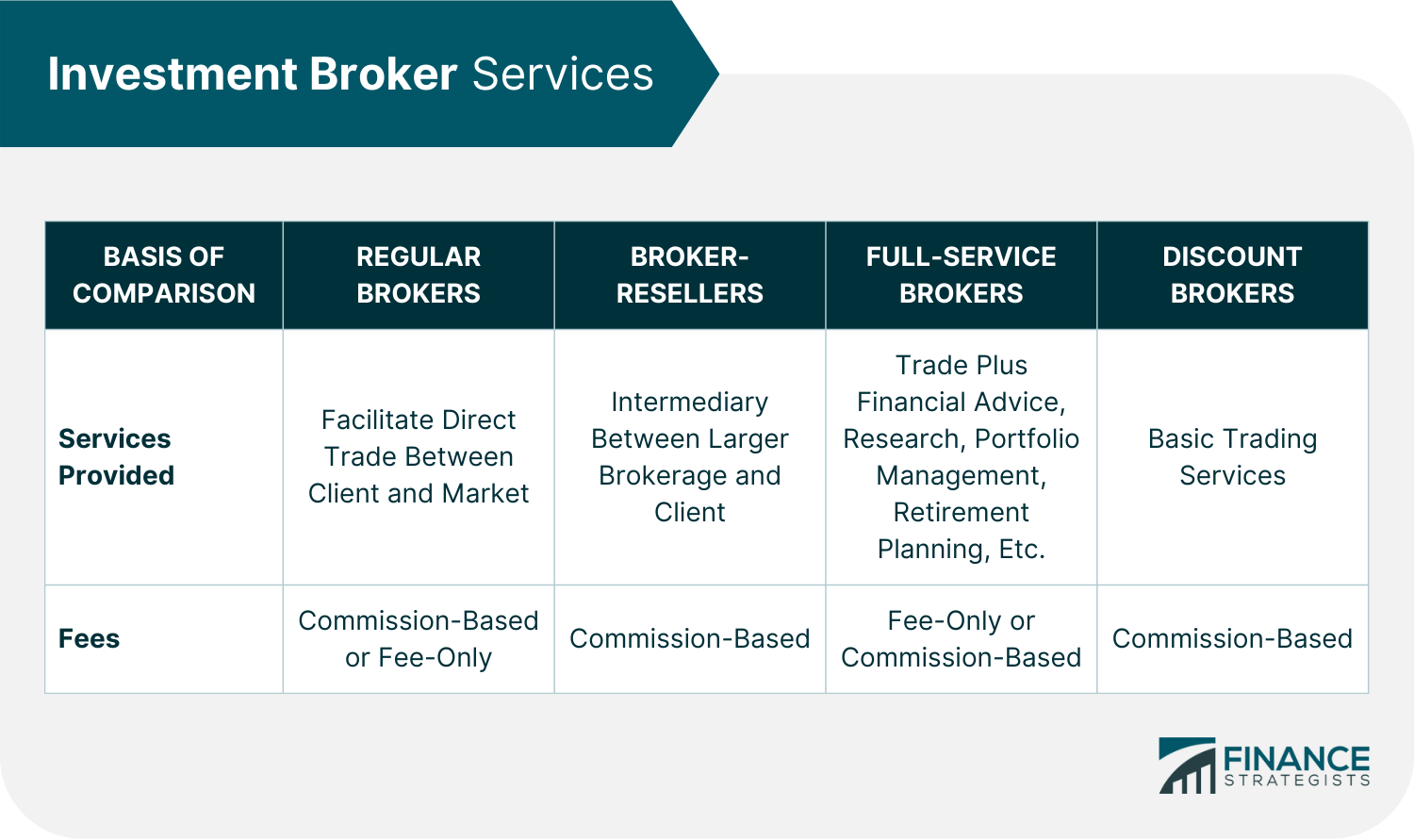

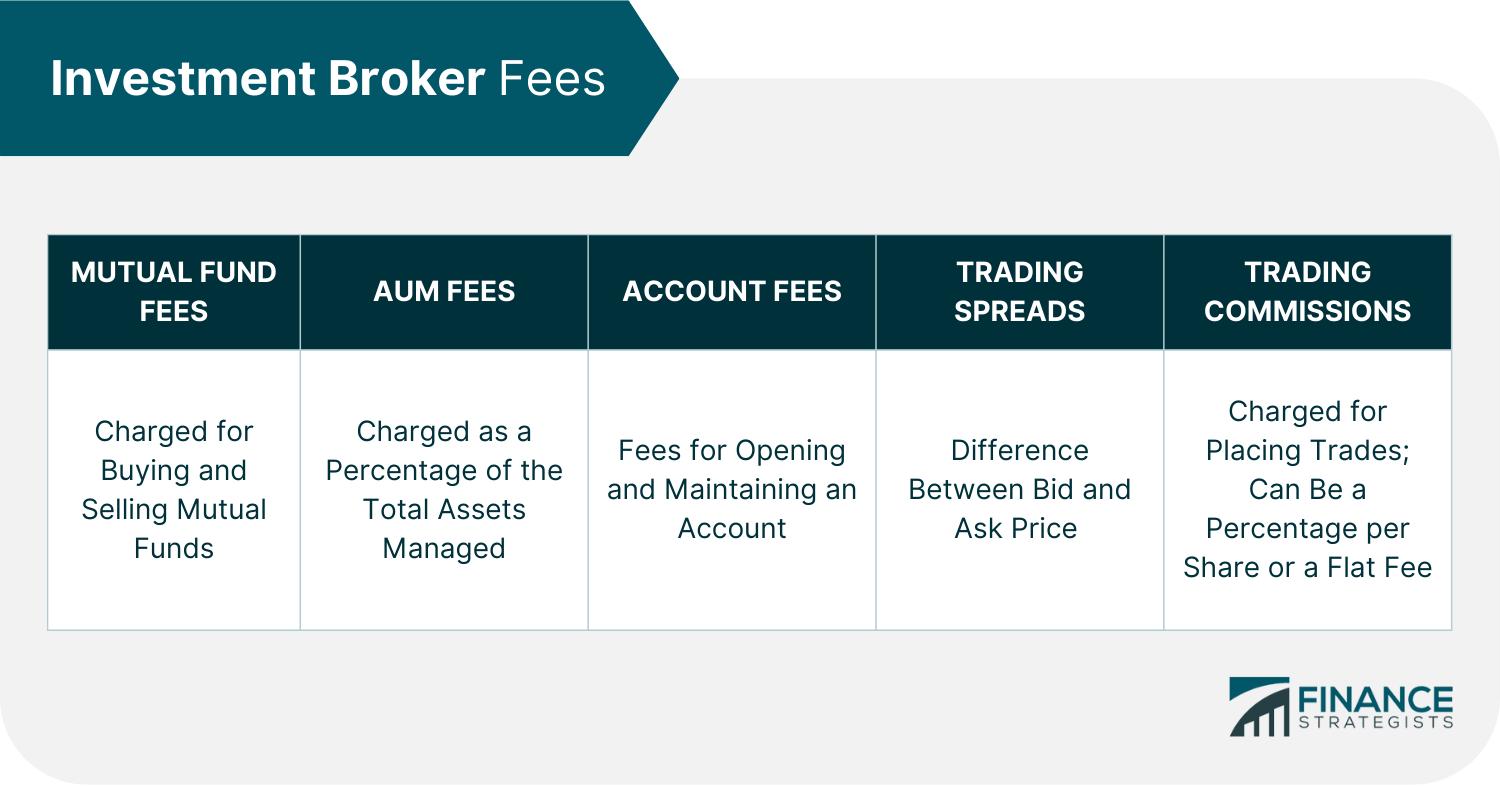

An investment broker is a person or institution who facilitates buying and selling investments, including stocks, bonds, mutual funds, commodities, real estate, and other securities. They execute trades on behalf of their clients and provide detailed reports about the performance of their investments. They may also offer investment advice based on their client’s financial goals. Investment brokers are also known as securities brokers or stockbrokers and are usually required to hold a license from the Financial Industry Regulatory Authority (FINRA). FINRA is charged with protecting investors by ensuring brokers abide by regulations. An investment broker is not the same as a financial advisor. Brokers typically focus on executing trades, while financial advisors provide professional advice on managing investments. Financial advisors may also help clients with retirement planning, estate planning, and more. Have a financial question? Click here. The primary role of an investment broker is to facilitate the buying and selling of investments. They can be further classified as Regular Brokers, Broker-Resellers, Full-Service Brokers, and Discount Brokers. A regular broker is a go-between in buying and selling investments. They accept orders from their clients and place them directly on the market for a fee. Regular brokers typically work with individual investors and institutional clients such as hedge funds and mutual funds. They may also advise their clients about which investments are best suited for them based on their financial goals. Broker-resellers do not place orders directly on the market. Instead, they work with other larger brokerages to execute trades for their clients. They act as intermediaries between a client and a larger broker and earn a commission for their service. Smaller investors or those looking for lower fees and commissions commonly use broker resellers. Full-service brokers provide a full suite of services for their clients. They offer research, advice, portfolio management, and placing orders on the market. They typically charge higher fees than regular brokers or broker-resellers because they provide more services. Full-service brokers can benefit those needing more comprehensive guidance and personalized investment advice. They can also be helpful to people with more extensive investment portfolios. Discount brokers provide basic trading services at reduced rates. They accept orders from their clients and execute trades on their behalf but do not provide additional services like financial advice or research. Discount brokers are popular with investors who want to save money by cutting out unnecessary costs and just focus on buying and selling investments. Investment broker fees vary depending on the services provided. Generally, two types of costs are associated with availing broker services: commission-based and fee-only. In most cases, brokers will charge a commission for each transaction they process on behalf of their clients. This can range from a few dollars