Benchmarking and Performance Attribution: Overview

Benchmarking and performance attribution are related but distinct concepts in finance.

Benchmarking involves comparing the performance of an investment portfolio to a relevant benchmark, such as an index or a peer group of similar funds.

Benchmarking aims to evaluate how well the portfolio has performed relative to its peers or a market index and identify areas for improvement or adjustment.

On the other hand, performance attribution is a technique for analyzing the sources of a portfolio's returns relative to a benchmark.

Performance attribution aims to identify the factors that drove the portfolio's outperformance or underperformance relative to the benchmark, such as asset allocation, security selection, or other factors.

Both benchmarking and performance attribution are valuable tools for organizations and investors to assess their performance and make informed decisions based on their findings.

What Is Benchmarking?

Benchmarking is the process of comparing the performance of a company, product, or service against a standard or best practice in the industry.

The goal of benchmarking is to identify improvement areas and adopt best practices that will help an organization improve its performance, efficiency, and effectiveness.

Benchmarking can be done internally by comparing the performance of different departments within a company or externally by comparing a company's performance against its competitors or other companies in the same industry.

The benchmarking process typically involves identifying the metrics that are most relevant to the performance of the organization or product, collecting data on these metrics, and analyzing the data to identify areas for improvement.

Benchmarking can be used in a variety of areas, including operations, finance, marketing, customer service, and product development.

By benchmarking against best practices, companies can identify opportunities for cost savings, process improvements, and innovations that can help them to gain a competitive edge and achieve better results.

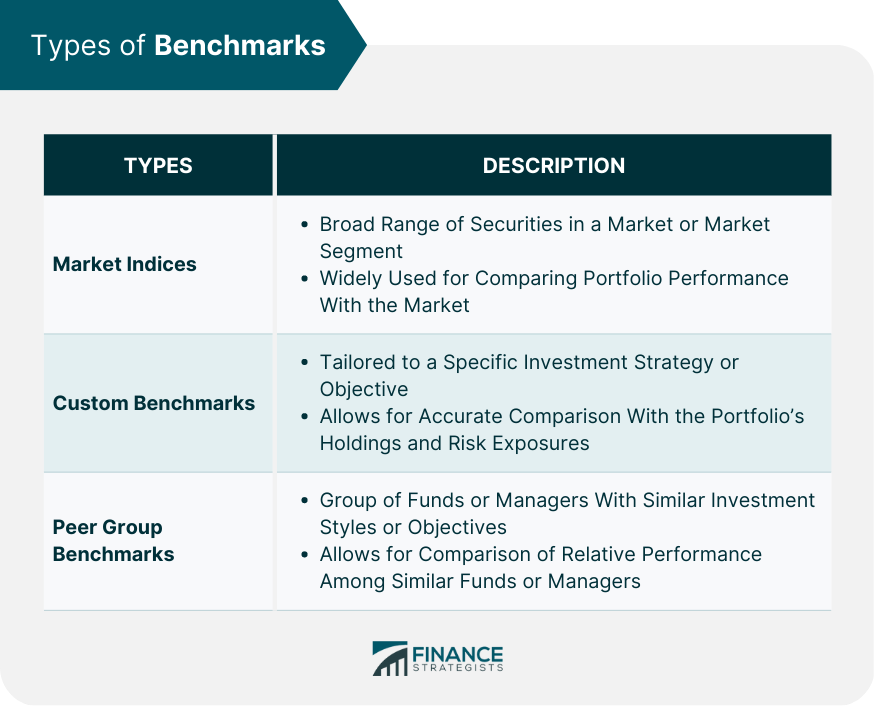

Types of Benchmarks

Market Indices

Market indices are widely used as benchmarks because they represent a broad range of securities within a specific market or market segment.

They provide a simple and easy-to-understand way for investors to compare the performance of their portfolio with the overall market.

Custom Benchmarks

Custom benchmarks are tailored to a specific investment strategy or objective. They allow for a more accurate comparison with the portfolio's actual holdings and risk exposures, enabling better evaluation of the manager's skill and performance.

Peer Group Benchmarks

Peer group benchmarks consist of a group of funds or managers that share similar investment styles or objectives.

By comparing a portfolio's performance to its peers, investors can gain insight into the manager's relative performance within the context of the investment universe.

Choosing the Right Benchmark

Representativeness

The chosen benchmark should accurately represent the portfolio's investment universe, strategy, and objectives. A representative benchmark ensures that the comparisons made between the portfolio and the benchmark are meaningful and relevant.

Investability

Investability refers to the ease with which investors can gain exposure to the benchmark. An investable benchmark allows for a more accurate comparison, as it factors in the actual investment opportunities available to the portfolio manager.

Relevance to Investment Objectives

The benchmark should align with the portfolio's investment objectives and risk tolerance. This ensures that the portfolio manager's performance is evaluated against the backdrop of achieving these objectives rather than an unrelated benchmark.

