A negative correlation is a relationship between any two variables in which one increases while another decreases. For example, albeit a very simplified one, a negative correlation exists between hot coffee and warmer weather. The degree to which two variables are negatively correlated with one another is called a correlation coefficient (denoted by r), and its measurement ranges from -0.1 and -1. If a relationship were to have a correlation coefficient score of -1, then the two variables would have a perfect negative relationship. While a score -0.1 would indicate a weak negative relationship between variables. By squaring a relationship's R-value, referred to as R-squared, an analyst can then determine the degree to which the variance of the two variables is related to one another. Expressed in percent, if a R-value was equal to -.6, then the value's R-squared would equal 36%. Meaning that the variance in one variable could be explained by the second variable 36% of the time. In finance, negative correlations come in handy when attempting to diversify a portfolio. By putting money into investments that tend to perform oppositely under the same economic conditions, stocks and bonds for example, an investor can remain profitable under a variety of conditions. Diversification is a cornerstone of financial planning, and it hinges on the concept of negative correlation. By allocating funds among investments that do not move in tandem, a portfolio can experience less overall volatility. When some investments decline, others may increase, tempering the overall impact on the portfolio. A well-diversified portfolio typically includes assets that have a negative correlation. For instance, if the stock market faces a downturn, bonds, which often move in the opposite direction, can provide a cushion against significant losses. Incorporating assets with negative correlation helps improve portfolio performance during various market conditions. A negative correlation serves as an effective tool for managing investment risks. Understanding how various assets perform relative to each other allows investors to anticipate potential losses and act accordingly. If two assets have a strong negative correlation, when one experiences gains, the other may suffer losses, and vice versa. Investors can leverage this relationship to balance the performance of their portfolio. When a particular asset class is expected to underperform, investors can overweight their portfolio with the asset class that typically moves in the opposite direction. This strategy allows them to mitigate the risk of significant losses. A hedge is an investment made to offset potential losses or gains that may be incurred by a companion investment. In finance, hedges are typically constructed from negatively correlated assets. For instance, if an investor has a significant position in a particular company's stock, they may hedge this risk by taking a short position in a related industry or sector that has a negative correlation with the company. If the stock's value decreases, the loss may be offset by the gain from the short position. Hence, understanding and utilizing negative correlations can protect portfolios from adverse market movements. When it comes to the dynamic between stocks and bonds, a negative correlation often exists. In times of economic growth and optimism, investors may flock to stocks, driving their prices up. Simultaneously, the demand for bonds, considered safer but lower-yielding assets, may decline, leading to lower bond prices. However, in periods of economic uncertainty, the trend may reverse. Investors may prefer bonds for their perceived safety and stable returns, reducing their stock holdings and leading to a fall in stock prices. This inverse relationship, though not always consistent, provides opportunities for investors to balance their portfolios. The U.S. dollar's value and commodity prices often demonstrate a negative correlation. When the dollar strengthens, commodities that are priced in dollars, such as oil and gold, typically become more expensive for foreign buyers, leading to decreased demand and lower prices. Conversely, when the U.S. dollar weakens, commodity prices usually rise. This happens because a weaker dollar makes commodities cheaper for foreign buyers, increasing demand and pushing up prices. Understanding this relationship can help traders and investors make informed decisions about commodity and currency investments. Another classic example of negative correlation in finance is the relationship between interest rates and real estate prices. As interest rates rise, the cost of borrowing increases. This increase makes mortgages more expensive, which can lead to decreased demand for real estate, pushing property prices down. In contrast, when interest rates fall, mortgages become cheaper, which can spur demand for real estate and potentially lead to higher property prices. Investors and homebuyers who understand this negative correlation can better time their real estate purchases and potentially secure better deals. Correlation coefficients, which range from -1 to 1, help quantify the strength of the relationship between two variables. In the context of negative correlation, a coefficient of -1 indicates a perfect negative correlation, meaning that if one asset rises by a certain percentage, the other will decrease by the same percentage. However, it's essential to remember that correlation is not causation. A strong negative correlation doesn't necessarily mean one variable's movement is causing the other to move. It simply reflects the observed relationship in the data. Furthermore, correlations can change over time and should not be used as the sole basis for investment decisions. Negative correlation implies that the assets move in opposite directions. However, the degree to which they move can vary significantly. For example, a small decrease in one asset might correspond to a large increase in another asset, or vice versa. Investors should be aware that negative correlation doesn't guarantee equal and opposite movements between two assets. The actual movement depends on a variety of factors, including the asset's