Worden Stochastics is a momentum indicator that plays a crucial role in financial analysis and trading strategies. It is designed to assess the strength or weakness of a security's price by considering both price and volume data. In financial analysis, Worden Stochastics provides valuable insights into market trends, helping investors identify potential reversal points and overbought/oversold conditions. Its unique incorporation of volume data enhances its accuracy and responsiveness, making it a powerful tool for informed decision-making. Implementing Worden Stochastics in trading involves setting it up on a trading platform and interpreting its signals. Traders can use Worden Stochastics to determine entry and exit points, manage risk, and develop effective trading strategies. By combining Worden Stochastics with other technical analysis tools, traders can confirm signals and maximize their effectiveness. Worden Stochastics' ability to provide timely and reliable signals makes it an essential component in the toolkit of traders seeking to improve their trading performance. The importance of Worden Stochastics in financial analysis lies in its ability to provide valuable insights into market trends and potential reversal points. By considering both price and volume data, this momentum indicator enhances the accuracy of trading decisions. It helps investors identify overbought and oversold conditions, indicating when price levels are unsustainable and prone to a reversal. This information is crucial for managing risk and optimizing entry and exit points. By incorporating Worden Stochastics into financial analysis, traders gain a better understanding of market dynamics and can make informed trading decisions, ultimately improving their overall financial performance. To effectively use Worden Stochastics, one must first understand key terminologies, like stochastics, overbought, and oversold conditions. Stochastics is a technical momentum indicator that compares a security's closing price to its price range over a specific period. It oscillates between zero and 100, with readings above 80 being considered overbought and readings below 20 viewed as oversold. Overbought and oversold conditions in trading refer to situations when an asset has been bought or sold to the extent that its current price level is no longer sustainable and is prone to a reversal. Unlike traditional stochastics, Worden Stochastics factors in the trading volume, which provides a more accurate depiction of market sentiment. This approach ensures more responsive signals, improving trading decisions. Before applying Worden Stochastics, understanding its technical details, such as the calculation process and what the values represent, is crucial. The Worden Stochastics formula incorporates both price and volume data, computing the cumulative sum of the product of two differences: between closing and lowest price, and between volume and a 21-period simple moving average of volume. The calculation process for Worden Stochastics is intricate, involving a series of steps. It begins with calculating the difference between the closing and lowest price, multiplied by the difference between volume and a 21-period simple moving average of volume. The results are then aggregated and divided by the highest value reached during the calculation period to generate a percentage. A high value of Worden Stochastics, typically above 80, signifies an overbought condition, indicating a potential price reversal to the downside. Conversely, a low value, often below 20, signifies an oversold condition, suggesting a potential price reversal to the upside. Most modern trading platforms offer Worden Stochastics as an available indicator. To set it up, traders typically select it from a menu of available indicators, then adjust the settings according to their trading strategy. The Worden Stochastics indicator is typically depicted as an oscillating line on a graph. A crossing above the 80 level signals an overbought condition, indicating that it may be time to sell. Conversely, a crossing below the 20 level signals an oversold condition, suggesting that it may be time to buy. Successful trading strategies using Worden Stochastics often involve pairing it with other technical analysis tools. Traders might combine it with trend lines, moving averages, or resistance and support levels to confirm signals and minimize false positives. Worden Stochastics can be even more effective when combined with other technical analysis tools. Pairing Worden Stochastics with tools like moving averages or Bollinger Bands can provide confirmation for the signals it generates. For example, a sell signal from Worden Stochastics that coincides with the price hitting the upper Bollinger Band could indicate a strong opportunity to sell. While combining Worden Stochastics with other tools can improve the accuracy of trading decisions, it also increases complexity and may lead to analysis paralysis if not done carefully. Advanced trading strategies involving Worden Stochastics can help traders to extract more profits from the markets. Divergence occurs when the price of an asset is moving in the opposite direction of a technical indicator, in this case, Worden Stochastics. Spotting such discrepancies can signal potential price reversals, providing lucrative trading opportunities. Convergence, the opposite of divergence, occurs when the price of an asset and Worden Stochastics are moving in the same direction. This often signals the continuation of a trend, allowing traders to ride the momentum. Examining multiple time frames can provide a broader perspective on the market, revealing trends that might be invisible in a single time frame. Worden Stochastics can be used on various time frames to identify the best trading opportunities. Worden Stochastics can generate false signals during periods of low volatility or sideways markets when price movements are minimal. Additionally, it can remain in overbought or oversold conditions for extended periods during strong trends, which could lead to premature or late trades. Some professionals critique that Worden Stochastics and similar technical indicators are more self-fulfilling prophecies than accurate predictors of market movements. Critics argue that these tools work because many traders use them, thereby influencing the market, rather than identifying inherently predictive patterns. Worden Stochastics is a momentum indicator that incorporates price and volume data to determine the strength or weakness of a security's price. Its importance and role in financial analysis cannot be overstated. By providing insights into overbought and oversold conditions, it allows traders to make informed decisions about potential price reversals. Implementing Worden Stochastics in trading requires understanding its technical details, such as the calculation process and interpretation of the values. By setting it up on a trading platform and combining it with other technical analysis tools, traders can develop effective trading strategies. Incorporating Worden Stochastics into trading provides a unique perspective on market trends, enabling traders to optimize entry and exit points and manage risk more effectively. While it has its limitations and critics, Worden Stochastics remains a powerful tool for traders seeking to enhance their decision-making process and improve profitability in the dynamic world of financial markets.Definition of Worden Stochastics

