Value at Risk (VaR) is a widely used risk measure in finance, providing an estimate of the maximum potential loss a portfolio can experience over a specific time period and at a given confidence level. Monte Carlo simulation, a computational technique that generates random scenarios based on historical data, offers a robust and flexible approach to calculating VaR. The first step in the Monte Carlo VaR calculation process is to identify the relevant risk factors affecting the portfolio. These factors can include market variables, such as interest rates, exchange rates, and asset prices, as well as other factors, such as credit risk and liquidity risk. Next, random scenarios are generated based on historical data for each risk factor. This process involves selecting a time period, sampling from the historical data, and generating random paths for each risk factor using statistical techniques, such as bootstrapping or random walk simulations. Once the random scenarios have been generated, the changes in portfolio value are simulated based on these scenarios. This involves applying the appropriate valuation models for each asset in the portfolio and aggregating the results to obtain the simulated portfolio value for each scenario. Finally, the VaR is calculated by analyzing the distribution of simulated portfolio values. The VaR at a given confidence level is determined by identifying the portfolio value at the specified percentile of the distribution, and the difference between this value and the initial portfolio value represents the potential loss. Several variance reduction techniques can be employed to improve the accuracy of Monte Carlo VaR estimates. These include antithetic variates, control variates, and importance sampling. Antithetic variates involve using mirrored scenarios to reduce variability and improve efficiency, while control variates use an auxiliary variable to improve the accuracy of the simulation. Importance sampling, on the other hand, involves weighing the scenarios to focus on those with the greatest impact on the portfolio. Monte Carlo VaR assumes that portfolio returns follow a normal distribution. However, financial data often exhibits fat tails, which means that extreme events occur more frequently than predicted by a normal distribution. Incorporating fat-tailed distributions, such as the Student's t-distribution, can improve the accuracy of VaR estimates. The number of simulation runs required to achieve accurate VaR estimates depends on several factors, including the size of the portfolio, the level of precision required, and the degree of confidence desired. Increasing the number of simulations generally improves accuracy but also increases computational time and cost. An appropriate balance must be struck between accuracy and efficiency. Monte Carlo VaR is a valuable tool for risk management in financial institutions, where it is used to assess the potential losses associated with different types of financial instruments and portfolios. It is particularly useful for assessing the risk of complex portfolios that may contain non-linear relationships and correlations. Monte Carlo VaR can also be used in portfolio optimization to identify the optimal asset allocation that balances risk and return. By simulating the potential outcomes of different investment strategies, Monte Carlo VaR can help investors to make more informed decisions about their portfolios. Monte Carlo VaR is a key tool in stress testing, which assesses the resilience of financial institutions to adverse market conditions. Regulators also use VaR to monitor and limit the risk exposure of financial institutions. Monte Carlo VaR is essential in pricing complex derivatives, such as options and structured products, and in designing effective hedging strategies. By simulating the potential outcomes of different scenarios, Monte Carlo VaR can