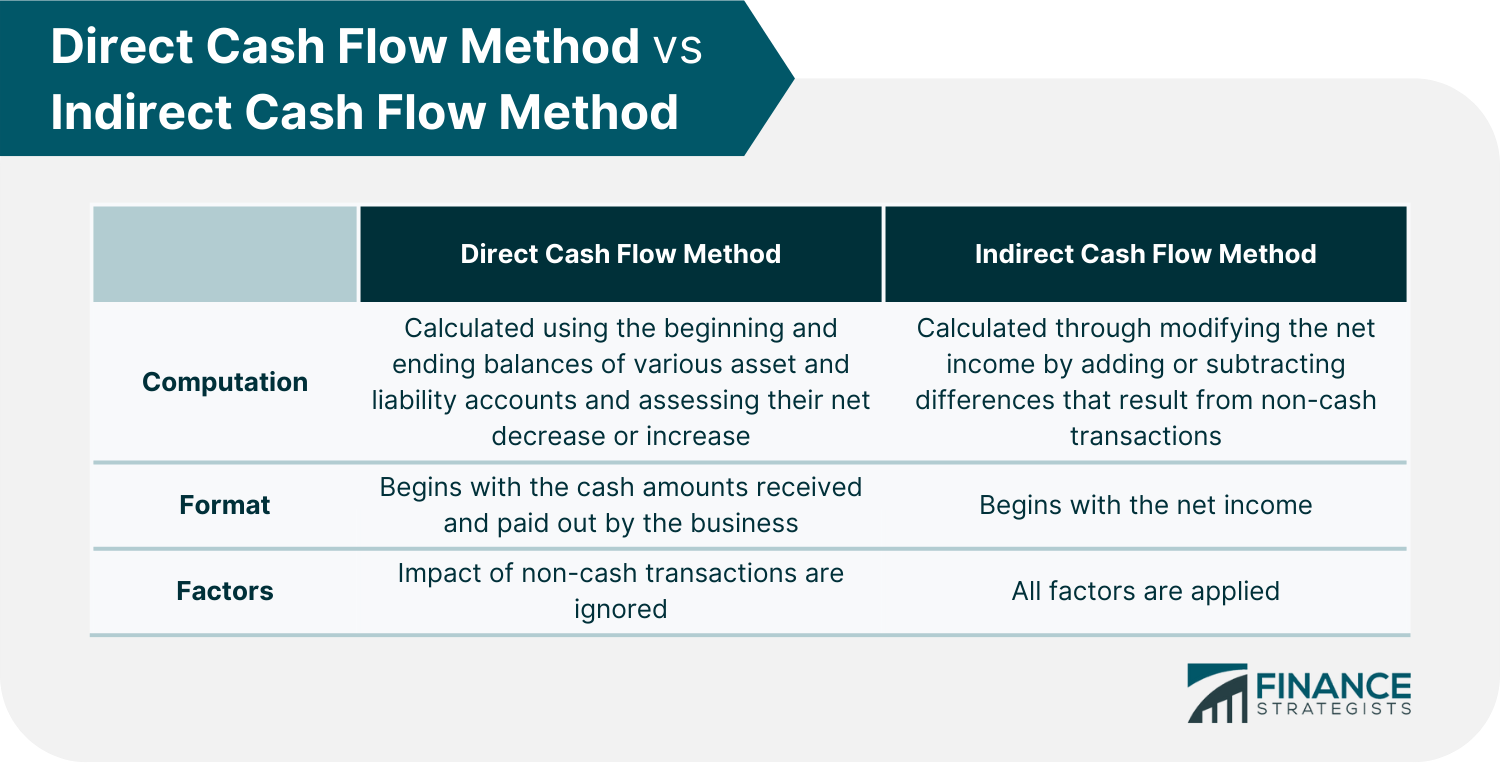

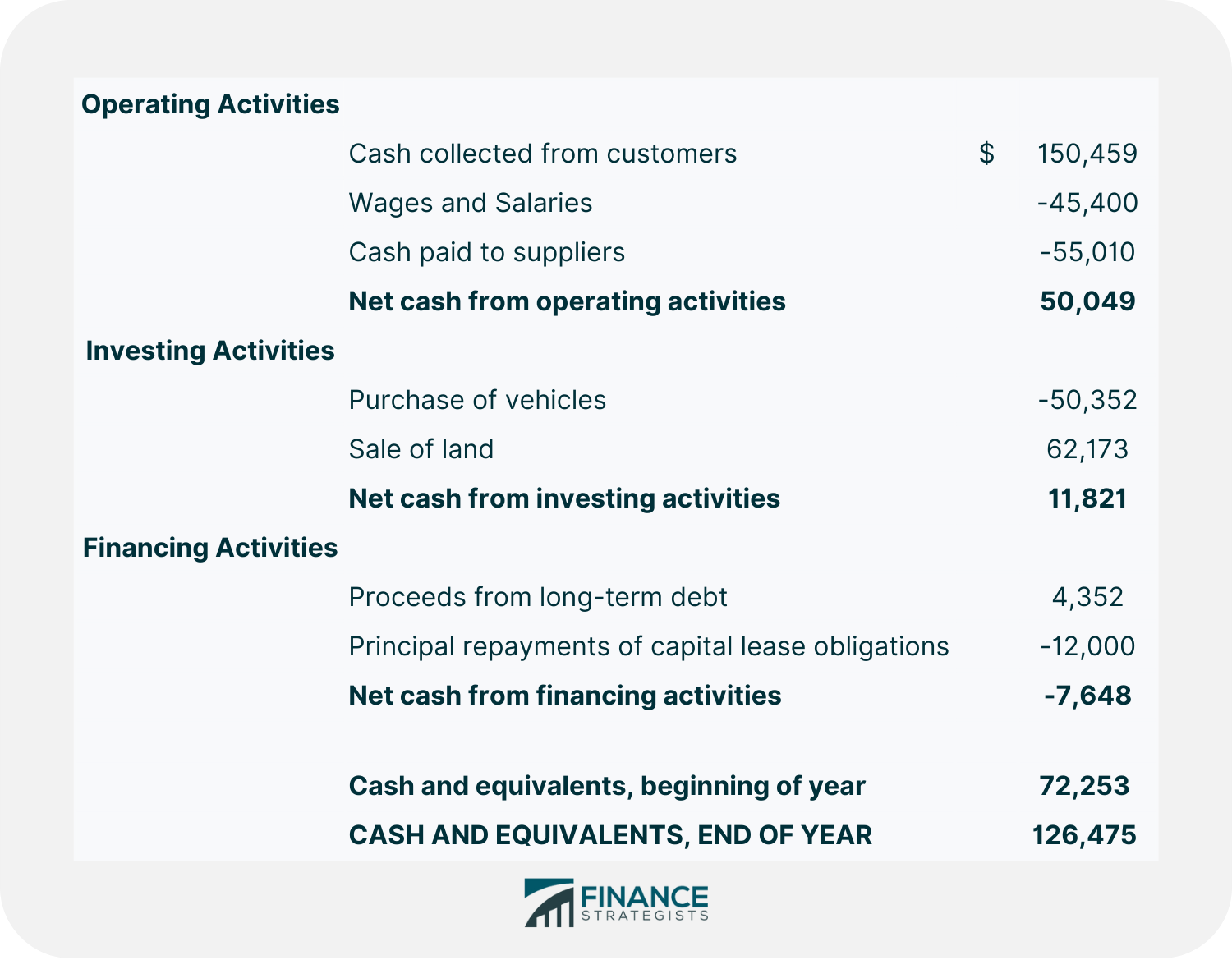

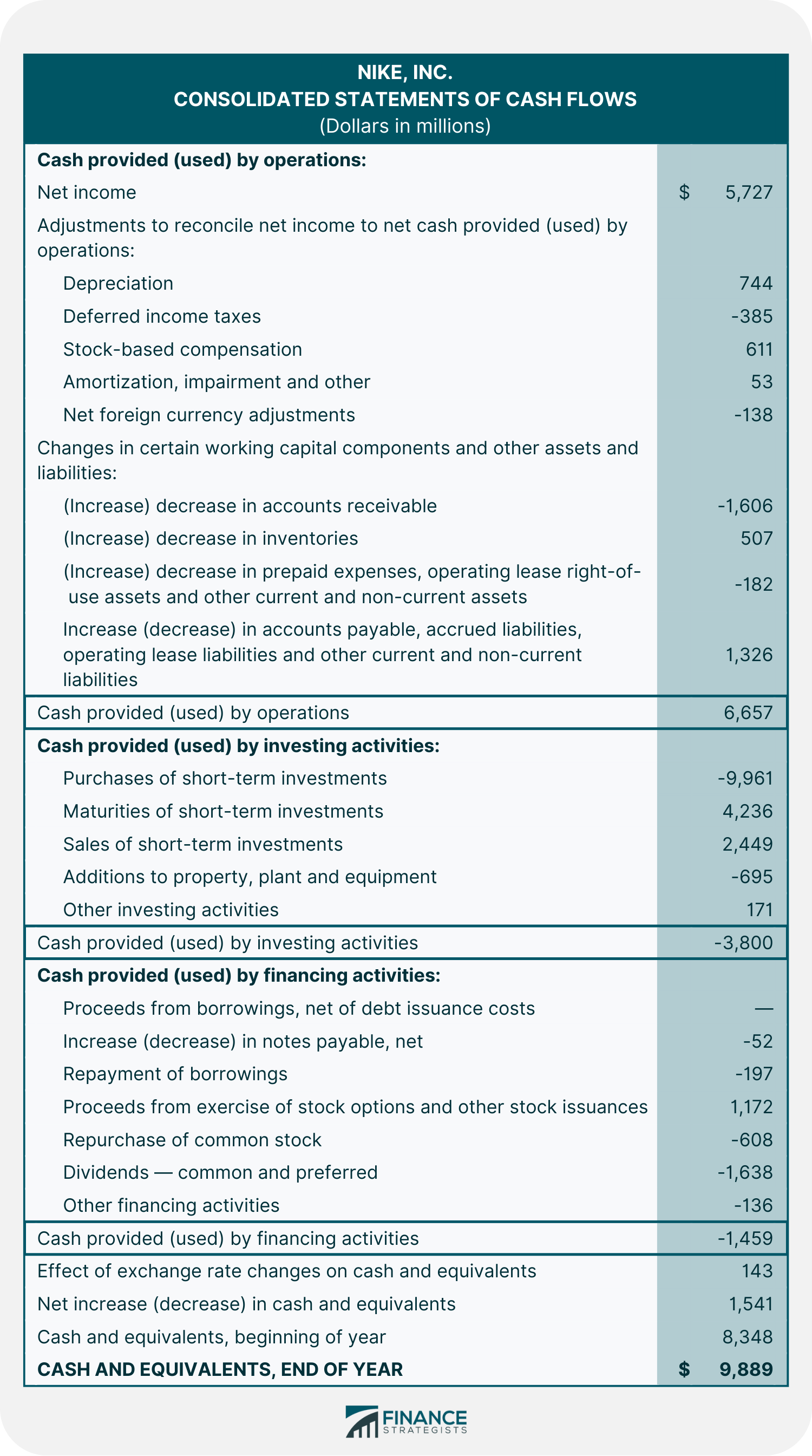

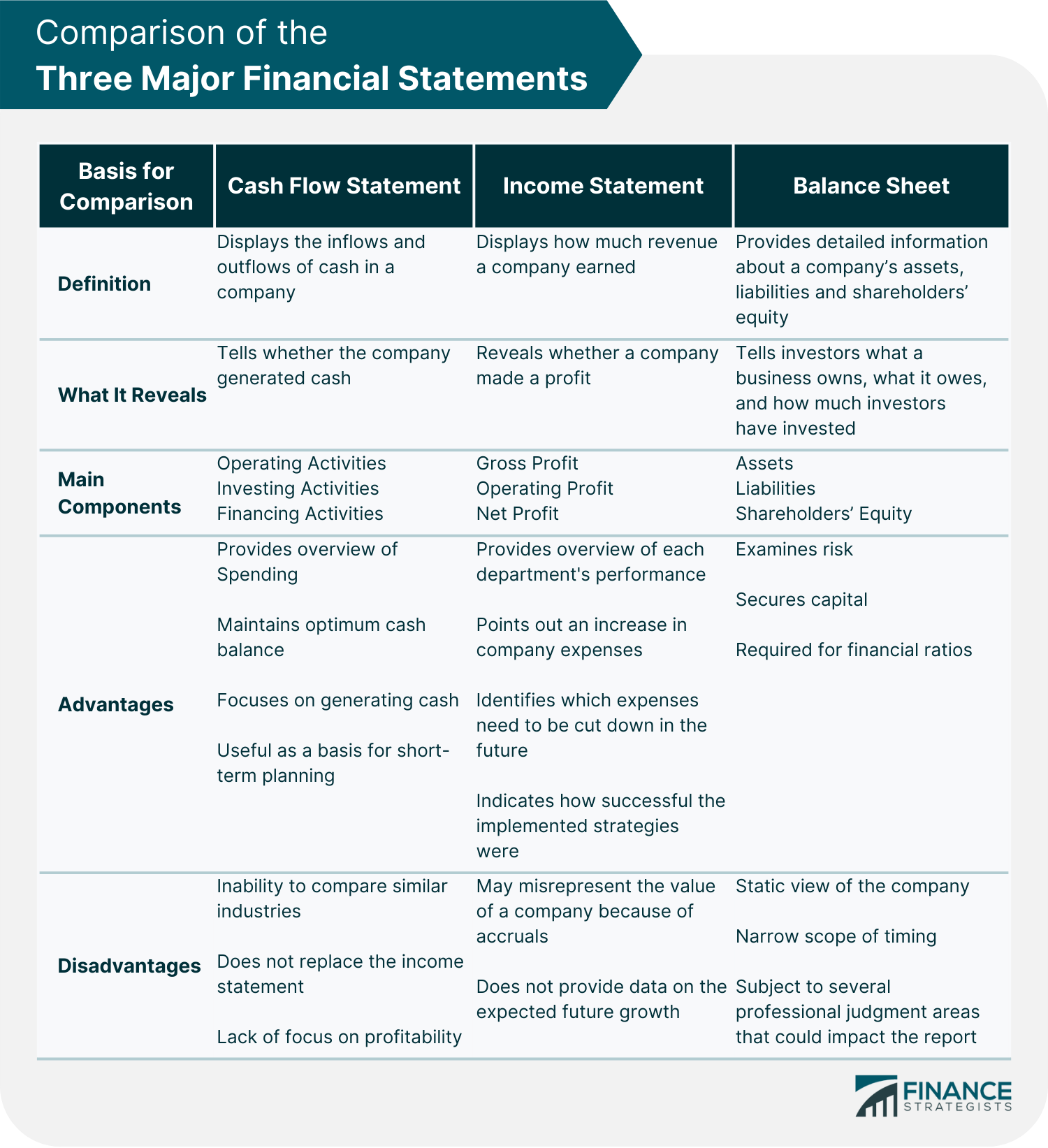

A cash flow statement (CFS) is a financial statement that captures how much cash is generated and utilized by a company or business in a specific time period. By looking at the cash flow statement, one can see whether the company has sufficient cash flowing in to pay its debts, fund its operations, and return money to shareholders via dividends or stock buybacks. CFS bridges the income statement and balance sheet because it shows how money moves in and out of the business via three main channels: operating, investing, and financing activities. It produces what is called the net cash flow by breaking down where the changes in the beginning and ending balances came from. The cash flow statement is focused on the cash accounting method, which means that business transactions reflect in the financial statement when the cash flows into or out of the business or when actual payments are received or distributed. The Cash Flow Statement has three main sections: cash flows from operating activities, investing activities, and financing activities. Together, these different sections can help investors and analysts determine the value of a company as a whole. Let us learn more about them below. This section covers cash transactions from all of a business’ operational activities, such as receipts from sales of goods and services, wage payments to employees, payments to suppliers, interest payments, and tax payments. For an investment company or a trading portfolio, equity instruments or receipts for the sale of debt and loans are also included because it is counted as a business activity. It can be considered as a cash version of the net income of a company since it starts with the net income or loss, then