The Win/Loss ratio, also referred to as the success ratio, is a fundamental measure used in the world of investing and trading. It represents the number of profitable trades relative to the number of losing trades. It calculates your victories versus defeats, providing a snapshot of your trading performance. A higher win/loss ratio signifies a more profitable and efficient trading strategy. Understanding the win/loss ratio is vital to any investor or trader. It helps determine the effectiveness of a particular trading strategy over a period of time. Moreover, it serves as a benchmark to compare different trading strategies, providing investors with a tool to optimize their methods. The win/loss ratio also provides valuable insights into potential risks, allowing investors to make informed decisions and manage their investments wisely. Mathematically, the win/loss ratio is calculated by dividing the number of winning trades by the number of losing trades. For instance, if an investor makes 100 trades, 60 trades are profitable, while 40 are not, the win/loss ratio would be 60/40 or 1.5. This means the investor is winning 1.5 trades for every losing trade. In investment, a high win/loss ratio is typically desirable as it implies more winning trades. However, it's crucial to remember that a high win/loss ratio does not necessarily guarantee overall profitability. For instance, an investor could have a high win/loss ratio, but if their losses significantly outweigh their wins, they could still end up with a negative return. Therefore, investors should consider the win/loss ratio with other metrics like the profit/loss ratio to get a holistic view of their investment performance. The win/loss ratio is also an essential tool in risk management. By understanding their win/loss ratio, investors can gauge the level of risk associated with their trading strategy. For instance, a low win/loss ratio may indicate a high-risk strategy, prompting investor to adjust their tactics to mitigate potential losses. In wealth management, the win/loss ratio is used to assess the performance of investment portfolios. By monitoring this ratio, wealth managers can identify which investments are performing well and underperforming. This information can then be used to adjust the portfolio's composition, aligning it with the client's financial goals and risk tolerance. The win/loss ratio is a Key Performance Indicator (KPI) in wealth management. It provides an objective measure of an investment strategy's success, allowing wealth managers to quantify their performance and communicate it effectively to their clients. Balancing the win/loss ratio is crucial for achieving optimal wealth management. A portfolio with a balanced win/loss ratio ensures steady growth in wealth while minimizing potential risks. To achieve this balance, wealth managers may employ various strategies such as diversification, hedging, and rebalancing of assets. By doing so, they can strike a balance between pursuing higher returns and maintaining an acceptable level of risk. In fundamental analysis, the win/loss ratio plays a crucial role in evaluating investments. It helps analysts determine the success rate of a company's trading strategies or the performance of a specific security over time. When used alongside fundamental indicators like Earnings per Share (EPS), the Price-To-Earnings Ratio (P/E), and dividend yield, the win/loss ratio can provide a comprehensive picture of an investment's profitability. Interpreting the win/loss ratio should always be done considering other fundamental factors. For instance, a high win/loss ratio might not be impressive if a company has a high debt load or poor cash flow. Conversely, a low win/loss ratio might not necessarily spell doom if a company has strong fundamentals like a robust balance sheet and a steady revenue stream. In technical analysis, the win/loss ratio is often used with technical indicators such as moving Averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD). These indicators can help identify potential entry and exit points, improving the win/loss ratio. The win/loss ratio plays a key role in adjusting trading strategies. For instance, if a trader has a low win/loss ratio, they might consider adopting a more conservative trading strategy or using stop-loss orders to limit potential losses. On the other hand, a trader with a high win/loss ratio may consider taking on more risk in the pursuit of higher returns. The importance of the win/loss ratio in technical analysis cannot be overstated. By providing a clear measure of a trading strategy's success, the win/loss ratio allows traders to optimize their strategies, manage risk effectively, and, ultimately, increase profitability. The risk/reward ratio is another important metric that can be used with the win/loss ratio. The risk/reward ratio measures the potential reward for every dollar risked. When used with the win/loss ratio, it can provide a more comprehensive view of a trading strategy's performance. Expectancy is a concept that combines the win/loss ratio with the average win and average loss. It provides a measure of the expected profitability of a trading strategy. A positive expectancy indicates a profitable strategy, while a negative expectancy suggests a losing strategy. Market conditions can greatly affect the win/loss ratio. In volatile markets, the win/loss ratio might be lower due to increased risk. Therefore, it's important for investors to adjust their win/loss ratio based on market conditions to reflect their trading strategy's performance accurately. The win/loss ratio is a vital tool in various areas of finance, including wealth management, fundamental analysis, and technical analysis. It provides valuable insights into the effectiveness of trading strategies and helps in optimizing investment methods. In wealth management, the win/loss ratio serves as a key performance indicator, enabling wealth managers to assess portfolio performance and communicate it to clients. Achieving a balanced win/loss ratio is crucial for optimal wealth management, ensuring steady growth while managing risks. In fundamental analysis, the win/loss ratio helps evaluate investments by considering trading strategy success and security performance. When used with technical indicators, the win/loss ratio aids in identifying potential entry and exit points in technical analysis. Advanced concepts, such as the risk/reward ratio and expectancy, further enhance the understanding of the win/loss ratio. Overall, incorporating the win/loss ratio in investment decision-making can lead to more informed choices, effective risk management, and increased profitability.Win/Loss Ratio Overview

