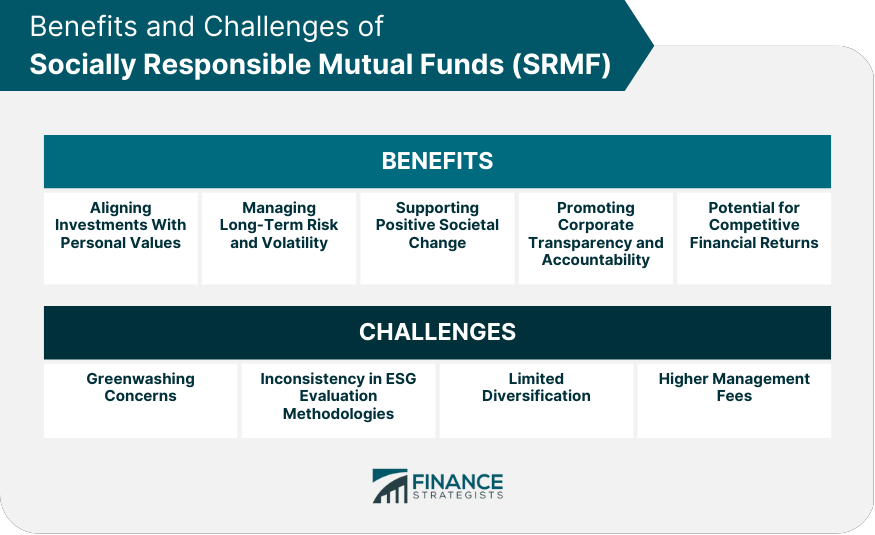

Benefits of Investing in SRMFs

Aligning Investments With Personal Values

Managing Long-Term Risk and Volatility

Supporting Positive Societal Change

Promoting Corporate Transparency and Accountability

Potential for Competitive Financial Returns

Challenges and Criticisms of SRMFs

Greenwashing Concerns

Inconsistency in ESG Evaluation Methodologies

Limited Diversification

Higher Management Fees

How to Choose Socially Responsible Mutual Funds

Assessing Fund Objectives and Strategies

Examining ESG Ratings and Methodologies

Evaluating Fund Performance and Risk

Comparing Management Fees and Other Costs

Regulatory Landscape for SRMFs

Securities and Exchange Commission (SEC) Guidelines

Global Reporting Initiatives

Industry Standards and Certifications

Conclusion

Socially Responsible Mutual Funds FAQs

Socially responsible mutual funds (SRMFs) are investment vehicles that aim to generate financial returns while adhering to specific environmental, social, and governance (ESG) criteria. These funds invest in companies that demonstrate ethical and sustainable practices, aligning with the values and principles of socially responsible investing (SRI).

SRMFs typically invest in companies that demonstrate strong ESG performance, encompassing environmental factors such as energy efficiency and waste management, social factors such as labor practices and human rights, and governance factors such as corporate ethics and executive compensation.

Research suggests that SRMFs can generate competitive financial returns, demonstrating that responsible investing does not necessarily mean sacrificing financial performance. While higher management fees may be associated with SRMFs, the potential benefits of aligning investments with personal values and promoting positive social change can outweigh these costs.

Investors should evaluate SRMFs based on their objectives, investment strategies, ESG criteria, historical performance, risk-adjusted returns, and management fees. Examining ESG ratings and methodologies can also provide valuable insights into the underlying investments.

By investing in companies demonstrating strong ESG performance, SRMFs can promote sustainable business practices and drive positive societal change. The growing interest in responsible investing is expected to encourage more companies to adopt transparent and accountable business practices, leading to improved corporate governance and ethical standards.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.