Stochastic modeling is a mathematical framework used to simulate and analyze random processes and their outcomes. It involves the use of probability theory and statistical methods to model and predict the behavior of uncertain variables. In the context of wealth management, stochastic modeling provides a tool for assessing and quantifying risk, making informed investment decisions, and developing long-term financial plans. It provides a systematic approach to understanding and managing uncertainty in financial markets and allows investors to incorporate the randomness and volatility of market conditions into their decision-making process. By using stochastic models, investors can better assess the risk and return trade-offs of investment strategies, optimize asset allocation, and develop robust financial plans that account for various future scenarios. At the core of stochastic modeling are stochastic processes, which are mathematical representations of random phenomena that evolve over time. These processes capture the probabilistic nature of variables and their interactions, allowing for the modeling of complex systems and the analysis of their behavior. Examples of stochastic processes commonly used in financial modeling include geometric Brownian motion and mean-reverting processes. Stochastic modeling relies on probability distributions and random variables to describe the uncertainty associated with the variables of interest. Probability distributions, such as the normal distribution or the log-normal distribution, provide a mathematical framework for characterizing the range of possible outcomes and their associated probabilities. Random variables represent the uncertain quantities that follow these probability distributions, allowing for the generation of random samples to simulate different scenarios. Stochastic modeling often involves analyzing time series data, which captures the evolution of variables over time. Time series analysis techniques, such as autoregressive integrated moving average (ARIMA) models or GARCH models, help identify patterns, trends, and dependencies in the data. These models can be used for forecasting future values based on historical data, incorporating the stochastic nature of the variables and capturing the inherent uncertainty in the predictions. Stochastic modeling is instrumental in asset allocation and portfolio optimization, helping wealth managers determine the optimal mix of investments to achieve clients' financial goals while managing risk. By incorporating stochastic simulations, wealth managers can assess the potential risk and return characteristics of different portfolios under various market scenarios. This enables them to identify portfolios that offer a balance between risk and return and align with clients' risk tolerance and investment objectives. Monte Carlo simulations, a popular technique in stochastic modeling, generate multiple random scenarios by sampling from probability distributions to assess the potential outcomes of an investment or portfolio. These simulations help wealth managers estimate the probability of different risk scenarios, such as market downturns or extreme market events. By quantifying the potential downside risks, wealth managers can implement appropriate risk mitigation strategies and make more informed investment decisions. It allows wealth managers to simulate different market scenarios and assess the impact of market volatility on clients' retirement savings and financial goals. By considering the stochastic nature of investment returns, inflation rates, and other variables, wealth managers can provide clients with more realistic projections and identify potential gaps or risks in their retirement plans. Stochastic modeling helps in developing strategies to mitigate those risks and ensure clients have a higher probability of achieving their long-term financial objectives. The first step in stochastic modeling involves collecting and analyzing relevant data, such as historical market data, economic indicators, or company-specific information. This data serves as the foundation for building stochastic models and understanding the statistical properties of the variables of interest. Once the data is collected, wealth managers select appropriate stochastic models that capture the characteristics of the variables under consideration. Model selection involves choosing the most suitable mathematical framework and probability distributions that align with the data and reflect the nature of the financial markets. Parameter estimation involves determining the values of the model parameters based on the available data, often using statistical estimation techniques such as maximum likelihood estimation. Stochastic modeling often involves simulating multiple scenarios to assess the behavior and performance of financial systems under various conditions. Simulation techniques, such as Monte Carlo simulations or