Relative value is a concept that is widely used in various fields, including finance and marketing. At its core, relative value refers to the comparison of one thing against another to determine its worth or value. It is a measure that compares the price, worth, or value of one asset to another. The purpose of relative value is to identify which asset is a better investment opportunity or has better value. In finance, for example, relative value is used to determine whether a stock is overvalued or undervalued compared to its peers in the industry. In marketing, relative value is used to compare the value of one product or service to its competitors. Understanding relative value is crucial in making informed decisions in different fields. Knowing the relative value of different assets is essential in determining which ones to invest in. For example, if an investor knows that a particular stock is undervalued compared to its peers, they can invest in that stock with the expectation of a higher return in the future. Similarly, in marketing, understanding relative value helps businesses identify the value proposition of their products or services compared to their competitors. This knowledge helps businesses to differentiate themselves in the market and attract more customers. Relative value is used to compare the price, yield, or risk of different assets. There are different ways to measure relative value, including price-to-earnings ratio, price-to-book ratio, and yield spreads. Price-to-earnings (P/E) ratio is a metric used to determine the value of a stock. It is calculated by dividing the stock's price by its earnings per share (EPS). A high P/E ratio indicates that the market has high expectations for the company's future earnings, while a low P/E ratio suggests that the company is undervalued. Price-to-book (P/B) ratio, on the other hand, compares the market price of a stock to its book value, which is the value of its assets minus its liabilities. A low P/B ratio indicates that the stock is undervalued compared to its book value. Yield spread is another metric used in relative value analysis. It compares the yield of one bond to another bond with a similar maturity and credit rating. A positive yield spread indicates that the first bond is a better investment opportunity than the second bond. In contrast, a negative yield spread suggests that the second bond is a better investment opportunity. Relative value investing is a popular investment strategy that involves buying undervalued assets and selling overvalued ones. This strategy assumes that the market will eventually correct itself, and the undervalued assets will increase in value while the overvalued ones will decrease in value. This is based on the belief that the market tends to overreact to good and bad news, leading to mispricing of assets. Therefore, by investing in undervalued assets, investors can generate higher returns in the long run. In marketing, relative value is used to determine the value proposition of products or services compared to their competitors. The value proposition refers to the unique benefits that a product or service provides to its customers, which sets it apart from its competitors. One method of assessing relative value in marketing is by conducting a comparative analysis. This involves comparing the price, quality, features, and benefits of a product or service to those of its competitors. This analysis helps businesses identify areas where they are doing well and areas where they need to improve to remain competitive. Another method of assessing relative value is by conducting customer surveys. This involves asking customers to rate the value proposition of a product or service compared to its competitors. This information helps businesses to understand how customers perceive their product or service in the market. One way businesses can increase their relative value is by focusing on product differentiation. This involves adding unique features or benefits to their products or services that set them apart from their competitors. For example, a clothing brand can differentiate itself by offering customized fittings or using eco-friendly materials in its products. Another strategy for increasing relative value is by improving the quality of products or services. This involves investing in research and development to enhance the features, functionality, or durability of the products or services. Relative value and absolute value are two essential concepts used in various fields, including finance, economics, and mathematics. Understanding the difference between these concepts is fundamental to making informed decisions and staying competitive in today's market. Absolute value refers to the actual value of an asset, product, or service, without any comparison to other similar assets, products, or services. In finance, for example, absolute value is often used to refer to the actual price of a stock or bond, without any comparison to other similar stocks or bonds. In contrast, relative value is a measure that compares the value, price, or worth of one asset, product, or service to another. The primary advantage of using relative value over absolute value is that it provides a more comprehensive and contextual understanding of the value of an asset or product. By comparing the value of one asset or product to another, businesses and investors can make more informed decisions about where to invest their resources or which products to sell. Another advantage of using relative value is that it accounts for the changing market conditions and trends. Absolute value can be affected by a wide range of factors, including supply and demand, market volatility, and economic conditions. By using relative value, businesses and investors can adjust their strategies to reflect the changing market conditions and trends. Relative value is a critical concept that is used in various industries, including finance and marketing. The ability to compare the value of one asset, product, or service to another is fundamental to making informed decisions and staying competitive in today's market. In finance and investment, understanding relative value analysis helps investors identify opportunities for profitable investments. This analysis involves comparing the value, price, and yield of different assets to determine which ones are undervalued or overvalued. Undervalued assets allow investors to generate higher returns in the long run. In marketing, relative value analysis helps businesses identify the value proposition of their products or services compared to their competitors. By conducting comparative analyses and customer surveys, businesses can understand how their products or services compare to those of their competitors. This information helps businesses to differentiate themselves in the market and attract more customers.Definition of Relative Value

