Gapping, a term in technical analysis, refers to a situation where a significant price discrepancy exists between the closing price of a trading session and the opening price of the next. It is typically triggered by impactful news events or substantial economic announcements that affect investors' sentiment toward the security. Gaps can occur in both directions, referred to as up-gaps and down-gaps, indicating strong bullish or bearish momentum, respectively. Gapping serves as a valuable indicator for traders and investors, enabling them to anticipate potential trend reversals or continuations, facilitating better-informed decisions. Understanding gapping is essential in the broader context of chart patterns and price action analysis. However, gaps should be interpreted with caution and corroborated with other technical indicators, as they might also represent temporary volatility. Awareness of this phenomenon significantly influences trading strategies, particularly concerning entry and exit points. The phenomenon of gapping in trading, characterized by the emergence of a stark discontinuity in price progression, is manifested in different forms, each bearing its distinct implications. Common gaps, as the term suggests, are the most frequently encountered form of gapping in financial markets. These gaps are characterized by their relatively short-term nature and are often promptly filled, meaning the prices tend to return to pre-gap levels swiftly. This transient nature of common gaps is attributable to their genesis, as they are typically spawned from standard market volatility and do not carry implications of noteworthy trend alterations. Unlike common gaps, breakaway gaps aren't as frequent but are far more consequential. They emerge at the inception of a new market trend, usually precipitated by a major news announcement or a significant market development. This type of gap appears when the price 'breaks away' from a consolidation or trading range, often accompanied by a noticeable surge in trading volume. Runaway gaps, also referred to as "measuring gaps" or "continuation gaps," emerge amidst a prevailing market trend. They often indicate that the current trend is likely to endure, driven by an increased surge of buyer or seller enthusiasm. These gaps often occur halfway through a price movement, serving as a reaffirmation of the trend's strength. Exhaustion gaps are typically seen towards the culmination of a price pattern and signal a terminal thrust in price movement before a forthcoming trend reversal. They represent the last gasps of a trend where the participants make a final attempt to push the price in the trend's direction before the sentiment reverses. High trading volumes usually accompany these gaps, as many participants tend to join the trend near its end. Identifying exhaustion gaps can provide a precursor to a potential trend reversal, offering opportunities for contrarian traders. Unexpected news events, encompassing geopolitical shifts, natural disasters, or surprising corporate developments, can abruptly compel traders to reassess the value of a security. Such rapid reevaluation can result in an immediate shift in demand or supply, leading to a gap. Earnings announcements are pivotal milestones in a company's financial calendar and can significantly sway its stock prices. When reported earnings notably exceed or fall short of market expectations, the ensuing reaction can lead to a gap. A substantial earnings beat might spark a gap up, while a considerable miss could trigger a gap down. Economic reports and indicators wield a considerable influence on financial markets. Significant macroeconomic data, including employment statistics, GDP growth, inflation rates, or central bank policy changes, among others, hold the potential to generate gaps. These reports are critical as they offer glimpses into a