The concept of "average life" is a critical financial term with significant implications for investors, lenders, and borrowers alike. In finance, average life refers to the average length of time it will take to repay the outstanding principal on a debt issue, such as a Treasury bill, bond, loan, or mortgage-backed security. It is a measure used to forecast the lifespan of a debt obligation and is particularly relevant in the realm of fixed-income securities. From an investor's perspective, understanding the average life of an investment is crucial. This metric is often used as a tool for comparing the risk and potential returns associated with various investments before making a decision. The general rule is that investments with a shorter average life are often considered less risky, as they enable investors to recoup their initial investment sooner. However, as with all aspects of investment, this isn't a one-size-fits-all rule, and various factors can influence the actual outcomes. Average life is calculated by summing the product of each time period and the proportion of the total principal repayments made in that period, then dividing by the total principal. It's a weighted-average calculation that provides a measure of how long it takes, on average, to repay the principal of a debt. A treasury bill, or T-bill, is a short-term debt security issued by a government. T-bills typically have a maturity of less than a year, making their average life relatively short. Because they're backed by the full faith and credit of the issuing government, they're considered a low-risk investment. Bonds are debt securities with a longer maturity period. Depending on the issuing entity, bonds can have a wide range of average lives. For example, U.S. Treasury bonds have a maturity of 10 to 30 years. Corporate bonds, on the other hand, can vary widely depending on the company's financial situation. Loans, such as personal loans or business loans, have an average life that depends on the loan's terms, including its interest rate and repayment schedule. In most cases, the loan's average life will be equal to its term, assuming no prepayments. Mortgage-backed securities (MBS) are a type of asset-backed security that is secured by a mortgage or collection of mortgages. The average life of an MBS can be tricky to calculate due to the possibility of homeowners refinancing or paying off their mortgages early, which can significantly shorten the average life of the investment. Average life is a valuable tool for comparing the risks associated with different investments. In general, a longer average life implies a higher degree of risk, as the investor's capital is tied up for a longer period, increasing exposure to interest rate fluctuations, default risk, and other market uncertainties. By considering the average life, investors can make more informed decisions about which investments best align with their risk tolerance and financial goals. Many investors prefer investments with a shorter average life, as they allow for quicker recoupment of the initial investment. This preference is tied to the concept of the time value of money, which posits that a dollar received today is worth more than a dollar received in the future due to its potential earning capacity. The average life of an investment is directly tied to the concept of return on investment (ROI). The shorter the average life, the sooner the investor can start earning returns, which can then be reinvested or used elsewhere. Therefore, a shorter average life could potentially lead to higher returns over time, all other factors being equal. Prepayment risk is a type of risk associated with the possibility that a borrower will pay off a loan or a bond issuer will repay a bond principal earlier than scheduled. While this might seem like a good thing from a risk perspective, it can lead to reinvestment risk for the investor, as they may not be able to reinvest the returned principal at the same rate. Prepayment significantly affects the average life of an investment. When prepayment occurs, the average life of the loan, bond, or mortgage-backed security is shortened as the principal is repaid ahead of schedule. Prepayment can also negatively impact the interest income that investors receive. When the principal is paid off early, the total amount of interest the investor would have received over the life of the investment is reduced. For fixed-income investors who rely on interest payments for income, this can be a significant drawback. Investors can manage prepayment risk in several ways. One common strategy is through the use of call protection, a provision in a bond contract that prevents the issuer from repaying the principal early. Another strategy is to invest in securities with prepayment penalties, which discourage borrowers from repaying early. Average life is a crucial concept in finance, particularly in fixed-income investments. It helps forecast the lifespan of debt issues and allows for risk comparisons across different investments. Investments with shorter average lives are generally preferred as they enable quicker recoupment of the initial investment, aligning with the time value of money. The concept of return on investment is closely tied to average life, as shorter average lives allow for earlier returns and potential higher returns over time. Prepayment risk can significantly impact average life and interest income for investors. Managing prepayment risk involves strategies like call protection and investing in securities with prepayment penalties. Understanding and considering average life is essential for making informed investment decisions and managing associated risks.What Is Average Life?

