Gann Fans are a technical analysis tool developed by legendary trader W.D. Gann. They consist of a series of diagonal lines that are drawn on a price chart to identify key support and resistance levels, as well as potential trend lines. Gann Fans are based on the principle that price movements tend to follow geometric angles, which can provide valuable insights into future market behavior. These angles are drawn from an anchor point and extend into the future, helping traders make informed decisions about market trends and potential price reversals. Gann Fans play a vital role in wealth management strategies. They provide traders with a visual representation of price movements and potential support and resistance levels. By analyzing these levels, traders can determine optimal entry and exit points, manage risk effectively, and enhance profitability. Gann Fans offer a unique perspective on market trends and can be used across various financial markets, including stocks, commodities, and forex. Incorporating Gann Fans into wealth management strategies allows traders to make informed decisions and navigate the complex world of financial markets more effectively. At the core of Gann Fans are the geometric angles derived from Gann's studies. The primary angle used in Gann Fans is the 1x1 angle, which represents a 45-degree angle on the price chart. According to Gann's principles, this angle indicates a balanced relationship between time and price. Additional angles used in Gann Fans include the 1x2, 2x1, 3x1, and 4x1 angles. Each angle provides unique insights into the price-time relationship and can help identify potential support and resistance levels. Gann Fans are based on the understanding that time and price relationships play a crucial role in market movements. Gann believed that markets have natural cycles and that these cycles can be analyzed using the principles of time and price. Gann Fans enable traders to analyze the relationship between time and price, providing insights into potential market trends, reversals, and price targets. By understanding these relationships, traders can make more informed decisions about when to enter or exit trades, effectively managing risk and optimizing profitability. One of the key principles of Gann Fans is their ability to identify trends and forecast future price movements. By drawing the fan lines from the anchor point, Gann Fans create a framework that helps traders visualize potential trend lines and the direction of the market. Gann Fans can assist in identifying the strength and duration of a trend, as well as potential areas of support and resistance. This information is invaluable for traders in making strategic decisions, such as setting profit targets or stop-loss levels. The anchor point is the starting reference point for drawing Gann Fans. It is usually a significant swing high or swing low on the price chart. The anchor point serves as the foundation for the fan lines and helps traders identify key levels of support and resistance. The accuracy of the anchor point selection is critical in determining the reliability of the Gann Fans. Traders should choose anchor points that are significant and reflect the overall market structure. The fan lines are the diagonal lines drawn from the anchor point. These lines represent the different angles used in Gann Fans and provide insights into potential support and resistance levels, as well as trend lines. The key fan lines in Gann Fans include the 1x1 line, 1x2 line, 2x1 line, 3x1 line, and 4x1 line. Each line represents a different relationship between time and price and can help traders identify significant price levels and trend directions. The spacing between the fan lines can vary depending on the price scale and the time period being analyzed. Traders can adjust the spacing to fit the specific market they are trading. Gann Fans are widely used to identify key support and resistance levels. The fan lines serve as potential areas where prices may encounter obstacles or reversals. Traders can observe how the price interacts with the fan lines to determine potential support and resistance levels. These levels can be used to set profit targets, place stop-loss orders, or assess the overall strength of a trend. Another important application of Gann Fans is in determining trend direction and strength. By observing the angle and position of the fan lines, traders can assess the overall trend and its potential continuation or reversal. Steep fan lines indicate a strong trend, while flatter fan lines suggest a weaker trend. Traders can use this information to make informed decisions about entering or exiting trades, as well as managing their positions in line with the prevailing trend. Gann Fans can assist traders in timing their market entry and exit points. By observing how the price interacts with the fan lines, traders can identify potential market turning points or areas of price acceleration. When the price approaches a fan line, it can act as a signal for traders to consider entering or exiting a position. This timing component can enhance trading accuracy and profitability, as traders align their trades with potential support or resistance levels. One limitation of Gann Fans is the subjective nature of their interpretation. Traders may have different opinions on selecting the anchor point or adjusting the fan lines' spacing. This subjectivity can lead to varying interpretations and potential inconsistencies in trading decisions. To mitigate this limitation, traders should combine Gann Fans with other technical analysis tools and indicators to validate their trading signals. Gann Fans are not immune to false signals and whipsaws, particularly in volatile or choppy markets. The price may briefly break through a fan line, only to reverse direction and continue its original trend. Traders should exercise caution and consider using additional confirmation indicators or patterns to reduce the risk of false signals and whipsaws when relying solely on Gann Fans for trading decisions. Like any technical analysis tool, Gann Fans are susceptible to market volatility and unexpected events that can disrupt price patterns and trends. Extraordinary events such as economic crises, geopolitical tensions, or unexpected news can cause sudden price movements that may invalidate the accuracy of Gann Fans. Traders should remain vigilant and adjust their trading strategies accordingly to account for market volatility and unforeseen events. Gann Fans are a valuable technical analysis tool used to identify support and resistance levels, determine trend direction and strength, and time market entry and exit points. They are based on the principles of geometric angles, time and price relationships, and trend identification and forecasting. Gann Fans consist of an anchor point, which serves as the reference point, and fan lines that represent the different angles used in the analysis. The fan lines provide insights into support and resistance levels and trend lines, assisting traders in making informed trading decisions. Gann Fans find applications in identifying support and resistance levels, determining trend direction and strength, and timing market entry and exit points. However, traders should be aware of the subjectivity in interpretation, the risk of false signals and whipsaws, and the impact of market volatility and unpredictable events. Incorporating Gann Fans into wealth management strategies can provide traders with valuable insights and enhance their decision-making process. By utilizing Gann Fans alongside other technical analysis tools, traders can develop a comprehensive approach to managing their portfolios and optimizing their trading strategies.Definition of Gann Fans