country's economic health and future prospects. Financial analysts play a crucial role in shaping market sentiment toward individual stocks. They scrutinize companies' fundamentals, industry positions, and broader market trends to deliver a verdict on the company's potential performance. When these professionals upgrade or downgrade their ratings of a company, it can significantly impact the stock's demand. The analysis of gap patterns helps traders determine potential price movements. By studying the characteristics of various gaps, like their size or volume, and the context in which they occur, traders can predict whether a gap might signal a continuation of the trend or a possible reversal. Volume plays a crucial role in gap analysis. High trading volumes during a gap suggest strong investor sentiment, making it less likely that the gap will close rapidly. Traders employ several technical indicators to predict gap reversals, such as moving averages, oscillators like the relative strength index (RSI), or candlestick patterns. Gaps can create a sense of excitement or fear among traders, leading to increased trading activity. A gap up may attract buyers hoping to ride the upward momentum, while a gap down could trigger selling as traders try to limit their losses. From a psychological perspective, gaps can represent market inefficiencies, and traders may view them as opportunities to profit until the market 'corrects' itself and the gap is filled. Gaps can contribute to market volatility, particularly when they occur due to unexpected news or events. In such situations, gaps can lead to rapid and significant price changes, increasing market volatility. The Gap and Go strategy is a popular approach for day traders based on the idea that the price will continue moving in the direction of the gap. In the Fade Gap strategy, traders assume that the price will reverse course and 'fill' the gap. This strategy is typically used with common gaps, which tend to close quickly. Similar to the Fade Gap strategy, the Fill Gap strategy involves betting that the price will reverse and fill the gap. The primary difference is that it is used more in longer-term trading. Slippage occurs when a trade is executed at a different price than expected, often due to gaps. Traders can mitigate this risk by using limit orders instead of market orders. Overnight trading is subject to gap risk as significant news can occur outside regular trading hours, leading to a gap at the market opening. Traders manage the risks associated with gapping through various means, such as using stop-loss orders, trading derivatives that offer gap protection, or hedging their positions. Gapping is a pivotal occurrence in financial trading manifested as significant price discrepancies between the closing and opening values of different trading sessions. It takes various forms - common, breakaway, runaway, and exhaustion gaps - each bearing distinct implications for market trends. Factors leading to gap formation encompass news events, earnings announcements, economic reports, and changes in analyst ratings. Analyzing gaps, their patterns, volumes, and potential for reversal, enables traders to make informed decisions. Gapping dramatically influences market sentiment, triggering varying investor behaviors and affecting market volatility. Strategies such as the Gap and Go, Fade Gap, and Fill Gap, help traders capitalize on these occurrences. However, it's crucial to remember the associated risks, such as slippage and overnight trading gap risks. To successfully navigate the complexities of gapping, it is crucial to employ effective risk management strategies such as the utilization of stop-loss orders, trading derivatives, and hedging. A comprehensive understanding of gapping can greatly improve one's trading skills and facilitate well-informed decision-making.What Is Gapping?

