Odd Lot Theory is a hypothesis that small investors, as characterized by their buying and selling of securities in odd lots (smaller units than the standard 100 shares, referred to as round lots), typically trade against the market trend and consequently lose out. Therefore, by monitoring odd lot trades, other investors could do the exact opposite and potentially reap the rewards. Understanding the Odd Lot Theory requires a grasp of what odd lots are and the role they play in financial markets. Odd lots, generally referring to any unit below 100 shares, are usually preferred by smaller, retail investors due to their affordability. These investors often lack the financial strength to purchase round lots, which are typically more expensive because of the higher number of shares involved. The Odd Lot Theory came into existence in the early to mid-20th century, primarily as a reflection of the prevailing market dynamics of the era. During this period, the stock market was predominantly the playground of institutional investors and wealthy individuals, while smaller retail investors were seen as novices, more likely to be driven by emotion than by sound financial acumen. This notion, though a stereotype, formed the basis of the Odd Lot Theory, which viewed the small investors' actions as a counter-indicator of the market's future direction. The underlying assumption was that smaller investors were often wrong, thus their trading decisions, particularly those involving odd lots, could signal a contrary investment opportunity. In financial parlance, the term 'odd lots' refers to a batch of shares that doesn't meet the standard lot size of 100 shares. Odd lots can range from a single share to 99 shares, and are typically traded by small retail investors who may not have the capital to buy round lots. The primary difference between odd lots and round lots lies in the number of shares involved in a trade. Round lots consist of 100 shares, a standard set by stock exchanges for ease of trading. On the other hand, odd lots involve any number of shares less than 100. This difference is significant because it affects the liquidity of the shares. Round lots are more liquid, meaning they are easier to buy and sell without significantly affecting the price. Odd lots, due to their smaller size, are less liquid, and selling large quantities of shares as odd lots could potentially impact the share price. There are various reasons why traders may choose to trade in odd lots. The most prevalent reason is the affordability of odd lots compared to round lots. For a small investor, it's more feasible to buy 30 shares of a stock rather than 100, particularly when the share price is high. Another reason is flexibility. By trading in odd lots, an investor has the flexibility to invest in as many or as few shares as they wish, without being restricted by the standard lot size. This could be particularly useful when looking to make small adjustments to a portfolio or when buying into a stock gradually. Understanding the Odd Lot Theory requires getting to grips with some fundamental assumptions upon which the theory is built. At the heart of the Odd Lot Theory is the characterization of the small investor as an unsophisticated participant in the market. The theory assumes that these individuals, often trading in odd lots, are less experienced, less informed, and more prone to making decisions based on emotions or popular trends rather than rigorous financial analysis. This brings us to the counter-indicator concept, a key component of the Odd Lot Theory. The premise is simple: since the small investor is often wrong, their trading behavior can serve as a contrarian indicator. If odd lot buying is on the rise, it may signal a market top as these investors are perceived to be "the last in" during a market uptrend. Conversely, an increase in odd lot selling might suggest a market bottom, since small investors are assumed to panic and sell near market lows. While the Odd Lot Theory provides an interesting perspective on market trends, it's important to note its criticisms and limitations. Critics argue that the theory overgeneralizes small investors, presuming them to be uniformly unsophisticated and invariably wrong, which is not necessarily the case. Furthermore, with the advent of online trading platforms and fractional shares, the landscape of stock trading has significantly changed. It's now possible for smaller investors to get real-time information, conduct detailed research, and make more informed decisions. Also, the ability to buy fractional shares means that the significance of odd lot trading as a counter-indicator may be diminished. The Odd Lot Theory provides a distinctive lens through which to interpret market trends. In essence, it serves as a form of contrarian investing, using the perceived missteps of small investors as a signal for potential profit opportunities. In the realm of the Odd Lot Theory, an uptick in odd lot buying is seen as a potential sell signal. The rationale is that when small investors, often perceived as less experienced, start buying in large numbers, the market may be nearing a peak. Conversely, a surge in odd lot selling may be seen as a potential buying opportunity, as it could indicate that the market is near the bottom. The volume of odd lot trades is integral to the Odd Lot Theory. A spike in the volume of odd lot trades—either buying or selling—can be viewed as a strong counter-indicator signal. This relationship between odd lot trade volume and market trends forms the backbone of the Odd Lot Theory and guides its application in real-world scenarios. There are several benefits to incorporating the Odd Lot Theory into an investment strategy. The Odd Lot Theory can help identify potential market extremes. An increase in odd lot activity might signal that a market trend—upward or downward—is about to reverse, providing an opportunity for contrarian investors. The theory encourages investors to consider the activities of small investors, which are often overlooked in favor of large institutional trades. This broader perspective can add depth to market analysis and inform more nuanced trading strategies. As a contrarian indicator, the Odd Lot Theory can help investors develop a contrarian investing strategy. This can be especially beneficial in volatile markets where herd mentality can drive prices away from their intrinsic values. While the Odd Lot Theory can serve as a useful tool in a trader's arsenal, it's not without its risks and drawbacks. One of the key criticisms of the Odd Lot Theory is that it oversimplifies investor behavior, assuming that all small investors are uniformly uninformed and make poor decisions. This stereotype may not hold true, especially in today's digital age where access to information and financial literacy has significantly improved. The Odd Lot Theory shouldn't be used as a standalone indicator. Like all investment theories and strategies, it doesn't guarantee success and needs to be used in conjunction with other technical and fundamental analysis tools to make informed investment decisions. The rise of online trading platforms, fractional shares, and high-frequency trading has significantly changed the dynamics of stock trading. This shift means that odd lot trades are no longer the sole domain of small investors, thereby diluting the relevance of the Odd Lot Theory as a counter-indicator. Understanding the Odd Lot Theory within the wider context of financial theories can help clarify its place in investment strategy. The Efficient Market Hypothesis (EMH) posits that at any given time, stock prices fully reflect all available information, meaning it's impossible to consistently achieve higher than average returns. EMH effectively contradicts the Odd Lot Theory, which assumes that misinformed small investors create exploitable opportunities in the market. Behavioral finance studies how psychological biases influence investor behavior and market outcomes. While the Odd Lot Theory assumes small investors to be irrational, behavioral finance acknowledges that all investors, big or small, can fall prey to cognitive biases that affect their investment decisions. The Odd Lot Theory and contrarian investing intersect in their shared philosophy of going against the herd. Contrarian investing involves buying and selling when others are doing the opposite, based on the belief that the crowd often gets it wrong. This aligns with the Odd Lot Theory's assumption that small investors—often seen as representing the crowd—are frequently incorrect in their market timing. The Odd Lot Theory, an investment strategy born from the early 20th century's market dynamics, offers an intriguing perspective on the role of small investors in determining market trends. At its core, it assumes that small investors, often trading in odd lots, frequently make erroneous decisions, thereby providing a contrarian indicator for other market participants. While the Odd Lot Theory offers several benefits such as identifying market extremes, broadening market perspective, and serving as a contrarian indicator, it's not without risks. The theory may oversimplify investor behavior, become unreliable as a standalone indicator, and might be less relevant due to changing market dynamics. If you're unsure about how to incorporate the Odd Lot Theory into your investment strategy, consider seeking advice from wealth management services. Professionals in the field can provide personalized guidance tailored to your financial goals and risk tolerance.What Is the Odd Lot Theory?

