The Omega Ratio is a performance measurement tool used in finance and investment to evaluate the risk-return trade-off of a given investment or portfolio. It measures the likelihood of achieving a target return in comparison to the potential downside risk. A higher Omega Ratio indicates a more favorable risk-return profile. The Omega Ratio was developed in the early 2000s by Con Keating and William Shadwick as an alternative to traditional risk measures, such as the Sharpe Ratio and the Sortino Ratio. It was designed to address the limitations of these measures, particularly their reliance on assumptions of normality in return distributions. The Omega Ratio is widely used by portfolio managers, financial advisors, and individual investors to assess the risk-reward balance of various investment options. It helps in making better-informed decisions and contributes to the overall optimization of investment portfolios. Cumulative return refers to the total return on an investment over a given time period. It is calculated by taking the final value of the investment and dividing it by the initial value, minus one. Cumulative returns are essential in understanding the overall performance of an investment. The frequency distribution of investment returns refers to how often different return levels occur within a given time period. This distribution is crucial for the Omega Ratio, as it accounts for the variations in returns that may not be captured by other risk measures. The threshold return, or minimum acceptable return, is a predefined level of return that an investor wishes to achieve. This return level serves as a benchmark for evaluating the performance of an investment or portfolio. The threshold return plays a critical role in the calculation of the Omega Ratio, as it divides the return distribution into two parts: returns above the threshold (positive outcomes) and returns below the threshold (negative outcomes). The Omega Ratio is the ratio of the probability of achieving returns above the threshold to the probability of experiencing returns below the threshold. The Omega Ratio is calculated as follows: Omega Ratio = Probability (Return > Threshold) / Probability (Return < Threshold) This ratio provides a comprehensive measure of risk and reward based on an investor's specific target return. An Omega Ratio greater than 1 indicates that the investment has a higher probability of achieving the target return than experiencing a loss. Conversely, an Omega Ratio of less than 1 suggests that the investment is more likely to underperform the target return. Higher Omega Ratios are generally preferable, as they represent better risk-adjusted performance. Traditional risk measures often assume that investment returns follow a normal distribution, which may not always be the case. The Omega Ratio accounts for non-normal return distributions, such as those with skewness (asymmetry) or kurtosis (fat tails). The Omega Ratio's ability to consider non-normal return distributions allows for a more accurate representation of the investment's risk-reward profile. This flexibility helps investors better understand the potential outcomes of their investments. The Omega Ratio allows investors to set their own threshold return, which means they can tailor the measure to their specific risk tolerance and investment objectives. By customizing the threshold return, investors can align the Omega Ratio calculation with their portfolio objectives, making the measure more relevant and useful in decision-making. The Omega Ratio offers a more comprehensive assessment of risk and reward than traditional measures like the Sharpe Ratio and the Sortino Ratio. It considers the entire return distribution and accommodates the unique features of each investment, leading to a more accurate evaluation of performance. By providing a more complete picture of an investment's risk-reward profile, the Omega Ratio enables investors to make better-informed decisions when selecting investments or managing their portfolios. Like many financial metrics, the Omega Ratio relies on historical data to estimate return distributions. In cases where there is limited data, the accuracy of the Omega Ratio may be compromised, leading to potential misinterpretations of risk. While historical data is useful for understanding past performance, it may not always be indicative of future results. The Omega Ratio is subject to the same limitation, as it is based on historical return distributions. The Omega Ratio's value is highly sensitive to the choice of threshold return. An arbitrary selection of this value can result in a distorted risk-reward assessment, potentially leading investors to make suboptimal decisions. If the threshold return is set too high or too low, it may not accurately reflect an investor's risk tolerance or investment objectives. This could lead to misinterpretation of the Omega Ratio, making it less effective as a decision-making tool. The Omega Ratio can be employed to guide asset allocation decisions, as it helps identify the optimal mix of investments that offer the best risk-reward balance. By doing so, investors can create a diversified portfolio that is aligned with their risk tolerance and investment goals. Investors can use the Omega Ratio to monitor and manage the risk of their portfolios. By regularly assessing the Omega Ratio of individual investments and the overall portfolio, investors can make adjustments to mitigate potential downside risks. The Omega Ratio can be used to compare the risk-reward profiles of various investments, helping investors identify the most suitable options for their portfolios. By considering both risk and return, the Omega Ratio provides a more comprehensive view of investment performance than traditional metrics. Investors can use the Omega Ratio to benchmark the performance of their investments against relevant market indices or other investment vehicles. This helps to assess whether their investments are meeting expectations and delivering the desired risk-reward balance. Financial institutions can use the Omega Ratio to design structured products that target specific risk-reward profiles. By optimizing the Omega Ratio, these products can offer investors tailored solutions that meet their unique needs and objectives. Asset managers can apply the Omega Ratio to develop risk-targeted funds, which aim to deliver a specific level of risk-adjusted return. These funds allow investors to easily access investment strategies that match their risk tolerance and return expectations. The Omega Ratio has become an essential tool in modern finance for evaluating the risk-reward balance of investments and portfolios. Its ability to consider the entire return distribution and accommodate unique investment features sets it apart from traditional risk measures, making it a valuable addition to any investor's toolkit. While the Omega Ratio offers several advantages over traditional risk measures, it is important to be aware of its limitations, such as its reliance on historical data and sensitivity to the threshold return. As financial markets continue to evolve, the need for more robust and comprehensive risk measures like the Omega Ratio will only grow. Future research and development efforts should focus on refining the Omega Ratio, addressing its limitations, and exploring new applications in finance and investment. By doing so, the Omega Ratio will continue to be a valuable resource for investors, portfolio managers, and financial advisors alike.Definition of Omega Ratio

