Blended finance is the strategic combination of public, private, and philanthropic capital to mobilize additional investment for sustainable development projects. By blending different types of capital, blended finance aims to address market failures and create opportunities for private investors to support social and environmental goals. The role of blended finance in development and investment is to bridge the funding gap between the public and private sectors. This is achieved by leveraging public and philanthropic funds to attract private capital for investments in projects that advance the United Nations Sustainable Development Goals (SDGs). Blended finance helps overcome market barriers and catalyzes private investments in sectors that might otherwise be considered too risky or unprofitable. The primary objectives of blended finance are to mobilize private sector investment, reduce risks for private investors, and enhance the financial viability of development projects. By combining different sources of capital and risk-sharing mechanisms, blended finance aims to increase the scale and impact of development efforts while promoting market-based solutions to global challenges. Concessional finance is provided on terms more favorable than market rates, often by public or philanthropic organizations, to encourage investment in development projects. Grants are non-repayable funds provided by governments, multilateral institutions, or philanthropic organizations. They can be used to cover project costs, provide technical assistance, or support capacity-building efforts, reducing the financial burden on project developers and beneficiaries. Low-interest loans offer financing at below-market rates, making them more affordable for borrowers. By providing access to capital at favorable terms, low-interest loans can encourage investment in projects that may be considered too risky or not financially viable under market conditions. Guarantees are financial instruments that protect investors from potential losses, usually by covering a portion of the debt in case of default. By mitigating risks for private investors, guarantees can help mobilize additional capital for development projects and encourage greater private sector participation. Commercial finance is provided by private sector actors, such as banks, institutional investors, and impact investors, at market rates and conditions. Market-rate loans are a common form of commercial finance offered by banks and other financial institutions. These loans provide capital for projects at interest rates that reflect market conditions, allowing investors to earn a return on their investments while supporting development initiatives. Equity investments involve purchasing ownership shares in a company or project, providing capital in exchange for a stake in the potential profits. This form of commercial finance aligns the interests of investors and project developers, as both parties benefit from the success of the investment. Bonds are debt instruments issued by governments, corporations, or financial institutions to raise capital for projects. Investors purchase bonds in exchange for regular interest payments and the return of the principal amount at the end of the bond's term. Bonds can be an attractive investment for those seeking stable returns while supporting development initiatives. Public sector actors play a crucial role in blended finance by providing concessional resources and creating enabling environments for private investments. MDBs are international financial institutions that provide financing and technical assistance to support economic and social development. They often act as catalysts for blended finance, leveraging their resources to mobilize additional private sector investment in development projects. DFIs are government-owned institutions that provide financing, guarantees, and technical assistance to promote private sector investment in developing countries. They play a key role in blended finance by offering risk-sharing mechanisms and facilitating partnerships between public and private sector actors. Government agencies contribute to blended finance by providing policy support, funding, and regulatory frameworks that encourage private sector investment in development projects. They can also partner with other public, private, and philanthropic actors to design and implement blended finance initiatives. Private sector actors are essential for mobilizing the capital and expertise needed to scale up investments in sustainable development projects. Commercial banks provide loans, guarantees, and other financial services to support development projects. They can participate in blended finance structures by offering market-rate financing alongside concessional resources from public sector actors, helping to bridge funding gaps and reduce risks for private investors. Institutional investors, such as pension funds, insurance companies, and asset managers, have significant resources and a long-term investment horizon. They can play a critical role in blended finance by providing large-scale capital for development projects and contributing to the growth of sustainable investment markets. Impact investors actively seek to generate social and environmental benefits alongside financial returns. They can contribute to blended finance by providing patient capital and supporting innovative financing structures that align with their mission-driven objectives. Philanthropic organizations, including foundations and NGOs, bring unique resources and expertise to blended finance, helping to address market failures and enhance the impact of development projects. Foundations can provide grants, concessional financing, or guarantees to support development projects and encourage private-sector investment. By leveraging their financial resources and networks, foundations can play a catalytic role in blended finance initiatives. NGOs often have deep knowledge of local contexts and the needs of beneficiaries, making them valuable partners in blended finance initiatives. They can contribute by providing technical assistance, capacity-building support, or acting as intermediaries between public and private sector actors. Blended finance can help address the substantial infrastructure financing gap in developing countries by mobilizing private sector investment and enhancing the viability of projects. This can lead to improved access to essential services like transportation, water, and sanitation, ultimately fostering economic growth and poverty reduction. Blended finance can support the transition to clean and sustainable energy sources by attracting private sector investment in renewable energy projects. This can help reduce greenhouse gas emissions, increase energy access, and promote energy security in developing countries. By mobilizing private sector investment and promoting innovation, blended finance can contribute to increased agricultural productivity, improved food