Importance of Understanding Relative Value

Relative Value in Finance and Investment

Relative Value Metrics

Investment Strategies Based on Relative Value

Relative Value in Marketing

Assessing Relative Value in Products and Services

Strategies for Increasing Relative Value in Marketing

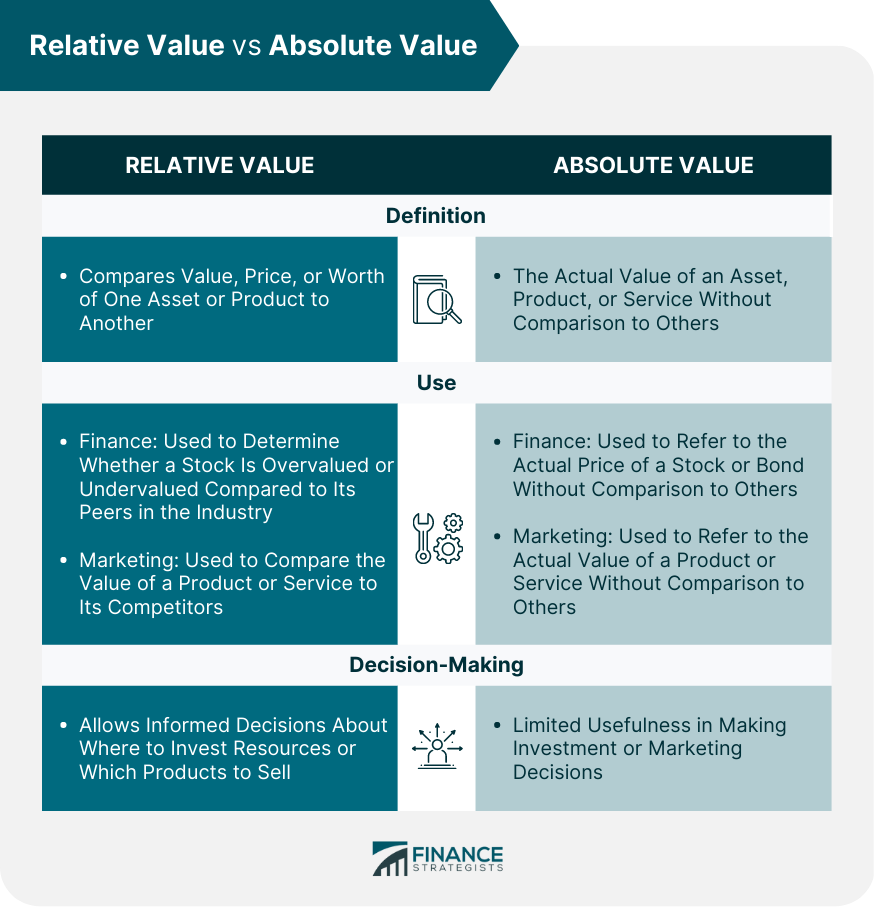

Relative Value vs Absolute Value

Final Thoughts

For more information on how to use relative value in analyzing financial markets, you may consult a wealth management professional.

Relative Value FAQs

Relative value is a measure that compares the price, worth, or value of one asset, product, or service to another.

Relative value is used in finance and investment to compare the value, price, and yield of different assets to determine which ones are undervalued or overvalued. By investing in undervalued assets, investors can generate higher returns in the long run.

Relative value is used in marketing to determine the value proposition of products or services compared to their competitors. By conducting comparative analyses and customer surveys, businesses can understand how their products or services compare to those of their competitors and differentiate themselves in the market.

Absolute value refers to the actual price, worth, or value of an asset, while relative value compares the value of one asset to another.

Relative value can be measured using various metrics, including price-to-earnings ratio, price-to-book ratio, and yield spreads. These metrics help to compare the value, price, and yield of different assets or products to identify undervalued or overvalued opportunities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.