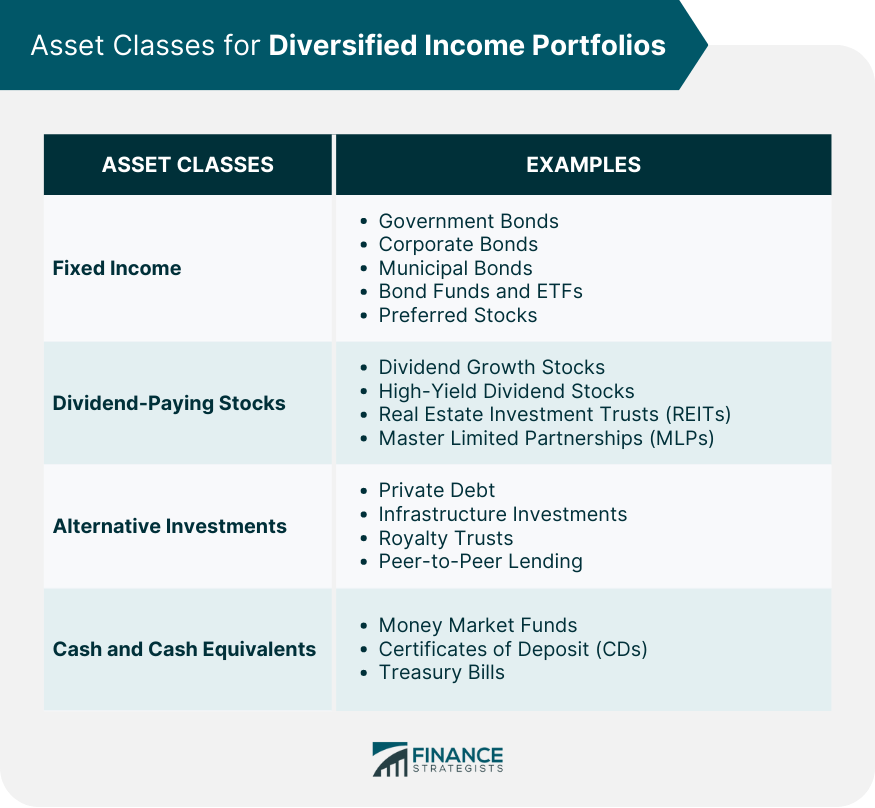

A diversified income portfolio is a collection of various income-generating investments designed to minimize risk and provide consistent income. This type of portfolio typically includes a mix of fixed income, dividend-paying stocks, alternative investments, and cash or cash equivalents. Diversification is a crucial aspect of income investing as it reduces the overall risk associated with the portfolio. By spreading investments across various asset classes, investors can minimize the impact of poor performance in a single investment or sector on their overall income. A diversified income portfolio typically includes a mix of fixed-income securities, dividend-paying stocks, alternative investments, and cash or cash equivalents. The allocation among these asset classes may vary depending on an investor's risk tolerance, investment objectives, and market conditions. Government Bonds: They are debt securities issued by national governments to finance public projects or fund government operations. It typically offers a lower risk profile and provides investors with a stable source of income. Corporate Bonds: They are debt securities companies issue to raise capital for business operations or expansion. They generally offer higher yields than government bonds but carry a higher level of risk due to the potential for default. Municipal Bonds: They are debt securities issued by local governments, such as cities or counties, to fund public projects like infrastructure or education. These bonds can offer tax advantages and provide investors with a stable income stream. Bond Funds and ETFs: They are investment vehicles that pool investors' money to invest in a diversified portfolio of bonds. They offer investors exposure to a wide range of bonds, providing diversification and potentially reducing risk. Preferred Stocks: They are hybrid securities that share characteristics of both stocks and bonds. They typically pay regular dividends and have a higher claim on a company's assets and earnings than common stocks. Dividend Growth Stocks: These companies have a history of consistently increasing their dividend payments over time. These stocks can provide investors with a growing stream of income, as well as potential capital appreciation. High-Yield Dividend Stocks: These companies offer higher-than-average dividend yields compared to other stocks and can provide investors with a significant income stream. However, they may carry higher risks due to the potential for dividend cuts. Real Estate Investment Trusts (REITs): REITs are companies that own, operate or finance income-producing real estate properties. They are required to distribute a large percentage of their income to shareholders in the form of dividends. Master Limited Partnerships (MLPs): MLPs are publicly traded partnerships primarily investing in energy infrastructure assets, such as pipelines and storage facilities. They typically offer high yields due to their pass-through structure. Private Debt: Private debt refers to loans made to non-public companies or individuals outside traditional banking channels. These investments can offer higher yields than traditional fixed-income investments but may carry increased risks and lower liquidity. Infrastructure Investments: Infrastructure investments involve the financing, constructing, or operating infrastructure assets. These investments can provide stable, long-term income streams and may offer some inflation protection. Royalty Trusts: Royalty trusts hold interests in natural resource production & distribute income from sales to investors. They distribute income from the sale of these resources to investors, providing a potentially attractive source of income. Peer-to-Peer Lending: Peer-to-peer lending platforms connect borrowers with investors who provide loans for interest payments. This alternative investment can offer attractive yields but may carry higher risks and lower liquidity. Money Market Funds: They are investment vehicles that offer high-quality debt securities, stable value, and easy access, making them a suitable option for holding cash reserves in a diversified income portfolio. Certificates of Deposit (CDs): CDs are bank-issued time deposits with fixed interest rates. They provide predictable income and low risk but may lack liquidity. Treasury Bills: They are short-term debt securities issued by the U.S. government. They are considered one of the safest investments available and can provide a stable source of income with minimal risk. Before constructing a diversified income portfolio, it is essential to assess an investor's risk tolerance and income objectives. This assessment helps determine the appropriate asset allocation and investment strategy to meet the investor's specific needs and goals. Asset allocation is the process of dividing investments among different asset classes