security, and sustainable resource management. This can lead to better livelihoods for smallholder farmers and more resilient food systems. Blended finance can help improve healthcare access and quality in developing countries by mobilizing private sector resources to construct healthcare facilities, develop innovative health technologies, and expand health services. This can lead to better health outcomes and increased well-being for vulnerable populations. Investing in education through blended finance can support the development of inclusive and high-quality education systems, providing opportunities for lifelong learning and skills development. This can help reduce inequalities and promote social and economic development. Blended finance can support the growth of technology and innovation in developing countries by attracting private sector investment in research and development, digital infrastructure, and entrepreneurship. This can lead to increased access to digital services, enhanced productivity, and the creation of new jobs and industries. Blended finance significantly mobilize private sector capital for sustainable development projects. By leveraging public and philanthropic funds, blended finance incentivizes private investors to participate in projects that contribute to social and environmental outcomes, bridging the financing gap and increasing the overall pool of available resources. One of the key benefits of blended finance is the risk mitigation it provides for private investors. By combining public and private resources, blended finance structures can help distribute risks among different stakeholders, making investments in sustainable development projects more attractive and feasible for private sector actors. Blended finance contributes to the achievement of the United Nations SDGs by directing capital towards projects that address global challenges such as poverty, inequality, climate change, and environmental degradation. By aligning financial resources with the SDGs, blended finance helps promote sustainable and inclusive development worldwide. Blended finance can foster innovation and entrepreneurship by providing financial support for the development of new technologies, products, and services that address global challenges. By mobilizing private sector capital and expertise, blended finance can help drive the creation of innovative solutions and business models that contribute to sustainable development. Blended finance can contribute to accelerated economic growth by attracting private sector investment in infrastructure, energy, agriculture, healthcare, education, and other sectors that underpin sustainable development. This can increase productivity and job creation and improve living standards in developing countries. One of the main challenges of blended finance is balancing the interests of public and private sector actors. Ensuring that public resources are used effectively to achieve development objectives while protecting the financial interests of private investors requires careful design, negotiation, and implementation of blended finance initiatives. Transparency and accountability are crucial for the success of blended finance initiatives. Ensuring that public resources are used effectively and that private sector actors adhere to environmental, social, and governance (ESG) standards requires robust monitoring and reporting mechanisms and clear lines of responsibility among all stakeholders. Blended finance can create potential market distortions if public resources are not used effectively or if private sector actors take undue advantage of concessional financing. Careful design and implementation of blended finance initiatives are necessary to minimize the risk of market distortions and ensure that public resources are used efficiently and responsibly. Blended finance initiatives often involve complex risk assessments and risk-sharing arrangements among different stakeholders. Identifying, assessing, and mitigating risks related to financial performance, environmental and social impacts, and other factors is essential for the success of blended finance projects and the achievement of sustainable development objectives. Blended finance initiatives can involve complex deal structures that require coordination and negotiation among multiple stakeholders. Navigating blended finance projects' legal, financial, and operational complexities can be challenging and time-consuming, requiring specialized expertise and resources. Global economic trends, such as the ongoing effects of the COVID-19 pandemic, climate change, and geopolitical shifts, can influence the demand for and supply of blended finance. Navigating these trends will require adaptability, collaboration, and innovation among public, private, and philanthropic actors to ensure that blended finance continues to drive sustainable development. Multilateral development banks and development finance institutions are likely to play an increasingly important role in blended finance as the need for sustainable development financing grows. These institutions can act as catalysts and conveners, mobilizing resources, sharing expertise, and fostering partnerships to advance blended finance initiatives. The range of blended finance instruments and vehicles is expected to expand as investors, policymakers, and development practitioners explore new ways to mobilize private sector capital for sustainable development. Innovations in financial instruments, risk-sharing mechanisms, and investment platforms will be crucial for scaling up the impact of blended finance. Integrating ESG criteria into blended finance initiatives is likely to become increasingly important as investors and other stakeholders demand greater accountability and transparency. Incorporating ESG considerations into the design and implementation of blended finance projects can help ensure that public and private resources are used responsibly and contribute to sustainable development outcomes. Blended finance mobilizes private sector capital and expertise to address global development challenges by leveraging public and philanthropic resources. It can bridge the financing gap, accelerate progress towards SDGs and foster sustainable growth. Effective collaboration and innovation among public, private, and philanthropic actors are crucial for its success. Creating partnerships, sharing knowledge, and developing new financial instruments and risk-sharing mechanisms are essential to harness the full potential of blended finance. It offers significant potential for sustainable and inclusive growth by mobilizing private sector investment in infrastructure, energy, agriculture, healthcare, education, and technology. Experienced professionals can help investors, development practitioners, and policymakers navigate the complex landscape of blended finance opportunities to maximize their impact and contribute to a more sustainable and inclusive world.What Is Blended Finance?

