A price target refers to the projected future price level of a financial security, as estimated by an investment analyst or advisor. It can provide an indication of the potential movement of a stock's price and can influence an investor's decision to buy, hold, or sell the security. Price targets hold significant relevance in investment decisions, as they offer a benchmark for investors to gauge the potential upside of a stock or the level of risk involved. In the realm of technical analysis, a price target is a pivotal concept that aids traders in predicting future price movements based on historical price patterns and market data. Price target is not a guaranteed projection but rather an educated forecast, often used in conjunction with other technical indicators to make sound trading decisions. Price targets in technical analysis can help traders identify potential entry and exit points for a trade. By comparing the price target with the current market price, traders can evaluate the risk-to-reward ratio of a trade. This risk-to-reward ratio is fundamental in formulating and managing a profitable trading strategy. The concept stems from the fundamental belief that market prices move in patterns and that they tend to repeat over time. This principle forms the core of technical analysis and, consequently, the idea of price targets. Technical analysts use various methods to determine price targets, often based on past price movements and trends. Several factors can influence price targets, including changes in the company's earnings, shifts in the overall economy, changes in market sentiment, and adjustments in the industry or sector. Other influential factors could include changes in company management, product launches, mergers and acquisitions, and other company-specific news events. One common quantitative method for determining price targets is discounted cash flow (DCF) analysis. DCF analysis involves estimating the future cash flows of a company and then discounting them back to their present value using an appropriate discount rate. The resulting figure gives an estimation of the company’s intrinsic value, serving as a potential price target. Comparative valuation techniques involve comparing a company’s financial metrics, such as price-to-earnings (P/E) or price-to-sales (P/S) ratios, with those of similar companies in the same industry. If a company's P/E ratio is lower than the average P/E ratio of its peers, it might suggest that the company’s stock is undervalued, indicating a higher price target. It involves examining a stock's past price movements to predict future performance. For instance, if a stock price has been consistently increasing, a technical analyst may set a higher price target, anticipating the continuation of the upward trend. These are significant price points on a stock's chart that consistently stop the stock's price movement. Analysts often set price targets at these levels, predicting that the price will either bounce back from these points (in the case of support) or reverse after hitting these points (in the case of resistance). Chart patterns, such as head-and-shoulders, double tops and bottoms, and triangles, can also help in setting price targets. These patterns represent specific price movements that have predictive value, providing insights into potential price breakouts or reversals. Price targets play a crucial role in position sizing, which refers to the amount of capital invested in a particular security. By comparing the price target with the current price, traders can determine the potential profit of a trade and size their positions accordingly. Traders often use price targets when placing stop-loss and take-profit orders. A stop-loss order is designed to limit a trader's loss on a trade, while a take-profit order is meant to secure a trader's profits. By setting these orders at or near their price targets, traders can effectively manage their risk and secure their gains. In the realm of risk management, price targets can serve as a helpful tool. By providing an estimated future price, they enable traders to calculate potential profit and loss and assess the risk-to-reward ratio. Traders can then use this information to manage their risk exposure and make better-informed trading decisions. Price targets are based on assumptions about future events, such as a company's earnings growth, industry trends, or broader economic conditions. Since no one can predict the future with complete certainty, price targets should always be viewed as educated guesses rather than guaranteed outcomes. Analysts use a variety of models and techniques to forecast future earnings and other relevant factors, but these models can't account for every possible scenario. Unexpected events, such as market disruptions, changes in government policy, or significant company news, can significantly impact a company's stock price and render a price target inaccurate. Analysts are humans and may allow their judgments to be influenced by cognitive biases. For instance, an analyst may overestimate a company's future earnings due to overconfidence or optimism bias. Similarly, confirmation bias might lead an analyst to overvalue evidence that supports their existing beliefs while undervaluing evidence that contradicts them. There can also be institutional biases at play. For example, an analyst working for a brokerage firm that has a business relationship with the company they're analyzing may feel pressure to issue a favorable price target. Price targets do not adjust in real time to market dynamics or new information. While analysts may revise their price targets periodically, there can be a significant time lag between when new information becomes available and when a price target is updated. This time lag can be problematic in fast-moving markets, where stock prices can change rapidly. A price target issued just a few days ago may already be outdated if significant new information has come to light. Price targets can sometimes become self-fulfilling. For instance, if a prominent analyst issues a high price target for a stock, it can spark investor enthusiasm and drive up the stock's price, regardless of the company's underlying fundamentals. Similarly, if many investors set their sell orders at the same price target, it can create a significant resistance level that may prevent the stock's price from rising further, even if the company's fundamentals suggest it should. This influence can lead to stock prices that reflect market sentiment or trading dynamics more than a company's intrinsic value. Price targets provide a benchmark for evaluating the upside potential and level of risk associated with a stock. By comparing the price target with the current market price, investors can make informed decisions regarding buying, holding, or selling a security. Price targets are extensively used in technical analysis, where they help traders identify entry and exit points, manage risk, and formulate profitable trading strategies. However, it's crucial to recognize the limitations of price targets, including their inherent uncertainty, potential analyst bias, static nature, and the influence they can have on market behavior. Price targets serve as valuable guidance for investors and traders, but they should be interpreted alongside other fundamental and technical indicators. It is essential to stay updated with new information and market dynamics that can impact stock prices, as price targets may not adjust in real-time. By considering the broader context and incorporating a holistic approach to investment decisions, individuals can make more informed choices and mitigate the potential risks associated with relying solely on price targets.What Is a Price Target?