to achieve diversification and balance risk and return. A diversified income portfolio typically includes a mix of fixed income, dividend-paying stocks, alternative investments, and cash or cash equivalents, with a specific allocation depending on the investor's risk tolerance and objectives. Rebalancing is the process of adjusting a portfolio's asset allocation to maintain the desired risk-return profile. Regular monitoring and rebalancing can help ensure that the portfolio stays aligned with the investor's objectives and adapts to changing market conditions. Income investing can have various tax implications depending on the specific investments and investor circumstances. It is crucial to consider the tax consequences of different income-generating assets, such as the preferential tax treatment of qualified dividend income or the tax-exempt status of municipal bonds. A diversified income portfolio helps to minimize risk by spreading investments across various asset classes and sectors. This approach can reduce the impact of poor performance in a single investment or sector on the overall portfolio, leading to more stable returns. Diversified income portfolios aim to provide investors with a steady stream of income from a variety of sources. This approach can help investors maintain a reliable income stream regardless of market fluctuations, making it particularly appealing to retirees or those seeking consistent income. While the primary focus of a diversified income portfolio is generating income, it also has the potential for capital appreciation. By investing in assets that offer both income and growth potential, investors can benefit from potential capital gains in addition to regular income. Diversification provides investors access to a wider range of investment opportunities across different asset classes and sectors. This increased variety can help investors find attractive income-generating investments that suit their specific risk tolerance and investment objectives. A diversified income portfolio can offer some protection against inflation by including investments that tend to perform well during inflationary periods. Assets such as dividend-paying stocks, real estate investment trusts (REITs), and inflation-protected bonds can help preserve the purchasing power of income in the face of rising prices. Interest rate risk refer to the potential for interest rate changes to negatively impact the value of fixed-income investments. As interest rates rise, bond prices typically fall, which can result in losses for investors holding bonds or bond funds in their portfolios. Credit risk is the potential for an issuer to default on its debt obligations, resulting in losses for investors. Diversified income portfolios that include corporate bonds, private debt, or other credit-sensitive investments may be exposed to credit risk. Market risk is the potential for the overall financial market to experience downturns or volatility, impacting the value of investments in a diversified income portfolio. Exposure to market risk can be mitigated through diversification and asset allocation. Concentration risk arises from having a significant portion of a portfolio invested in a single asset or sector. To minimize this risk, a well-diversified income portfolio should avoid excessive concentration in any one investment. Liquidity risk is the potential difficulty in converting investment into cash quickly and without significant loss of value. Some income-generating investments, such as private debt or alternative investments, may have limited liquidity, making it challenging to sell or adjust positions when needed. Diversified income portfolios are essential in income investing as they provide investors with a range of income-generating assets, reducing risk and increasing the potential for stable income streams. Diversification helps investors achieve their income objectives while managing risk. A well-constructed diversified income portfolio balances risk and return by allocating investments across various asset classes and sectors. This approach enables investors to benefit from multiple income sources and reduces the impact of poor performance in any single investment or sector. Regularly monitoring and rebalancing a diversified income portfolio is crucial to ensuring that it remains aligned with an investor's objectives and adapts to changing market conditions. Wealth management services can help investors identify suitable income-generating investments, develop a personalized investment strategy, and navigate tax considerations, helping to achieve their income objectives while managing risk effectively. Engaging with experienced professionals can offer valuable insights and support, enabling investors to make well-informed decisions and optimize their diversified income portfolios for long-term success.What Are Diversified Income Portfolios?

