Net Asset Value Per Share is a financial metric used to determine the value of an entity's assets after subtracting its liabilities and dividing the result by the number of outstanding shares. It is commonly used to evaluate the performance of mutual funds and other investment vehicles. It provides investors with a clear and transparent way to determine how well their investments are performing. By comparing the NAVPS of different funds, investors can assess which investments are generating the highest returns, and by calculating the NAVPS of a company, investors can determine whether its shares are undervalued or overvalued in the market. To calculate NAVPS, the net asset value of a company is divided by the number of outstanding shares. The formula for calculating NAVPS is as follows: NAVPS = (Assets - Liabilities) / Number of Outstanding Shares Assets include all of the company's holdings, such as stocks, bonds, and cash, while liabilities include all of its debts and obligations, such as expenses and fees. The number of outstanding shares represents the total number of shares issued by the company that are owned by shareholders. Several factors can affect a company's NAVPS. These include investment returns, expenses, dividends, and corporate actions. The performance of a company's holdings directly affects its NAVPS. If the company's investments perform well, its NAVPS will increase. Conversely, if its investments perform poorly, its NAVPS will decrease. For example, if a mutual fund invests in a stock that experiences a significant price increase, the value of the mutual fund's assets will increase, resulting in a higher NAVPS. The expenses incurred by a company can also affect its NAVPS. These expenses include management fees, transaction costs, and administrative expenses. If a company's expenses increase, its NAVPS will decrease, even if the value of its holdings remains the same. Dividends are payments made by a company to its shareholders. If a company pays out dividends, its NAVPS will decrease. This is because the cash used to pay the dividend is subtracted from the company's assets, which reduces its net asset value. Corporate actions, such as mergers, acquisitions, and stock splits, can also affect a company's NAVPS. For example, if a company merges with another company, its net asset value will increase due to the acquisition of new assets. Conversely, if a company undergoes a stock split, its net asset value will remain the same, but the number of outstanding shares will increase, resulting in a lower NAVPS. NAVPS is an important metric for evaluating the performance of mutual funds and other investment vehicles. It provides investors with a clear and transparent way to determine how well their investments are performing. By comparing the NAVPS of different funds, investors can assess which investments are generating the highest returns. NAVPS is particularly useful for comparing mutual funds. By comparing the NAVPS of different funds, investors can determine which funds are generating the highest returns for their shareholders. This allows investors to make informed decisions about where to invest their money. NAVPS is also used to determine the market value of a company's shares. If the NAVPS of a company is higher than the market price of its shares, its shares are considered undervalued. Conversely, if the NAVPS of a company is lower than the market price of its shares, its shares are considered overvalued. NAVPS provides investors with a transparent and standardized way to evaluate the performance of mutual funds and other investment vehicles. This allows investors to make informed decisions about where to invest their money. NAVPS is a simple and easy-to-understand metric. It provides investors with a clear picture of the value of their investments. NAVPS provides investors with a measure of the liquidity of their investments. By comparing the NAVPS of different funds, investors can determine which funds are more liquid than others. NAVPS is widely available and can be easily accessed by investors. It is reported regularly by mutual funds and other investment vehicles, making it easy for investors to track their investments over time. NAVPS can be affected by market fluctuations. If the market experiences a downturn, the value of a company's holdings may decrease, resulting in a lower NAVPS. The timing of investments can also affect NAVPS. If an investor purchases shares in a mutual fund when the NAVPS is high, the investor may experience a loss if the NAVPS decreases. NAVPS is not always an accurate indicator of the performance of a mutual fund or other investment vehicle. Other factors, such as management style and investment strategy, can also affect the performance of these vehicles. Net Asset Value Per Share is a crucial metric in the investment industry that helps investors evaluate the performance of mutual funds and other investment vehicles. It offers transparency and standardization by providing a clear picture of the value of an entity's assets after subtracting its liabilities. Furthermore, it allows for easy comparison of funds, determining the market value of a company's shares, and tracking investments over time. However, while NAVPS provides significant advantages to investors, it also has limitations, including market fluctuations, timing of investments, and its inability to be considered an accurate indicator of investment performance. As such, investors must take into account other factors, such as management style and investment strategy, to make informed decisions about where to invest their money. Nonetheless, understanding and utilizing NAVPS can aid in making more informed investment decisions, and investors should continue to use it as a key metric in their investment analysis.What Is Net Asset Value per Share (NAVPS)?