How the Price Target Works

Importance in Technical Analysis

Theoretical Framework

Factors Influencing Price Targets

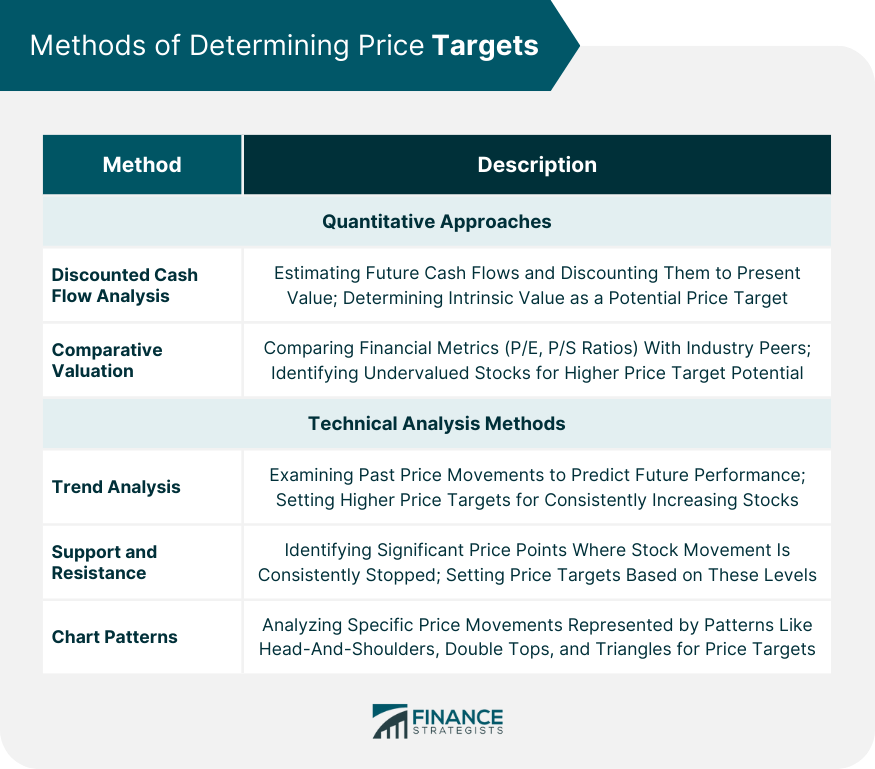

Methods of Determining Price Targets

Quantitative Approaches

Discounted Cash Flow Analysis

Comparative Valuation Techniques

Technical Analysis Methods

Trend Analysis

Support and Resistance Levels

Chart Patterns

Price Targets in Trading Strategies

Position Sizing

Stop-Loss and Take-Profit Orders

Risk Management

Limitations of Price Targets

Inherent Uncertainty

Bias in Analyst Projections

Static Nature of Price Targets

Influence on Market Behavior

Final Thoughts

Price Target FAQs

Price targets should be viewed as educated forecasts rather than guaranteed predictions. They are based on assumptions and analysis of various factors but cannot account for unforeseen events or changes in market conditions that may significantly impact a stock's price.

It is not recommended to rely solely on price targets when making investment decisions. Price targets should be considered alongside other fundamental and technical indicators, as well as broader market analysis, to form a comprehensive view of the investment opportunity.

Analysts may revise their price targets periodically, but the frequency can vary. It's important to note that there can be a time lag between when new information becomes available and when a price target is updated, which can be problematic in fast-moving markets.

Yes, price targets can sometimes influence market behavior and become self-fulfilling prophecies. Positive price targets from prominent analysts can create investor enthusiasm and drive up the stock's price, while many sell orders set at the same price target can create a significant resistance level, limiting further price increases.

Price targets have inherent limitations. They are based on assumptions about the future and are subject to analyst bias. Price targets are static and may not adjust in real-time to new information, and they can also be influenced by market sentiment or trading dynamics rather than a company's intrinsic value. It's important to be aware of these limitations and use price targets as part of a broader analysis.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.