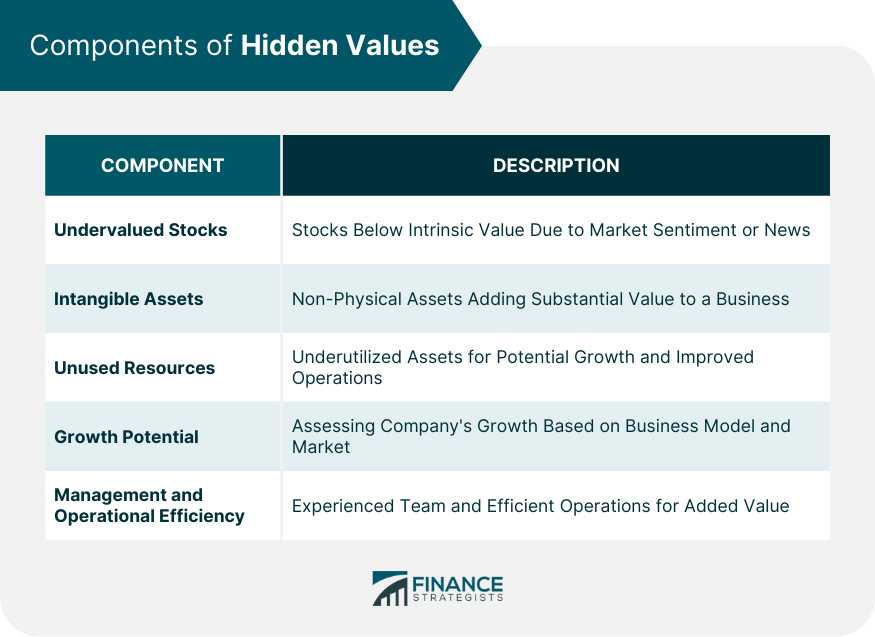

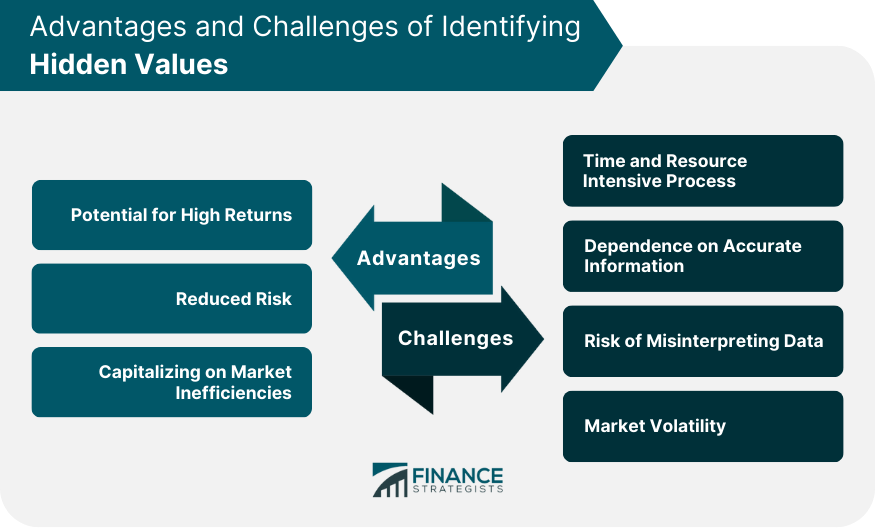

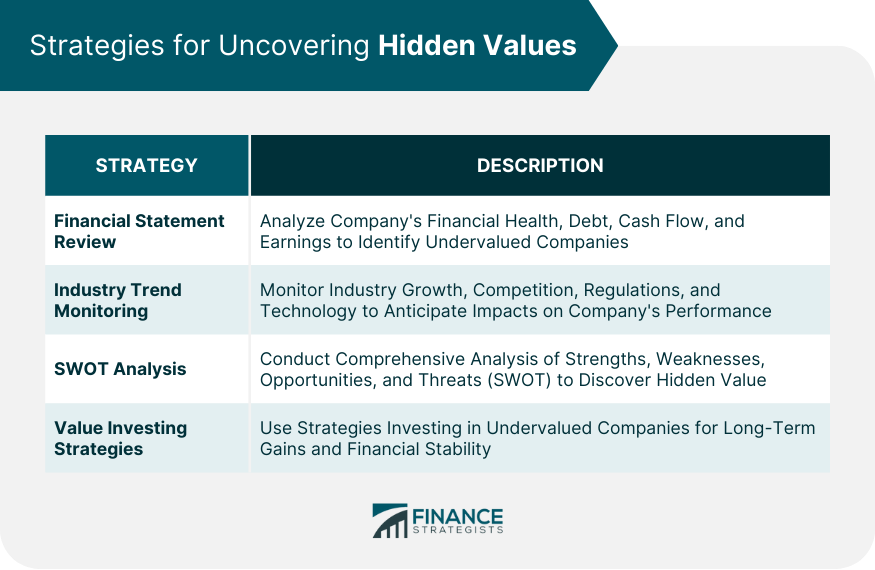

The term 'hidden value' refers to the intrinsic value within a company that is not reflected in its current stock price. This might include intangible assets, growth potential, or operational efficiency. Discovering hidden value is like unearthing a treasure that the market has overlooked. Financial statements are one of the primary tools used in fundamental analysis to discover hidden value. By meticulously reviewing a company's balance sheet, income statement, and cash flow statement, analysts can identify undervalued assets or potential growth opportunities. For example, a firm might possess an abundance of cash reserves that it can invest to expand its business. An undervalued stock is one that trades for less than its intrinsic value. This discrepancy can occur due to various reasons, including market sentiment, financial downturns, or adverse news affecting the company. However, if the underlying fundamentals of the company remain robust, it suggests the stock is undervalued, and thus, contains hidden value. Intangible assets include non-physical items like patents, copyrights, brand reputation, trademarks, and customer loyalty. While these assets might not be visible on the balance sheet, they can add substantial value to a business. A strong brand reputation, for instance, can give a company a competitive edge and increase its market share, leading to higher revenues. Similarly, patents protect a company's proprietary technology, keeping competitors at bay and allowing the company to charge premium prices. This could include underutilized real estate, redundant machinery, or even surplus cash that has not been reinvested into the business. These resources present an opportunity for the company to expand its operations, enhance its product line, or invest in research and development activities, all of which could fuel future growth. Analysts assess growth potential by examining factors like the company's business model, planned expansions, product pipeline, and the overall market size. A company operating in a rapidly expanding industry or one with a robust pipeline of innovative products might have substantial growth potential not yet recognized by the market. By identifying these growth prospects before they are priced into the stock, investors can tap into the hidden value and realize significant returns. A talented and experienced management team can navigate business complexities, capitalize on market opportunities, and steer the company towards growth, all of which add to the intrinsic value of the business. Similarly, companies with efficient operations often have higher profit margins and are better equipped to weather economic downturns. Such efficiencies, though not always obvious from the stock price, can be a source of hidden value for investors. Companies with hidden value are often underpriced, providing an attractive entry point for investors. When the broader market eventually recognizes the company's true value, the stock price can appreciate significantly, offering a considerable return on investment. This capital gain is the primary reward for the diligent and meticulous analysis that goes into uncovering hidden value. Unlike speculative trading, which heavily relies on timing the market, investments based on the identification of hidden value are grounded in the fundamental financial health of a company. These investments typically have a long-term horizon, providing insulation from short-term market fluctuations and volatility. By basing investment decisions on solid financial analysis, investors can minimize their exposure to undue risk. The Efficient Market Hypothesis posits that at any given time, asset prices fully reflect all available information. However, in practice, this is not always the case. Market inefficiencies occur when the market price of a stock does not accurately reflect its intrinsic value. These inefficiencies can arise from several sources, such as asymmetric