History and Origin of Odd Lot Theory

Understanding the Concept of Odd Lots

Difference Between Odd Lots and Round Lots

Why Traders May Choose to Buy or Sell Odd Lots

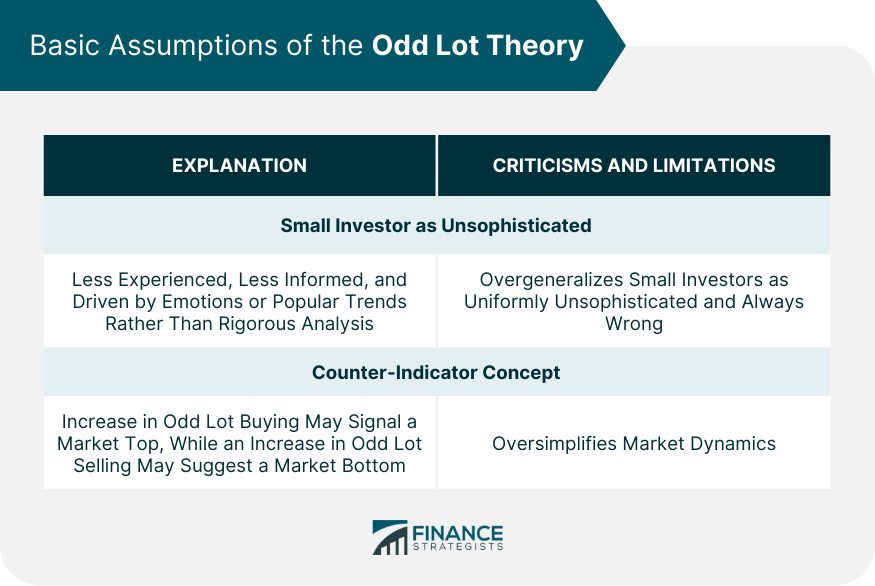

Basic Assumptions of the Odd Lot Theory

The Perception of the "Small Investor"

