In the dynamic landscape of financial markets, an Alternative Trading System (ATS) is a non-exchange trading venue that matches buyers and sellers to execute transactions. It serves as an alternative to traditional exchanges, providing a platform that connects various market participants directly, often bypassing the intermediaries typical of conventional exchange-based trading. ATS are often characterized by greater operational flexibility and less regulatory supervision compared to traditional exchanges. They cater to a diverse set of securities, including stocks, bonds, and derivatives. Moreover, ATS can also provide additional liquidity to the market, allowing for potentially smoother transaction processes and reducing price volatility. The origin of ATS dates back to the 1970s when the U.S. Securities and Exchange Commission (SEC) introduced regulations permitting electronic exchanges. The intention was to decentralize financial markets and break the duopoly of the New York Stock Exchange (NYSE) and the National Association of Securities Dealers Automated Quotations (NASDAQ). The subsequent decades witnessed the proliferation of ATS, driven by technological advancements and regulatory changes that promoted competition and transparency in the securities industry. The functioning of an ATS relies on advanced computer algorithms to match buy and sell orders. Market participants enter their order details into the system, which includes the type of security, quantity, and price. When a corresponding order is found, the ATS matches the orders, executing the trade automatically. This eliminates the need for a human broker, increasing speed and efficiency. Technology is at the heart of ATS. It allows for the rapid processing of vast quantities of data, high-frequency trading, and the immediate execution of trades. Advanced algorithms, artificial intelligence, and machine learning techniques are commonly employed to optimize order matching and execution. Furthermore, technologies such as blockchain are being explored for their potential to enhance transparency, security, and efficiency within these systems. Upon the execution of trades, the clearing and settlement process in an ATS is typically handled by a clearing house. The clearinghouse confirms the transaction details, ensures the transfer of securities and payment, and manages the associated counterparty risk. This process further ensures the efficiency and security of trading within an ATS. ATS is designed to serve a wide range of market participants. These include: These are individual, non-professional investors who use ATS to access a broader array of securities, often at lower costs than traditional exchanges. Institutional investors, such as hedge funds, mutual funds, and pension funds, utilize ATS to execute large-volume trades discreetly, minimizing market impact. Broker-dealers use ATS to provide their clients with access to additional liquidity and potential price improvements. High-frequency traders leverage the speed and efficiency of ATS for algorithmic trading strategies, executing large numbers of trades in fractions of a second. ATS provides a venue for trading securities that may not have sufficient liquidity on traditional exchanges. By aggregating supply and demand from various sources, ATS can offer improved liquidity, potentially leading to better execution prices for traders. ATS usually operate with lower overheads than traditional exchanges, largely due to their technology-driven operations. These cost savings are often passed onto participants in the form of lower transaction fees. ATS often allows participants to trade anonymously. This can be particularly advantageous for institutional investors who wish to trade large blocks of securities without revealing their intentions to the wider market. Many ATS offer extended trading hours, providing participants with the opportunity to trade outside the standard hours of traditional exchanges. This can enable more timely responses to market news and developments. Given their reliance on technology, ATS are susceptible to operational risks, including system failures, programming errors, and cyber threats. By decentralizing trading activities, ATS could potentially contribute to systemic risk. In particular, the lack of transparency associated with some forms of ATS, such as dark pools, could exacerbate market instability during periods of stress. Unlike traditional exchanges, some ATS do not provide pre-trade price transparency. This means that prices are not publicly displayed before trades are executed, which could limit the price discovery process. As ATS operate globally, they need to navigate a complex and diverse regulatory landscape. Changes in regulations or failure to comply with regulatory requirements can pose significant risks. In the U.S., ATS are regulated under the SEC's Regulation ATS. This regulation establishes a regulatory framework for ATS, including requirements for registration, fair access, and transparency. In the European Union, the Markets in Financial Instruments Directive II (MiFID II) provides the regulatory framework for ATS. This directive aims to improve transparency, promote competition, and better protect investors. In other global markets, local regulatory bodies oversee the operation of ATS. These regulations vary widely, reflecting differences in market structures, legal systems, and regulatory philosophies. While both ATS and traditional exchanges serve the fundamental purpose of facilitating securities trading, they differ in many respects. ATS offers direct market access, often operates with lower fees, and provides greater anonymity. In contrast, traditional exchanges provide greater transparency, have stringent listing requirements, and offer the prestige associated with being listed on a well-known exchange. ATS are favored for their lower costs, speed, and discretion, making them suitable for high-frequency and block trading. However, their lack of transparency and potential contribution to market fragmentation are key concerns. Traditional exchanges are appreciated for their transparency and regulated nature, but they may be less efficient and more costly for traders. An Alternative Trading System (ATS) is a non-exchange trading venue that matches buyers and sellers to execute transactions. It serves as an alternative to traditional exchanges, providing a platform that connects various market participants directly, often bypassing the intermediaries typical of conventional exchange-based trading. ATS are often characterized by greater operational flexibility and less regulatory supervision compared to traditional exchanges. They cater to a diverse set of securities, including stocks, bonds, and derivatives. Moreover, ATS can also provide additional liquidity to the market, allowing for potentially smoother transaction processes and reducing price volatility. Some of the key advantages of ATS include increased liquidity, lower costs, anonymity and discretion, and extended trading hours. However, there are also some risks associated with ATS, such as operational risk, systemic risk, lack of public price discovery, and regulatory risks.Definition of Alternative Trading System (ATS)