bootstrapping, generate random samples based on the selected stochastic models and input parameters. These simulations help generate probabilistic forecasts and evaluate the robustness of the models. Model validation involves comparing the model outputs with real-world observations and historical data to assess the model's accuracy and reliability. Stochastic models enable wealth managers to quantify and assess the potential risks and rewards associated with different investment strategies. This allows for a more comprehensive evaluation of investment opportunities, helping wealth managers make better-informed decisions that align with clients' risk tolerance and financial objectives. Stochastic modeling provides flexibility in analyzing different market scenarios and adapting to changing market conditions. Financial markets are dynamic, and their behavior can be unpredictable. Stochastic models enable wealth managers to incorporate the inherent uncertainty and variability of financial markets into their analyses. By considering a range of potential outcomes, wealth managers can develop investment strategies that are more robust and resilient to changing market conditions. By using stochastic simulations, wealth managers can assess the impact of different asset allocations on portfolio returns and risks. Stochastic modeling allows for the evaluation of various scenarios and the identification of portfolios that offer an optimal balance between risk and return. This helps wealth managers construct diversified portfolios that can potentially improve risk-adjusted returns and reduce portfolio volatility. Stochastic modeling is invaluable in long-term financial planning and wealth preservation. By considering the stochastic nature of financial variables, such as investment returns and inflation rates, wealth managers can develop more accurate and realistic long-term financial plans for their clients. Stochastic models enable wealth managers to identify potential risks, such as the impact of market downturns on clients' retirement savings, and develop strategies to mitigate those risks. This leads to better long-term financial outcomes and a higher likelihood of achieving clients' financial goals. Stochastic modeling relies on certain assumptions and simplifications to represent complex financial systems. These assumptions can introduce limitations and potential biases into the models. For example, the assumption of normally distributed returns may not hold true in all market conditions. It is crucial for wealth managers to understand the underlying assumptions and evaluate their implications when interpreting the outputs of stochastic models. Stochastic models aim to capture and quantify uncertainty, but they cannot eliminate it entirely. The future behavior of financial markets is inherently uncertain and influenced by numerous factors. Stochastic models provide probabilistic forecasts based on historical data, but they cannot accurately predict future events or unforeseen circumstances. Wealth managers should be aware of the limitations of predictive models and exercise judgment and expertise when interpreting the results. Stochastic models heavily rely on historical data for parameter estimation and generating simulations. The accuracy and reliability of the models depend on the quality and representativeness of the historical data. Additionally, historical data may contain biases due to specific market conditions or anomalies. Wealth managers should be cautious when using historical data and consider potential biases that could impact the model's outputs. Stochastic modeling involves complex mathematical concepts and techniques. Proper implementation and interpretation of stochastic models require a solid understanding of probability theory, statistical methods, and financial concepts. It is crucial for wealth managers to have the necessary expertise or collaborate with professionals who specialize in stochastic modeling to ensure accurate model development, analysis, and application. Stochastic modeling is a valuable tool for analyzing complex systems under uncertainty. It involves using mathematical techniques to simulate and model behavior, allowing for realistic representations of real-world scenarios. The application of stochastic modeling spans across asset allocation, portfolio optimization, risk management and retirement planning. In order to do this, it involves data collection, model selection and simulation techniques. Stochastic modeling offers benefits such as capturing randomness, assessing uncertainties, and aiding in decision-making. However, limitations include the complexity of representing all sources of randomness and the computational resources required. Stochastic modeling remains crucial in understanding and predicting systems subject to randomness and uncertainty with its ability to provide probabilistic insights and aid in decision-making.What Is Stochastic Modeling?