help investors to identify the most effective hedging strategies to manage risk exposure. Monte Carlo VaR offers a high degree of flexibility when it comes to modeling complex portfolios. It can accommodate non-linear relationships between assets, incorporate various types of financial instruments, and include risk factors that may be difficult to account for using other methods. Monte Carlo VaR can easily model the impact of non-linear relationships and correlations between assets. This is particularly important for portfolios containing options, structured products, or other derivatives, as these instruments often exhibit non-linear behavior. Monte Carlo VaR can be applied to a wide range of financial instruments, including stocks, bonds, derivatives, and structured products. This versatility makes it a valuable tool for risk management across various asset classes and financial sectors. The main drawback of Monte Carlo VaR is its computational intensity, as it requires a large number of simulations to obtain accurate results. This can make the process time-consuming, particularly for large portfolios or when high precision is required. Monte Carlo VaR's accuracy depends heavily on the quality of input data and the assumptions used in modeling the portfolio. If historical data is not representative of future market conditions or if key assumptions are flawed, the resulting VaR estimates may be inaccurate. Monte Carlo VaR is sensitive to the choice of random number generation and the specific simulation paths are chosen. This can lead to variation in VaR estimates, especially if the number of simulations is insufficient or if the random number generator is biased. Parametric VaR is a simpler method for calculating VaR that assumes portfolio returns follow a normal distribution with a fixed mean and variance. It uses historical data to estimate the mean and variance of each asset and the correlations between them and then apply these estimates to calculate the VaR. Parametric VaR is less computationally intensive than Monte Carlo VaR but is less flexible and may be less accurate. Historical Simulation VaR uses historical data to generate a distribution of portfolio returns and then identifies the VaR at a specified confidence level based on this distribution. Historical Simulation VaR is simple to implement and requires no assumptions about the distribution of returns or the correlations between assets. However, it is less flexible and may not capture the impact of new or rare events. Each VaR method has its advantages and disadvantages. Monte Carlo VaR is flexible, can accommodate non-linear relationships and correlations, and can be applied to a wide range of financial instruments. However, it is computationally intensive and can be sensitive to input data and assumptions. Parametric VaR is simpler and less computationally intensive but may be less accurate and flexible. Historical Simulation VaR is simple to implement and requires no assumptions but may not capture the impact of new or rare events. Monte Carlo VaR is a powerful tool for risk management and financial decision-making that offers flexibility, accuracy, and applicability to a wide range of financial instruments. However, it is computationally intensive and sensitive to input data and assumptions, and requires careful consideration of variance reduction techniques, the choice of distribution, and the number of simulation runs. Monte Carlo VaR is an essential component of modern finance, providing valuable insights into risk exposure, portfolio optimization, stress testing, and derivative pricing and hedging strategies. As financial markets continue to evolve and become more complex, the importance of Monte Carlo VaR is likely to increase, and new developments in computational techniques and statistical modeling will continue to shape its future.Monte Carlo VaR Overview