Purpose of Gann Fans

Principles of Gann Fans

Geometric Angles

Time and Price Relationships

Trend Identification and Forecasting

Components of Gann Fans

Anchor Point

Fan Lines

Application of Gann Fans in Wealth Management

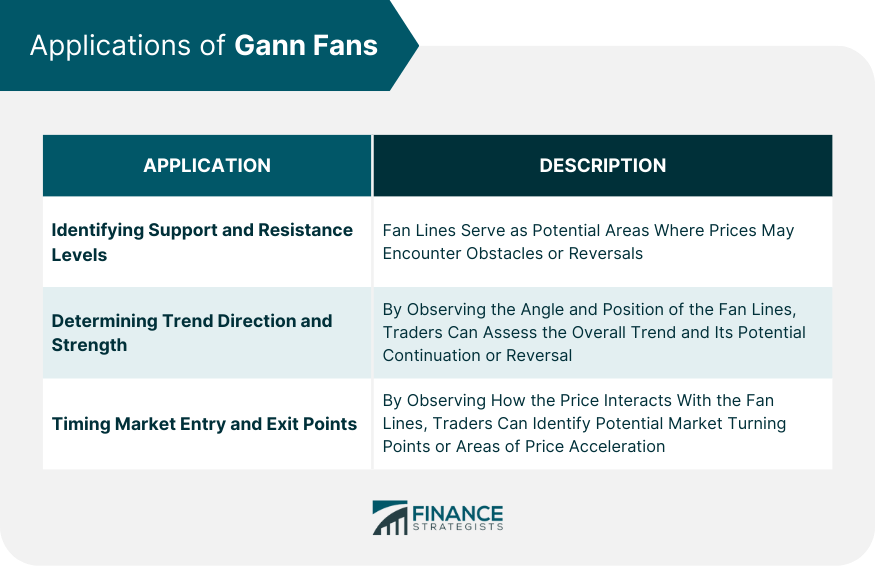

Identifying Support and Resistance Levels

Determining Trend Direction and Strength

Timing Market Entry and Exit Points

Limitations and Risks of Gann Fans

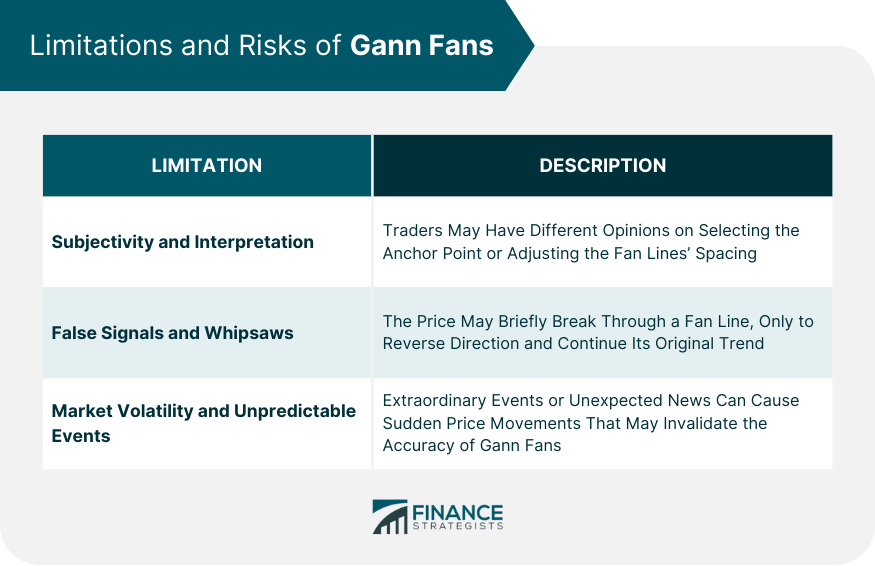

Subjectivity and Interpretation

False Signals and Whipsaws

Market Volatility and Unpredictable Events

Conclusion

Gann Fans FAQs

Gann Fans are a technical analysis tool consisting of diagonal lines drawn on a price chart to identify support and resistance levels, trend lines, and potential market turning points.

Gann Fans are based on the principles of geometric angles, time and price relationships, and trend identification. By analyzing the interaction between price and the fan lines, traders can make informed decisions about market trends and potential price reversals.

The components of Gann Fans include an anchor point, which serves as the reference point, and fan lines that represent different angles derived from Gann's studies.

Gann Fans can be applied in wealth management to identify support and resistance levels, determine trend direction and strength, and time market entry and exit points. They provide traders with valuable insights for making informed trading decisions.

Limitations of Gann Fans include the subjective nature of interpretation, the risk of false signals and whipsaws, and the impact of market volatility and unpredictable events. Traders should use Gann Fans in conjunction with other technical analysis tools and exercise caution in their application.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.