adds or subtracts from that amount to produce a net cash flow figure. Items that are added or subtracted include accounts receivables, accounts payables, amortization, depreciation, and prepaid items recorded as revenue or expenses in the income statement because they are non-cash. This section is the result of investment gains and losses. It includes cash spent on property, plant, and equipment. Analysts look in this section to see if there are any changes in capital expenditures (CapEx). Companies could generate cash flow from investing by selling equipment, property, or assets. Loans given to vendors or received from customers, as well as any payments associated with mergers and acquisitions (M&A), are also included in this section. Cash-out items are those changes caused by the purchase of new equipment, buildings, or marketable securities. Cash-in items are when a company divests an asset. This section records the cash flow between the company, its shareholders, investors, and creditors. It provides an overview of cash utilized in business financing. Transactions in CFF typically involve debt, equity, dividends, and stock repurchases. Cash-out transactions in CFF happen when dividends are paid, while cash-in transactions occur when the capital is raised. Thus, when a company issues a bond to the public, the company receives cash financing. In contrast, when interest is given to bondholders, the company decreases its cash. There are two accepted methods in calculating cash flow: direct and indirect. This method measures only the cash received, typically from customers, and the cash payments made, such as to suppliers. These inflows and outflows are then calculated to arrive at the net cash flow. This method of calculating cash flow takes more time since you need to track payments and receipts for every cash transaction. Figures used in this method