underlying characteristics, market conditions, and broader economic trends. Negative correlation has significant implications for investment strategies. It can help investors diversify their portfolios, manage risk, and design effective hedging strategies. By combining assets that tend to move in opposite directions, investors can reduce volatility and enhance potential returns. However, investors should also recognize that negative correlation is only one piece of the puzzle. It's equally crucial to consider other factors, such as an asset's potential return, risk level, and alignment with the investor's financial goals and risk tolerance. The concept of negative correlation is crucial in determining optimal portfolio allocation. By including assets with varying degrees of correlation, investors can achieve a balance between risk and return. This is often achieved through a mix of asset classes, including stocks, bonds, commodities, and real estate. Investors must regularly revisit their portfolio allocation as market conditions change. They must consider current and projected correlations, adjusting their portfolio as needed to maintain the desired balance between potential return and risk exposure. While negative correlation can be a useful tool in financial planning, it's important to recognize its limitations. Correlation is not a constant characteristic but rather a statistical measure that can change over time. This means that two assets that are negatively correlated in one period may not be in another. During times of significant market stress, correlations can converge or even reverse. For example, during a market crash, traditionally negatively correlated assets may both fall as investors sell off a wide range of assets. Investors should keep this in mind and continually monitor correlations to ensure their portfolio remains appropriately diversified. Negative correlations can also be affected by unforeseen events and market shifts. Major economic or geopolitical events can cause investors to react in unpredictable ways, which can distort usual correlations. For example, an unexpected rise in inflation might cause both stocks and bonds to decline, despite their typical negative correlation. Market shifts, such as changes in monetary policy or technology advancements, can also impact correlations. The advent of quantitative easing has been argued to have altered traditional correlations, especially between stocks and bonds. Investors should always be aware of the broader market context when interpreting correlations. Finally, while correlation provides useful insights, it can lead to potential false interpretations or assumptions. Correlation is a measure of linear association, meaning it only captures a specific type of relationship. Non-linear relationships, which are often prevalent in financial markets, may not be adequately captured by correlation measures. Additionally, correlation does not imply causation. Just because two assets move in tandem does not mean one's movement is causing the other. Misunderstanding this can lead to erroneous investment decisions. Furthermore, relying solely on correlation without considering other market factors can result in an overly simplified view of risk. Various economic factors can influence the degree of negative correlation between assets. These factors include interest rates, inflation, economic growth, and unemployment rates. Changes in these variables can alter investor sentiment and market dynamics, leading to shifts in correlations. For example, rising interest rates often lead to falling bond prices but can affect different sectors of the stock market differently. While financial sector stocks may benefit from higher rates, sectors like real estate, which is sensitive to borrowing costs, may suffer. This can lead to changing correlations among various assets. Market conditions, including stages of the business cycle, market sentiment, and liquidity conditions, can also affect negative correlations. During periods of economic expansion, riskier assets like stocks may perform well, while safer assets like bonds may underperform. Conversely, during economic downturns, the relationship might reverse. Market sentiment, driven by factors such as geopolitical events, corporate earnings, and regulatory changes, can also cause shifts in correlations. For example, during times of market stress, investors often flock to safe-haven assets, potentially reversing traditional correlations. Investor behavior plays a crucial role in determining correlations. Investor sentiment, risk tolerance, and trading behavior can all influence the price movements of various assets and, consequently, their correlations. For instance, in a bull market, optimistic investors may bid up prices of riskier assets, leading to positive performance across many asset classes and potentially diminishing the usual negative correlations. Similarly, in a bear market, widespread selling can lead to falling prices across the board, despite typical negative correlations. Negative correlation refers to a relationship between two variables in which one variable increases while the other decreases. It is quantified by correlation coefficients, which range from -1 to 1, with -1 indicating a perfect negative correlation. Understanding negative correlation is essential for investors as it has numerous applications and implications in finance. It enables diversification of portfolios, reduces risk through effective risk management strategies, and facilitates hedging against potential losses. However, negative correlation has limitations, including its temporary nature, vulnerability to unforeseen events and market shifts, and potential false interpretations or assumptions. Economic factors, market conditions, and investor behavior are additional factors that can influence negative correlations. To leverage negative correlation effectively, investors must consider these factors, regularly monitor correlations, and maintain a well-balanced and diversified portfolio. By doing so, investors can make informed decisions, navigate market complexities, and strive for optimal risk-adjusted returns.Negative Correlation Definition