The Counter-Indicator Concept

Criticisms and Limitations of These Assumptions

Odd Lot Theory in Action

Interpretation of Odd Lot Buying or Selling

Relationship Between Odd Lot Trade Volume and Market Trends

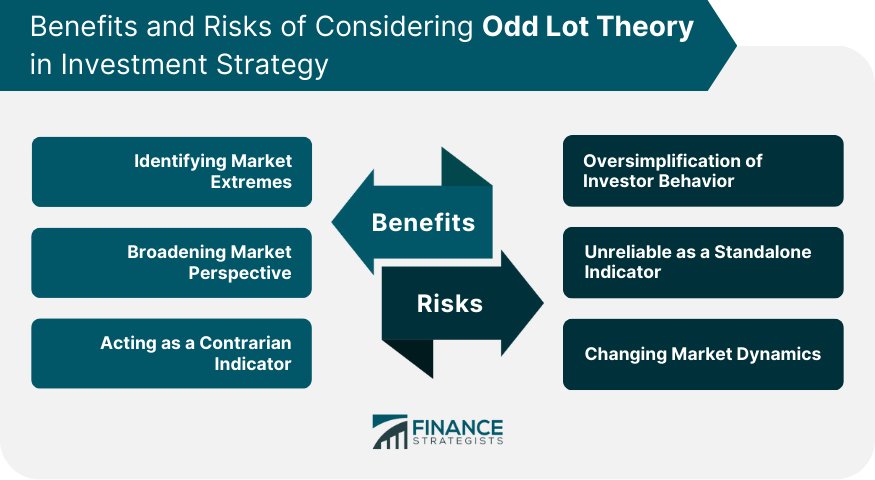

Benefits of Considering Odd Lot Theory in Investment Strategy

Identifying Market Extremes

Broadening Market Perspective

Acting as a Contrarian Indicator

Risks and Drawbacks of Relying on Odd Lot Theory

Oversimplification of Investor Behavior

Unreliable as a Standalone Indicator

Changing Market Dynamics

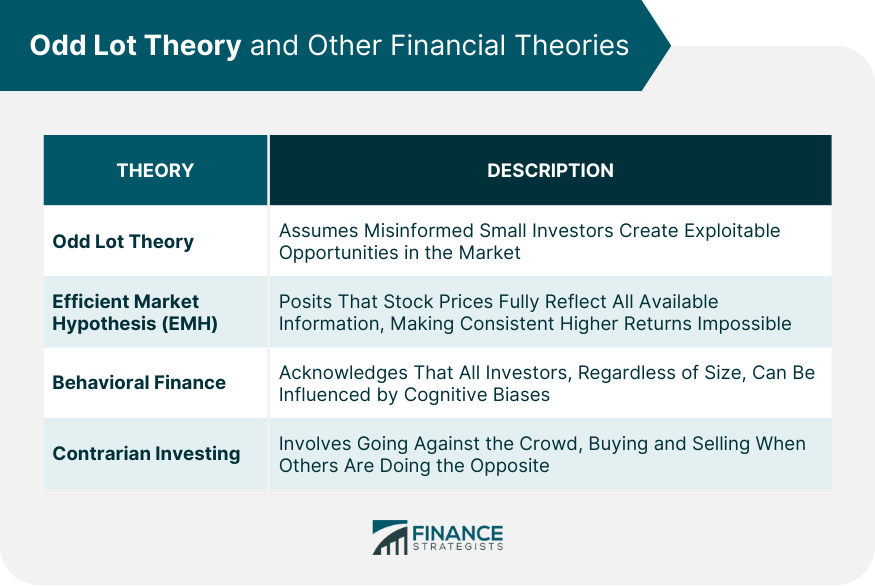

Comparison of Odd Lot Theory to Other Financial Theories

Contrasting Odd Lot Theory and Efficient Market Hypothesis

Differences Between Odd Lot Theory and Behavioral Finance

Intersection of Odd Lot Theory and Contrarian Investing

Final Thoughts

Odd Lot Theory FAQs

The Odd Lot Theory is a financial hypothesis suggesting that small investors, typically trading in odd lots, often trade contrary to market trends and are therefore wrong most of the time. This behavior can serve as a contrarian indicator for other market participants.

The Odd Lot Theory can influence investment decisions by serving as a contrarian indicator. According to the theory, an increase in odd lot buying or selling can signal a market top or bottom, providing a potential investment opportunity.

The Odd Lot Theory can help identify potential market extremes, broaden market perspective, and serve as a contrarian indicator, adding depth to market analysis and aiding in the development of nuanced trading strategies.

Risks include oversimplification of investor behavior, unreliability as a standalone indicator, and diminished relevance due to changing market dynamics such as the rise of online trading platforms and fractional shares.

While the Efficient Market Hypothesis assumes stock prices reflect all available information, making it impossible to consistently outperform the market, the Odd Lot Theory suggests that market mispricing can occur due to the trading behavior of small, less informed investors.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.