are presented in a straightforward manner. They can be calculated using the beginning and ending balances of various asset and liability accounts and assessing their net decrease or increase. Using this method, cash flow is calculated through modifying the net income by adding or subtracting differences that result from non-cash transactions. This is done in order to come up with an accurate cash inflow or outflow. Instead of presenting transactional data like the direct method, the calculation begins with the net income figure found in the income statement of the company and makes adjustments to undo the impact of accruals that were made during the accounting period. The major differences between the two methods are outlined in the table below: To present a clearer picture of the two methods, there are some examples presented below. An example of the cash flow statement using the direct method for a hypothetical company is shown here: In the above example, the business has net cash of $50,049 from its operating activities and $11,821 from its investing activities. It has a net outflow of cash, which amounts to $7,648 from its financing activities. As a result, the business has a total of $126,475 in net cash flow at the end of the year. This is another example of a cash flow statement of Nike, Inc. using the indirect method for the fiscal year ending May 31, 2021. This cash flow statement shows that Nike started the year with approximately $8.3 million in cash and equivalents. The business brought in $6.65 million through its operating activities. Meanwhile, it spent approximately $3.8 million in investment activities, and a further $1.45 million in financing activities. The changes in the value of cash balance due to fluctuations in foreign currency exchange rates amount to $143 million. Consequently, the business ended the year with a positive cash