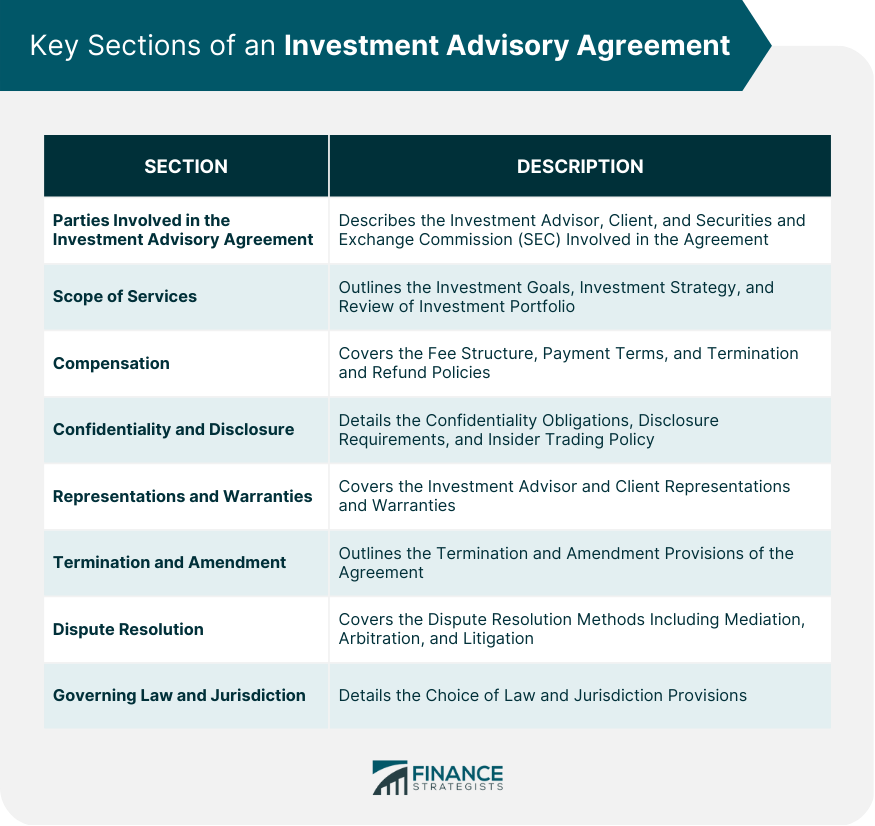

An investment advisory agreement is a legally binding document that outlines the terms and conditions of the relationship between an investment advisor and a client. The agreement details the scope of services that the advisor will provide, the compensation that the advisor will receive, and the responsibilities of both parties. The document also outlines the obligations of the advisor to act in the best interests of the client and to disclose any conflicts of interest that may arise. The purpose of an investment advisory agreement is to establish a clear understanding between the advisor and the client about the services that will be provided and the compensation that will be received. The agreement helps to define the expectations of both parties and reduces the likelihood of misunderstandings or disputes. It also provides a mechanism for resolving any disagreements that may arise between the parties. An investment advisory agreement is important because it provides legal protection for both the advisor and the client. The agreement outlines the obligations and responsibilities of each party, reducing the likelihood of disputes or misunderstandings. It also ensures that the advisor is held accountable for their actions and that they act in the best interests of the client. Additionally, the agreement provides a clear framework for resolving any conflicts that may arise between the parties. The parties involved in an investment advisory agreement are the following: The investment advisor is the individual or firm that provides investment advice and management services to the client. The advisor is responsible for developing an investment strategy that aligns with the client's goals and objectives. They must also ensure that they act in the best interests of the client and disclose any conflicts of interest that may arise. The advisor is compensated for their services through a fee structure outlined in the investment advisory agreement. The client is the individual or entity that seeks investment advice and management services from the investment advisor. The client's responsibilities include providing the advisor with accurate and complete information about their financial situation and investment goals. The client must also review and understand the terms of the investment advisory agreement and agree to abide by its terms. The client pays the advisor for their services through a fee structure outlined in the agreement. The Securities and Exchange Commission (SEC) is the government agency responsible for regulating the investment advisory industry in the United States. The SEC oversees investment advisors and enforces compliance with federal securities laws. Investment advisors are required to register with the SEC if they manage assets over a certain threshold. The SEC also provides resources for investors to research investment advisors and to file complaints if necessary. The scope of services must be clearly defined in the agreement including the following: The investment advisory agreement should clearly outline the client's investment goals and objectives. This includes the client's risk tolerance, investment time horizon, and desired rate of return. The advisor is responsible for developing an investment strategy that aligns with the client's goals and objectives. The investment strategy outlines the specific investments that the advisor will recommend to the client. The strategy should be tailored to the client's investment goals and objectives and should take into account the client's risk tolerance and time horizon. The investment strategy may include recommendations for stocks, bonds, mutual funds, and other securities. The agreement includes restrictions on the investment advisor's activities. For example, the agreement may prohibit the advisor from investing in certain types of securities or from engaging in certain types of transactions. This may also require the advisor to obtain the client's permission before making certain types of investments. The investment advisory agreement should include provisions for the periodic review of the client's investment portfolio. The agreement should specify how often the advisor will review the portfolio and what specific items the advisor will review, such as the performance of individual investments and the overall asset allocation. The review should take into account any changes in the client's financial situation or investment goals and may result in recommendations for changes to the investment strategy. The compensation details must also be included in the agreement: The investment advisory agreement should clearly outline the fee structure that the advisor will charge for their services. This may include a flat fee, a percentage of assets under management, or a performance-based fee. The agreement should also specify how the fee will be calculated and when it will be due. The investment advisory agreement should specify the payment terms for the advisor's fees. This may include a schedule of payments or a lump sum payment. The agreement should also specify how the advisor will be paid, such as through a direct debit from the client's account. There must be provisions for termination and refund policies. The agreement should specify the circumstances under which the agreement may be terminated, such as breach of contract or failure to provide agreed-upon services. The agreement should also specify whether any fees will be refunded in the event of termination. A section on confidentiality and disclosure must be included in the agreement with the following details: The investment advisory agreement should include provisions for confidentiality obligations. The agreement should specify how the advisor will handle confidential information about the client, such as their financial situation and investment goals. The agreement should also specify the circumstances under which the advisor may disclose confidential information, such as to comply with a legal obligation. It should specify the advisor's disclosure requirements. The agreement should require the advisor to disclose any conflicts of interest that may arise and any fees or compensation that the advisor may receive from third parties. The agreement should also specify the advisor's obligations to provide the client with regular reports on the performance of their investments. The investment advisory agreement should include provisions for an insider trading