Technical analysis is a methodology used to evaluate securities by analyzing statistics generated by market activity, such as past prices and volume. It employs chart patterns, indicators, and other analytical tools to predict price movements and identify trading opportunities. The roots of technical analysis can be traced back to ancient times, with early applications seen in rice trading in 18th century Japan. However, the framework we recognize today started in the late 19th century when Charles Dow developed his theory that markets move in identifiable patterns. The Dow Theory, named after Charles Dow, co-founder of Dow Jones & Company, is a cornerstone of technical analysis. It asserts that market movements are not random but move in identifiable trends and patterns that can be leveraged for predictive purposes. The Dow Theory rests on several assumptions: markets reflect all available information; prices move in trends; and these trends continue until significant signals indicate their end. Additionally, the Dow Jones Industrial and Rail averages should confirm each other to validate market trends. Dow Theory states that the market moves in three primary trends: the primary trend, the secondary trend, and the minor trend. The primary trend is the dominant long-term trend, usually lasting for months to years, and represents the major direction of the market. Secondary trends are shorter-term corrections or counter-trends against the primary trend, typically lasting from a few weeks to a few months. The minor trend consists of day-to-day fluctuations within the secondary trend. The primary trend can be further divided into three distinct phases: the accumulation phase, the public participation phase, and the distribution phase. During the accumulation phase, smart money or informed investors start acquiring positions in anticipation of an upcoming bull market. In the public participation phase, the broader public recognizes the upward trend and starts entering the market. Finally, in the distribution phase, smart money begins selling their positions to less-informed investors, leading to a potential reversal. According to this principle, all known information, including fundamental factors, economic conditions, and investor psychology, is already reflected in the current market price. Dow believed that the collective wisdom of all market participants determines the price, making it a reflection of the overall market sentiment and expectations. Dow Theory emphasizes the importance of confirming market signals between the industrial and transportation averages. According to Dow, for a trend to be considered valid, both averages (such as the DJIA and the Dow Jones Transportation Average) should move in the same direction. If one average reaches a new high or low, the other average should also confirm that movement. Divergences between the two averages could indicate a potential reversal or weakness in the trend. Dow believed that trading volume should validate the trend. In an uptrend, volume should increase as prices rise and decrease during corrective phases. Similarly, in a downtrend, volume should expand during declines and diminish during temporary rallies. The principle suggests that volume acts as a confirming indicator, supporting the prevailing trend and indicating the participation of market players. The final tenet of Dow Theory states that trends are assumed to continue until there is definitive evidence of a trend reversal. Traders and investors should not assume that a trend will reverse until there are clear indications or signals that the trend has indeed changed. It is important to be cautious and not anticipate a reversal based on assumptions or minor fluctuations alone. Dow Theory helps identify market trends and trend reversals, serving as a valuable tool for traders and investors to align their positions with the prevailing market trend. Dow Theory can be used to analyze sectors' performance by comparing sector averages to the broader market averages, helping investors make informed decisions. Despite being over a century old, Dow Theory remains relevant in today's high-tech, global markets. Traders worldwide still use its principles to gauge the health of the market and identify potential trading opportunities. Incorporating Dow Theory into a trading strategy can help investors time their entries and exits, potentially improving their returns. By aligning trades with the primary trend, investors can reduce the risk of betting against market momentum. While powerful on its own, Dow Theory becomes even more effective when combined with other technical analysis tools, such as Fibonacci retracement, moving averages, or RSI, to confirm trends and generate trading signals. Dow Theory can assist in managing investment risk by helping traders identify trend reversals. Exiting positions when the trend changes can limit losses and protect profits. Dow Theory relies heavily on the interpretation of chart patterns and price movements, which can be subjective. Different analysts may interpret the same information differently, leading to conflicting conclusions. Dow Theory primarily focuses on price and volume patterns and does not incorporate quantitative analysis or fundamental factors. Critics argue that it overlooks important aspects such as earnings, financial ratios, and economic indicators that can impact stock prices. Dow Theory was developed in the early 20th century when the financial markets were significantly different from today. The theory's principles were designed primarily for analyzing industrial and transportation stocks and may not be as applicable to the modern, complex, and globalized financial markets. Critics argue that Dow Theory tends to be a lagging indicator, as it relies on historical price movements to identify trends. By the time a trend is confirmed, a significant portion of the price move may have already occurred, reducing the effectiveness for traders seeking timely entry or exit points. Dow Theory provides general principles but does not offer specific rules for entry, exit, or position sizing. Traders may find it challenging to translate the theory into actionable trading strategies without additional guidance. Dow Theory places significant emphasis on the movements of stock market averages, particularly the Dow Jones Industrial Average and the Dow Jones Transportation Average. Critics argue that this focus on a limited number of stocks may not accurately represent the entire market or specific sectors. While Dow Theory can identify trends and potential reversals, it does not provide a reliable method for precise market timing. It may generate false signals or miss short-term fluctuations, making it challenging for traders to time their entries and exits effectively. The Dow Theory has established itself as a foundational framework in technical analysis, providing traders and investors with valuable insights into market trends and reversals. Its enduring relevance in today's financial markets is a testament to its effectiveness and adaptability. By understanding the three primary trends, the phases within those trends, and the importance of confirmation through volume and market averages, market participants can make informed decisions aligned with the prevailing market sentiment. Incorporating the Dow Theory into trading strategies, particularly when combined with other technical analysis tools, can enhance risk management and improve investment returns. However, it is important to acknowledge the criticisms and limitations of the Dow Theory, such as subjectivity, the absence of specific trading rules, and its potential as a lagging indicator. Despite these drawbacks, the Dow Theory remains a valuable tool for market analysis and continues to shape the approach of traders worldwide.Overview of Technical Analysis

What Is the Dow Theory?

