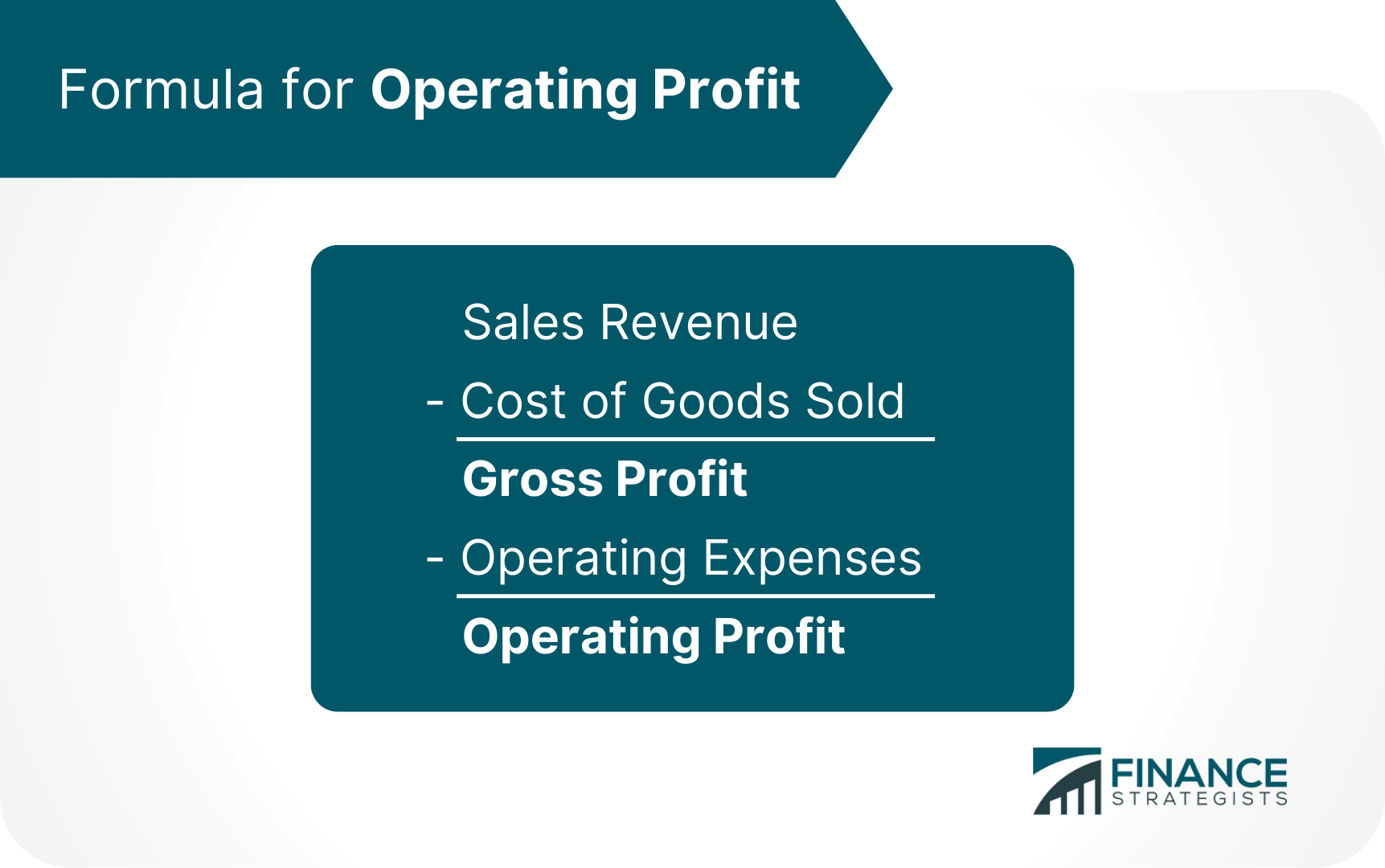

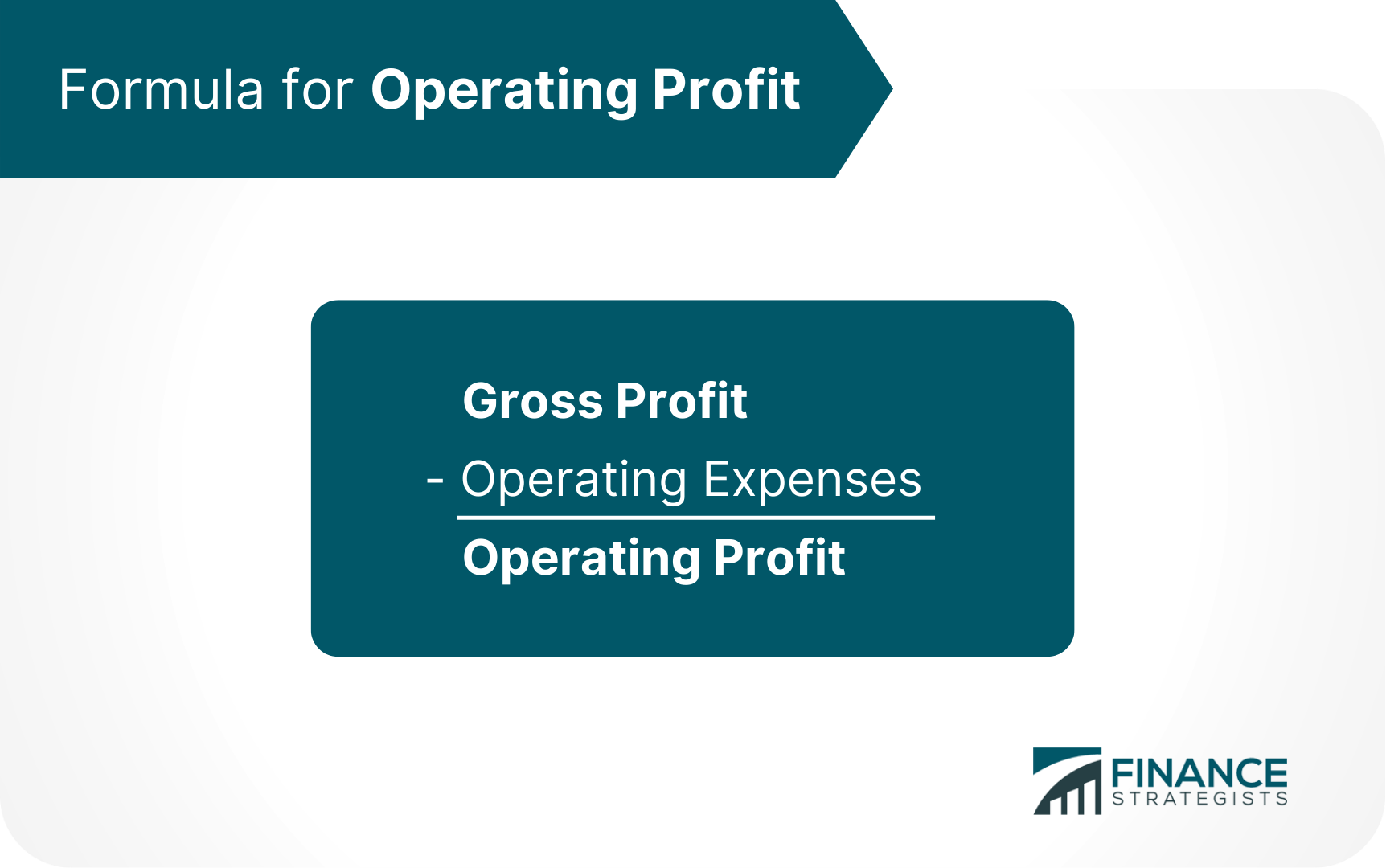

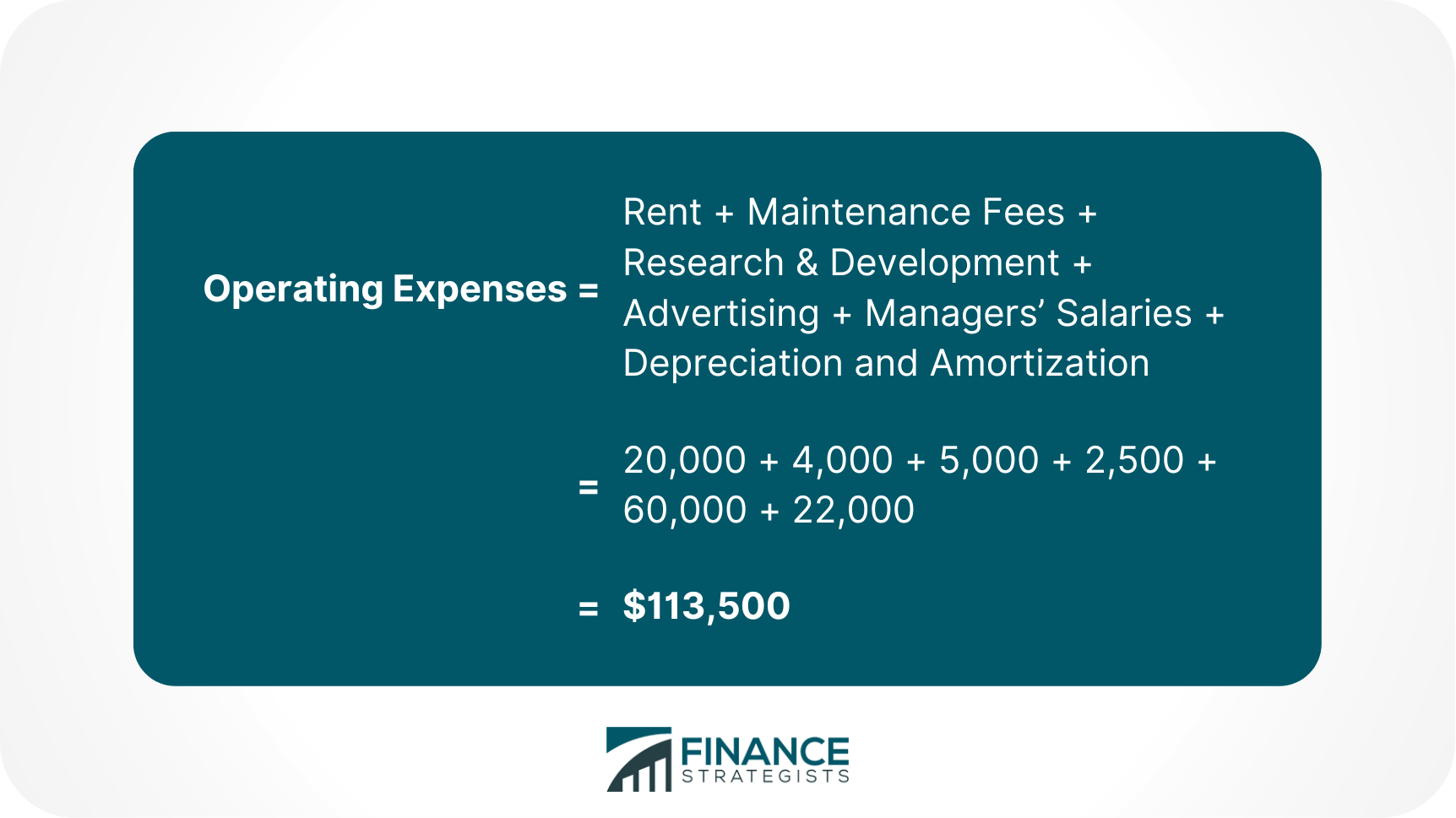

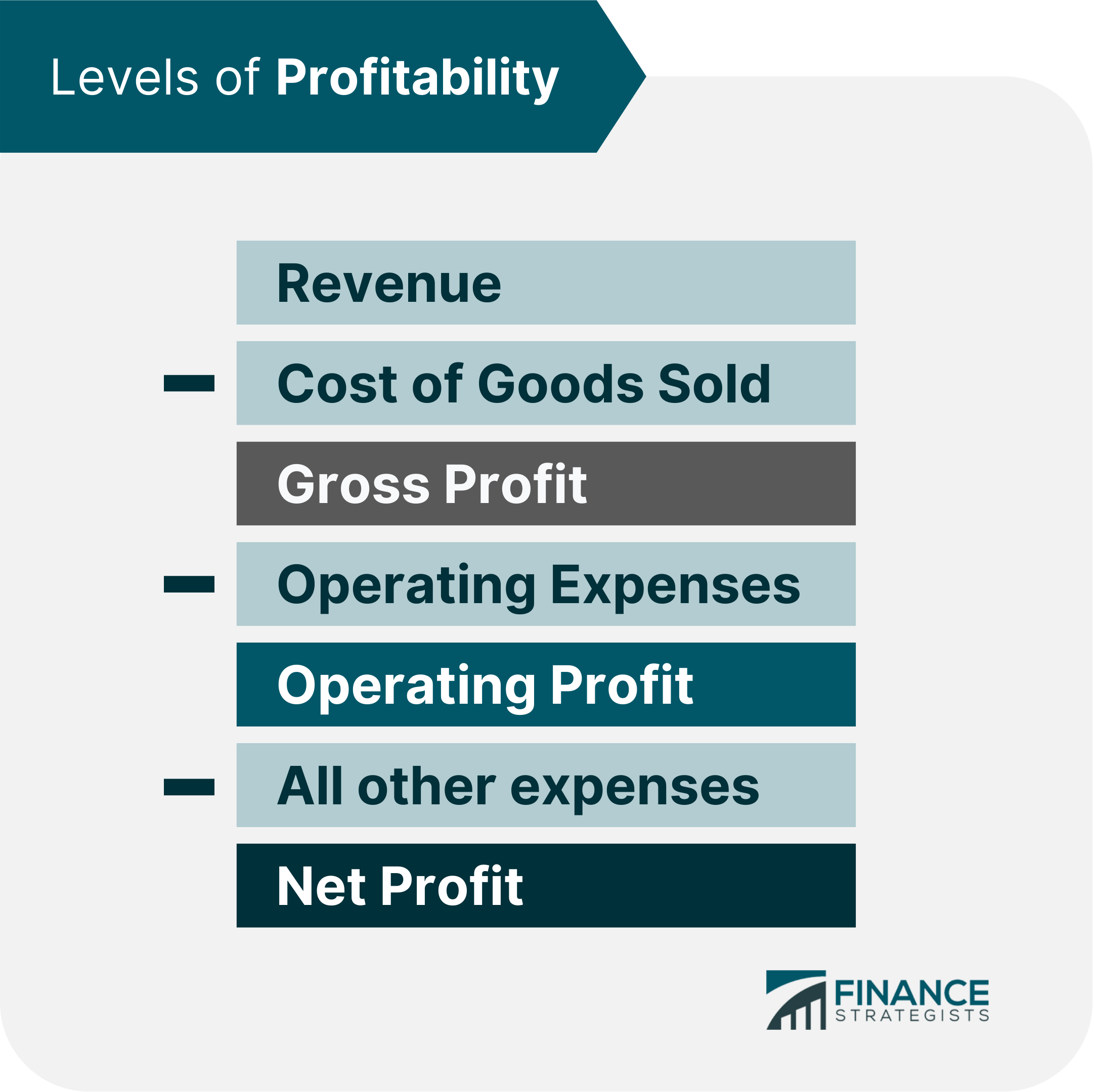

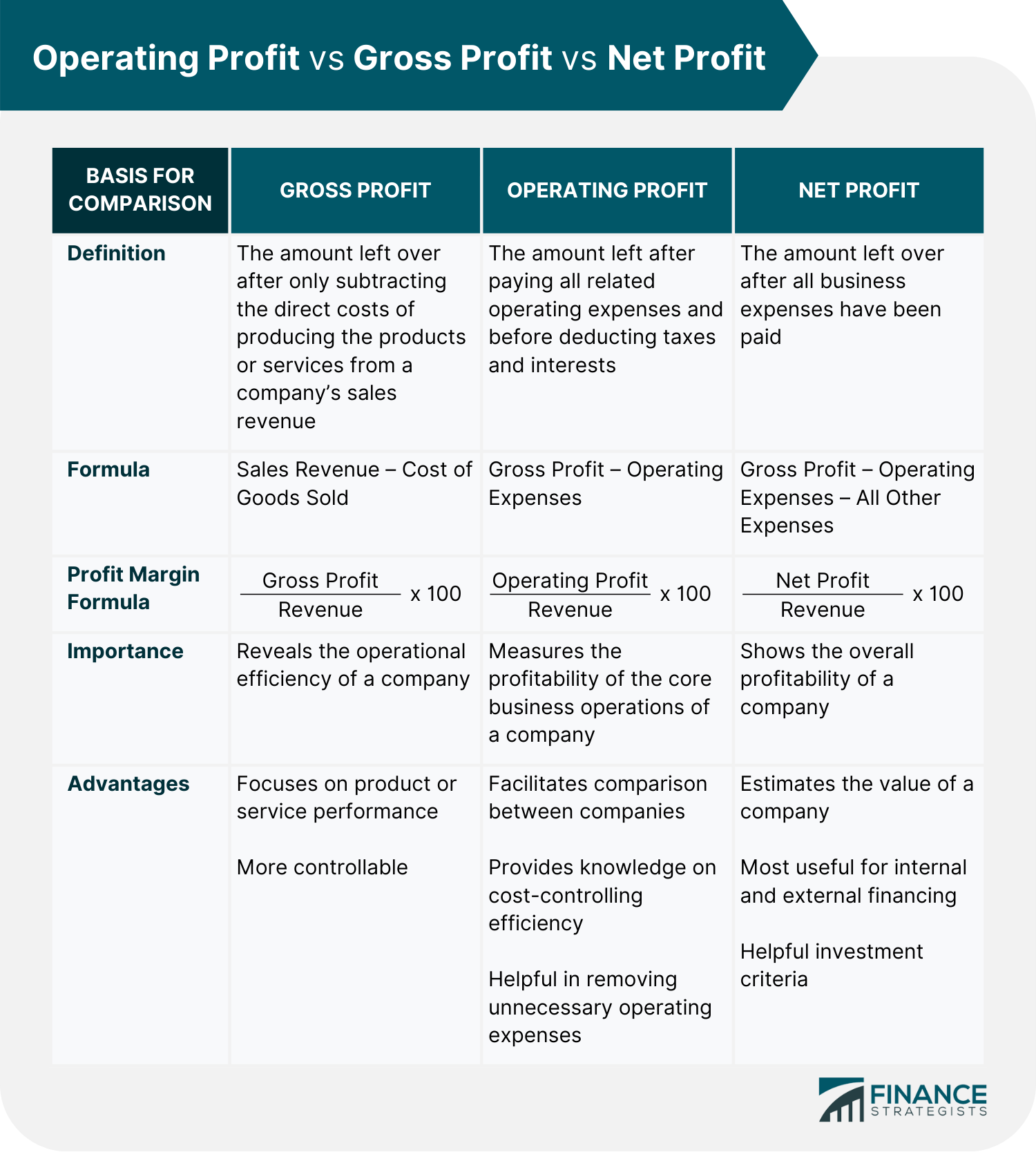

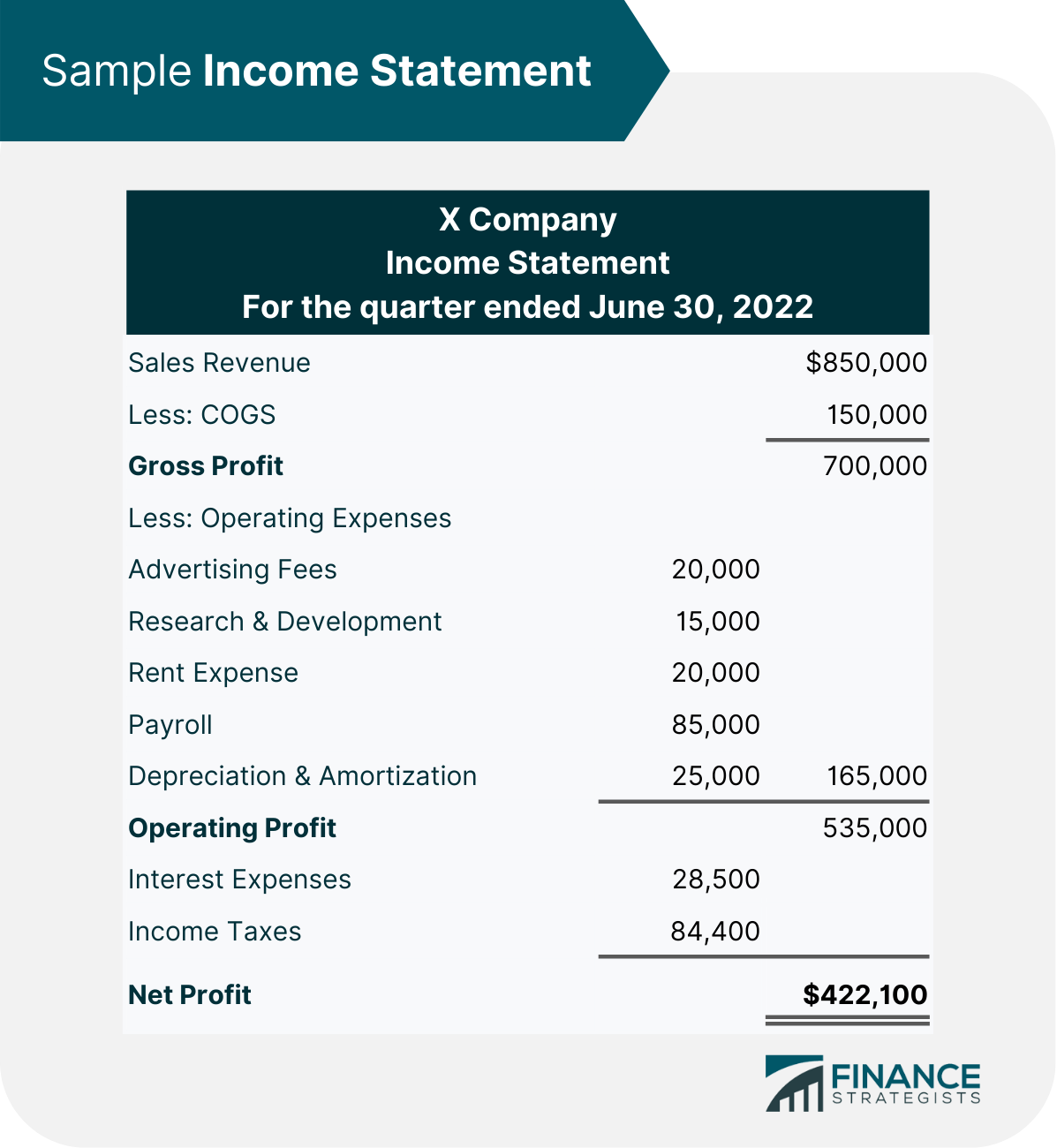

Operating profit, also referred to as operating income or income from operations, is the total income of a company for a given period after paying all related operating expenses and before taking into account interest, taxes, and other non-operating items. It is calculated by taking a company’s revenue and subtracting the cost of goods sold (COGS) and operating expenses. Operating expenses are the ongoing costs of running the business and may include items such as rent, employee payroll, depreciation, inventory costs, and marketing expenses. Operating profit is essential because it measures the profitability of a company’s core business operations or the main way that a company generates revenue. The formula to calculate operating profit is as follows: Given that gross profit is obtained by subtracting COGS from sales revenue, the formula for calculating operating profit can also be written as: Sales revenue is the value of generated sales of goods and services from normal business operations during a set period of time. It is also considered the "top line" figure because it appears at the top of an income statement. COGS refers to the direct costs