Limitations of Benchmarking

Inappropriate Benchmarks

Using an inappropriate benchmark can lead to misleading conclusions about a portfolio's performance. Selecting a benchmark that accurately reflects the portfolio's investment universe, strategy, and objectives is crucial to ensure meaningful comparisons.

Overemphasis on Short-Term Performance

Focusing too much on short-term performance can encourage excessive risk-taking and discourage long-term, strategic decision-making. Investors should be mindful of this potential pitfall and consider longer-term performance trends when evaluating their investments.

Potential for Benchmark Hugging

Benchmark hugging occurs when a portfolio manager closely mimics the benchmark's holdings to minimize the risk of underperformance.

This can lead to reduced active management and limit the potential for outperformance, as the manager becomes more focused on tracking the benchmark than generating alpha.

What Is Performance Attribution?

Performance attribution is a technique used to analyze the sources of a portfolio's returns relative to a benchmark.

Performance attribution aims to identify the factors that drove the portfolio's outperformance or underperformance relative to the benchmark, such as asset allocation, security selection, or other factors.

Performance attribution involves decomposing a portfolio's return into its various components, such as market, style, and individual security returns.

Comparing these components to the benchmark, performance attribution can help identify which factors contributed most to the portfolio's performance.

Importance of Performance Attribution

Identifying Sources of Performance

Performance attribution helps investors identify the specific drivers of a portfolio's performance. By understanding which factors have contributed to or detracted from performance, investors can make more informed decisions about their investment strategies and allocations.

Evaluating Investment Strategies

Performance attribution allows investors to evaluate the effectiveness of their investment strategies. By breaking down the sources of performance, investors can assess whether their strategies have been successful in generating alpha or if adjustments need to be made.

Enhancing Communication with Stakeholders

Transparent performance attribution enables better communication with stakeholders, such as clients and investors, by clearly explaining the portfolio's performance drivers.

This transparency can help build trust and confidence in the portfolio manager's decision-making process.

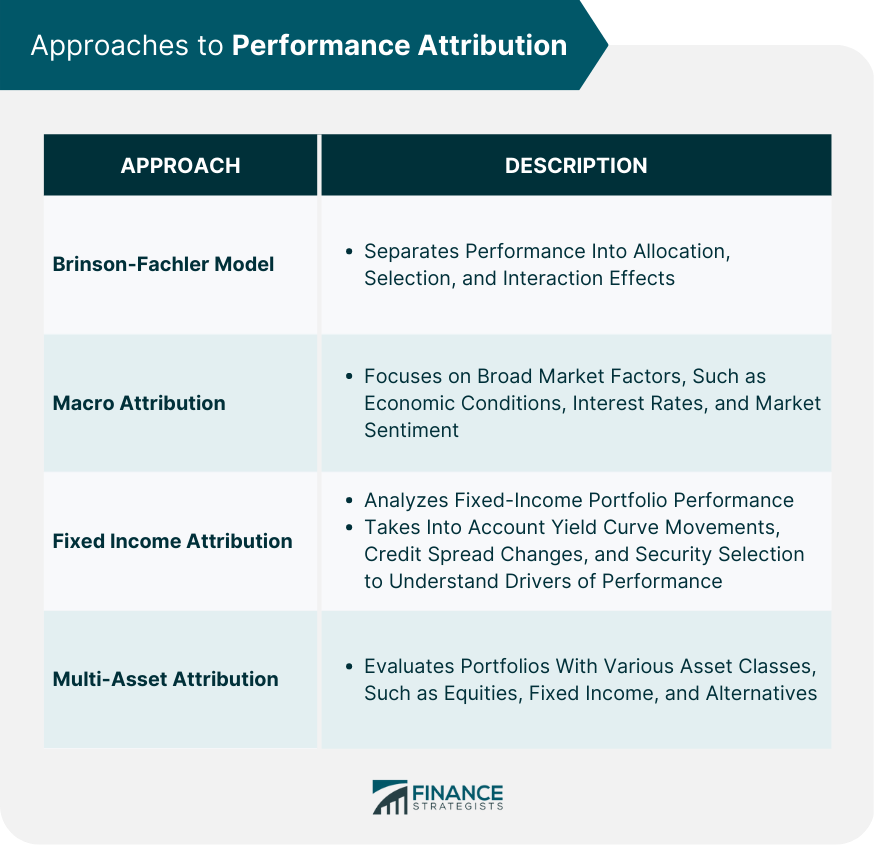

Approaches to Performance Attribution

Brinson-Fachler Model

The Brinson-Fachler model is a widely used approach to performance attribution that separates a portfolio's performance into allocation, selection, and interaction effects.

This model helps investors understand the impact of asset allocation decisions, security selection skills, and the interaction between the two on the portfolio's performance.

Macro Attribution

Macro attribution focuses on the impact of broad market factors, such as economic conditions, interest rates, and market sentiment, on a portfolio's performance.

