Values-based investing, or ethical or socially responsible investing, is an investment strategy that aims to align an individual's financial goals with their values, beliefs, and principles. This approach to investing has gained popularity in recent years, as more investors seek to contribute to a better world while growing their wealth. Socially responsible investing (SRI) is an investment strategy focusing on companies meeting certain ethical, social, and environmental criteria. SRI has its roots in the 1960s, during which socially conscious investors sought to avoid supporting companies involved in producing tobacco, alcohol, gambling, and weapons. Investors typically use negative and positive screens to identify companies for SRI portfolios. Negative screens exclude companies that don't meet specific ethical standards, while positive screens include companies that demonstrate strong social and environmental performance. Some common SRI themes include human rights, fair labor practices, environmental sustainability, and corporate governance. Environmental, social, and governance (ESG) investing involves the systematic evaluation of companies based on their performance in three key areas: environmental responsibility, social responsibility, and corporate governance. ESG investing emerged in the early 2000s and has since grown in popularity among investors and asset managers. ESG factors include a wide range of issues, such as climate change, resource management, labor practices, diversity and inclusion, and executive compensation. There are several ways to integrate ESG factors into investment decisions, including best-in-class selection, thematic investing, and active ownership. Impact investing refers to investments made with the intention of generating measurable social or environmental benefits alongside financial returns. The concept of impact investing gained traction in the late 2000s, driven by the desire of investors to address global challenges such as poverty, inequality, and climate change. Measuring the impact of investments can be complex, but it often involves tracking specific metrics and outcomes related to the social or environmental goals of the investment. Impact investments can be made in various asset classes, including public equities, fixed income, private equity, and real assets. Faith-based investing is an investment approach that aligns investment decisions with religious principles and teachings. This type of investing has been practiced for centuries across various religious traditions, including Christianity, Islam, and Judaism. Faith-based investors may follow specific guidelines based on their religious beliefs, such as avoiding investments in companies involved in activities that are considered immoral or unethical. Some common faith-based investing strategies include Islamic investing (which avoids interest-bearing investments), Catholic investing (which follows the social teachings of the Catholic Church), and Jewish investing (which adheres to Halakhic principles). Numerous studies have shown that values-based investing can achieve competitive financial returns compared to traditional investing strategies, making it an attractive option for investors. Values-based investing can help investors manage long-term risks by focusing on companies with strong ESG performance, which may be better positioned to adapt to future challenges and regulatory changes. By aligning investments with personal values, investors may feel more engaged with the companies in their portfolio, leading to increased interest in shareholder activism, proxy voting, and corporate engagement. Values-based investing allows investors to support companies that positively impact society and the environment, thereby contributing to a more sustainable and equitable world. One of the main challenges in values-based investing is the need for standardized definitions and metrics for evaluating ESG performance, which can make it difficult for investors to compare companies and investment options. Some companies may engage in "greenwashing," or the practice of presenting themselves as more environmentally or socially responsible than they actually are. This can mislead investors and undermine the effectiveness of values-based investing. While many studies show that values-based investing can generate competitive returns, there may be situations where investors need to accept lower returns in order to stay true to their values. Values-based investing is inherently subjective, as different investors may prioritize different issues and interpret ethical behavior differently. This can lead to potential biases and inconsistencies in investment decisions. The first step in values-based investing is to reflect on your values, beliefs, and principles to determine the most important issues. Next, research various investment options that align with your values, including individual stocks, mutual funds, and exchange-traded funds (ETFs) focused on specific themes or sectors. When selecting an investment advisor or platform, consider their expertise in values-based investing, track record, and commitment to transparency and accountability. Regularly monitor your investment portfolio to ensure that it continues to align with your values, and make adjustments as needed based on changes in your personal values or the performance of the investments. The increasing availability of data and advancements in technology will likely improve the analysis and measurement of ESG factors, making it easier for investors to make informed values-based investment decisions. Regulatory changes and policy initiatives aimed at promoting sustainability and corporate responsibility will continue to shape the landscape of values-based investing, potentially leading to increased standardization and transparency in ESG reporting. As values-based investing becomes more mainstream, investors will likely demand greater transparency and accountability from companies and investment managers with regard to their ESG performance and impact. New and emerging themes, such as gender equality, racial justice, and digital privacy, will likely expand the scope of values-based investing, offering investors more opportunities to align their investments with their personal values and beliefs. Value investing strategies can vary depending on the investor's goals, risk tolerance, and investment horizon. Some common value investing strategies include deep value investing, dividend investing, and contrarian investing. Deep value investing focuses on buying stocks of companies that are trading at a significant discount to their intrinsic value. In contrast, dividend investing involves buying stocks of companies that pay consistent dividends. Contrarian investing involves buying stocks that are out of favor with the market and have low valuations but have the potential for long-term growth. Understanding these strategies can help investors tailor their value investing approach to meet their unique investment objectives. Investors interested in value investing can also apply this approach to exchange-traded funds. ETFs are investment vehicles that provide exposure to a diversified portfolio of stocks, bonds, or other assets. Some ETFs are designed to track the performance of value-focused indexes, such as the S&P 500 Value Index or the Russell 1000 Value Index. These ETFs typically invest in stocks with low price-to-earnings or price-to-book ratios and high dividend yields. Investors can also screen ETFs based on specific value investing criteria, such as low P/E ratios or high dividend yields, to identify ETFs that align with their value investing strategy. Values-based investing offers investors the opportunity to align their investments with their personal values and contribute to a better world while potentially achieving competitive financial returns. There are several types of values-based investing, including socially responsible investing, environmental, social, and governance investing, impact investing, and faith-based investing, each with its own unique strategies and advantages. While values-based investing has its challenges and criticisms, it can be a powerful tool for investors seeking to achieve long-term financial goals while positively impacting society and the environment. If you are interested in implementing a values-based investing strategy, working with a wealth management professional who can provide expert guidance and support may be helpful. A wealth management professional can help you identify your values, research investment options, evaluate investment advisors and platforms, and monitor your portfolio to ensure it continues aligning with your values and financial goals. What Is Value-Based Investing?

