The buy and hold strategy is a long-term investment approach where investors purchase stocks, bonds, or other assets and hold them for an extended period, regardless of short-term market fluctuations. This strategy is based on the premise that, over time, the market will produce positive returns, thereby increasing the value of the assets. The primary purpose of the buy and hold strategy is to achieve long-term capital growth while minimizing transaction costs and taxes. By not actively trading assets, investors can take advantage of the compounding effect of returns and avoid short-term market fluctuations that can lead to poor investment decisions. The buy and hold strategy has its roots in the early 20th century, when investing pioneers like Benjamin Graham and Warren Buffet advocated for long-term, value-oriented investing. Over the years, the strategy has gained popularity among individual and institutional investors alike, owing to its simplicity and historical success in generating attractive returns. Diversification is the practice of spreading investments across different asset classes, sectors, and geographical regions to reduce risk. A well-diversified portfolio can help buy and hold investors minimize the impact of market fluctuations, individual asset underperformance, and specific risks, increasing the potential for long-term success. Asset allocation refers to the process of dividing an investment portfolio among various asset classes, such as stocks, bonds, and cash. A proper asset allocation strategy can help buy and hold investors balance risk and reward, ensuring that their portfolios align with their investment objectives and risk tolerance. Rebalancing is the process of adjusting the weightings of assets in a portfolio to maintain the desired asset allocation. Regular rebalancing is essential for buy and hold investors, as it can help them stay on track with their investment goals, manage risk, and avoid overexposure to certain asset classes or sectors. The time horizon is the length of time an investor expects to hold their investments before needing to access the funds. A longer time horizon allows buy and hold investors to ride out short-term market fluctuations and focus on long-term growth, making it an essential factor in the success of the strategy. Risk tolerance is an investor's ability and willingness to accept investment risk in pursuit of higher returns. Understanding one's risk tolerance is crucial for buy and hold investors. It can guide their asset allocation, diversification, and rebalancing decisions, ensuring that their portfolios align with their personal comfort levels and investment goals. Buy and hold investors have various investment options to choose from, including individual stocks, index funds, exchange-traded funds (ETFs), and mutual funds. Each option has its advantages and disadvantages, and investors should consider factors such as fees, diversification, and management style before making their selections. Although buy and hold investing is a passive strategy, investors should still regularly monitor and review their portfolios to ensure they remain on track to meet their investment goals. This process may include evaluating the performance of individual assets, assessing the overall asset allocation, and making adjustments as needed. Life events, such as marriage, the birth of a child, or retirement, may impact an investor's financial goals and risk tolerance. Similarly, changes in market conditions can also affect the risk-reward profile of an investment portfolio. Buy and hold investors should be prepared to adjust their strategies in response to these changes to ensure their portfolios continue to align with their long-term objectives. Active trading involves frequent buying and selling of assets in an attempt to outperform the market. While active trading can potentially generate higher returns than buy and hold investing, it also comes with higher transaction costs, increased risk, and the potential for significant losses due to market timing errors and other factors. Market timing is the practice of attempting to predict market movements and buy or sell assets accordingly. Unlike the buy and hold strategy, market timing relies on short-term predictions and can lead to significant losses if investors make incorrect forecasts. It is generally considered a high-risk strategy with limited long-term success. Value investing is an investment approach that focuses on identifying undervalued assets with the potential for long-term appreciation. While value investing shares some similarities with the buy and hold strategy, it typically involves more active research and analysis to identify undervalued opportunities, resulting in a more hands-on investment approach. Growth investing is a strategy that focuses on investing in companies with strong growth potential. While both growth investing and buy and hold strategies can generate long-term capital appreciation, growth investing often involves taking on higher risk for the potential of higher returns, as it targets companies with above-average growth prospects. Dividend investing is a strategy that focuses on investing in companies that pay regular dividends to their shareholders. Unlike the buy and hold strategy, which prioritizes long-term capital appreciation, dividend investing emphasizes income generation. While both strategies can be effective for long-term investors, they cater to different investment objectives and risk tolerances. One of the primary benefits of the buy and hold strategy is the potential for long-term capital growth. Investors who stay invested in the market over a long period can take advantage of the compounding effect of returns, as their investments grow in value and generate more returns. By not actively trading assets, buy and hold investors can significantly reduce transaction costs associated with frequent buying and selling. Lower transaction costs mean the investor retains a higher percentage of the overall returns, leading to better long-term performance. The buy and hold strategy offers several tax advantages, as long-term capital gains are generally taxed at a lower rate than short-term capital gains. Additionally, by holding assets for an extended period, investors can defer taxes until they sell their investments, allowing their portfolios to grow without the drag of tax liabilities. The buy and hold strategy is a passive investment approach, requiring minimal investor effort. Investors can avoid the stress and time-consuming nature of active trading by focusing on long-term growth rather than short-term fluctuations, freeing up time for other pursuits. Market timing – the practice of attempting to predict market movements and buy or sell assets accordingly – is notoriously difficult, even for professional investors. The buy and hold strategy helps investors avoid the pitfalls of market timing by focusing on long-term trends rather than short-term fluctuations. By not actively trading, buy and hold investors may miss out on profitable short-term opportunities. These missed opportunities represent an opportunity cost, as investors could have potentially made more money by taking advantage of short-term trends or trading opportunities. The buy and hold strategy is not immune to the risk of underperformance, especially when compared to active trading strategies that aim to outperform the market. Passive investors who follow the buy and hold strategy may experience periods of lackluster returns or even losses if their investments underperform. Buy and hold investors typically have limited flexibility when it comes to adjusting their portfolios in response to changing market conditions or personal circumstances. This inflexibility can result in a less optimal asset allocation, potentially impacting long-term performance. Remaining committed to a buy and hold strategy can be emotionally challenging during periods of market volatility or underperformance. Investors must have the discipline to resist the urge to sell their investments during market downturns or in response to negative news. Inflation erodes the purchasing power of money over time, which can negatively impact the real returns of a buy and hold portfolio. Investors must consider the impact of inflation on their long-term investment goals and ensure that their portfolios are diversified enough to mitigate this risk. The buy and hold strategy is a long-term investment approach where investors purchase stocks, bonds, or other assets and hold them for an extended period regardless of short-term market fluctuations. This strategy is based on the belief that over time, the market will produce positive returns, leading to increased asset value. Key components of a successful buy and hold strategy include diversification, asset allocation, rebalancing, time horizon, and risk tolerance. Implementing this strategy involves selecting investment options, regularly monitoring and reviewing portfolios, and adjusting strategies in response to life events and market conditions. Compared to other investment strategies, the buy and hold strategy offers long-term capital growth, reduced transaction costs, tax benefits, a passive investing approach, and avoiding market timing mistakes. However, it also has its disadvantages, such as the opportunity cost of missing out on short-term opportunities, the risk of underperformance, limited flexibility, emotional challenges, and inflation risk. By seeking wealth management services, you can ensure that your buy and hold strategy is optimized for success and tailored to your unique circumstances, risk tolerance, and objectives. Reach out to a trusted financial advisor to discuss how a buy and hold strategy can work for you and help secure your financial future.What Is Buy and Hold Strategy?

