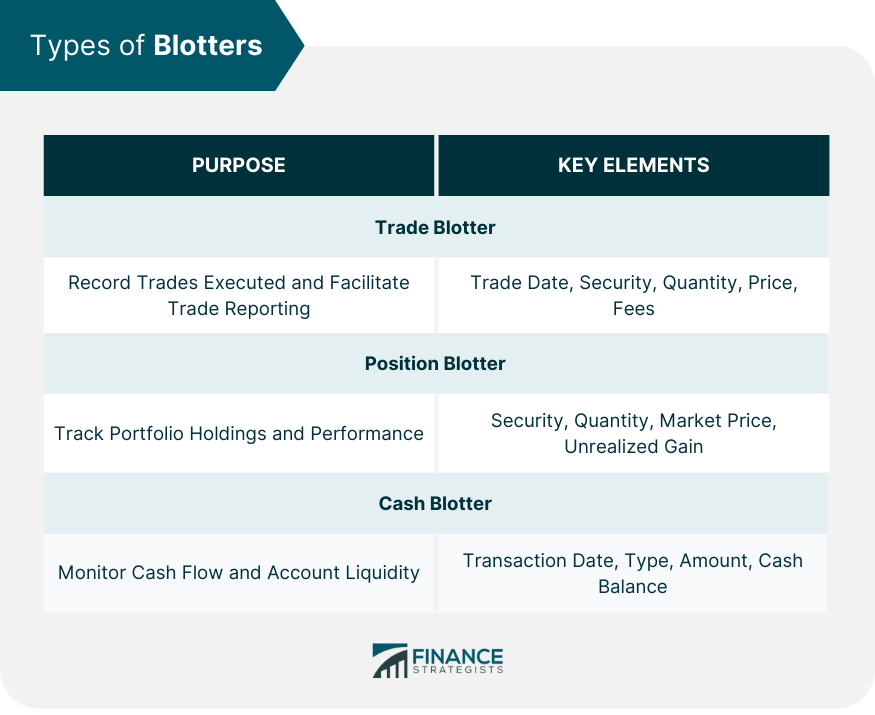

In the context of investment, a blotter refers to a log or record that tracks and documents trades and transactions executed by a trader or brokerage firm. It serves as a comprehensive record of all buy and sell orders, including the date, time, security, quantity, price, and other relevant details. The blotter helps maintain an accurate and transparent record of trading activities, facilitating regulatory compliance, risk management, and trade reconciliation. Traders and firms use blotter systems or software to electronically capture and organize this information, enabling efficient monitoring, analysis, and reporting of trading activities. The blotter plays a crucial role in maintaining transparency, accountability, and integrity in the investment process. There are different types of blotters, including trade blotters, position blotters, and cash blotters, each serving a unique function in financial record keeping and management. There are several types of blotters that can be used to track different aspects of an investor's financial activities. The three primary types are trade blotters, position blotters, and cash blotters. A trade blotter is a detailed record of all trades executed by an investment manager or broker on behalf of their clients. This includes information such as trade date, security, quantity, price, and transaction costs. The purpose of a trade blotter is to ensure accurate record-keeping and to facilitate trade reporting, as required by financial regulators. Key elements of a trade blotter include: Trade date and time Security identifier (CUSIP, ISIN, or ticker symbol) Buy or sell indicator Quantity of shares or units Price per share or unit Total transaction value Counterparty information Transaction fees and commissions Trade blotters are essential tools for wealth and investment managers as they provide a comprehensive overview of all trading activity within a portfolio. They enable managers to monitor trading performance, identify trends, and spot potential issues such as excessive trading or concentration in a particular security. A position blotter is a summary of an investor's holdings in a portfolio, showing the quantity of each security held, its current market value, and the unrealized gain or loss on the position. Position blotters help wealth and investment managers track portfolio performance, monitor risk exposure, and make informed investment decisions. Key elements of a position blotter include: Security identifier (CUSIP, ISIN, or ticker symbol) Quantity of shares or units held Current market price per share or unit Total market value of the position Cost basis of the position Unrealized gain or loss Position blotters are valuable tools for wealth and investment managers as they provide a snapshot of a client's holdings at any given time. This information helps managers evaluate the overall health of a portfolio, identify areas of risk, and make strategic decisions about asset allocation and rebalancing. A cash blotter is a record of all cash transactions within an investment account, including deposits, withdrawals, dividends, interest payments, and fees. Cash blotters help wealth and investment managers monitor the cash flow of a portfolio and ensure that sufficient liquidity is maintained for future investment opportunities or client needs. Key elements of a cash blotter include: Transaction date and time Type of cash transaction (deposit, withdrawal, dividend, interest, fee) Amount of cash involved Running cash balance Cash blotters play a vital role in managing a client's investment portfolio by providing a clear view of the account's cash position. Wealth and investment managers use cash blotters to ensure that there is sufficient cash on hand to cover upcoming expenses, take advantage of investment opportunities, and meet client withdrawal requests. Blotters serve several essential functions within the realm of wealth and investment management. These include record keeping, risk management, and compliance with regulatory requirements. Accurate record-keeping is essential for effective financial management. It allows wealth and investment managers to track portfolio performance, identify areas for improvement, and ensure that client goals are being met. Additionally, accurate records are crucial for tax reporting and estate planning purposes. Blotters provide a comprehensive, organized, and easily accessible record of financial transactions. They allow wealth and investment managers to quickly review historical trades, positions, and cash flows, making it easier to identify trends, spot potential issues, and make informed decisions on behalf of their clients. Risk management is a critical component of wealth and investment management. Portfolio managers must constantly monitor and assess the various risks their clients face, such as market risk, credit risk, liquidity risk, and operational risk. By managing these risks effectively, managers can help their clients achieve their financial goals while minimizing potential losses. Blotters provide valuable information for identifying and managing risks within an investment portfolio. For example, trade blotters can reveal excessive trading activity or a lack of diversification, while position blotters can help managers assess the overall risk exposure of a client's holdings. This information enables wealth and investment managers to take proactive steps to mitigate risks and protect their clients' assets. The financial industry is subject to numerous regulations and reporting requirements designed to protect investors and maintain the integrity of the markets. Wealth and investment managers must ensure that they are in compliance with these rules to avoid penalties, fines, and