This approach helps investors understand how external factors influence their investments and identify potential areas of vulnerability.

Fixed Income Attribution

Fixed income attribution specifically analyzes the performance of fixed-income portfolios.

It takes into account factors such as yield curve movements, credit spread changes, and security selection to help investors understand the drivers of performance within their bond portfolios.

Multi-Asset Attribution

Multi-asset attribution evaluates the performance of portfolios with various asset classes, such as equities, fixed income, and alternatives.

This approach allows investors to understand the contribution of each asset class to the overall performance and assess the effectiveness of their asset allocation decisions.

Key Components of Performance Attribution

Allocation Effect

The allocation effect measures the impact of a portfolio manager's asset allocation decisions on the portfolio's performance. It helps investors understand how the manager's allocation to different asset classes, sectors, or regions has contributed to the overall performance.

Selection Effect

The selection effect evaluates the portfolio manager's ability to select individual securities that outperform their respective benchmarks.

It helps investors assess the manager's skill in identifying and capitalizing on investment opportunities within each asset class, sector, or region.

Interaction Effect

The interaction effect captures the combined impact of allocation and selection decisions on the portfolio's performance.

It reflects the extent to which a portfolio manager's security selection within an over- or underweighted asset class, sector, or region has contributed to the overall performance.

Combining Benchmarking and Performance Attribution

Aligning Benchmarking and Performance Attribution

Aligning benchmarking and performance attribution is crucial for accurate and comprehensive performance analysis.

By using relevant benchmarks and consistent attribution methodologies, investors can better understand their portfolio's performance drivers and make better-informed decisions.

Assessing Active Management Performance

Benchmarking and performance attribution enable investors to assess the effectiveness of active management.

By comparing a portfolio's performance to its benchmark and analyzing the sources of outperformance or underperformance, investors can evaluate the manager's skill and the value added by active management.

Implementing a Feedback Loop for Investment Strategy Improvement

A feedback loop for investment strategy improvement can be implemented using benchmarking and performance attribution analysis results.

This feedback process allows investors to identify areas of strength and weakness within their investment strategies and make adjustments to enhance performance and better align with their objectives.

Challenges and Best Practices in Benchmarking and Performance Attribution

Data Accuracy and Consistency

Data accuracy and consistency are critical for reliable benchmarking and performance attribution analysis.

Accurate and consistent data allows for more meaningful comparisons between portfolio performance and benchmark performance and more reliable attribution results, facilitating better decision-making.

Ensuring Transparency and Objectivity

Transparency and objectivity are key to building trust with stakeholders and enabling informed decision-making.

Investors and portfolio managers should maintain a clear and unbiased approach to benchmarking and performance attribution, ensuring that results accurately reflect the true drivers of performance.

Adapting to Changing Market Conditions

Investors must adapt their benchmarking and performance attribution methodologies to evolving market conditions.

By staying up-to-date with market developments and adjusting their analysis accordingly, investors can ensure that their evaluations remain relevant and their investment strategies continue to align with their objectives.

Final Thoughts

Benchmarking and performance attribution are essential tools in investment management, allowing investors to evaluate their portfolios' performance, identify the drivers of success, and make more informed decisions.

Continuous improvement and learning are crucial for success in investment management. By regularly analyzing their portfolios using benchmarking and performance attribution, investors can identify opportunities for improvement and stay ahead of the competition.

Benchmarking and performance attribution help ensure that investment strategies remain aligned with investor objectives and risk tolerance.

Regular evaluations enable investors to make necessary adjustments to their portfolios, ensuring that their investments continue to meet their needs and preferences.

Investors should consider seeking professional wealth management services in light of the importance of benchmarking and performance attribution.

A skilled wealth manager can help investors navigate the complexities of benchmarking and performance attribution, ensuring the best possible outcomes for their portfolios.

Benchmarking and Performance Attribution FAQs

Benchmarking is the process of comparing a portfolio's performance to a benchmark to evaluate its performance. It is essential in investing because it enables investors to identify areas of strength and weakness within their investment strategies, make more informed decisions, and assess the effectiveness of active management.

Performance attribution is the process of identifying the sources of a portfolio's performance. By breaking down the sources of performance, investors can better evaluate the effectiveness of their investment strategies, assess the value added by active management, and make more informed decisions.

The right benchmark should be representative of the portfolio's investment universe, strategy, and objectives. It should be investable, relevant to investment objectives, and accurately reflect the investment opportunities available to the portfolio manager.

Limitations of benchmarking include inappropriate benchmarks, overemphasis on short-term performance, and potential for benchmark hugging. Limitations of performance attribution include data accuracy and consistency, ensuring transparency and objectivity, and adapting to changing market conditions.

By aligning benchmarking and performance attribution methodologies and using consistent attribution methodologies, investors can gain a more comprehensive understanding of their portfolio's performance drivers. This enables them to identify areas of strength and weakness and make adjustments to enhance performance and better align with their objectives.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.