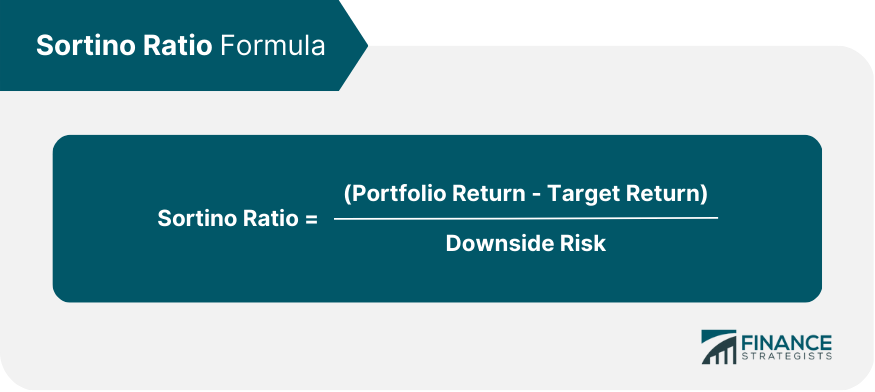

Sortino Ratio is a risk-adjusted performance measure that evaluates an investment's return relative to its downside risk. It is particularly useful for investors who are concerned about potential losses rather than the overall volatility of their investments. The purpose of the Sortino Ratio is to help investors make more informed decisions by comparing the performance of different investment options while considering the downside risk. This can help identify investments with higher expected returns and lower downside risk, making it a valuable addition to any investor's toolkit. To calculate the Sortino Ratio, you need to identify its three main components: portfolio return, target return, and downside risk. Portfolio Return: This is the actual return generated by the investment portfolio over a specific period. Target Return: This is the minimum acceptable return (MAR) set by the investor. It serves as a benchmark to evaluate the portfolio's performance. Downside Risk: This is the downside deviation, which measures the variability of returns below the target return. It captures the risk of negative returns or returns that fall short of the target. The Sortino Ratio is calculated using the following formula: To calculate the Sortino Ratio: Understanding the Sortino Ratio's value is crucial for evaluating portfolio performance and comparing different investment options. A higher Sortino Ratio indicates a better risk-adjusted performance, as it signifies that the investment generates higher returns relative to its downside risk. Conversely, a lower Sortino Ratio suggests a less favorable risk-adjusted performance. A positive Sortino Ratio implies that the investment is outperforming the target return, while a negative ratio indicates underperformance. The Sortino Ratio is particularly useful when comparing different investments with varying risk profiles. By focusing on downside risk, it allows investors to compare investments on a more equal footing, highlighting those that offer higher returns for a given level of downside risk. While the Sortino Ratio provides valuable insights, it is important to be aware of its limitations. It is sensitive to the choice of target return, and it assumes that downside risk is the only relevant risk for investors. Additionally, it does not account for the specific distribution of returns, making it less reliable for investments with non-normal return distributions. The Sortino Ratio can be applied in various areas of investment management, including portfolio management, risk assessment, and performance benchmarking. Portfolio managers can use the Sortino Ratio to optimize their portfolio by selecting investments that provide higher returns for a given level of downside risk. This can help them construct a more efficient portfolio that balances risk and reward, ultimately meeting the investor's goals and risk tolerance. The Sortino Ratio can be used to assess the downside risk associated with an investment, allowing investors to make more informed decisions about their risk exposure. By focusing on the downside deviation, investors can identify investments that may have a lower risk of underperforming the target return. Investment managers can use the Sortino Ratio to benchmark their performance against other managers or market indices. A higher Sortino Ratio compared to a benchmark indicates that the manager is providing superior risk-adjusted returns, making them a more attractive option for investors. The Sortino Ratio can be applied in real-world investment decisions to evaluate the risk-adjusted performance of various investment options. A portfolio manager may use the Sortino Ratio to compare two mutual funds with similar returns but different downside risks. By selecting the fund with the higher Sortino Ratio, the manager can potentially achieve better risk-adjusted returns for their clients. It is crucial to understand that the Sortino Ratio should not be used in isolation but rather as a complement to other performance measures and risk metrics. Relying solely on the Sortino Ratio could lead to an incomplete assessment of an investment's risk and return profile. There are several enhancements and alternatives to the Sortino Ratio that can provide additional insights into an investment's risk-adjusted performance. The Adjusted Sortino Ratio modifies the standard Sortino Ratio by incorporating the portfolio's skewness and kurtosis, providing a more accurate representation of downside risk for investments with non-normal return distributions. The Omega Ratio is another risk-adjusted performance measure that considers both the upside and downside potential of an investment by calculating the ratio of gains to losses relative to a target return. This ratio provides a more comprehensive assessment of an investment's risk and return profile. The Kappa Ratio is a risk-adjusted performance measure that accounts for an investment's downside risk, as well as higher-order moments such as skewness and kurtosis. This can be particularly useful for analyzing investments with asymmetric return distributions. The Sortino Ratio is a valuable risk-adjusted performance measure that evaluates an investment's return relative to its downside risk. It helps investors make more informed decisions by comparing different investment options while considering the downside risk. Unlock your investment potential with expert wealth management services, leveraging the Sortino Ratio to optimize risk-adjusted performance.Definition of the Sortino Ratio