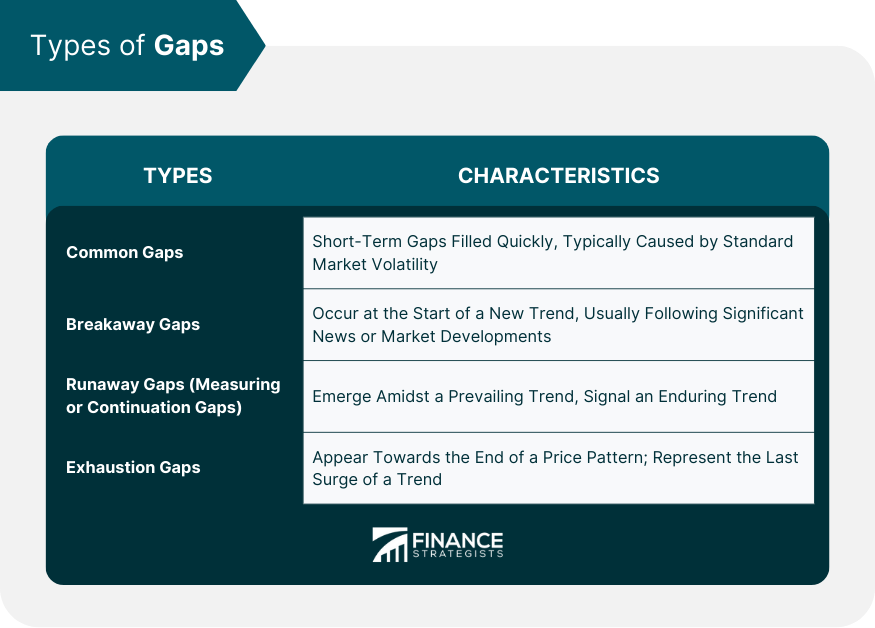

Types of Gaps

Common Gaps

Breakaway Gaps

Runaway Gaps

Exhaustion Gaps

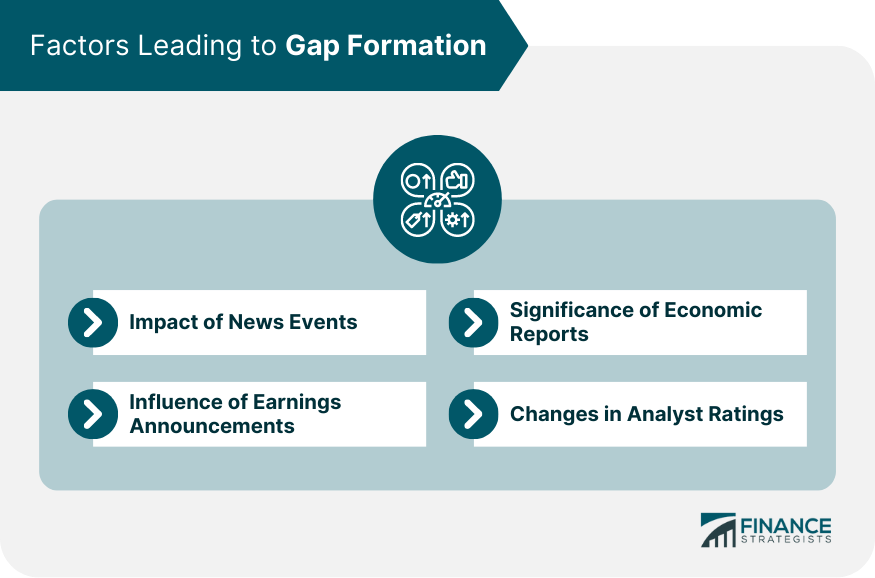

Factors Leading to Gap Formation

Impact of News Events

Influence of Earnings Announcements

Significance of Economic Reports

Changes in Analyst Ratings

Analyzing Gapping in the Stock Market

Understanding Gap Patterns

Role of Volume in Gap Analysis

Indicators of Gap Reversal

Impact of Gapping on Market Sentiment

How Gapping Influences Investor Behavior

Psychological Aspects of Gapping

Effect of Gapping on Market Volatility

Strategies for Trading Gaps

Gap and Go Strategy

Fade Gap Strategy

Fill Gap Strategy

Risks Associated With Gapping

Slippage

Gap Risk in Overnight Trading

Risk Management Strategies for Gapping

Final Thoughts

Gapping FAQs

Gapping refers to a situation in financial trading where a significant price difference exists between the opening of one trading period and the closing of the previous one. This discrepancy creates a 'gap' on the price chart where no trading has occurred, usually triggered by a substantial shift in market sentiment or news events.

There are four primary types of gaps: Common, Breakaway, Runaway, and Exhaustion gaps. Common gaps are minor and often filled quickly. Breakaway gaps signify the start of a new trend. Runaway gaps, also called continuation gaps, indicate an existing trend is likely to continue. Exhaustion gaps occur towards the end of a price pattern, often signaling a forthcoming trend reversal.

Gapping can be incorporated into various trading strategies. For instance, the 'Gap and Go' strategy involves trading in the direction of the gap, expecting the trend to continue. The 'Fade Gap' strategy is based on the expectation that the price will reverse to fill the gap. The 'Fill Gap' strategy also anticipates a return to pre-gap levels.

Not always. While breakaway, runaway, and exhaustion gaps often indicate significant market moves, common gaps, which are the most frequent, typically result from normal market fluctuations and do not necessarily suggest a major trend change.

Yes, gapping can occur in any financial market - stocks, forex, commodities, etc., although the nature of the market can influence the frequency and size of gaps. For instance, due to the 24-hour nature of the forex market, gaps are less common and usually occur over the weekend or due to significant news events.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.