Cash flow management is the process of monitoring, analyzing, and optimizing the inflow and outflow of cash within a business. Profit isn't everything. Businesses can be profitable but crumble without steady cash flow. It is a critical aspect of financial management that helps businesses maintain solvency, ensure smooth operations, and support growth. Effective cash flow management involves understanding key components, including cash inflows, cash outflows, and available cash balances, and implementing strategies to improve the overall financial health of a business. There are three main types of cash flow that businesses should consider when managing their finances: Operating cash flow refers to the cash generated from the core operations of a business, such as sales revenue and payments for goods and services. It is an essential indicator of a company's ability to generate sufficient cash to maintain and grow its operations. Investing cash flow results from the purchase and sale of long-term assets, such as property, equipment, and investments. A positive investing cash flow signifies that a business is disposing of its long-term assets, while a negative investing cash flow indicates that a company is investing in its future growth. Financing cash flow involves cash transactions between a business and its owners, investors, and creditors. Examples include issuing or repurchasing shares, borrowing funds, and repaying loans. Financing cash flow can impact a company's cash position and its ability to fund operations and growth. The cash flow statement is a financial report that provides a detailed overview of a company's cash inflows and outflows during a specific period. The statement is divided into three sections corresponding to the three types of cash flow: operating, investing, and financing. Analyzing the cash flow statement enables businesses to understand their cash position, identify trends, and make informed financial decisions. It is crucial to distinguish between cash flow and profit, as they are not interchangeable. Profit refers to the excess of revenues over expenses, whereas cash flow represents the movement of cash in and out of business. A company can be profitable but still face cash flow problems if it does not manage its cash resources effectively. Managing accounts receivable is essential for maintaining a healthy cash flow. By implementing the following strategies, businesses can ensure timely payments from customers and minimize cash flow disruptions: 1. Establish Credit Policies: Create clear credit policies that outline payment terms, credit limits, and procedures for dealing with overdue accounts. These policies should be communicated to customers and enforced consistently. 2. Invoice Promptly and Accurately: Send out invoices as soon as goods or services are delivered, and ensure they are accurate and easy to understand. Providing customers with detailed invoices reduces the likelihood of disputes and delays in payment. 3. Offer Incentives for Early Payment: Encourage customers to pay their invoices early by offering discounts or other benefits. This can help businesses receive payments faster and improve cash flow. Effectively managing accounts payable helps businesses maintain positive relationships with suppliers while ensuring optimal cash flow. Consider the following strategies to optimize accounts payable processes: 1. Negotiate Payment Terms: Work with suppliers to negotiate favorable payment terms that align with your business's cash flow needs. Extending payment deadlines can provide additional time to collect receivables and avoid cash flow shortages. 2. Leverage Discounts: Take advantage of early payment discounts offered by suppliers. These discounts can reduce costs and improve cash flow as long as they do not negatively impact cash reserves. 3. Monitor and Prioritize Payments: Track accounts payable and prioritize payments based on their importance and due dates. This approach ensures that critical expenses, such as payroll and taxes, are paid on time, while other payments can be scheduled to align with cash inflows. Effective inventory management is crucial for maintaining a healthy cash flow, as excess or obsolete inventory can tie up cash resources. Implement the following strategies to optimize inventory management: 1. Implement Inventory Control Systems: Utilize inventory management software or other tracking systems to monitor inventory levels, sales, and reorder points. This information can help businesses make informed decisions about purchasing and maintaining optimal inventory levels. 2. Optimize Reorder Points and Order Quantities: Analyze sales data and inventory levels to determine the optimal reorder points and order quantities that minimize stockouts and excess inventory. This approach can help businesses maintain adequate inventory levels while minimizing cash tied up in stock. 3. Reduce Obsolete Inventory: Regularly review inventory for obsolete or slow-moving items and implement strategies to clear them, such as offering discounts, bundling products, or donating items. Reducing obsolete inventory frees up cash and storage space for more profitable items. Cash flow forecasting is an essential part of cash flow management. It enables businesses to anticipate cash inflows and outflows, identify potential cash shortages, and make informed financial decisions. Regular cash flow forecasting can help businesses plan for future growth, manage risks, and ensure they have sufficient cash resources to cover expenses. There are two primary methods of cash flow forecasting: 1. Direct Method: This approach involves estimating future cash inflows and outflows based on historical data and expected future transactions. The direct method provides a detailed view of a business's cash position and is often used for short-term forecasts. 