to hundreds or even thousands of dollars, depending on the type of transaction. Fee-only brokers charge a flat fee for their services, which is typically based on the size and complexity of the portfolio. Regular brokers and broker-resellers usually charge a commission based on the amount of money they are trading, while full-service brokers often charge a flat fee for their services. Discount brokers may also charge a fee, but it is usually much lower than other brokerages. Specifically, broker fees may include: Mutual fund fees are the fees brokers charge for buying and selling mutual funds, which typically range from 0.2% to 1.5%, depending on how active or passive the management of such funds is and the particular share class. A 12B-1 fee is also charged as a recurring fee for selling a mutual fund, ranging from 0.25% to 0.75% of the total sales. Many investment brokers charge clients a fee based on the percentage of assets they manage. This is known as an AUM fee. This is calculated as a percentage of the total value of assets managed by the broker and usually ranges from 0.25% to 1%. For example, if a broker manages a portfolio worth $1,000,000 and charges a 0.5% AUM fee, the investor will pay $5,000 in total fees. Typically, the cost associated with opening and maintaining a brokerage account depends on the type of assets you invest in. Some brokers may charge an annual fee for specific accounts or require minimum deposits, while some investment brokers may charge fees if an account is inactive for a certain period of time. In addition to commissions and other expenses, some brokers also charge a trading spread when placing trades. A trading spread is the difference between a security or asset’s bid and ask price. This fee can range from a fraction of a penny per share to several dollars, depending on the type of asset being traded. Trading commissions are the fees charged by brokers for placing trades. These can range from a few cents per share to several dollars depending on the type of asset being traded and the broker’s commission structure. Some brokers charge a flat fee regardless of the number of assets traded, while others charge a commission per share. The decision to use an investment broker is a personal one and depends on your individual financial goals. Investment brokers can help new and experienced investors alike. At the onset, it is important to be clear about your financial and investment goals. Doing this will set what type of investment broker you need and which services you will require. Suppose you are looking for comprehensive assistance, including research and personalized financial advice, and want someone to manage your investments on an ongoing basis. In that case, it may be worth considering working with a full-service broker. However, if you are comfortable researching and selecting investments on your own, then a discount broker might be more suitable for your needs. If you have a smaller portfolio and are looking for lower fees or commissions, consider working with a broker-reseller. When deciding to work with an investment