incurred in producing the goods and services sold by a company. It includes the cost of materials and labor directly used to create the goods and services, excluding indirect expenses, such as sales force costs and distribution costs. COGS is also known as "cost of sales." Operating expenses are those expenses incurred by the company from its normal business operations, excluding COGS. It takes into account selling, general and administrative (SG&A) expenses, equipment, rent, inventory costs, payroll, marketing, step costs, depreciation, and funds allocated for research and development. Assume ABC Company recorded sales revenue worth $400,000 in the previous month. For the time period, the COGS was $55,000, rent was $20,000, maintenance fees were $4,000, research & development $5,000, advertising $2,500, managers’ salaries were $60,000, and depreciation and amortization were $22,000. First, calculate the operating expenses: Operating profit would be: So, in the previous month, ABC Company generated an operating profit of $231,500. Gross profit, operating profit, and net profit are the three levels of profitability of a business. Each of these metrics shows a profit at different moments of the production cycle and earnings process. These three financial metrics can be found on the income statement of a company and the order in which they appear helps understand the relationship between them and their importance. Compared to gross profit, operating profit gives clearer insights into a company's health because it takes into account all relevant operating items. Whereas, gross profit only considers the direct costs associated with revenue generation or COGS. Operating profit is a good metric to assess the company's core profitability. However, it is not the final number that stakeholders should focus on. Indeed, there are certain non-operating items, such as interest and taxes, that can have a significant impact on the bottom line. Net profit, also called net income, is the final profit figure that appears on the income statement. It takes into account the COGS, operating, and non-operating items. From an accounting perspective, net profit is the most accurate measure of profitability because it includes all items that impact the bottom line. However, from an investor's perspective, operating profit is often a more useful metric because it excludes items that are not directly related to the company's core operations. Here is a comparison chart of gross profit, operating profit, and net profit: Below is a sample income statement to clearly illustrate the differences and locations of gross profit, operating profit, and net profit. From the example above, gross profit was $700,000 for the period, achieved by subtracting $150,000 in COGS from the revenue of $850,000. Operating profit was $535,000 