2. Indirect Method: This method starts with a business's net income and adjusts it for non-cash items, such as depreciation and changes in working capital. The indirect method provides a broader view of a company's cash flow and is commonly used for long-term forecasts. A comprehensive cash flow forecast should include the following elements: Estimated cash inflows from sales, investments, and financing activities Projected cash outflows for operating expenses, capital expenditures, and debt repayments Opening and closing cash balances for each period Assumptions and contingencies to account for uncertainties and potential changes in the business environment Regularly review and update cash flow forecasts to account for changes in the business environment, such as fluctuating market conditions, evolving customer demands, or unexpected expenses. Implementing strategies to mitigate cash flow risks, such as maintaining a cash reserve, diversifying revenue streams, and securing financing access can help businesses navigate uncertainties and maintain financial stability. Short-term financing can provide businesses with immediate access to cash, helping them manage temporary cash flow shortages. Some common short-term financing options include: 1. Line of Credit: A flexible financing arrangement allows businesses to borrow funds up to a predetermined limit. Interest is only charged on the outstanding balance, making it a cost-effective option for managing cash flow fluctuations. 2. Invoice Financing: This financing option involves selling outstanding invoices to a third party at a discount in exchange for immediate cash. Invoice financing can help businesses manage cash flow gaps caused by slow-paying customers. 3. Short-term Loans: Short-term loans are typically repaid within one year and can provide businesses with quick access to cash for urgent needs or temporary cash flow shortages. Long-term financing options can help businesses fund growth initiatives, major capital expenditures, or other significant investments. Some common long-term financing options include: 1. Term Loans: Term loans are loans with fixed repayment schedules and interest rates, typically lasting between one and ten years. Businesses can use term loans to fund major purchases, expansions, or refinancing existing debt. 2. Equity Financing: Equity financing involves raising capital by selling shares of the company to investors. This type of financing can provide businesses with access to large amounts of capital without the need for immediate repayment. However, it requires sharing ownership and control with investors. 3. Leasing and Asset-based Financing: Leasing allows businesses to use assets, such as equipment or property, without purchasing them outright. Asset-based financing involves using a company's assets as collateral for a loan. Both options can help businesses manage cash flow by reducing upfront costs and spreading payments over time. Cash flow management software and tools can help businesses monitor, analyze, and optimize their cash flow more efficiently. These tools can automate data entry, generate real-time reports, and provide insights to help businesses make informed financial decisions. Popular cash flow management software includes QuickBooks, Xero, and FreshBooks. Monitoring key performance indicators (KPIs) related to cash flow can help businesses identify trends, spot potential issues, and evaluate the effectiveness of their cash flow management strategies. Some common cash flow KPIs include: Operating cash flow margin Days sales outstanding (DSO) Days payable outstanding (DPO) Inventory turnover Perform regular cash flow analysis and reporting to ensure a thorough understanding of the company's financial position and to track the impact of cash flow management strategies. Comparing actual cash flow results with forecasts can help businesses identify variances and adjust their strategies accordingly. Continuously evaluate and improve cash flow management processes to ensure optimal efficiency and effectiveness. This may involve reviewing internal procedures, implementing new technologies, or seeking external expertise to identify areas for improvement. Effective cash flow management is crucial for maintaining business solvency, ensuring smooth operations, and supporting growth. To enhance financial stability and achieve long-term success, businesses can optimize accounts receivable, accounts payable, and inventory management, monitor cash flow processes regularly, and comprehend various cash flow types. Maintaining a proactive approach to cash flow management and adapting to changes in the business environment will help ensure any organization's continued financial health and stability. Consider seeking professional wealth management services to further enhance your business's financial stability and long-term growth potential. What Is Cash Flow Management?