information, irrational investor behavior, or regulatory constraints. Investors skilled at fundamental analysis can spot these inefficiencies and invest in undervalued stocks before the market corrects itself, providing an opportunity to earn above-average returns. Analysts must dive deep into complex financial statements, assess macroeconomic indicators, and keep up-to-date with industry trends. This involves not only a high level of expertise but also considerable time and commitment. For instance, analyzing a company's balance sheet requires understanding various aspects such as the company's assets, liabilities, and shareholder equity. This intensive process often requires the help of financial experts, adding to the overall cost. For individual investors, this might pose a challenge given their limited resources. Companies are mandated to disclose certain financial information to the public, but the clarity and detail of this information can vary. Some companies may use complex accounting techniques that obscure true performance. Others might withhold negative information or overstate positive results. In other instances, data might simply be outdated, leading to inaccurate assessments. This reliance on potentially unreliable information significantly challenges the process of identifying hidden value. Even with access to accurate and comprehensive data, there's a risk that analysts could misinterpret the information. For example, an analyst might interpret a company's high debt levels as a negative factor, overlooking the fact that the company is investing in growth opportunities that could yield significant returns in the future. News events, market sentiment, and economic indicators can cause stock prices to fluctuate wildly in the short term. This volatility can sometimes deter investors, causing them to overlook companies with strong fundamentals but whose stock prices are currently undervalued. It can also lead to a "value trap," where a stock appears to be undervalued but is actually appropriately priced due to issues not reflected in the company's financial statements. A thorough review of financial statements is paramount to discovering hidden value. By understanding a company's financial health, debt levels, cash flow, and earnings potential, investors can better identify undervalued companies. This includes monitoring industry growth rates, competitive landscape, regulatory environment, and technology trends. Being aware of these dynamics helps in anticipating industry shifts that might affect a company's future performance. A SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis can provide a holistic view of a company. It can highlight potential growth opportunities and flag potential risks, aiding in the discovery of hidden value. Value investing strategies, which focus on investing in companies priced below their intrinsic value, align well with the concept of hidden value. These strategies prioritize long-term gains and financial stability, often leading to the discovery of hidden value. Hidden value refers to the intrinsic worth of a company that is not fully reflected in its stock price. Uncovering hidden value is like finding a treasure that the market has overlooked. It encompasses undervalued stocks, intangible assets, unused resources, growth potential, and management and operational efficiency. Discovering hidden value provides advantages such as the potential for high returns and reduced risk compared to speculative trading. It also allows investors to capitalize on market inefficiencies. However, challenges exist, including the time and resource-intensive nature of the process, dependence on accurate information, the risk of misinterpreting data, and market volatility. To effectively uncover hidden value, investors should review financial statements comprehensively, monitor industry trends, conduct SWOT analyses, and apply value investing strategies. By recognizing hidden value, investors can tap into significant returns while managing risks and taking advantage of market opportunities.What Are Hidden Values?