for the period, calculated by taking the gross profit of $700,000 minus operating expenses and depreciation and amortization of $15,000 (labeled as total expenses). Net profit, located at the bottom of the income statement, was $422,100 for the period, and was obtained by subtracting non-operating expenses ($28,500) and income taxes ($84,400) from operating profit. Operating profit margin is a profitability ratio used to determine the percentage of the profit the company generates from its operations before deducting the interest and taxes. It is calculated by dividing the operating profit of the company by its revenue and multiplying the result by 100. Using the previous example on operating profit, the operating profit margin will be: $231,500 / $400,000 x 10 = 58% Investors use operating profit margin to determine how much a company earns in terms of operating profit, thus ensuring efficiency and profitability. Additionally, the operating profit margin is often used as a metric to benchmark one company to other similar companies within the same industry. It can reveal the top performers within a particular industry and show the need for further research as to why a specific company is outperforming or falling behind its competitors. The operating profit margin is usually recognized as a superior indicator of the strength of a company's management team because it assesses their financial decision-making on office rent, staffing, equipment, and other operating expenses. Here are four ways to improve operating profit: A company can increase its operating profit by reducing the cost of goods and services it sells. This can be done through effective cost management and negotiation with suppliers for a lower price. A product-packaging design that is less expensive can also be considered to save additional cost per item. Although often overlooked, product packaging is a contributing expense. Improving inventory management can be done by reducing the amount of inventory on hand and increasing turnover. This, in turn, will reduce storage costs, obsolescence, and shrinkage. An effective inventory management system can help track stock levels and enable just-in-time ordering to avoid tying up too much capital in inventory. Conducting daily inventory inspections and asking employees to record the number of items returned or broken can help keep track of stock levels. It can help a company make better sales, purchasing, and marketing decisions. This allows the company to sell more products and reduce the need for markdowns. The average company loses more than 20% of its productive capacity to organizational drag — the structures and processes that consume valuable time and prevent employees from getting things done. Companies must regularly evaluate their processes to ensure they are not slowing people