Understanding Cash Flow

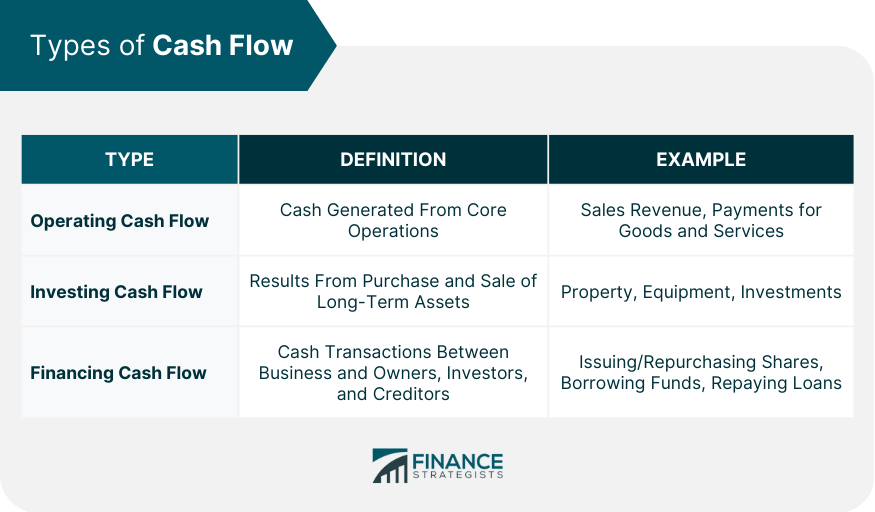

Types of Cash Flow

Operating Cash Flow

Investing Cash Flow

Financing Cash Flow

Cash Flow Statement

Cash Flow vs Profit

Cash Flow Management Strategies

Improve Accounts Receivable

Optimize Accounts Payable

Manage Inventory Efficiently

Cash Flow Forecasting in Cash Flow Management

Importance of Cash Flow Forecasting

Methods of Cash Flow Forecasting

Key Elements of a Cash Flow Forecast

Managing Cash Flow Risks and Uncertainties

Financial Tools for Cash Flow Management

Short-Term Financing Options

Long-Term Financing Options

Cash Flow Management Software and Tools

Monitoring and Improving Cash Flow

Key Performance Indicators (KPIs)

Regular Cash Flow Analysis and Reporting

Implementing Process Improvements

Final Thoughts

Cash Flow Management FAQs

Cash flow management is the process of monitoring, analyzing, and optimizing the inflow and outflow of cash within a business. It is crucial for maintaining solvency, ensuring smooth operations, and supporting growth. Effective cash flow management helps businesses make informed financial decisions, prevent cash shortages, and improve their overall financial health.

Cash flow management focuses on the movement of cash in and out of a business, while profit management deals with the excess of revenues over expenses. Although both concepts are related to a company's financial health, cash flow management is essential for maintaining liquidity and solvency, whereas profit management aims to maximize earnings.

To enhance cash flow management through accounts receivable, businesses should establish clear credit policies, invoice promptly and accurately, and offer incentives for early payment. These strategies help ensure timely payments from customers and minimize cash flow disruptions.

Cash flow forecasting is an essential aspect of cash flow management that enables businesses to anticipate cash inflows and outflows, identify potential cash shortages, and make informed financial decisions. Regular cash flow forecasting helps businesses plan for future growth, manage risks, and ensure they have sufficient cash resources to cover expenses.

Businesses can leverage various financial tools to manage their cash flow, including short-term financing options like lines of credit, invoice financing, and short-term loans, as well as long-term financing options such as term loans, equity financing, and leasing, and asset-based financing. Cash flow management software and tools can also help businesses monitor, analyze, and optimize their cash flow more efficiently.