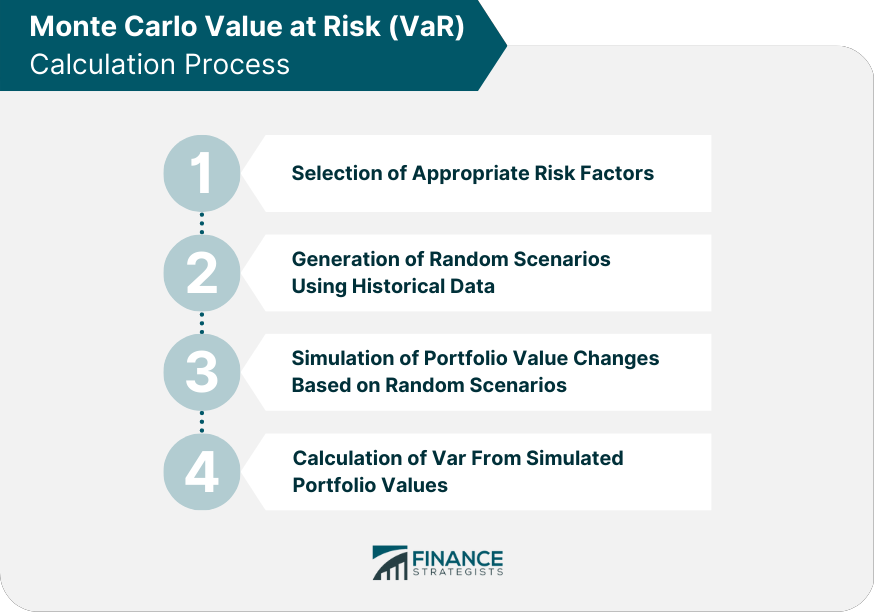

Monte Carlo VaR Calculation Process

Selection of Appropriate Risk Factors

Generation of Random Scenarios Using Historical Data

Simulation of Portfolio Value Changes Based on Random Scenarios

Calculation of VaR From Simulated Portfolio Values

Improving Monte Carlo VaR Accuracy

Utilizing Variance Reduction Techniques

Incorporating Fat-Tailed Distributions

Selecting an Appropriate Number of Simulation Runs

Applications of Monte Carlo VaR

Risk Management for Financial Institutions

Portfolio Optimization

Stress Testing and Regulatory Compliance

Derivative Pricing and Hedging Strategies

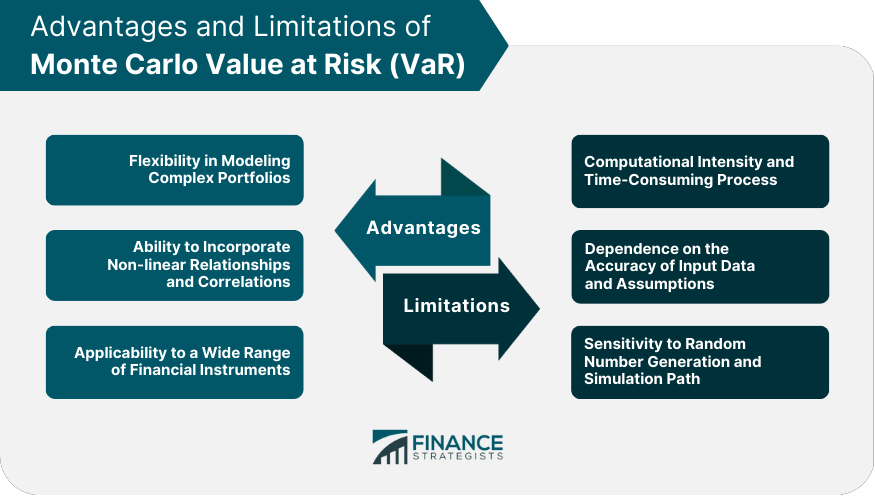

Advantages of Monte Carlo VaR

Flexibility in Modeling Complex Portfolios

Ability to Incorporate Non-Linear Relationships and Correlations

Applicability to a Wide Range of Financial Instruments

Limitations of Monte Carlo VaR

Computational Intensity and Time-Consuming Process

Dependence on the Accuracy of Input Data and Assumptions

Sensitivity to Random Number Generation and Simulation Paths

Comparison With Other VaR Methods

Parametric VaR (Variance-Covariance Method)

Historical Simulation VaR

Advantages and Disadvantages of Each Method

Conclusion

Monte Carlo VaR FAQs

Monte Carlo VaR is a method for calculating value at risk (VaR) that uses a computational technique called Monte Carlo simulation to generate random scenarios based on historical data. It is more flexible and can accommodate non-linear relationships and correlations between assets compared to other VaR methods like the variance-covariance method and historical simulation VaR.

Monte Carlo VaR offers a high degree of flexibility in modeling complex portfolios and can incorporate non-linear relationships and correlations between assets. It is also applicable to a wide range of financial instruments, making it a valuable tool for risk management across various asset classes and financial sectors.

The main limitations of Monte Carlo VaR are its computational intensity, dependence on the accuracy of input data and assumptions, and sensitivity to random number generation and simulation paths. It also requires careful consideration of variance reduction techniques, distribution choice, and the number of simulation runs.

Monte Carlo VaR has several applications in finance, including risk management for financial institutions, portfolio optimization, stress testing, regulatory compliance, and derivative pricing and hedging strategies. It is a key tool for assessing risk exposure and identifying the optimal asset allocation that balances risk and return.

Monte Carlo VaR accuracy can be improved by utilizing variance reduction techniques such as antithetic variates, control variates, and importance sampling. It can also be improved by incorporating fat-tailed distributions and selecting an appropriate number of simulation runs. Careful consideration of input data and assumptions is also necessary to achieve accurate VaR estimates.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.