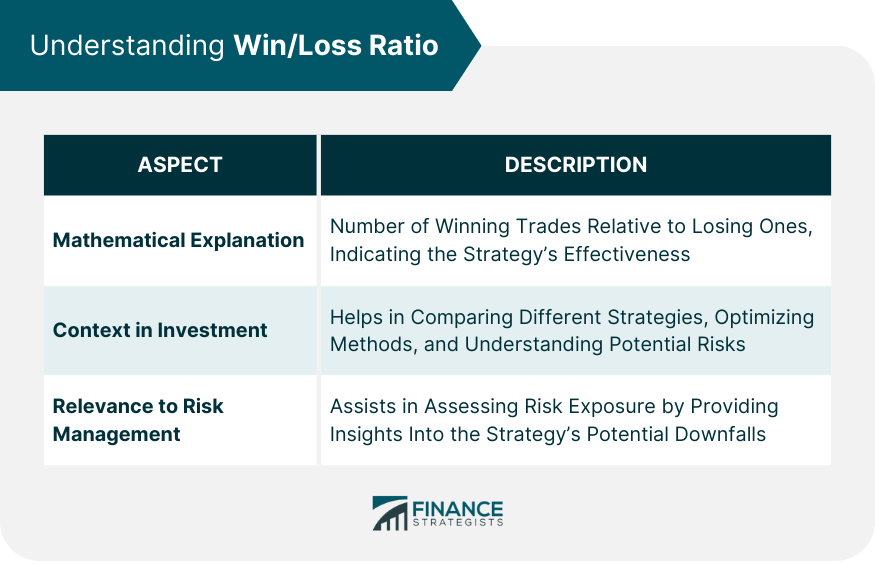

Understanding Win/Loss Ratio

Mathematical Explanation of Win/Loss Ratio

Win/Loss Ratio in the Context of Investment

Relevance of Win/Loss Ratio to Risk Management

Win/Loss Ratio and Wealth Management

Applying Win/Loss Ratio in Wealth Management Strategy

Win/Loss Ratio as a Key Performance Indicator (KPI)

Balancing the Win/Loss Ratio for Optimal Wealth Management

Win/Loss Ratio in Fundamental Analysis

Use of Win/Loss Ratio in Evaluating Investments

Interpreting Win/Loss Ratio in the Light of Fundamental Factors

Win/Loss Ratio in Technical Analysis

Win/Loss Ratio and Technical Indicators

Adjusting Trading Strategies Based on Win/Loss Ratio

Importance of Win/Loss Ratio in Technical Analysis

Advanced Concepts of Win/Loss Ratio

Enhancing Win/Loss Ratio With Risk/Reward Ratio

Win/Loss Ratio and Expectancy

Adjusting Win/Loss Ratio Based on Market Conditions

Bottom Line

Win/Loss Ratio FAQs

The Win/Loss Ratio is a measure used in investing and trading that represents the number of profitable trades relative to the number of losing trades. It's a crucial indicator of the effectiveness of a trading strategy and serves as a tool to compare different strategies, optimize methods, and provide insights into potential risks.

In wealth management, the Win/Loss Ratio is used to assess the performance of investment portfolios. By monitoring this ratio, wealth managers can identify well-performing investments and underperforming ones, enabling them to adjust the portfolio's composition to align with the client's financial goals and risk tolerance.

In fundamental analysis, the Win/Loss Ratio, alongside other fundamental factors, helps evaluate an investment's profitability. In technical analysis, it's used with technical indicators to optimize trading strategies. However, it's crucial to interpret the Win/Loss Ratio in light of other indicators and market conditions for a comprehensive analysis.

Although a high Win/Loss Ratio is generally desirable as it indicates more winning trades, it doesn't necessarily guarantee overall profitability. An investor might have a high Win/Loss Ratio, but if their losses significantly outweigh their wins, they could still end up with a negative return. Hence, it's essential to consider the Win/Loss Ratio alongside other metrics like the profit/loss ratio.

Real-world applications of the Win/Loss Ratio include its use by financial institutions to evaluate and optimize their trading strategies and its application in portfolio diversification. By analyzing the Win/Loss Ratios of different assets, investors can create a diversified portfolio that maximizes returns and minimizes risk.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.