flow of $1.5 million and total cash of $9.88 million. The CFS is one of the most important financial statements for a business. Cash is the lifeblood of any organization, and a company needs to have a good handle on its cash inflows and outflows in order to stay afloat. There are several reasons why the cash flow statement is so important: The cash flow statement presents a good overview of the company’s spending because it captures all the cash that comes in and goes out. This information is helpful so that management can make decisions on where to cut costs. It also helps investors and creditors assess the financial health of the company. Another important function of the cash flow statement is that it helps a business maintain an optimum cash balance. Management can use the information in the statement to decide when to invest or pay off debts because it shows how much cash is available at any given time. The cash flow statement also encourages management to focus on generating cash. This is because when a company knows where its cash is going, it can take steps to make sure that more cash is coming in than going out. A cash flow statement is an important measurement because it provides information that can be used to make short-term plans. For instance, if a company realizes that it will have a cash shortfall in the next month, it can take steps to ensure enough funds are available. The Cash Flow Statement has a few limitations: The cash flow statement is useful when analyzing changes in cash flow from one period to the next as it gives investors an idea of how the company is performing. However, it does not measure the efficiency of the business in comparison to a similar industry. This is because terms of sales and purchases may differ from company to company. Other companies may also have a higher capital investment which means they have more cash outflow rather than cash inflow. The cash flow statement does not replace the income statement as it only focuses on changes in cash. In contrast, the income statement is important as it provides information about the profitability of a company. The cash flow statement will not present the net income of a company for the accounting period as it does not include non-cash items which are considered by the income statement. Therefore, it does not evaluate the profitability of a company as it does not consider all costs or revenues. Three financial statements provide insights into the financial performance of a company and potential issues that may need to be addressed: the income statement, balance sheet, and cash flow statement. These three documents offer unique information that serves as the foundation of corporate accounting. Below is a comparison between cash flow statement, income statement, and balance sheet: The cash flow statement is an essential financial statement for any business as it provides critical information regarding cash inflows and outflows of the company. It helps businesses to make crucial decisions about spending, investments, and credit. Cash flow statements display the beginning and ending cash balances over a specific time period and points out where the changes came from (i.e operating activities, investing activities, and financing activities). This information allows businesses to forecast future cash needs, make informed investment decisions, and track actual performance against budgeted targets. However, the cash flow statement also has a few limitations, such as its inability to compare similar industries and its lack of focus on profitability. Therefore, it should always be used in unison with the income statement and balance sheet to get a complete financial overview of the company.What Is a Cash Flow Statement (CFS)?