Background and Development of Omega Ratio

Importance in Finance and Investment of Omega Ratio

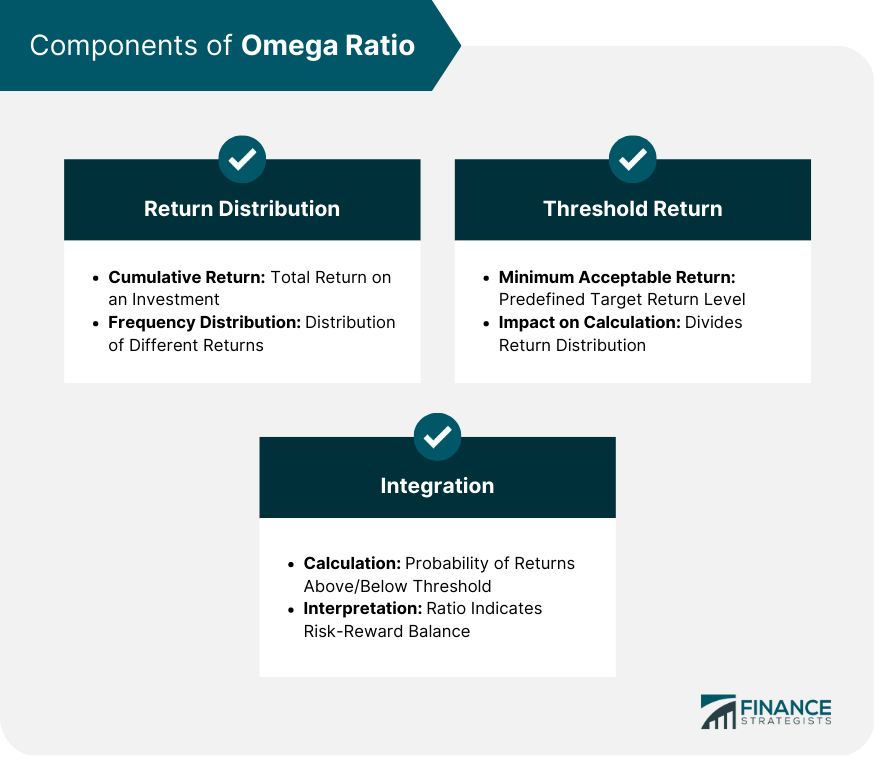

Components of Omega Ratio

Return Distribution

Cumulative Return

Frequency Distribution

Threshold Return

Minimum Acceptable Return

Impact on the Omega Ratio Calculation

Integration of Return Distribution and Threshold Return

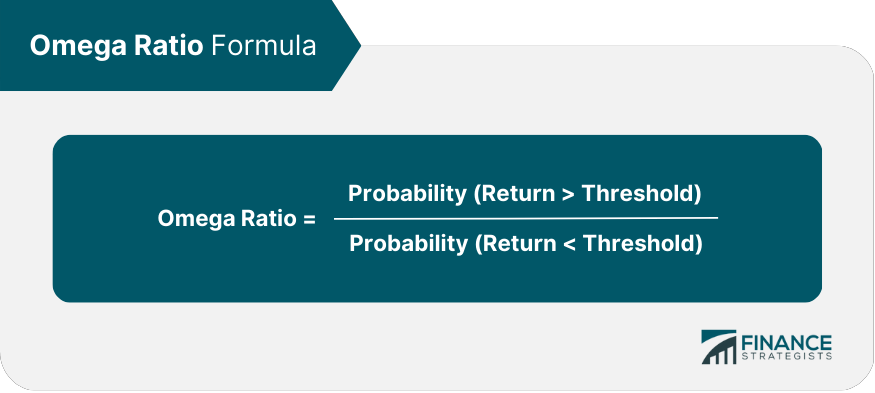

Calculation of Omega Ratio

Interpretation of Values

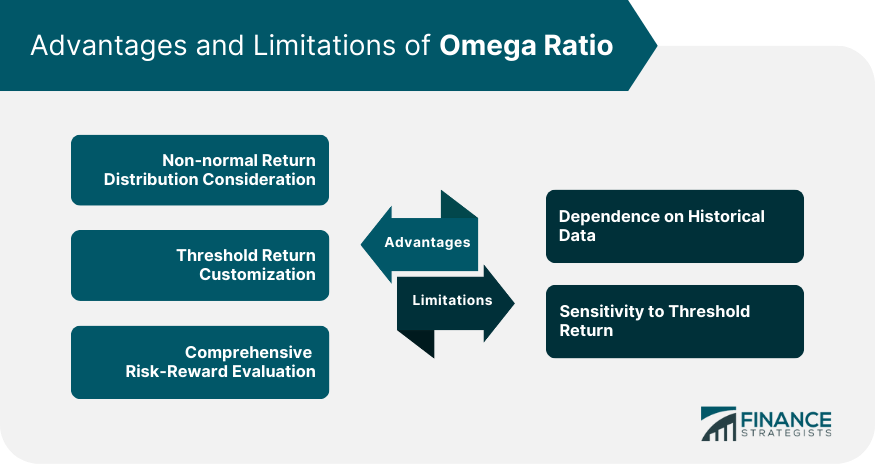

Advantages of Omega Ratio

Non-normal Return Distribution Consideration

Skewness and Kurtosis

Flexibility in Capturing Return Distribution

Threshold Return Customization

Personal Risk Tolerance

Portfolio Objectives

Comprehensive Risk-Reward Evaluation

Comparison With Other Risk Measures

Better Decision-Making

Limitations of Omega Ratio

Dependence on Historical Data

Data Availability

Limitations in Predicting Future Performance

Sensitivity to Threshold Return

Impact of Arbitrary Selection

Potential Misinterpretation

Practical Applications of Omega Ratio

Portfolio Optimization

Asset Allocation

Risk Management

Performance Evaluation

Comparing Investments

Benchmarking

Investment Product Development

Structured Products

Risk-Targeted Funds

Conclusion

Omega Ratio FAQs

The Omega Ratio is a performance measurement tool used to evaluate the risk-return trade-off of an investment or portfolio. It measures the likelihood of achieving a target return compared to the potential downside risk. It is important in finance and investment because it helps investors make better-informed decisions and contributes to the overall optimization of investment portfolios.

The Omega Ratio is calculated as the probability of achieving returns above a specified threshold divided by the probability of experiencing returns below the threshold. An Omega Ratio greater than 1 indicates a higher likelihood of achieving the target return than experiencing a loss, while a ratio less than 1 suggests that the investment is more likely to underperform the target return.

The Omega Ratio offers several advantages, including its ability to consider non-normal return distributions, the flexibility to customize the threshold return based on an investor's risk tolerance and investment objectives, and a comprehensive risk-reward evaluation that provides a more accurate representation of an investment's performance.

The Omega Ratio has some limitations, such as its dependence on historical data, which may not always be indicative of future results, and its sensitivity to the choice of threshold return. An arbitrary selection of the threshold return can result in a distorted risk-reward assessment and potentially lead to suboptimal investment decisions.

Investors and portfolio managers can use the Omega Ratio for portfolio optimization, performance evaluation, and investment product development. It can guide asset allocation decisions, help monitor and manage risk, compare the risk-reward profiles of various investments, benchmark performance against relevant market indices, and inform the design of structured products and risk-targeted funds.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.