Understanding Average Life

Determination of Average Life

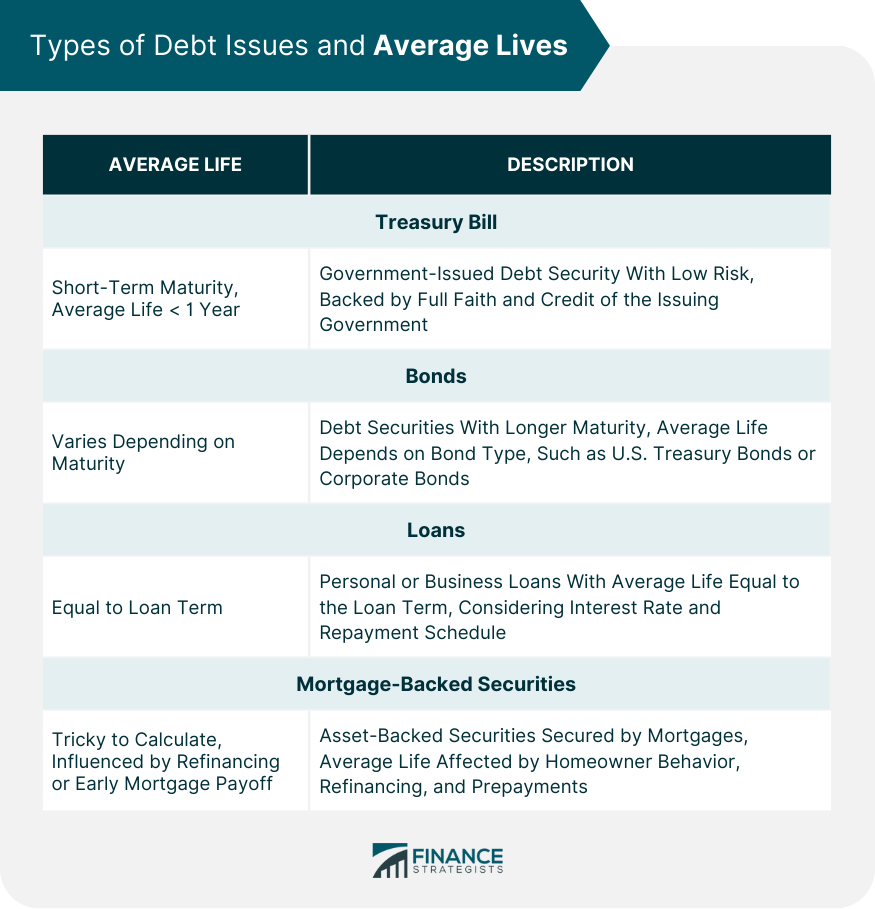

Types of Debt Issues and Their Average Lives

Treasury Bill

Bonds

Loans

Mortgage-Backed Securities

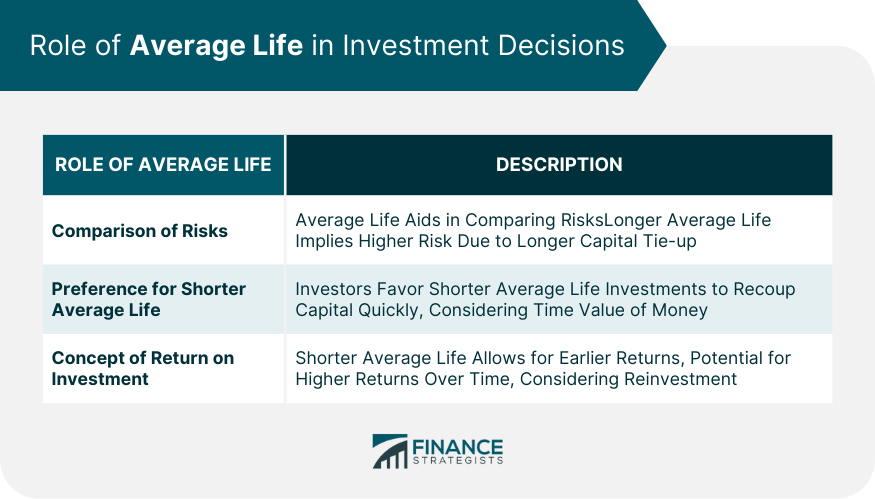

Role of Average Life in Investment Decisions

Comparison of Risks Across Different Investments

Preference for Shorter Average Life

Concept of Return on Investment

Prepayment Risk

Impact on Average Life

Effect on Interest Income for Investors

Strategies for Managing Prepayment Risk

Final Thoughts

Average Life FAQs

Average life refers to the average length of time it will take to repay the outstanding principal on a debt issue, such as a Treasury bill, bond, loan, or mortgage-backed security.

Average life is calculated by summing the product of each time period and the proportion of the total principal repayments made in that period, then dividing by the total principal.

Average life is a key consideration for investors because it helps them estimate the period during which their capital will be engaged, affecting their investment's liquidity and potential returns.

Prepayment risk can shorten the average life of an investment. When a borrower repays the principal ahead of schedule, the average life of the loan, bond, or mortgage-backed security is reduced.

Investors can manage prepayment risk through measures like call protection, a provision in a bond contract that prevents the issuer from repaying the principal early. They can also invest in securities with prepayment penalties, which discourage borrowers from repaying early.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.