The Six Tenets of the Dow Theory

The Market Has Three Movements

Market Trends Have Three Phases

The Stock Market Discounts All News

Stock Market Averages Must Confirm Each Other

Trends Are Confirmed by Volume

Trends Exist Until Definitive Signals Prove They Have Ended

Dow Theory in Market Analysis

Application in Trend Identification

Use in Sector Analysis

Relevance in Modern Financial Markets

Dow Theory in Trading Strategies

Utilization in Investment Decision Making

Integration With Other Tools

Importance in Risk Management

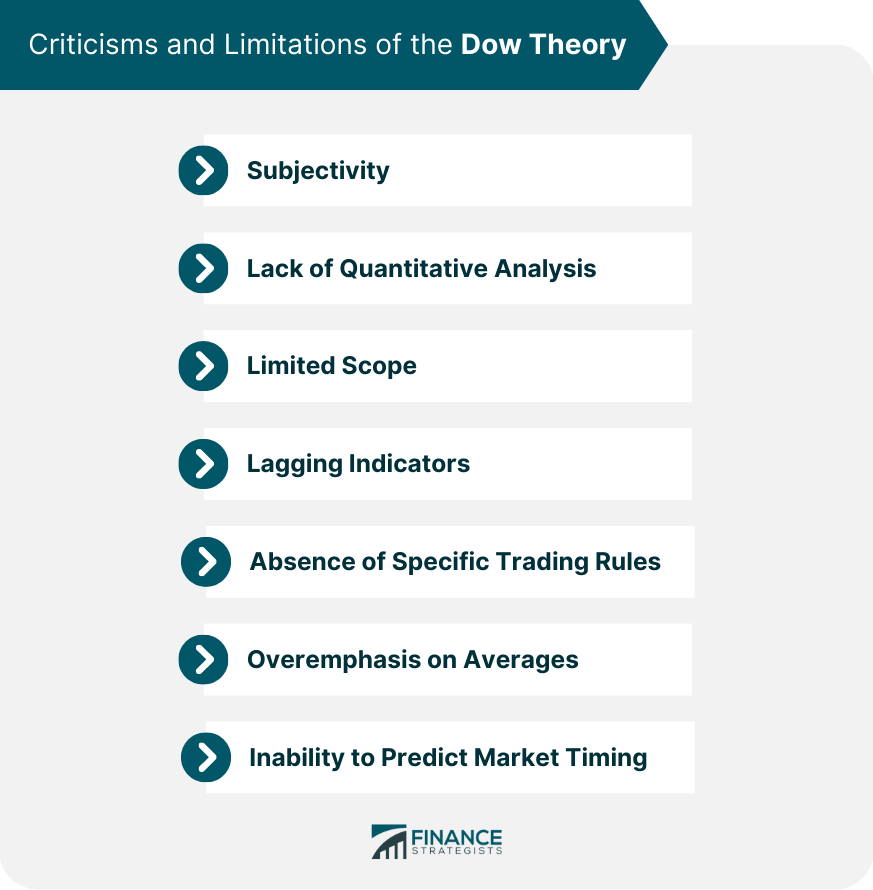

Criticisms and Limitations of the Dow Theory

Subjectivity

Lack of Quantitative Analysis

Limited Scope

Lagging Indicators

Absence of Specific Trading Rules

Overemphasis on Averages

Inability to Predict Market Timing

Final Thoughts

Dow Theory FAQs

The six tenets are: the market has three movements; market trends have three phases; the stock market discounts all news; stock market averages must confirm each other; trends are confirmed by volume; and trends exist until definitive signals prove they have ended.

Dow Theory, a cornerstone of technical analysis, provides a framework for understanding market trends and identifying potential reversals. It emphasizes the confirmation of trends by stock market averages, the importance of volume in validating trends, and the need for definitive signals to indicate trend changes.

Yes, Dow Theory can be effectively integrated with other technical analysis tools. Combining Dow Theory with tools like Fibonacci retracement, moving averages, or relative strength index (RSI) can enhance trend confirmation and generate more robust trading signals.

Despite the evolution of high-frequency and algorithmic trading, Dow Theory remains relevant in modern financial markets. Its focus on longer-term trends and overarching market perspective provides valuable insights for traders and investors.

Dow Theory has some limitations, including challenges in real-time trend identification, its relevance in high-frequency trading environments, and its limitations in forecasting major macroeconomic events. However, its core principles still offer valuable guidance in understanding market behavior and making informed trading decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.