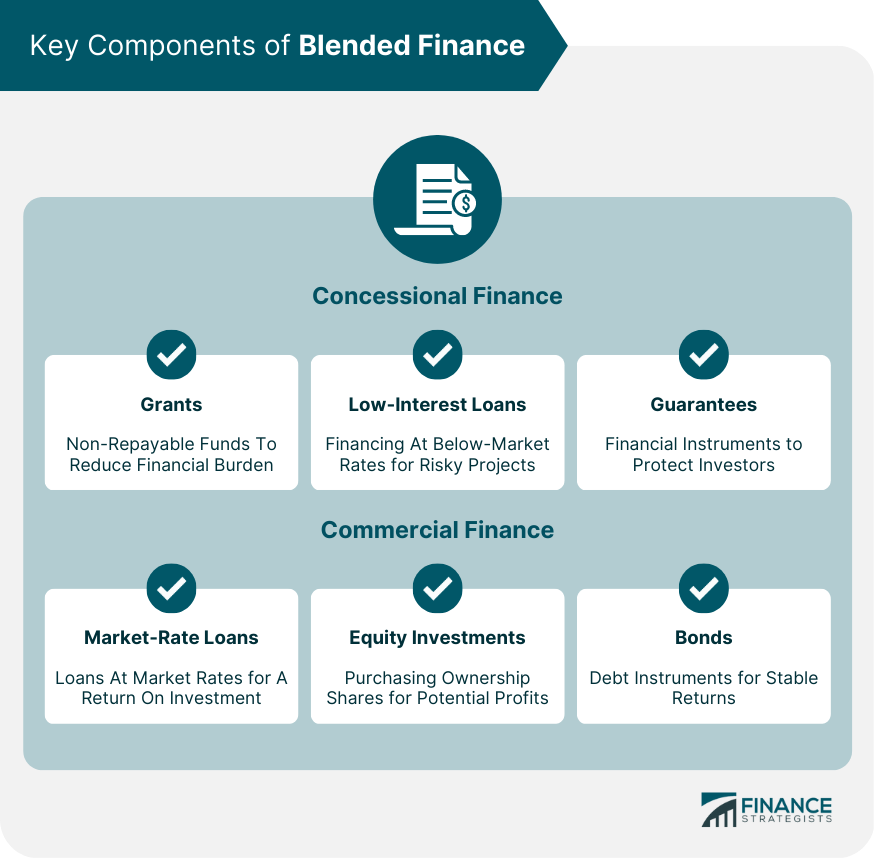

Key Components of Blended Finance

Concessional Finance

Grants

Low-interest loans

Guarantees

Commercial Finance

Market-rate loans

Equity investments

Bonds

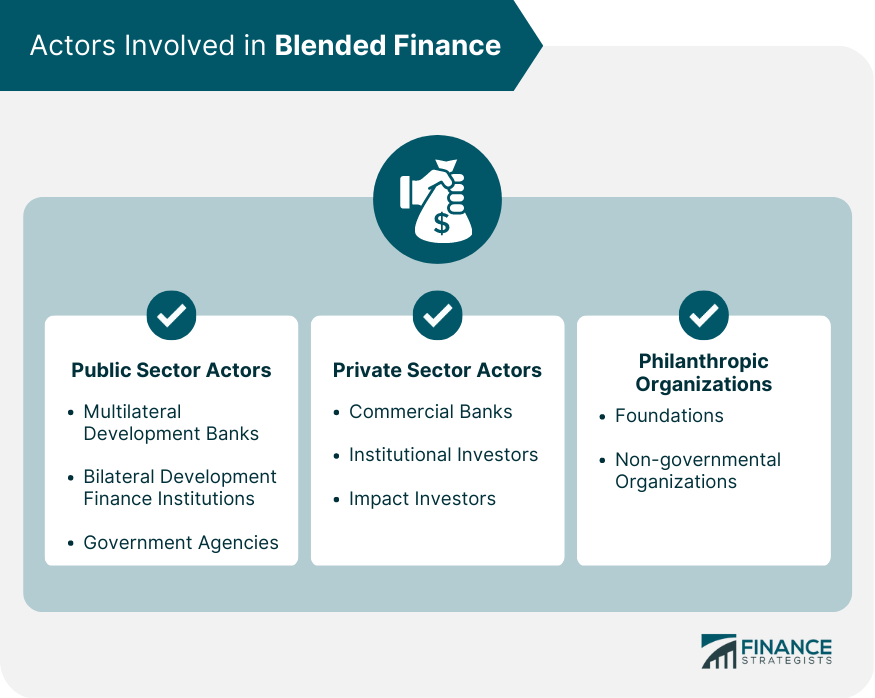

Actors Involved in Blended Finance

Public Sector Actors

Multilateral Development Banks (MDBs)