Computation of Net Asset Value per Share

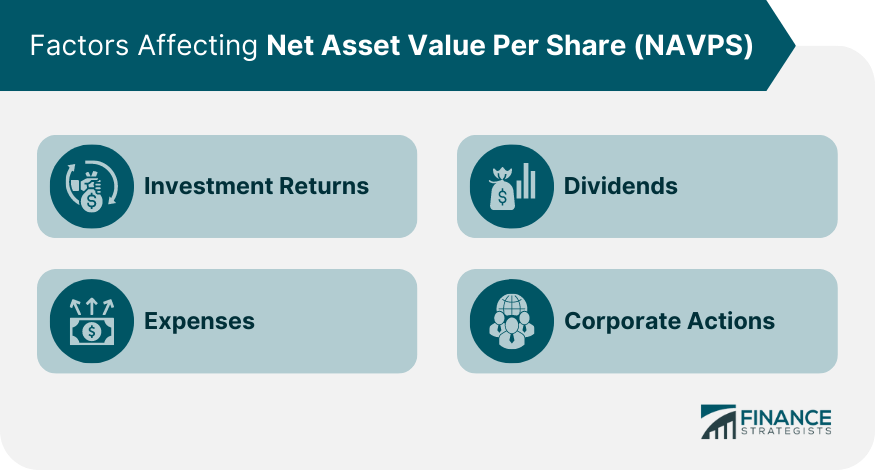

Factors Affecting Net Asset Value per Share

Investment Returns

Expenses

Dividends

Corporate Actions

Importance of Net Asset Value per Share

Evaluation of Investment Performance

Comparison of Mutual Funds

Determination of Market Value

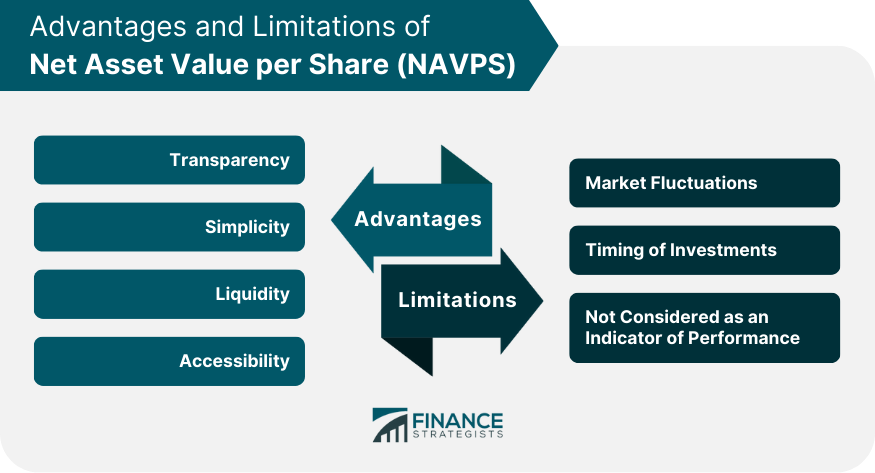

Advantages of Net Asset Value per Share

Transparency

Simplicity

Liquidity

Accessibility

Limitations of Net Asset Value per Share

Market Fluctuations

Timing of Investments

Not Considered as an Indicator of Performance

Conclusion

Net Asset Value per Share (NAVPS) FAQs

NAVPS is the per-share value of a mutual fund or exchange-traded fund's (ETF) net assets. It is calculated by dividing the total value of the fund's assets by the number of outstanding shares.

NAVPS is used by investors to determine the price of a mutual fund or ETF's shares. It is also used to track the performance of a fund over time. In general, if a fund's NAVPS is rising, it means that the value of the underlying assets is increasing.

The NAVPS of a mutual fund or ETF is affected by changes in the value of the underlying assets, as well as any fees or expenses associated with managing the fund. It may also be impacted by changes in the number of outstanding shares.

NAVPS and a fund's share price are related but not the same thing. The NAVPS is calculated by dividing the total value of the fund's assets by the number of outstanding shares, while the share price is determined by supply and demand in the market.

Not necessarily. A higher NAVPS does not necessarily mean that a fund is performing better than another with a lower NAVPS. Other factors such as fees and expenses, investment strategy, and risk tolerance should also be considered when evaluating a fund's performance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.