Calculation of the Sortino Ratio

Identifying the Components of the Sortino Ratio

Formula and Calculation Steps of the Sortino Ratio

1. Determine the portfolio return and target return.

2. Calculate the downside deviation.

3. Plug the values into the formula and compute the Sortino Ratio.Interpretation of the Sortino Ratio

Evaluating Portfolio Performance

Comparing Different Investment Options

Understanding the Limitations

Applications of the Sortino Ratio

Portfolio Management

Risk Assessment

Performance Benchmarking

Applying the Sortino Ratio in Real-World Investment Decisions

Enhancements and Alternatives to the Sortino Ratio

Adjusted Sortino Ratio

Omega Ratio

Kappa Ratio

Conclusion

A higher Sortino Ratio indicates better risk-adjusted performance, and it is particularly useful when comparing investments with varying risk profiles.

However, it is important to be aware of its limitations, such as sensitivity to the choice of target return and assumptions about downside risk as the only relevant risk.

The Sortino Ratio can be applied in portfolio management, risk assessment, and performance benchmarking. Real-world examples demonstrate its practical application in evaluating the risk-adjusted performance of various investment options.

There are also several enhancements and alternatives to the Sortino Ratio that can provide additional insights into an investment's risk-adjusted performance, such as the Adjusted Sortino Ratio, Omega Ratio, and Kappa Ratio.

Ultimately, the Sortino Ratio should be used in combination with other performance measures and risk metrics to obtain a more complete assessment of an investment's risk and return profile.

Sortino Ratio FAQs

The Sortino Ratio is a risk-adjusted performance measure that evaluates an investment's return relative to its downside risk. It helps investors make informed decisions by comparing investment options and identifying those with higher expected returns and lower downside risk.

The main difference between the Sortino Ratio and the Sharpe Ratio is the measure of risk they use. The Sortino Ratio focuses on downside risk, using downside deviation, while the Sharpe Ratio considers overall volatility, using standard deviation of returns.

To calculate the Sortino Ratio, you need three components: portfolio return, target return, and downside risk. The formula is: Sortino Ratio = (Portfolio Return - Target Return) / Downside Risk.

Yes, the Sortino Ratio can be used to compare different investment options with varying risk profiles. By focusing on downside risk, it allows investors to compare investments on a more equal footing and identify those with higher returns for a given level of downside risk.

The Sortino Ratio has some limitations, including sensitivity to the choice of target return and the assumption that downside risk is the only relevant risk for investors. It also does not account for the specific distribution of returns, making it less reliable for investments with non-normal return distributions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.