reputational damage. Blotters play a critical role in helping wealth and investment managers meet their regulatory obligations. They provide a detailed record of all transactions, which can be used to demonstrate compliance with trade reporting rules, anti-money laundering regulations, and other requirements. Additionally, blotters help managers identify and correct potential compliance issues before they become more significant problems. As technology continues to evolve, the tools and techniques used to manage blotters have advanced as well. This section will discuss the impact of technology on blotter management and the benefits it provides to wealth and investment managers. Blotter technology has come a long way from its manual, paper-based origins. Today, digital blotters can be easily integrated with portfolio management software, allowing for real-time access to transaction data and automated updates. This has significantly improved the efficiency and accuracy of blotter management. By integrating blotters with portfolio management software, wealth and investment managers can streamline their workflows and improve their decision-making capabilities. This integration allows managers to access and analyze transaction data within the context of their clients' overall portfolios, making it easier to identify trends, evaluate performance, and make strategic investment decisions. Real-time access to blotter data is a game-changer for wealth and investment managers. It allows managers to monitor trading activity, positions, and cash flows as they occur, enabling them to respond quickly to changing market conditions and client needs. Automated data updates also eliminate the need for manual data entry, reducing the risk of errors and improving overall data integrity. Automation has made blotter management more efficient and less prone to errors. For example, automated trade reconciliation can identify discrepancies between a firm's internal records and those of its custodian or broker, saving time and reducing the risk of costly errors. Similarly, automated reporting features can generate regulatory reports at the click of a button, ensuring that firms meet their reporting obligations in a timely manner. Given the sensitive nature of the information contained in blotters, data security, and confidentiality are paramount. Advances in technology have led to improved encryption and authentication methods, ensuring that blotter data is protected from unauthorized access. Additionally, cloud-based solutions offer the added benefit of data backup and disaster recovery, providing an extra layer of protection for firms and their clients. Effective blotter management requires more than just the right technology; it also requires adherence to best practices. This section will discuss several best practices for managing blotters in wealth and investment management. Regular review and reconciliation of blotters are crucial for maintaining data accuracy and integrity. By reconciling trade blotters with custodian or broker records, wealth and investment managers can identify and correct discrepancies, ensuring that their records accurately reflect all trading activity. Similarly, regular reviews of the position and cash blotters can help managers spot errors, omissions, or unusual activity. Proper training and education are essential for effective blotter management. Staff should be trained on the importance of accurate record-keeping, the features and functions of the firm's blotter system, and the firm's policies and procedures for blotter management. Regular refresher training can ensure that staff stay up-to-date with the latest best practices and regulatory requirements. Wealth and investment management firms should establish clear policies and procedures for blotter management. These should cover topics such as data entry standards, review, and reconciliation procedures, reporting requirements, and data security measures. Clear policies and procedures can help ensure consistency, accuracy, and compliance across the firm. Data accuracy and integrity are critical for effective blotter management. Wealth and investment managers should implement controls to ensure that all transaction data is accurately recorded and that any errors are quickly identified and corrected. This might include double-checking data entries, reconciling blotters with external records, and using automated data validation tools. Effective communication between all stakeholders involved in blotter management is vital. This includes communication between portfolio managers, traders, compliance officers, and back-office staff, as well as external parties such as custodians and brokers. Regular communication can help ensure that everyone is on the same page, reducing the risk of misunderstandings or oversights that could lead to errors or compliance issues. A blotter is a vital tool in wealth and investment management, serving as a comprehensive record of all trades and transactions. There are three main types of blotters: trade blotters, which record all trades executed; position blotters, providing a summary of an investor's portfolio holdings; and cash blotters, which track all cash transactions within an investment account. These blotters play a pivotal role in maintaining accurate records, enabling effective risk management, and ensuring compliance with regulatory requirements. By providing a clear, organized, and easily accessible view of all financial activities, blotters empower wealth and investment managers to monitor portfolio performance, identify trends, manage risks, and make strategic decisions that align with their clients' financial goals. Thus, blotters are indispensable in the realm of successful wealth and investment management.What Is Blotter?