Components of Hidden Value

Undervalued Stocks

Intangible Assets

Unused Resources

Growth Potential

Management and Operational Efficiency

Advantages of Identifying Hidden Values

Potential for High Returns

Reduced Risk

Capitalizing on Market Inefficiencies

Challenges in Identifying Hidden Values

Time and Resource Intensive Process

Dependence on Accurate Information

Risk of Misinterpreting Data

Market Volatility

Strategies for Uncovering Hidden Values

Comprehensive Review of Financial Statements

Monitoring Industry Trends

Conducting SWOT Analysis

Applying Value Investing Strategies

Final Thoughts

Hidden Values FAQs

Hidden values refer to the intrinsic worth of a company that is not fully reflected in its current stock price. It includes factors such as undervalued stocks, intangible assets, unused resources, growth potential, and management and operational efficiency.

Investors can identify hidden values through comprehensive analysis of financial statements, monitoring industry trends, conducting SWOT analyses, and applying value investing strategies. These methods help uncover undervalued assets, growth opportunities, and operational efficiencies that may not be apparent from the stock price alone.

Investors should be interested in hidden values because they provide the potential for high returns. When the market eventually recognizes the true value of a company, its stock price can appreciate significantly. Hidden values also offer reduced risk compared to speculative trading, as they are based on fundamental financial analysis rather than short-term market fluctuations.

Examples of hidden values include undervalued stocks that trade below their intrinsic value, intangible assets like brand reputation and patents, unused resources such as underutilized real estate or surplus cash, growth potential that is not yet recognized by the market, and management and operational efficiency that contribute to the company's intrinsic value.

Yes, there are challenges in identifying hidden values. The process can be time and resource-intensive, requiring expertise, analysis of complex financial statements, and staying updated with industry trends. Dependence on accurate information is crucial, as companies may provide incomplete or misleading data. There is also a risk of misinterpreting data and market volatility, which can hinder the identification of hidden values.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.