Structure of the Cash Flow Statement

Cash Flow From Operating Activities (CFO)

Cash Flow From Investing Activities (CFI)

Cash Flow From Financing Activities (CFF)

How Cash Flow Is Calculated

Direct Cash Flow Method

Indirect Cash Flow Method

Examples of a Cash Flow Statement

Calculated Using the Direct Cash Flow Method

Calculated Using the Indirect Cash Flow Method

Importance of a Cash Flow Statement

Provides an Overview of Spending

Maintains an Optimum Cash Balance

Focuses on Generating Cash

Useful as a Basis for Short-Term Planning

Limitations of the Cash Flow Statement

Inability to Compare Similar Industries

Does not Replace the Income Statement

Lack of Focus on Profitability

Cash Flow Statement vs Income Statement vs Balance Sheet

Final Thoughts

Cash Flow Statement (CFS) FAQs

Positive cash flow reveals that more cash is coming into the company than going out. This is a good sign as it tells that the company is able to pay off its debts and obligations. Negative cash flow typically shows that more cash is leaving the company than coming in, which can be a reason for concern as the company may not be able to meet its financial obligations in the future. However, this could also mean that a company is investing or expanding which requires it to spend some of its funds.

Direct cash flow statements show the actual cash inflows and outflows from each operating, investing, and financing activity. While the indirect cash flow method makes adjustments on net income to account for accrual transactions.

Cash flow statements are important as they provide critical information about the cash inflows and outflows of the company. This information is important in making crucial decisions about spending, investments, and credit.

The main components of a cash flow statement are cash flows from operating activities, investing activities, and financing activities.

Cash flow is the total amount of cash that is flowing in and out of the company. Free cash flow is the available cash after subtracting capital expenditures.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.