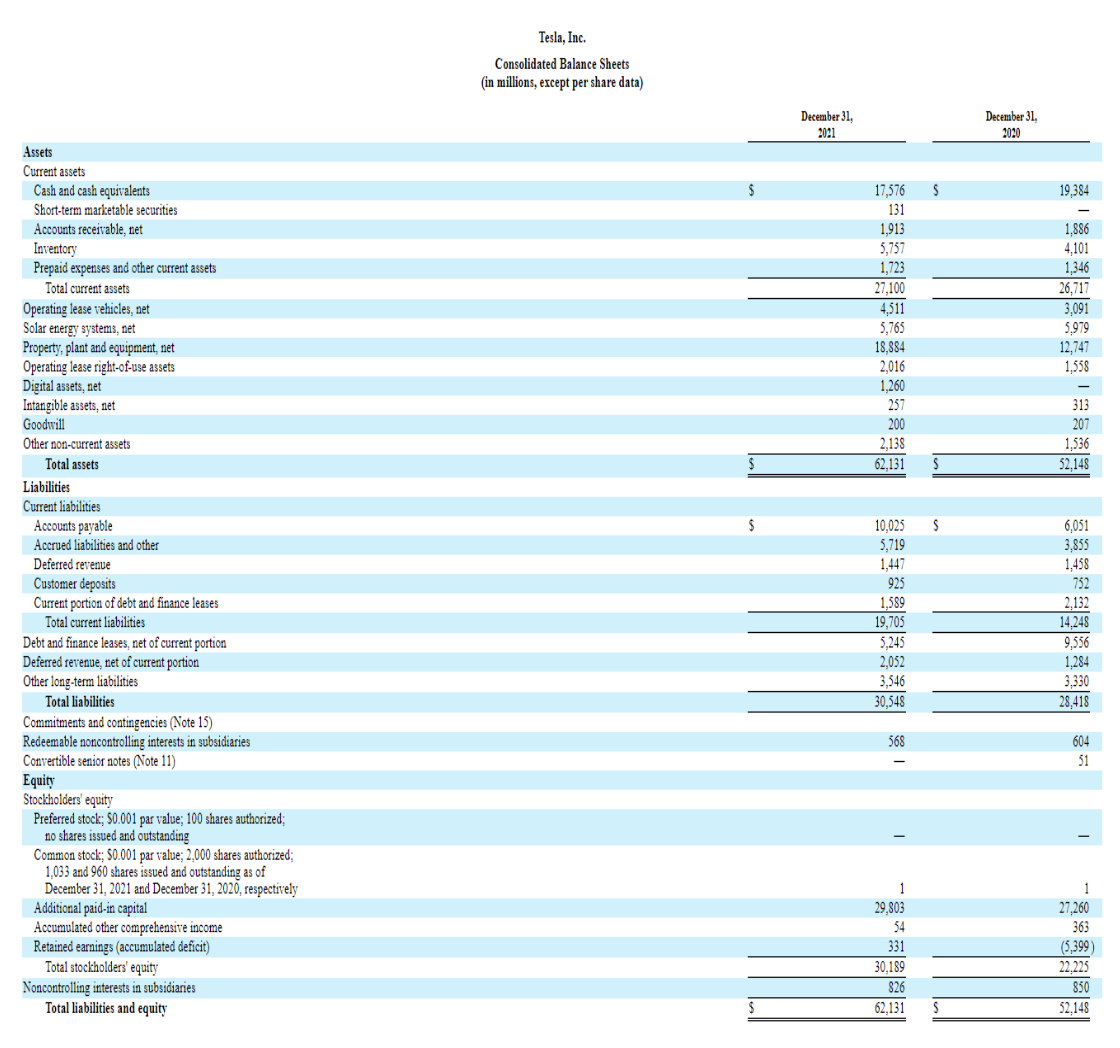

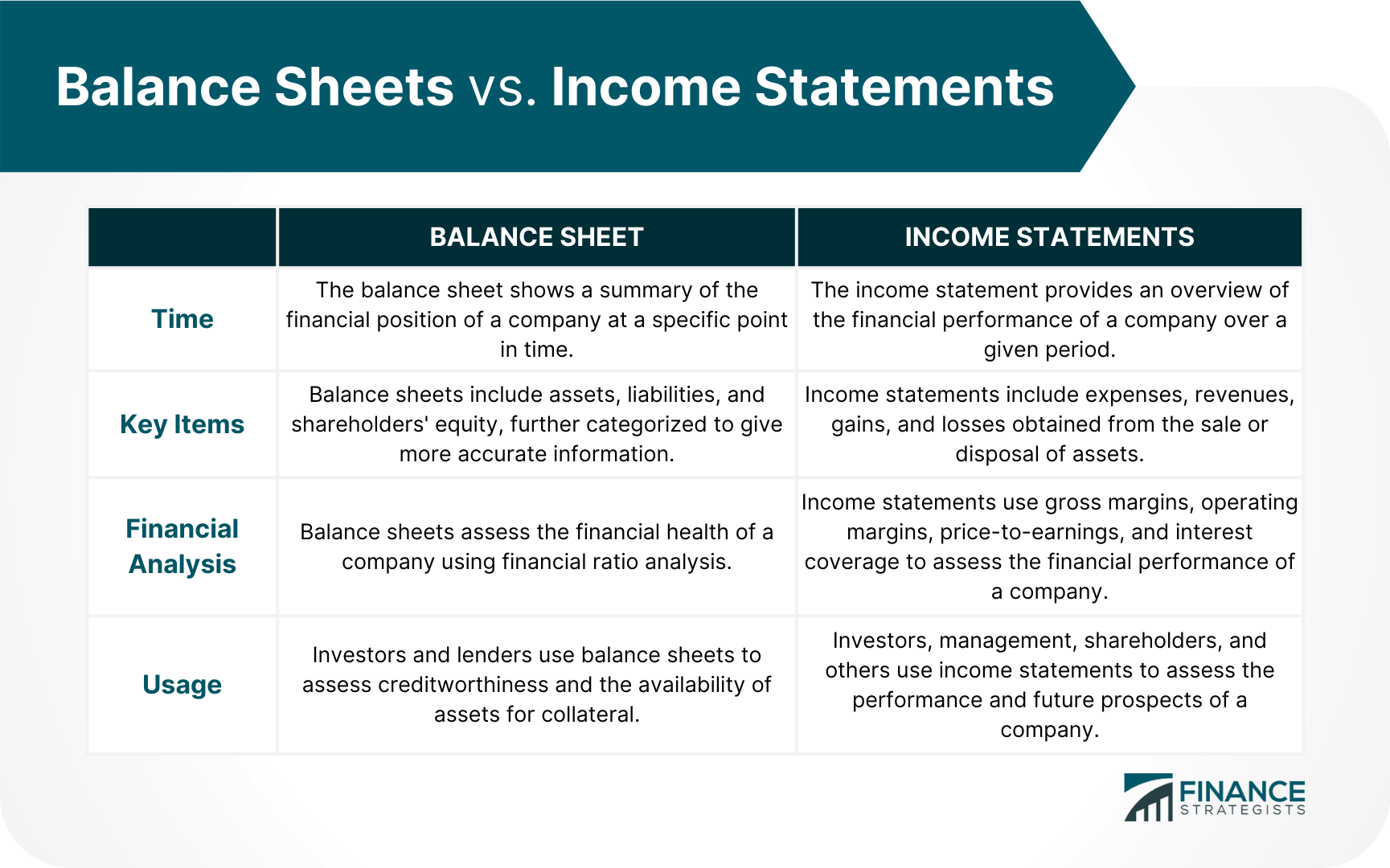

A balance sheet is a financial statement that shows the relationship between assets, liabilities, and shareholders’ equity of a company at a specific point in time. Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity. Balance sheets are useful tools for individual and institutional investors, as well as key stakeholders within an organization, as they show the general financial status of the company. It is also possible to grasp the information found in a balance sheet to calculate important company metrics, such as profitability, liquidity, and debt-to-equity ratio. However, it is crucial to remember that balance sheets communicate information as of a specific date. Naturally, a balance sheet is always based upon past data. While stakeholders and investors may use a balance sheet to predict future performance, past performance does not guarantee future results. In order to see the direction of a company, you will need to look at balance sheets over a time period of months or years. A balance sheet is guided by the accounting equation: Both parts should be equal to each other or balance each other out. This means that the assets of a company should equal its liabilities plus any shareholders’ equity that has been issued. Hence, a balance sheet should always balance. For instance, if a company takes out a ten-year, $8,000 loan from a bank, the assets of the company will increase by $8,000. Its liabilities will also increase by $8,000, balancing the two sides of the accounting equation. If the company takes $10,000 from its investors, its assets and stockholders’ equity will also increase by that amount. The revenues of the company in excess of its expenses will go into the shareholder equity account. These revenues will be balanced on the asset side of the equation, appearing as inventory, cash, investments, or other assets. A balance sheet has three primary components: assets, liabilities, and shareholders’ equity. Assets are anything the company owns that holds some quantifiable value, which means that they could be liquidated and turned into cash. These can include cash, investments, and tangible objects. Companies divide their assets into two categories: current assets and noncurrent (long-term) assets. Current assets are typically those that a company expects to convert easily into cash within a year. These assets include cash and cash equivalents, prepaid expenses, accounts receivable, marketable securities, and inventory. Noncurrent assets are long-term investments that the company does not expect to convert into cash within a year or have a lifespan of more than one year. Noncurrent assets include tangible assets, such as land, buildings, machinery, and equipment. They can also be intangible assets, such as trademarks, patents, goodwill, copyright, or intellectual property. Liabilities are anything a company owes. These are loans, accounts payable, bonds payable, or taxes. Like assets, liabilities can be classified as either current or noncurrent liabilities. Current liabilities refer to the liabilities of the company that are due or must be paid within one year. This may include accounts payables, rent and utility payments, current debts or notes payables, current portion of long-term debt, and other accrued expenses. Noncurrent or long-term liabilities are debts and other non-debt financial obligations that a company does not expect to repay within one year from the date of the balance sheet. This may include long-term loans, bonds payable, leases, and deferred tax liabilities. Shareholder’s equity is the net worth of the company and reflects the amount of money left over if all liabilities are paid, and all assets are sold. Shareholders’ equity belongs to the shareholders, whether public or private owners. Shareholders’ equity reflects how much a company has left after paying its liabilities. If the company wanted to, it could pay out all of that money to its shareholders through dividends. However, the company typically reinvests the money into the company. Retained earnings are the money that the company keeps. Share capital is the value of what investors have invested in the company. For instance, if someone invests $200,000 to help you start a company, you would count that $200,000 in your balance sheet as your cash assets and as part of your share capital. Stocks can be common or preferred stocks. Common stock is those that people get when they buy stock through the stock market. Preferred stock, on the other hand, provides the shareholder with a greater claim on the company’s assets and earnings. You can also see treasury stock on a balance sheet. This stock is a previously outstanding stock that is purchased from stockholders by the issuing company. Below is an example of a balance sheet of Tesla for 2021 taken from the U.S. Securities and Exchange Commission. As you can see, it starts with current assets, then the noncurrent, and the total of both. Below the assets are the liabilities and stockholders’ equity, which include current liabilities, noncurrent liabilities, and shareholders’ equity. For example, this balance sheet tells you: It is crucial to note that how a balance sheet is formatted differs depending on where the company or organization is based. The balance sheet is prepared using the following steps: The balance sheet previews the total assets, liabilities, and shareholders’ equity of a company on a specific date, referred to as the reporting date. Often, the reporting date will be the final day of the reporting period. Companies that report annually, like Tesla, often use December 31st as their reporting date, though they can choose any date. There are also companies, like publicly traded ones, that will report quarterly. For this case, the reporting date will usually fall on the last day of the quarter: However, it is common for a balance sheet to take a few days or weeks to prepare after the reporting period has ended. You will need to tally up all your assets of the company on the balance sheet as of that date. This will include both current and noncurrent assets. Assets are typically listed as individual line items and then as total assets in a balance sheet. This will make it easier for analysts to comprehend exactly what your assets are and where they came from. Tallying the assets together will be required for final analysis. Like assets, you need to identify your liabilities which will include both current and long-term liabilities. Again, these should be organized into both line items and total liabilities. They should also be both subtotaled and then totaled together. After you have assets and liabilities, calculating shareholders’ equity is done by taking the total value of assets and subtracting the total value of liabilities. Shareholders’ equity will be straightforward for companies or organizations that a single owner privately holds. The calculation may be complicated for publicly held companies depending on the various types of stock issued. Line items in this section include common stocks, preferred stocks, share capital, treasury stocks, and retained earnings. Adding total liabilities to shareholders’ equity should give you the same sum as your assets. If not, then there may be an error in your calculations. Causes of a balance sheet not truly balancing may be: Financial ratio analysis is the main technique to analyze the information contained within a balance sheet. It uses formulas to obtain insights into a company and its operations. Using financial ratios in analyzing a balance sheet, like the debt-to-equity ratio, can produce a good sense of the financial condition of the company and its operational efficiency. It is crucial to remember that some ratios will require information from more than one financial statement, such as from the income statement and the balance sheet. There are two types of ratios that use data from a balance sheet. These are: Financial strength ratios can provide investors with ideas of how financially stable the company is and whether it finances itself. It also yields information on how well a company can meet its obligations and how these obligations are leveraged. Financial strength ratios can include the working capital and debt-to-equity ratios. Activity ratios mainly focus on current accounts to reveal how well the company manages its operating cycle. These operating cycles can include receivables, payables, and inventory. Examples of activity ratios