Negative Correlation Explained

Profiting From Negative Correlations

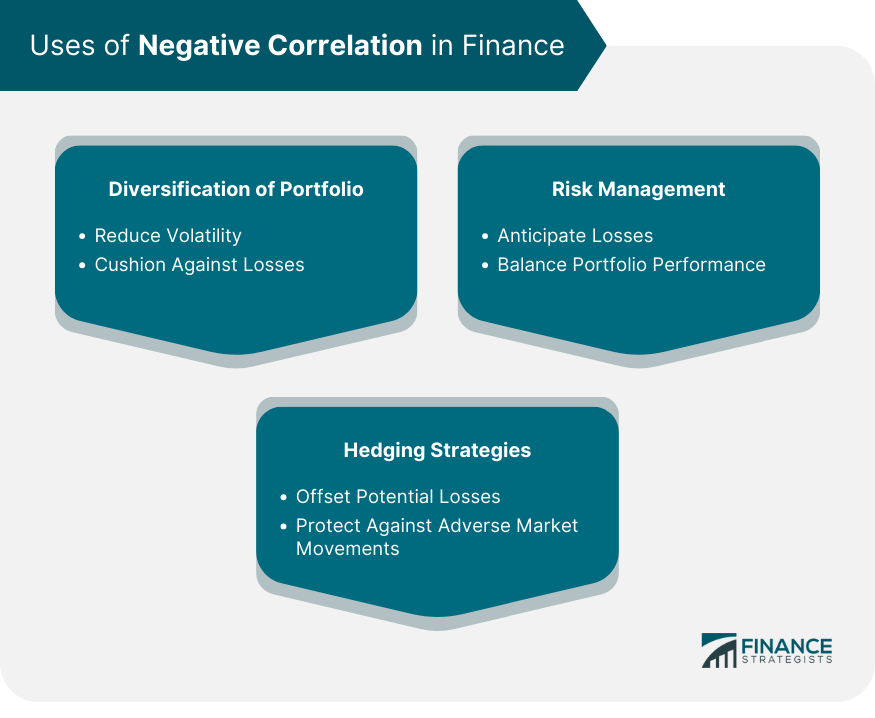

Uses of Negative Correlation in Finance

Diversification of Portfolio

Risk Management

Hedging Strategies

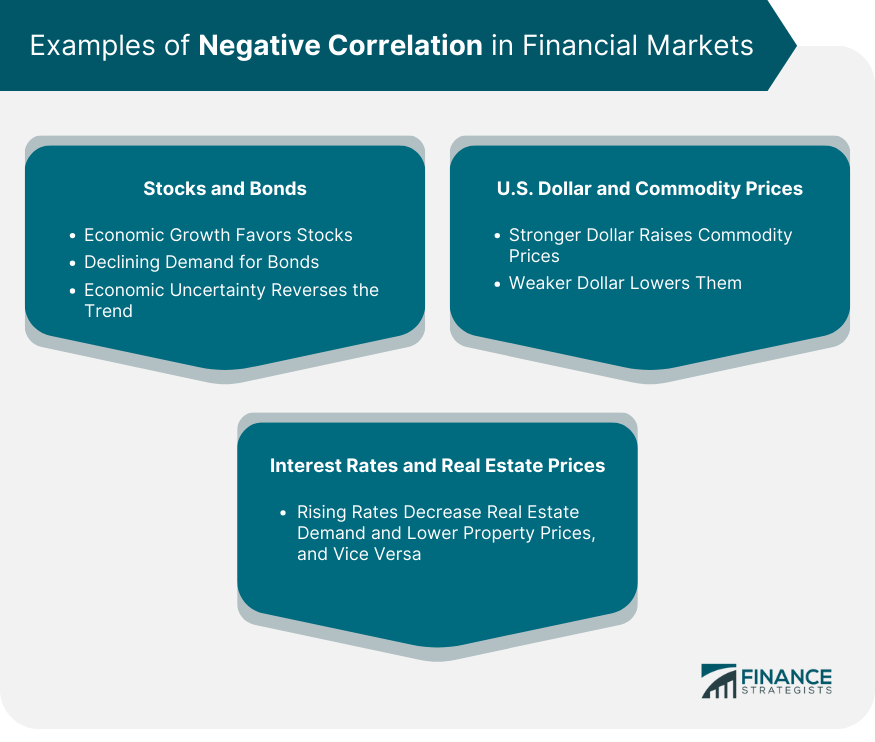

Examples of Negative Correlation in Financial Markets

Stocks and Bonds

U.S. Dollar and Commodity Prices

Interest Rates and Real Estate Prices

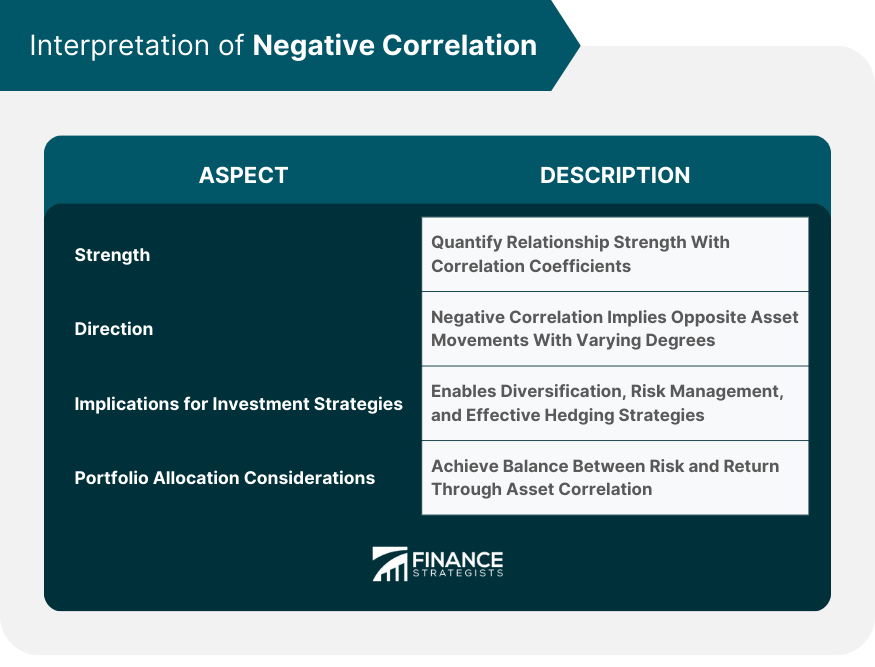

Interpretation of Negative Correlation

Strength

Direction

Implications for Investment Strategies

Portfolio Allocation Considerations

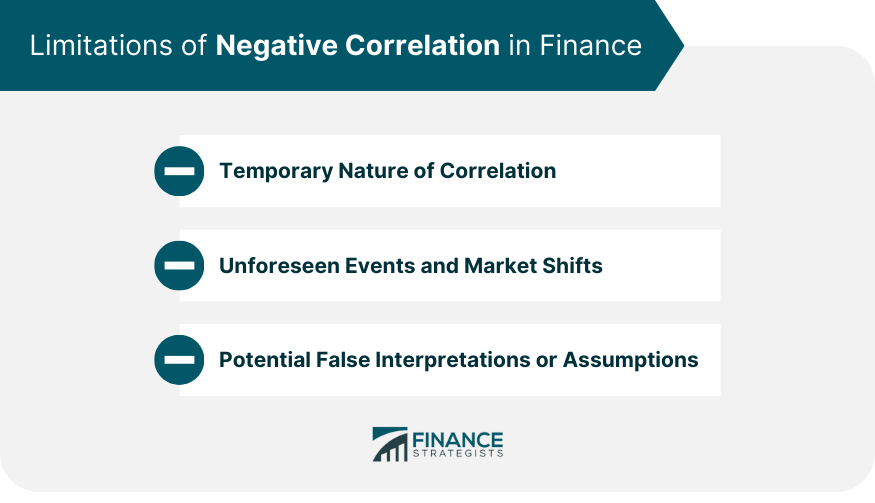

Limitations of Negative Correlation in Finance

Temporary Nature of Correlation

Unforeseen Events and Market Shifts

Potential False Interpretations or Assumptions