Historical Background

Function of an ATS

How ATS Matches Buy and Sell Orders

Role of Technology in an ATS

Clearing and Settlement Process

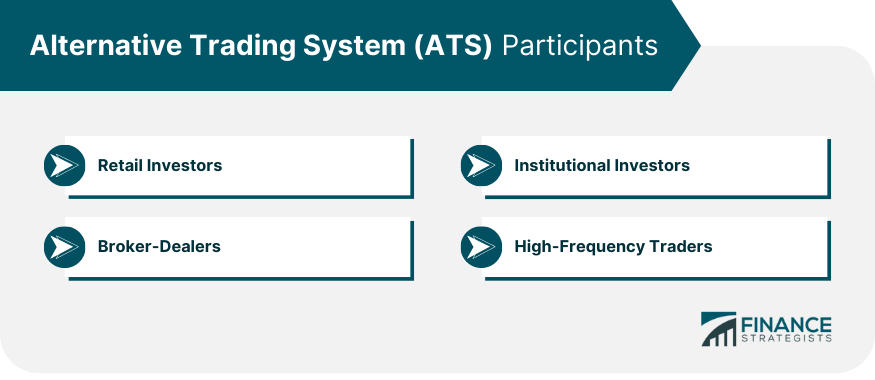

ATS Participants

Retail Investors

Institutional Investors

Broker-Dealers

High-Frequency Traders

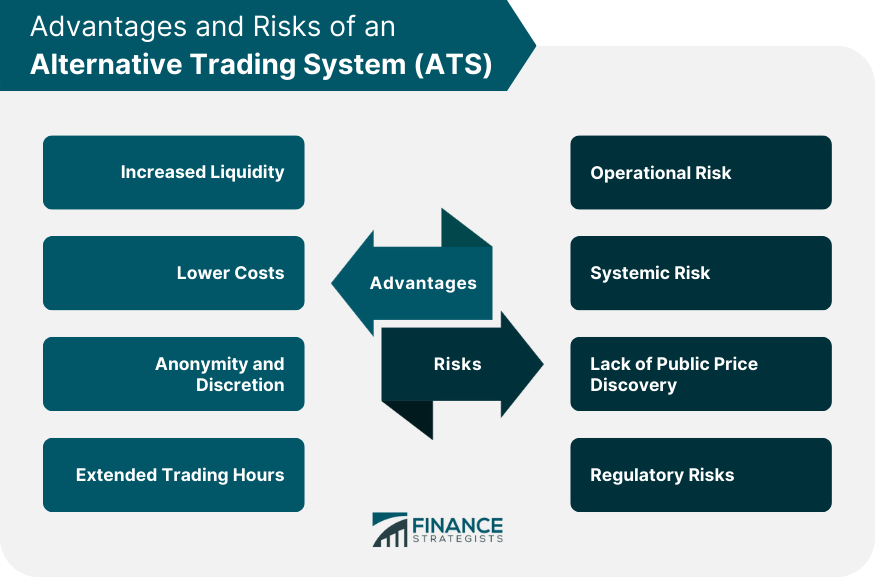

Advantages of an ATS

Increased Liquidity

Lower Costs

Anonymity and Discretion

Extended Trading Hours

Limitations and Risks of an ATS

Operational Risk

Systemic Risk

Lack of Public Price Discovery

Regulatory Risks

Regulatory Framework for ATS

U.S. SEC Regulation ATS

European Union's MiFID II

Regulation in Other Global Markets

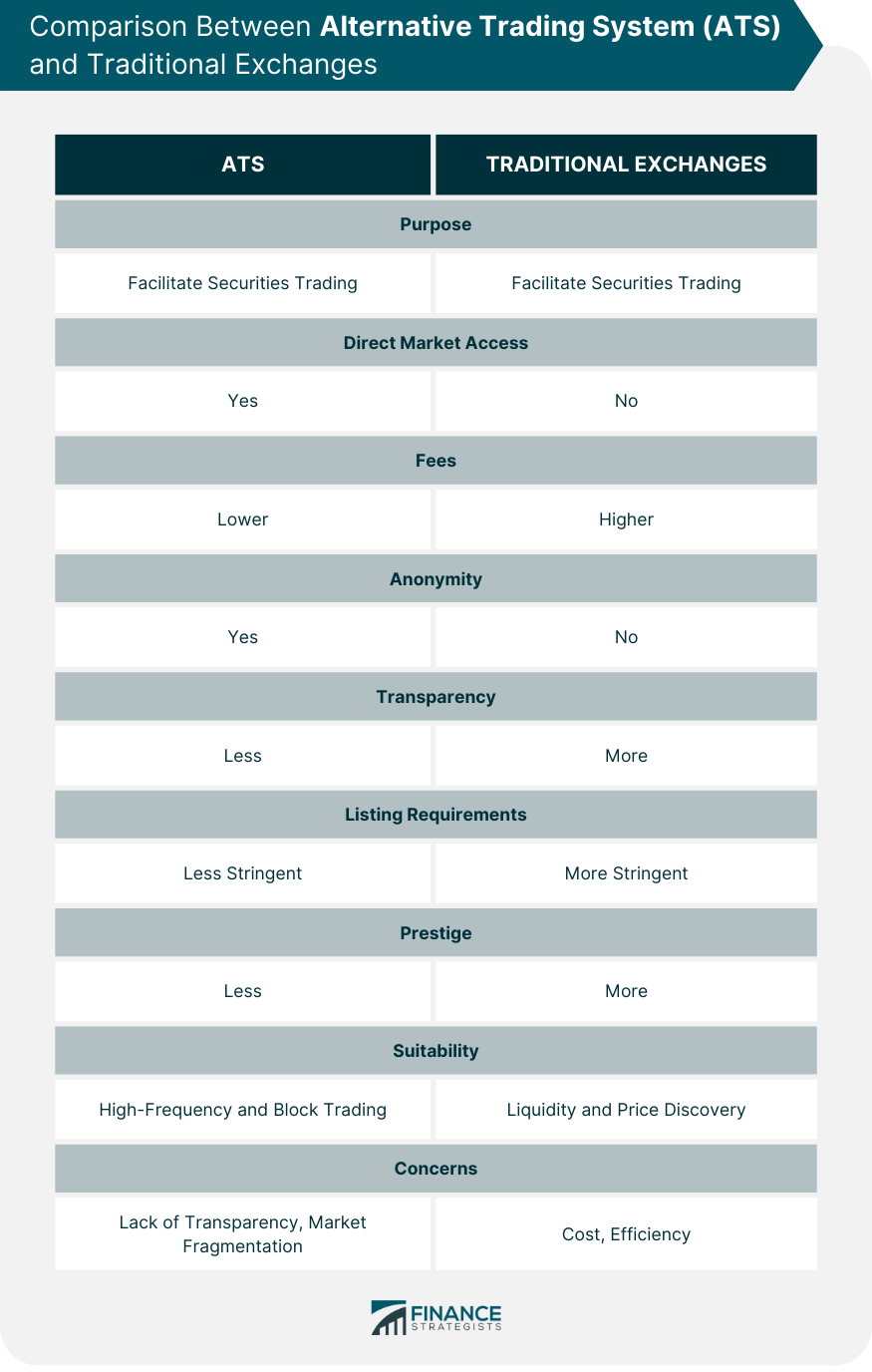

Comparison Between ATS and Traditional Exchanges

Similarities and Differences

Pros and Cons of Each System

Final Thoughts

Alternative Trading System (ATS) FAQs

An Alternative Trading System (ATS) is a non-exchange trading venue that matches buyers and sellers to execute transactions, providing an alternative to traditional exchanges.

Using an ATS offers several advantages, including increased liquidity, lower costs, anonymity and discretion, and extended trading hours.

Risks associated with ATS include operational risk, systemic risk, lack of public price discovery, and regulatory risks.

In the United States, ATS are regulated under the U.S. SEC Regulation ATS, while in the European Union, they are governed by MiFID II. Other global markets have their own regulatory frameworks for ATS.

The future of ATS is expected to be influenced by technological advancements, such as blockchain and cryptocurrency integration. Trends may include increased efficiency, transparency, and the convergence of ATS and traditional exchanges.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.