broker, it is also crucial to assess fees, commissions, account types, services offered, and other features. If you determine that you need a broker’s services, the following can help you choose the right investment broker for you: Start by looking online at FINRA’s BrokerCheck tool, which provides information on the background and experience of individual brokers and their firms. You can also contact your state securities regulator for further information on prospective brokers. You can also visit trusted online resources for reviews of investment brokers and their services, fees, commissions, and other related information. Check if the broker is a member of the Securities Investor Protection Corporation (SIPC). This nonprofit organization provides limited insurance to customers whose broker fails or declares bankruptcy. An insured investment broker adds another layer of protection for you and your investment. A fiduciary is someone who has a legal obligation to act and make decisions based on your best interest. They are expected to avoid conflicts of interest and to prioritize your financial well-being. Ensure the broker you are considering has a track record of working in a fiduciary capacity and provides transparent information about their fees and services. Firsthand experience of family and friends with a particular investment broker is invaluable. What they say could add depth to your decision process. While online reviews and government regulators matter, endorsement from people you know and trust boosts confidence in a particular broker. Compare services offered, fees, commissions, qualifications, and how investment brokers will manage your investments. Ask questions about their industry experience, investing strategies, performance history, and any additional services they provide, such as tax advice or retirement planning. Ask about their availability and how often they will provide updates on your investments and progress. Ensure you are comfortable with the answers your receive before selecting a broker. Once you have narrowed down your selection, consider setting up a trial period where you can evaluate their performance and service. Doing this will help you make an informed decision about whether or not the broker is right for you. Ensure the broker understands your targets and risk tolerance levels to help you achieve your financial goals. An investment broker helps you buy, sell, and manage investments such as stocks, bonds, and mutual funds. The cost of working with an investment broker can vary depending on the type of services offered and how they are compensated. Whether or not you need an investment broker depends on your individual financial goals, risk tolerance, and comfort level with researching and selecting investments on your own. Do your research to compare different brokers, and ask questions about their experience, fees, commissions, and other services provided before choosing one. Working with an experienced investment broker can be beneficial in helping to achieve success in reaching your financial goals.What Is an Investment Broker?