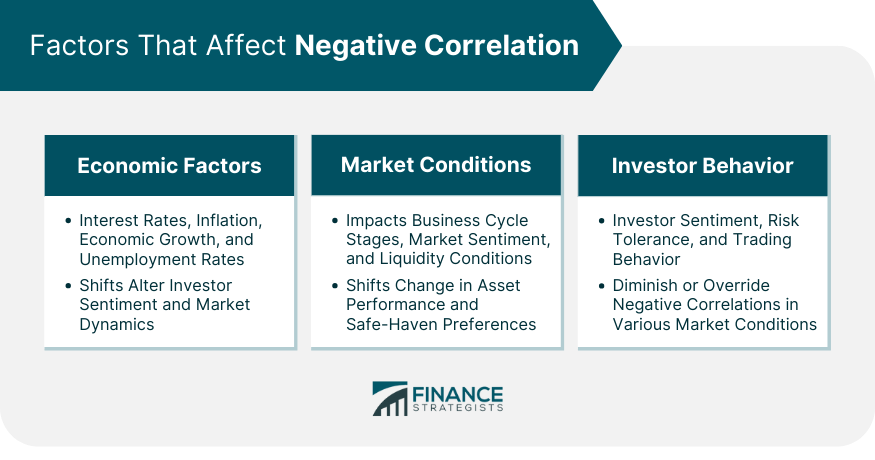

Factors That Affect Negative Correlation

Economic Factors

Market Conditions

Investor Behavior

Conclusion

Negative Correlation FAQs

A negative correlation is a relationship between any two variables in which one increases while another decreases.

In finance, negative correlations come in handy when attempting to diversify a portfolio.

By putting money into investments that tend to perform oppositely under the same economic conditions, stocks and bonds for example, an investor can remain profitable under a variety of conditions.

A negative correlation exists between hot coffee and warmer weather.

A score of -.1 would be a perfect negative relationship.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.