Importance and Role in Financial Analysis

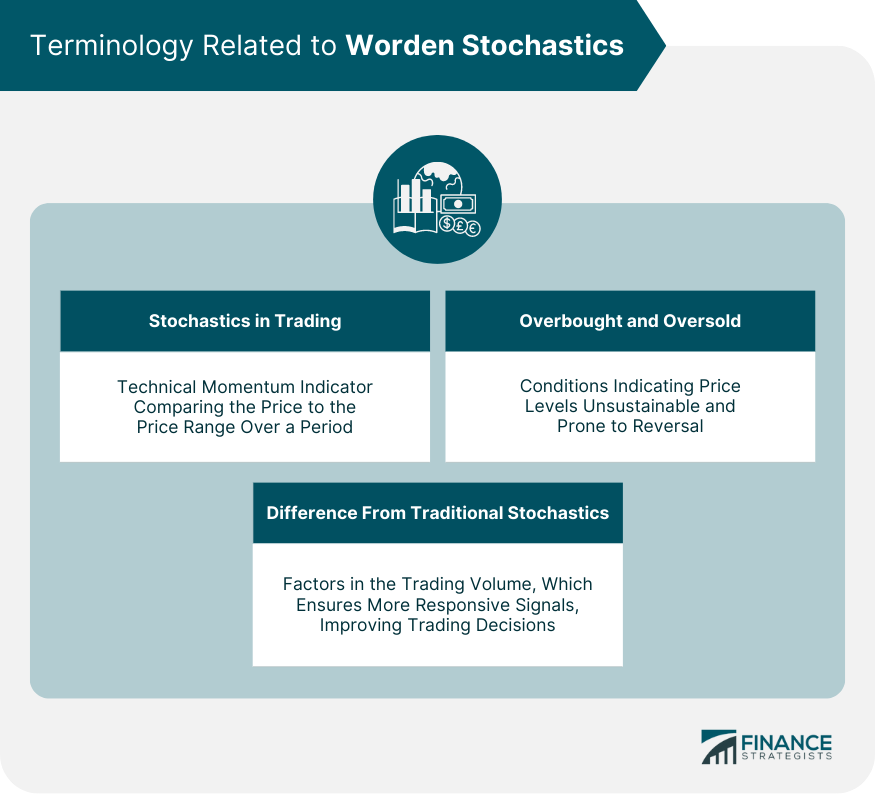

Understanding the Terminology Related to Worden Stochastics

What Is Stochastics in Trading

The Concept of Overbought and Oversold Conditions

How Worden Stochastics Differ from Traditional Stochastics

Worden Stochastics Indicator: Technical Details

The Mathematics Behind Worden Stochastics

Worden Stochastics Calculation Process

The Meaning of the Worden Stochastics Values

Implementing Worden Stochastics in Trading

The Process of Setting up Worden Stochastics on a Trading Platform

Basic Interpretation of Worden Stochastics Signals

Developing a Trading Strategy Using Worden Stochastics

Worden Stochastics and Other Technical Analysis Tools

How Worden Stochastics Works in Conjunction With Other Indicators

Pros and Cons of Combining Worden Stochastics With Other Tools

Advanced Worden Stochastics Strategies

Divergence Strategy Using Worden Stochastics

Convergence Strategy Using Worden Stochastics

Multiple Time Frame Analysis Using Worden Stochastics

Limitations and Critiques of Worden Stochastics

Circumstances Under Which Worden Stochastics May Give Misleading Signals

Academic and Professional Critiques of Worden Stochastics

Conclusion

Worden Stochastics FAQs

Worden Stochastics is a momentum indicator used in financial analysis and trading to assess the strength or weakness of a security's price by considering price and volume data.

Unlike traditional stochastics, Worden Stochastics incorporates volume data in its calculations, providing a more accurate and responsive analysis of market trends.

Worden Stochastics plays an important role in financial analysis by helping investors identify potential reversal points, overbought, and oversold conditions, enabling informed trading decisions.

To implement Worden Stochastics in trading, traders need to set it up on their trading platform. They can interpret its signals to determine entry and exit points, manage risk, and develop effective trading strategies.

Traders should consider using Worden Stochastics because it provides valuable insights into market trends, improves the accuracy of trading decisions, and helps optimize entry and exit points, leading to better trading performance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.