policy. The agreement should prohibit the advisor from engaging in insider trading and require the advisor to disclose any material nonpublic information that they may possess. Information regarding the representations and warranties should be available: It must be clearly specified that the advisor is registered with the SEC (if applicable) and that the advisor has the necessary qualifications and expertise to provide investment advice. The agreement should also include representations that the advisor will act in the best interests of the client and disclose any conflicts of interest. The investment advisory agreement should also include representations and warranties from the client. The agreement should specify that the client has provided accurate and complete information about their financial situation and investment goals. The agreement should also include representations that the client has the authority to enter into the agreement and to authorize the advisor to make investment decisions on their behalf. There should be a section with details on the termination and amendment of the agreement. The terms should specify the circumstances under which the agreement may be terminated, such as breach of contract or failure to provide agreed-upon services. The agreement should also specify the notice requirements and any fees that may be due upon termination. There should be clear specifications of the circumstances under which the agreement may be amended, such as changes to the client's financial situation or investment goals. The agreement should also specify the process for amending the agreement, such as requiring written consent from both parties. A section on dispute resolution should include: There must be a provision for the resolution of disputes. The agreement may require the parties to attempt to resolve any disputes through mediation before pursuing other options. The agreement should specify the process for selecting a mediator and how the costs of mediation will be allocated. The investment advisory agreement may contain clauses allowing for the resolution of disputes via arbitration, which would bind the parties involved to an arbitrator's decision instead of resorting to litigation. The procedure for selecting an arbitrator and how the arbitration expenses would be divided must be clearly indicated in the agreement. It is possible for the investment advisory agreement to indicate that disputes will be resolved via litigation, and the agreement ought to identify the legal proceedings' jurisdiction and location, and possibly include clauses that allow for the recovery of legal expenses and attorney fees. There are certain legal considerations that must be considered: The investment advisory agreement should specify the governing law that will apply to the agreement. The agreement should specify which state's law will apply to the agreement and any disputes that may arise. Additionally, the investment advisory agreement must specify the governing law and the jurisdiction that would have the power to hear any disputes that may arise under the agreement. The agreement should also identify the location for any legal proceedings and might feature provisions for recovering attorney fees and costs. An investment advisory agreement is a critical legal document that outlines the terms of the investment advisory relationship between the investment advisor and the client. The key sections of the agreement cover a range of topics, including the scope of services, compensation, confidentiality and disclosure, representations and warranties, termination and amendment, dispute resolution, and governing law and jurisdiction. The agreement's purpose is to establish a clear understanding of the obligations and responsibilities of both parties, provide legal protection, and ensure that the client's investments are managed in their best interests. It is essential to understand the investment advisory agreement thoroughly to avoid any misunderstandings and ensure a successful relationship between the investment advisor and the client. Understanding the investment advisory agreement is vital to ensuring a successful relationship between the advisor and the client when taking advantage of wealth management services. What Is an Investment Advisory Agreement?

Parties Involved in an Investment Advisory Agreement

Investment Advisor

Client

Securities and Exchange Commission

Scope of Services in an Investment Advisory Agreement

Investment Goals

Investment Strategy

Restrictions on the Investment Advisor

Review of Investment Portfolio

Compensation in an Investment Advisory Agreement

Fee Structure

Payment Terms

Termination and Refund Policies

Confidentiality and Disclosure in an Investment Advisory Agreement

Confidentiality Obligations

Disclosure Requirements

Insider Trading Policy

Representations and Warranties in an Investment Advisory Agreement

Investment Advisor Representations

Client Representations

Termination and Amendment in an Investment Advisory Agreement

Termination of Agreement

Amendment of Agreement

Dispute Resolution in an Investment Advisory Agreement

Mediation

Arbitration

Litigation

Governing Law and Jurisdiction in an Investment Advisory Agreement

Choice of Law

Jurisdiction

Final Thoughts

Investment Advisory Agreement FAQs

An investment advisory agreement is a legal document that outlines the terms and conditions of the investment advisory relationship between an investment advisor and a client.

The key sections of an investment advisory agreement include the scope of services, compensation, confidentiality and disclosure, representations and warranties, termination and amendment, dispute resolution, and governing law and jurisdiction.

An investment advisory agreement is important because it establishes a clear understanding of the obligations and responsibilities of both parties, provides legal protection, and ensures that the client's investments are managed in their best interests.

The purpose of confidentiality and disclosure provisions in an investment advisory agreement is to ensure that confidential information is not disclosed to unauthorized parties and to provide transparency about the investment advisor's activities.

The Securities and Exchange Commission (SEC) is responsible for regulating investment advisors and may review investment advisory agreements to ensure compliance with federal securities laws.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.