Bilateral Development Finance Institutions (DFIs)

Government Agencies

Private Sector Actors

Commercial Banks

Institutional Investors

Impact Investors

Philanthropic Organizations

Foundations

Non-governmental Organizations

Sectors Impacted by Blended Finance

Infrastructure

Energy and Renewable Resources

Agriculture and Food Security

Healthcare

Education

Technology and Innovation

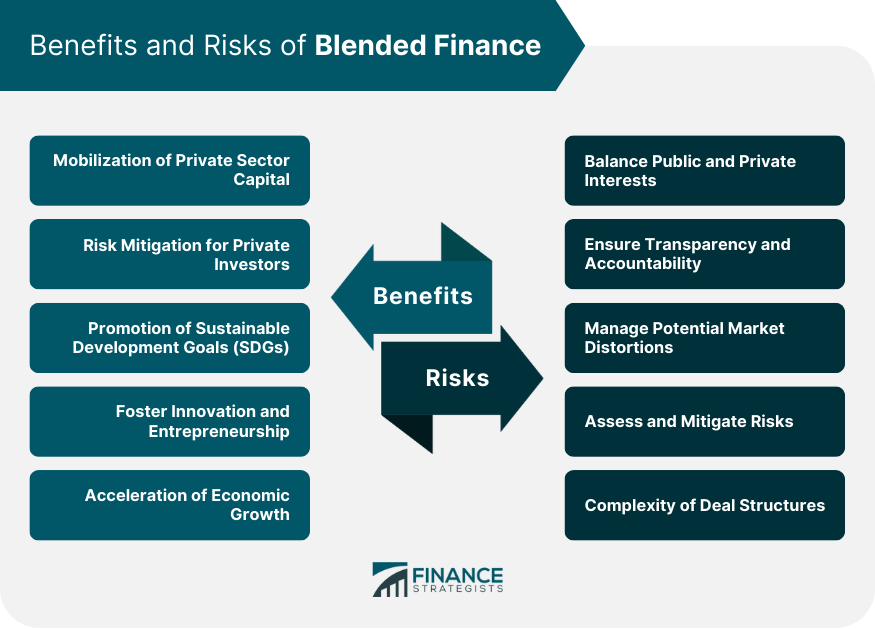

Benefits of Blended Finance

Mobilization of Private Sector Capital

Risk Mitigation for Private Investors

Promotion of Sustainable Development Goals

Fostering Innovation and Entrepreneurship

Acceleration of Economic Growth

Challenges and Risks of Blended Finance

Balancing Public and Private Interests

Ensuring Transparency and Accountability

Managing Potential Market Distortions

Assessing and Mitigating Risks

Complexity of Deal Structures

Future Outlook and Trends in Blended Finance

Impact of Global Economic Trends

Evolving Role of MDBs and DFIs

Expansion of Blended Finance Instruments and Vehicles

Integration of Environmental, Social, and Governance Criteria

Final Thoughts

Blended Finance FAQs

Blended finance is the combination of public, private, and philanthropic capital to mobilize additional investment for sustainable development projects. By blending different types of capital, blended finance aims to address market failures and create opportunities for private investors to support social and environmental goals.

Blended finance helps overcome market barriers and catalyzes private investments in sectors that might otherwise be considered too risky or unprofitable. The primary objectives of blended finance are to mobilize private sector investment, reduce risks for private investors, and enhance the financial viability of development projects.

Public sector actors such as multilateral development banks, bilateral development finance institutions, and government agencies, along with private sector actors such as commercial banks, institutional investors, and impact investors, and philanthropic organizations including foundations and NGOs play a crucial role in blended finance.

Blended finance can impact various sectors, including infrastructure, energy and renewable resources, agriculture and food security, healthcare, education, and technology. It can help address the substantial financing gap in developing countries and mobilize private sector investment in sustainable development projects.

The benefits of blended finance include the mobilization of private sector capital, risk mitigation for private investors, promotion of sustainable development goals, fostering innovation and entrepreneurship, and acceleration of economic growth. The risks and challenges of blended finance include balancing public and private interests, ensuring transparency and accountability, managing potential market distortions, assessing and mitigating risks, and complexity of deal structures.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.