are inventory turnover ratio, total assets turnover ratio, fixed assets turnover ratio, and accounts receivables turnover ratio. These ratios can yield insights into the operational efficiency of the company. There are a few key reasons why a balance sheet is important. Here are a few of them: A balance sheet lists all assets and liabilities of a company. With this information, a company can quickly assess whether it has borrowed a large amount of money, whether the assets are not liquid enough, or whether it has enough current cash to fulfill current demands. A lender will usually require a balance sheet of the company in order to secure a business plan. Additionally, a company must usually provide a balance sheet to private investors when planning to secure private equity funding. These are some of the cases in which external parties want to assess and check a company’s financial stability and health, its creditworthiness, and whether the company will be able to settle its short-term debts. Business owners use these financial ratios to assess the profitability, solvency, liquidity, and turnover of a company and establish ways to improve the financial health of the company. Some financial ratios need data and information from the balance sheet. Good and talented employees are always looking for stable and secure companies to work in. Balance sheets that are disclosed from public companies allow employees a chance to review how much the company has on hand and whether the financial health of the company is in accordance with their expectations from their employers. Although balance sheets are important financial statements, they do have their limitations. Here are some of them: It may not provide a full snapshot of the financial health of a company without data from other financial statements. In order to get a complete understanding of the company, business owners and investors should review other financial statements, such as the income statement and cash flow statement. The balance sheet only reports the financial position of a company at a specific point in time. This may not provide an accurate portrayal of the financial health of a company if the market conditions rapidly change or without knowledge of previous cash balance and understanding of industry operating demands. The data and information included in a balance sheet can sometimes be manipulated by management in order to present a more favorable financial position for the company. Businesses should be wary of companies that have large discrepancies between their balance sheets and other financial statements. It is also helpful to pay attention to the footnotes in the balance sheets to check what accounting systems are being used and to look out for red flags. For instance, accounts receivable should be continually assessed for impairment and adjusted to reveal potential uncollectible accounts. A company should make estimates and reflect their best guess as a part of the balance sheet if they do not know which receivables a company is likely actually to receive. Here are some key differences between balance sheets and income statements: Balance sheets are important financial statements that provide insights into the assets, liabilities, and shareholders’ equity of a company. It is helpful for business owners to prepare and review balance sheets in order to assess the financial health of their companies. Balance sheets also play an important role in securing funding from lenders and investors. Additionally, it helps businesses to retain talents. Although balance sheets are important, they do have their limitations, and business owners must be aware of them. Some of its limitations are that it is static, has a narrow scope of timing, and is subject to errors and frauds. A balance sheet is also different from an income statement in several ways, most notably the time frame it covers and the items included. It is important to understand that balance sheets only provide a snapshot of the financial position of a company at a specific point in time. In order to get a more accurate understanding of the company, business owners and investors should review other financial statements, such as the income statement and cash flow statement.What Is a Balance Sheet?