What Does an Investment Broker Do?

Regular Brokers

Broker-Resellers

Full-Service Brokers

Discount Brokers

Cost of an Investment Broker

Mutual Fund Fees

Assets Under Management (AUM) Fees

Account Fees

Trading Spreads

Trading Commissions

Do You Need an Investment Broker?

Hiring an Investment Broker

Do Your Research

Check if the Brokerage Is Insured

Review Fiduciary Standards

Get Referrals From Family and Friends

Compare Different Brokers

Set up a Trial Period

The Bottom Line

Investment Broker FAQs

A qualified investment broker can help investors make well-informed decisions about their money by offering access to research data and independent analysis of companies or assets they are considering investing in. With their expertise and experience, brokers can provide valuable guidance that leads to better long-term investment returns.

Investment brokers come in various classes, each providing different services and levels of access to the capital markets. Regular brokers directly facilitate trade between a client and the market, while broker-resellers are intermediaries between a client and a larger brokerage firm. Full-service brokers offer comprehensive financial services beyond asset trading by providing advice on investments, retirement planning, estate planning, taxes, and more. Discount brokers specialize in asset trading by offering access to a wide range of securities at reduced fees.

Consider your investment knowledge, needs, financial goals, and risk tolerance. Then, consider the investment broker’s fees, other payment structures, services offered, regulatory and licensing permits, and fiduciary standards.

Brokers typically earn from trading commissions, mutual fund fees, account fees, assets under management (AUM) fees, and trading spreads, among others. Fees will depend on the services provided and the payment structure of a particular broker.

You can use FINRA’s BrokerCheck Tool. You can also turn to trusted online resources such as financial advice websites and review sites. Check reviews from customers who have worked with various brokers before selecting one for yourself.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.