Key Components of a Successful Buy and Hold Strategy

Diversification

Asset Allocation

Rebalancing

Time Horizon

Risk Tolerance

Implementing Buy and Hold Strategy

Selecting Investment Options

Monitoring and Review Process

Adjusting Strategy Based on Life Events and Market Conditions

Comparing Buy and Hold Strategy with Other Investment Strategies

Active Trading

Market Timing

Value Investing

Growth Investing

Dividend Investing

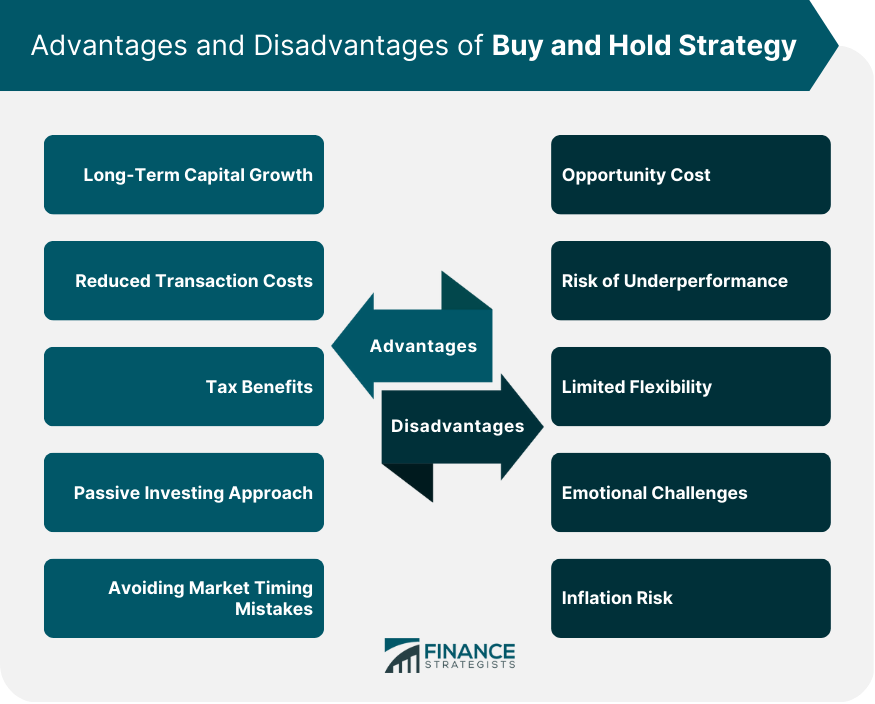

Advantages of Buy and Hold Strategy

Long-Term Capital Growth

Reduced Transaction Costs

Tax Benefits

Passive Investing Approach

Avoiding Market Timing Mistakes

Disadvantages of the Buy and Hold Strategy

Opportunity Cost

Risk of Underperformance

Limited Flexibility

Emotional Challenges

Inflation Risk

Final Thoughts

Buy and Hold Strategy FAQs

The buy and hold strategy is a long-term investment approach where investors purchase stocks, bonds, or other assets and hold them for an extended period, regardless of short-term market fluctuations.

The buy and hold strategy offers several advantages, including long-term capital growth, reduced transaction costs, tax benefits, a passive investing approach, and avoiding market timing mistakes.

The buy and hold strategy has some disadvantages, including opportunity costs, the risk of underperformance, limited flexibility, emotional challenges, and inflation risk.

Answer: The key components of a successful buy and hold strategy include diversification, asset allocation, rebalancing, time horizon, and risk tolerance.

While the buy and hold strategy is suitable for a wide range of investors, it may not be the best fit for investors seeking short-term gains or those willing to take on higher risk for potentially higher returns. It is particularly well-suited for those with a long-term investment horizon, a low risk tolerance, and limited time or interest in actively managing their investments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.