How Balance Sheets Work

Components of a Balance Sheet

Assets

Current Assets

Non-Current Assets

Liabilities

Current Liabilities

Noncurrent Liabilities

Shareholder’s Equity

Retained Earnings

Share Capital

Stocks

Example of a Balance Sheet

How to Prepare a Balance Sheet

Step 1: Determine the Reporting Date and Period

Step 2: Identify Your Assets

Step 3: Identify Your Liabilities

Step 4: Calculate Shareholders’ Equity

Step 5: Add Total Liabilities to Total Shareholders’ Equity and Compare to Assets

How to Analyze a Balance Sheet

Financial Strength Ratios

Activity Ratios

Importance of a Balance Sheet

Balance Sheets Examine Risk

Balance Sheets Secure Capital

Balance Sheets are Needed for Financial Ratios

Balance Sheets Lure and Retain Talents

Limitations of a Balance Sheet

Balance Sheets are Static

Balance Sheets Have a Narrow Scope of Timing

Balance Sheets May Be Susceptible to Errors and Fraud

Balance Sheets Are Subject to Several Professional Judgment Areas That Could Impact the Report

Balance Sheets vs. Income Statements

The Bottom Line

Balance Sheet FAQs

Balance sheets include assets, liabilities, and shareholders' equity. Assets are what the company owns, while liabilities are what the company owes. Shareholders' equity is the portion of the business that is owned by the shareholders.

The balance sheet is prepared by the management of the company. The auditor of the company then subjects balance sheets to an audit. Balance sheets of small privately-held businesses might be prepared by the owner of the company or its bookkeeper. On the other hand, balance sheets for mid-size private firms might be prepared internally and then reviewed over by an external accountant.

The balance sheet equation is: Assets = Liabilities + Shareholders' Equity

The balance sheet is used to assess the financial health of a company. Investors and lenders also use it to assess creditworthiness and the availability of assets for collateral.

Balance sheets are typically prepared at the end of set periods (e.g., annually, every quarter). Public companies are required to have a periodic financial statement available to the public. On the other hand, private companies do not need to appeal to shareholders. That is why there is no need to have their financial statements published to the public.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.