down or reducing their productivity. They need to create procedures that can easily be replicated and implemented by the employees when business operators are not around. One way to increase operating profit is to increase the average order value. This can be achieved by cross-selling and upselling complementary products to customers. Another way to do this is by bundling products together at a discounted price. This encourages customers to buy more items from the company, which will increase revenue and operating profit. Operating profit is the profit made from a company's main activities after deducting all costs associated with running the business and before deducting taxes and interest. It is calculated by subtracting a company's operating expenses, including depreciation and amortization, from its gross profit. The operating profit margin is the ratio of operating profit to total revenue, and it is used to measure a company's profitability and efficiency. There are a few key ways to improve operating profit, which include reducing the cost of goods, improving inventory management, boosting staff productivity, and increasing the average order value. When managed correctly, increasing operating profit can be a helpful way to grow a company's bottom line.What Is Operating Profit?

Formula for Operating Profit

Sales Revenue

COGS

Operating ExpensesOperating Profit Calculation

Operating Profit vs Gross Profit vs Net Profit

Operating Profit Margin

How to Improve Operating Profit

Reduce the Cost of Goods

Improve Inventory Management

Boost Staff Productivity

Increase Average Order Value

Conclusion

Operating Profit FAQs

Operating profit is the profit made from a company's main activities after deducting all costs associated with running the business and before deducting taxes and interest.

Operating profit is the amount left after paying all related operating expenses and before deducting taxes and interests. Gross profit is the profit made from a company's main activities, after deducting the cost of goods sold but before deducting any other operating expenses. Net profit is the amount of profit left over after all business expenses have been paid.

Operating profit is calculated by subtracting a company's operating expenses from its gross profit.

Operating profit can give you insight into how well a company is run and whether or not it is profitable. It can also help you compare different companies to see which is more efficient. Additionally, operating profit margin is a key metric for investors and creditors when considering whether or not to invest in or loan money to a company.

Operating profit margin is the ratio of operating profit to total revenue, and it is used to measure a company's profitability and efficiency.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.