Types of Values-Based Investing

Socially Responsible Investing (SRI)

Definition and History

SRI Screening Methods

Common SRI Themes

Environmental, Social, and Governance (ESG) Investing

Definition and History

ESG Factors

ESG Integration Strategies

Impact Investing

Definition and History

Measuring Impact

Types of Impact Investments

Faith-Based Investing

Definition and History

Religious Principles Guiding Investments

Common Faith-Based Investing Strategies

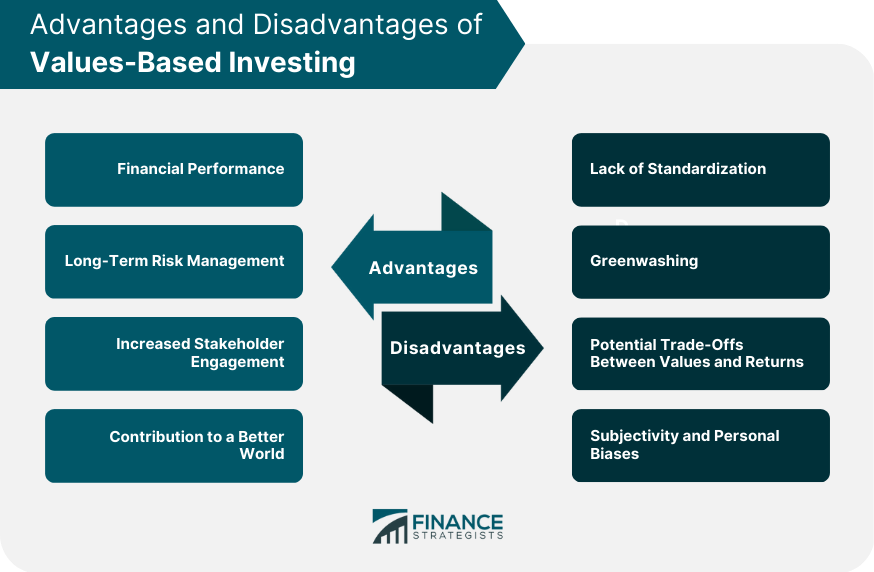

Advantages of Values-Based Investing

Financial Performance

Long-Term Risk Management

Increased Stakeholder Engagement

Contribution to a Better World

Challenges and Criticisms

Lack of Standardization

Greenwashing

Potential Trade-offs Between Values and Returns

Subjectivity and Personal Biases

Steps to Implement Values-Based Investing

Self-Reflection and Identifying Personal Values

Researching Investment Options

Evaluating Investment Advisors and Platforms

Monitoring and Adjusting Investment Portfolios

Future Trends and Outlook

Influence of Technology and Data Analytics

Role of Regulation and Policy

Growing Demand for Transparency and Accountability

Expanding Scope of Values-Based Investing Themes

Value Investing Strategies

Applying Value Investing to ETFs

Conclusion

Values-Based Investing FAQs

Values-based investing is an investment strategy that involves aligning investments with personal values and beliefs, including environmental, social, and governance factors, social responsibility, and faith-based principles.

Values-based investing differs from traditional investing in that it considers factors beyond financial performance, such as environmental impact and social responsibility when making investment decisions.

To identify investments that align with your values, research investment options that focus on specific themes or sectors, evaluate investment advisors and platforms and monitor your portfolio to ensure it continues aligning with your values.

Numerous studies have shown that values-based investing can achieve competitive financial returns compared to traditional investing strategies.

Common types of values-based investing include socially responsible investing, environmental, social, and governance investing, impact investing, and faith-based investing, each with its own unique strategies and advantages.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.