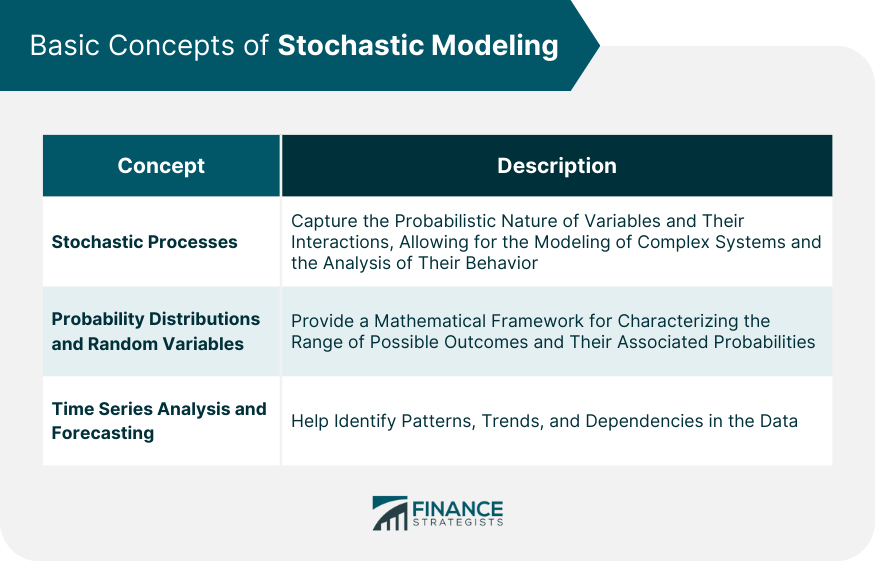

Basic Concepts of Stochastic Modeling

Stochastic Processes

Probability Distributions and Random Variables

Time Series Analysis and Forecasting

Applications of Stochastic Modeling

Asset Allocation and Portfolio Optimization

Risk Management and Monte Carlo Simulations

Retirement Planning and Long-Term Financial Projections

Methodology of Stochastic Modeling

Data Collection and Analysis

Model Selection and Parameter Estimation

Simulation Techniques and Model Validation

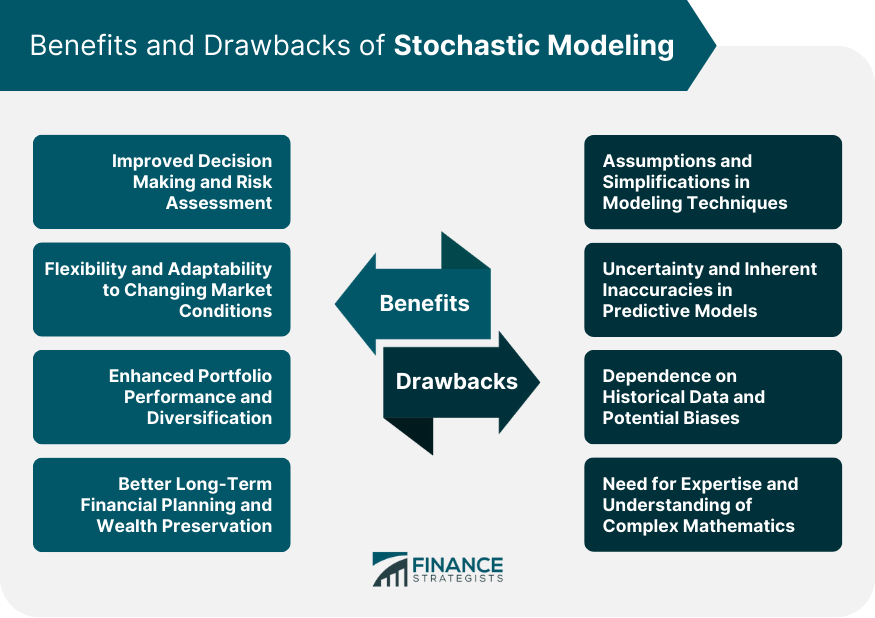

Benefits of Stochastic Modeling

Improved Decision Making and Risk Assessment

Flexibility and Adaptability to Changing Market Conditions

Enhanced Portfolio Performance and Diversification

Better Long-Term Financial Planning and Wealth Preservation

Drawbacks of Stochastic Modeling

Assumptions and Simplifications in Modeling Techniques

Uncertainty and Inherent Inaccuracies in Predictive Models

Dependence on Historical Data and Potential Biases

Need for Expertise and Understanding of Complex Mathematics

Conclusion

Stochastic Modeling FAQs

Stochastic modeling is a mathematical framework used to simulate and analyze random processes and their outcomes. It involves the use of probability theory and statistical methods to model and predict the behavior of uncertain variables. In wealth management, stochastic modeling helps assess risk, make informed investment decisions, and develop long-term financial plans.

Stochastic modeling is important in wealth management because it allows for the systematic analysis of uncertainty in financial markets. It helps wealth managers incorporate the randomness and volatility of market conditions into decision-making processes, assess risk and return trade-offs, optimize asset allocation, and develop robust financial plans.

The basic concepts of stochastic modeling include stochastic processes, which represent random phenomena evolving over time; probability distributions and random variables, which describe the uncertainty associated with variables; and time series analysis and forecasting techniques, which analyze and predict the behavior of variables over time.

Stochastic modeling has various applications in wealth management, including asset allocation and portfolio optimization, risk management and Monte Carlo simulations, and retirement planning and long-term financial projections. It helps wealth managers make informed decisions, assess risks, and develop strategies that align with clients' financial goals.

The benefits of stochastic modeling in wealth management include improved decision making and risk assessment, flexibility and adaptability to changing market conditions, enhanced portfolio performance and diversification, and better long-term financial planning and wealth preservation. However, there are limitations such as assumptions and simplifications in modeling techniques, uncertainties in predictive models, dependence on historical data, and the need for expertise and understanding of complex mathematics.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.