Asset Classes for Diversified Income Portfolios

Fixed Income

Dividend-Paying Stocks

Alternative Investments

Cash and Cash Equivalents

Portfolio Construction and Management

Assessing Investor Risk Tolerance and Income Objectives

Asset Allocation for a Diversified Income Portfolio

Portfolio Rebalancing and Monitoring

Tax Considerations in Income Investing

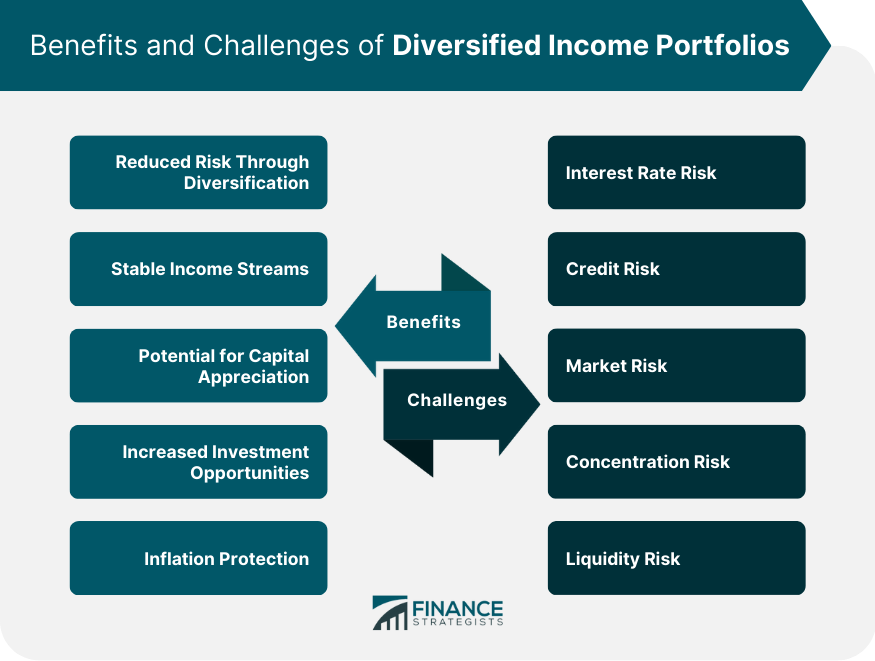

Benefits of Diversified Income Portfolios

Reduced Risk Through Diversification

Stable Income Streams

Potential for Capital Appreciation

Increased Investment Opportunities

Inflation Protection

Challenges and Risks in Diversified Income Portfolios

Interest Rate Risk

Credit Risk

Market Risk

Concentration Risk

Liquidity Risk

Final Thoughts

Diversified Income Portfolios FAQs

A diversified income portfolio is a collection of various income-generating investments that aim to reduce risk and provide consistent income. It typically includes a mix of fixed income, dividend-paying stocks, alternative investments, and cash or cash equivalents.

A diversified income portfolio typically includes a mix of fixed-income securities, dividend-paying stocks, alternative investments, and cash or cash equivalents. The allocation among these asset classes may vary depending on an investor's risk tolerance, investment objectives, and market conditions.

Diversified income portfolios offer reduced risk through diversification, stable income streams, potential for capital appreciation, increased investment opportunities, and inflation protection.

Diversified income portfolios may face risks such as interest rate risk, credit risk, market risk, concentration risk, and liquidity risk. These risks can be managed through diversification, asset allocation, and regular monitoring and rebalancing.

Given the potential complexity and risks associated with diversified income portfolios, investors may benefit from seeking professional guidance in constructing and managing their portfolios. Wealth management services can help investors develop a personalized investment strategy and navigate tax considerations, enabling them to optimize their diversified income portfolios for long-term success.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.