Types of Blotters in Wealth and Investment Management

Trade Blotter

Definition and Purpose

Elements of a Trade Blotter

How Trade Blotters Are Used in Wealth and Investment Management

Position Blotter

Definition and Purpose

Elements of a Position Blotter

How Position Blotters Are Used in Wealth and Investment Management

Cash Blotter

Definition and Purpose

Elements of a Cash Blotter

How Cash Blotters Are Used in Wealth and Investment Management

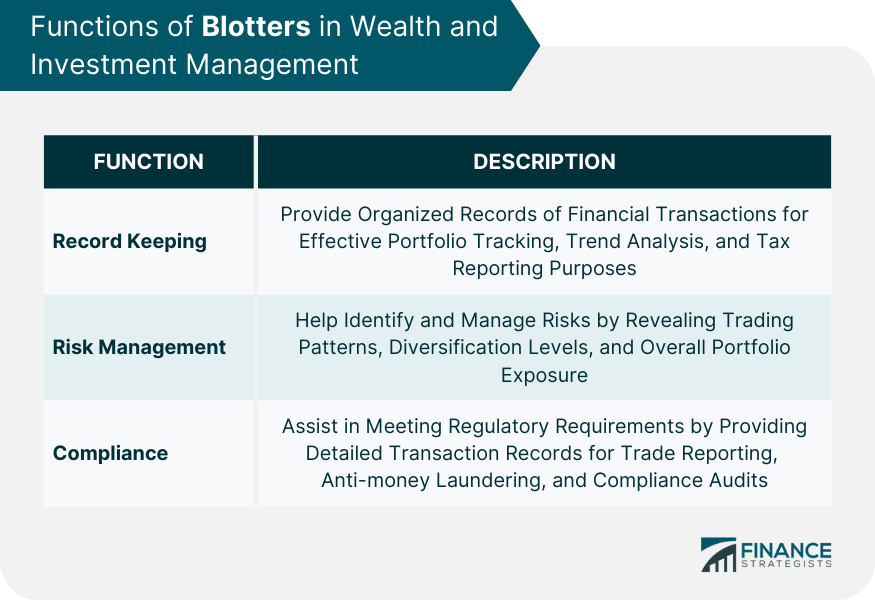

Functions of Blotters in Wealth and Investment Management

Record-Keeping

Importance of Accurate Record-Keeping in Financial Management

How Blotters Facilitate Record-Keeping

Risk Management

Identifying and Managing Risks in Investment Portfolios

Role of Blotters in Risk Management

Compliance and Regulatory Requirements

Financial Industry Regulations and Reporting Requirements

How Blotters Help Wealth and Investment Managers Maintain Compliance

Technology and Blotter Management in Wealth and Investment Management

Evolution of Blotter Technology

Integration With Portfolio Management Software

Real-Time Access and Data Updates

Automation and Efficiency Improvements

Data Security and Confidentiality

Best Practices for Blotter Management in Wealth and Investment Management

Regular Review and Reconciliation

Training and Education for Staff

Establishing Clear Policies and Procedures

Ensuring Data Accuracy and Integrity

Effective Communication Between Stakeholders

Conclusion

Blotter FAQs

A blotter in wealth and investment management is a record of all financial transactions. It provides crucial information for monitoring trading activity, positions, and cash flows, assisting managers in making informed decisions, tracking portfolio performance, managing risks, and maintaining regulatory compliance.

The three main types of blotters used in wealth and investment management are trade blotters, position blotters, and cash blotters. Trade blotters record all trades executed, position blotters summarize an investor's holdings in a portfolio, and cash blotters track all cash transactions within an investment account.

Blotters provide valuable information for identifying and managing risks within an investment portfolio. For example, trade blotters can reveal excessive trading activity or a lack of diversification, while position blotters can help managers assess the overall risk exposure of a client's holdings.

Technological advancements have led to the digitization of blotters, making them more accurate, efficient, and secure. Digital blotters can be integrated with portfolio management software, providing real-time access to data and automated updates. Additionally, they offer improved data security and confidentiality through advanced encryption and authentication methods.

Best practices for blotter management include regular review and reconciliation of blotters, training, and education for staff, establishing clear policies and procedures, ensuring data accuracy and integrity, and fostering effective communication between stakeholders. These practices help ensure that blotters provide accurate, timely, and useful information for wealth and investment managers.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.