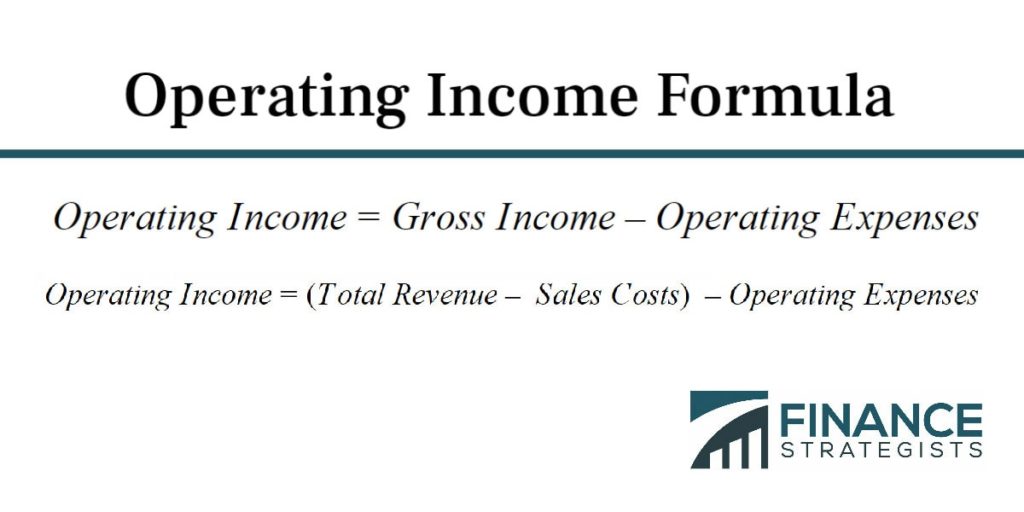

Operating income shows a company's profit after subtracting operating expenses incurred to make a product or provide a service. Examples of expenses included under operating income include manufacturing costs, employee wages, advertising fees and administrative expenses. Operating income does not include expenditures that affect a company's net income, such as gains from sales of assets or non-operating expenses including one-time losses or interest and tax expenses. It does, however, include cost of goods sold or sales costs, which is the only item deducted from total revenue when calculating gross profit or gross income. Thus, operating income is more general than gross income but more specific than net income in how it weighs a company's expenses against its revenue. Operating income is often included in an income statement, usually just before Earnings Before Income & Taxes (EBIT), a slightly more generalized measure of earnings. Operating income can also be pretty easily manually calculated, especially when starting from gross income. The easiest way to calculate operating income starts with calculating gross income first. Gross income takes the total revenue a company has accumulated from its various revenue streams and subtracts the cost of goods sold or sales costs from it. Because the cost of goods sold is also factored into determining operating income, starting with gross income to calculate operating income allows one to focus on listing other operating expenses such as employee salary and wages as well as research and marketing costs. Thus, the formula for calculating operating income breaks down into the following: While operating income may not be as holistic of a picture of a company's profitability as net income, it is a crucial metric in order to understand the type of profit a company is turning from just its day-to-day operations. The net income shows a company's total profit when all revenues and expenses are factored in. It is almost always listed at the bottom of an income statement, which is how it gets its moniker of "the bottom line." Other calculations of profit, income or earnings, such as gross income, EBIT and operating income, are all more specific interpretations of net income that exclude certain revenues and expenses. Examples of expenses used in net income but not operating income include interest, taxes, income from asset sales or other alternate revenue streams, one-time losses and various other uncommon expenses. Net income also includes all expenses and revenue that are seen in operating income such as gross income, depreciation, sales expenses and administrative expenses. While operating income lacks the complete overview of a company's profitability that net income provides, its specificity can still be a valuable tool when looking at a company's finances. For instance, if a company is showing a loss to its bottom line (or net income), an operating income can show whether that company is still turning a profit in its day-to-day operations or whether it is operating at a loss by taking on too many expenses in its normal course of operations. Revenue is the total amount of money made by a business or entity from selling products or providing services to customers. It does not include expenses incurred during the sale process or manufacturing costs to make the product. It also does not include expenses from other company activities to generate income, such as investments. Operating income factors in costs incurred for business activities including Sales, General & Administrative (SG&A) costs, manufacturing expenses etc. It also does not include income earned from investment and other activities but operating income provides a more detailed look at a company's ability to make money because it considers the costs involved for a company to generate its income. For example, if a company ABC reports $100 million in revenue from product sales during the second quarter, then that figure is the total amount of money that the firm made from selling the product. During the previous quarter, ABC had revenues of $75 million. An investor looking at those figures might be impressed by the increase. But closer analysis may reveal a different story. Suppose ABC's operating income was $2 million for the previous quarter and -$10,000 for the next one. Then it means that the company incurred a loss even as it increased sales. Operating income is a reflection of a company's ability to convert its expenses into profits through efficient allocation of its resources. As an illustration, in the earlier example, ABC's increase in profits came at the expense of losses in its income statement. This means that the company was not making optimal use of its resources or was overextending them to generate revenue. This inefficiency could create problems further down the line when it is unable to service debt commitments or further expenses on its balance sheet. While analyzing operating income, it is important to remember that it differs between industries. Because of their dynamics and production process, some industries are more capital intensive as compared to others. Therefore, companies in such industries often report operating income that is significantly lower as compared to companies in other industries. For example, the restaurant and dining industry's labor-intensive operations mean that it has a much lower operating income as compared to technology companies. It is important to remember that operating income is just one of several metrics used to analyze a company or industry's operations. It only tells part of the overall company story and must be used in conjunction with other metrics. For example, suppose that ABC from our earlier example had ambitious plans to expand beyond its local markets within the next two years to capitalize on growing demand for its products. Therefore, it took a hit to its operating income for a couple of quarters to rapidly expand its network. The red ink on its operating income figures in the income statement may not tell you that story. But other metrics, such as increased sales and product traction, might.Calculating Operating Income

Operating Income vs. Net Income

Operating Income vs. Revenue

Analysis Using Operating Income

Operating Income Formula FAQs

The Operating Income Formula is a calculation used to measure the profitability of a business, before accounting for taxes and other non-operating expenses. It is calculated by subtracting operating expenses from total revenue.

Operating income is an important measure of a company’s performance because it shows how much profit was generated solely from operational activities, rather than non-operational activities such as investments or financing decisions. A higher operating income will indicate that the company has been successful in running its operations efficiently and effectively.

To calculate operating income, subtract operating expenses from total revenue. Operating expenses include costs associated with labor, materials, and other services used to generate sales.

Items such as taxes, interest income, non-operating income, and extraordinary gains or losses are not included in the operating income calculation.

Changes in operating income can directly affect a company’s profitability and financial position. An increase in operating income indicates that the company is becoming more efficient at generating profits from its operations while a decrease may indicate that it is losing money due to rising costs or declining sales. Thus, tracking changes in operating income is important for monitoring a company's financial health.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.